The Treasury would see an extra £3.2bn flow into its coffers if the UK’s “non-dom” tax regime is abolished, a new report has found.

The current system allows for residents in Britain who are resident in the UK, but who claim on their tax return that their permanent home is abroad to avoid paying tax on income.

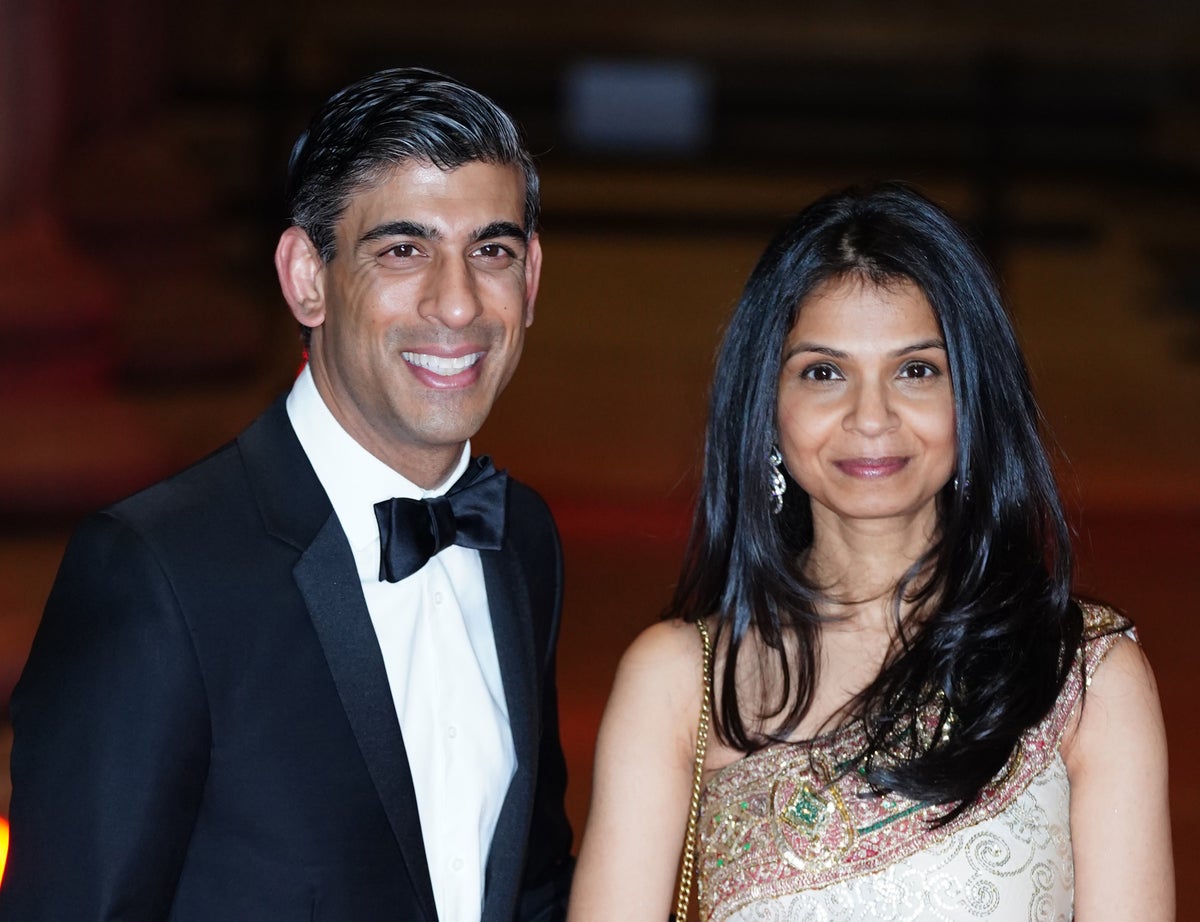

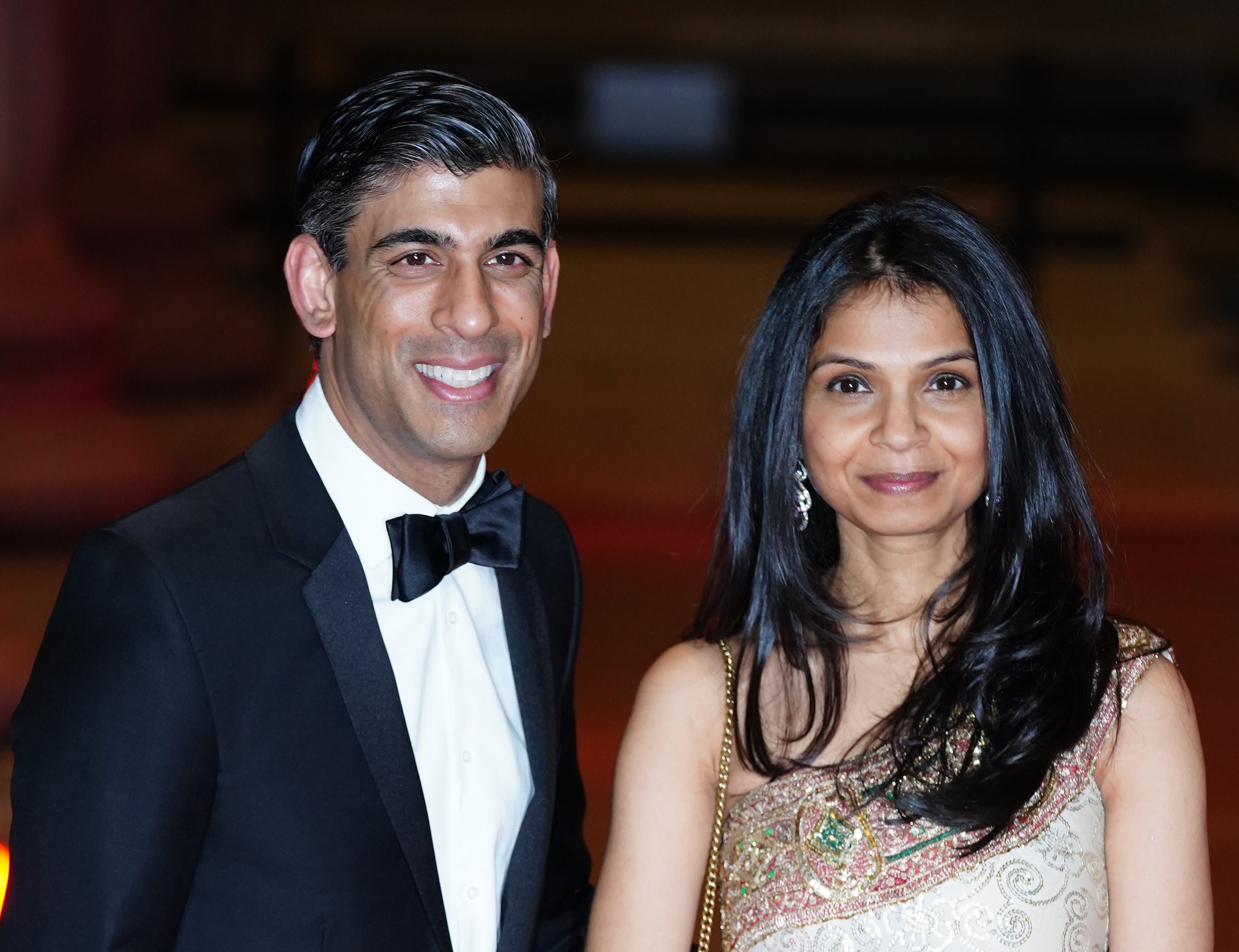

The tax status came under the spotlight earlier this year when The Independent revealed that Akshata Murty, the wife of the then-chancellor Rishi Sunak, might have saved millions of pounds through it.

Ms Murty, whose family business is estimated to be worth around £3.5bn, later said she would no longer claim the status on her worldwide earnings.

“It has become clear that many do not feel it is compatible with my husband’s role as chancellor,” she explained in early April.

“I understand and appreciate the British sense of fairness and I do not wish my tax status to be a distraction for my husband or to affect my family.”

Those who make use of the tax loophole earn at least £10.9bn in offshore income and capital gains each year, according to researchers from the University of Warwick and the London School of Economics and Political Science (LSE), who analysed the anonymised personal tax returns of people with non-domicile status between 1997 and 2018.

If that income was taxed, it would generate more than £3.2 billion in additional revenue each year, according to the report.

The average person who claims the status saves £125,000 in income tax annually, it added.

The academics said their research disproved the suggestion that many people of non-dom status would leave the UK if the loophole were abolished.

They pointed to how just 0.2 per cent of them left the UK after reforms in 2017 tightened access to the regime.

Arun Advani, of the University of Warwick, said: “Historically, arguments against abolition of the non-dom regime rested on uncertainty about whether it would raise any money. It’s now plain to see that it does, so supporters of the status quo need to find a new case for its defence.”

If elected, Labour has vowed to scrap the non-dom tax arrangement.