Acuity Inc. (NYSE:AYI) posted better-than-expected fourth-quarter earnings on Wednesday.

It clocked an adjusted EPS of $5.20, beating the analyst consensus estimate of $4.84. The company reported quarterly net sales growth of 17.1% year-over-year to $1.21 billion, compared to the analyst consensus estimate of $1.23 billion.

"Our fiscal 2025 fourth quarter performance was strong. We grew net sales, expanded our adjusted operating profit and adjusted operating profit margin, and increased our adjusted diluted earnings per share," stated Neil Ashe, Chairman, President and Chief Executive Officer of Acuity.

Acuity shares fell 0.6% to $360.70 on Thursday.

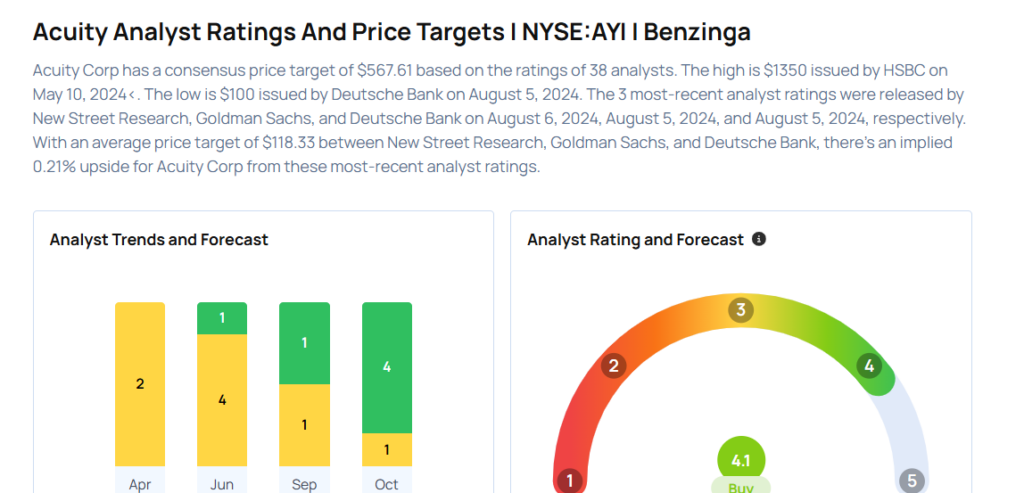

These analysts made changes to their price targets on Acuity following earnings announcement.

- Oppenheimer analyst Christopher Glynn maintained Acuity with an Outperform rating and raised the price target from $380 to $435.

- TD Cowen analyst Jeffrey Osborne maintained the stock with a Buy and raised the price target from $330 to $390.

- Wells Fargo analyst Joseph O’Dea maintained Acuity with an Overweight rating and raised the price target from $380 to $405.

- Goldman Sachs analyst Brian Lee maintained the stock with a Neutral and raised the price target from $312 to $356.

- Morgan Stanley analyst Christopher Snyder maintained Acuity with an Overweight rating and raised the price target from $365 to $425.

Considering buying AYI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock