- AbbVie (ABBV) stands out after its Allergan acquisition thanks to a transformed portfolio and higher long-term growth prospects.

- ABBV is trading at fresh all-time highs.

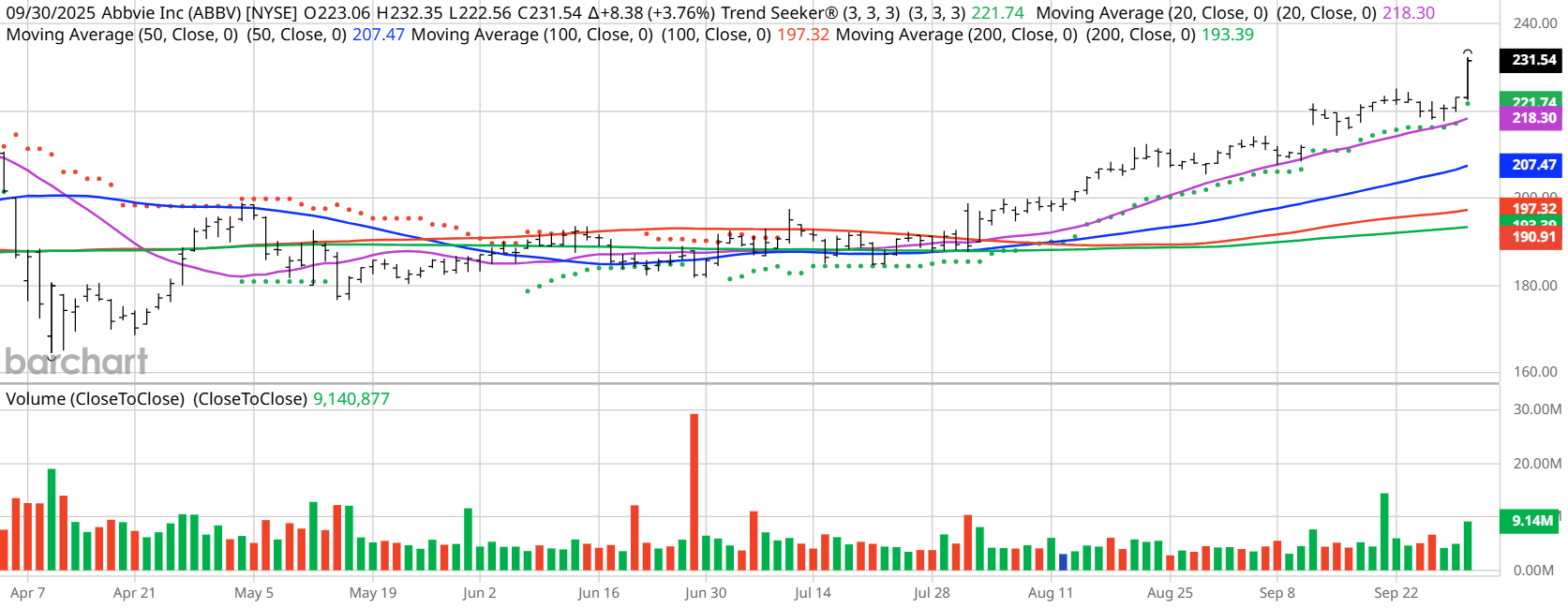

- Shares have a 100% Barchart “Buy” opinion and are trading above key moving averages.

- Analyst and investor sentiment is positive, with most major firms rating ABBV a “Buy” or “Strong Buy” and price targets suggesting further upside.

Today’s Featured Stock

Valued at $394 billion, AbbVie (ABBV) has become one of the top-most pharma companies after it acquired Allergan. The deal has transformed AbbVie’s portfolio by lowering its dependence on Humira, its flagship product. Humira is approved for several autoimmune diseases like rheumatoid arthritis, active psoriatic arthritis, active ankylosing spondylitis, and Crohn’s disease.

AbbVie has one of the most popular cancer drugs in its portfolio, Imbruvica, and its newest immunology drugs Skyrizi and Rinvoq position it well for long-term growth.

AbbVie enjoys leadership positions in key therapeutic areas including immunology, hematologic oncology, neuroscience, aesthetics, eye care, and women’s health.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions to sort for stocks with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. ABBV checks those boxes. Since the Trend Seeker signaled a new “Buy” on July 10, the stock has gained 18.74%.

ABBV Price vs. Daily Moving Averages:

Barchart Technical Indicators for AbbVie

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

AbbVie hit an all-time high of $232.35 in intraday trading on Sept. 30.

- ABBV has a Weighted Alpha of +28.72.

- AbbVie has an 100% “Buy” opinion from Barchart.

- The stock gained 17.25% over the past year.

- ABBV has its Trend Seeker “Buy” signal intact.

- AbbVie Street is trading above its 20-, 50-, and 100-day moving averages.

- The stock made 9 new highs and gained 10.05% in the last month.

- Relative Strength Index (RSI) is at 76.07.

- There’s a technical support level around $225.29.

Don’t Forget the Fundamentals

- $394 billion market capitalization.

- 20.83x trailing price-earnings ratio.

- 2.83% dividend yield.

- Revenue is projected to grow 7.70% this year and another 8.88% next year.

- Earnings are estimated to increase 18.22% this year and an additional 18.97% next year.

Analyst and Investor Sentiment on AbbVie

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.

It looks like Wall Street analysts are high on ABBV and so are individual investors.

- The Wall Street analysts tracked by Barchart have issued 16 “Strong Buys,” 2 “Moderate Buys,” and 10 “Hold” opinions on the stock.

- The price targets tracked by Barchart are between $190-$270.

- Value Line gives the stock its “Average” rating with a price target of $248.

- CFRA’s MarketScope Advisor rates it a “Buy” with a price target of $252.

- Morningstar thinks the stock is 21% overvalued.

- 1,498 investors following the stock on Motley Fool think the stock will beat the market while 112 think it won’t.

- 272,250 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line on AbbVie

ABBV appears to have backing not only from Wall Street, but also from other financial advisory sites and individual investors. Positive projections of increases in both revenue and earnings are a good sign. From the price targets projected, it looks like it still has room to run.

Today’s Chart of the Day was written by Jim Van Meerten. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.