If I told you that yttrium had surged in price by nearly 1,500% this year, I bet your next question would be: "What the hell is yttrium and how do I pronounce it?"

In the case of the latter, it's "it-ree-uhm", apparently. Yes, I had to look it up. In the case of the former, this rare earth element is vital for a number of engineering processes, including semiconductor manufacturing—and as a result of an export-related supply shortage, prices have risen from $8 per kilogram at the end of last year to $126 per kg in 2025 (via Bloomberg).

While US president Donald Trump's meeting with Chinese leader Xi Jinping late last month resulted in a pause on some of its rare earth restrictions, earlier global controls outlined in April of this year are still in place. These restrictions require companies to obtain licenses from Beijing before exporting rare earth materials out of the country, and the approvals granted to date are said to be for small shipments only.

That's a serious issue for the global manufacturing supply chain, as China is estimated to control roughly 69% of rare earth mining, and refines nearly all of the yttrium currently available. The US, for example, imports almost all of its yttrium, with 93% of those imports said to come from China directly.

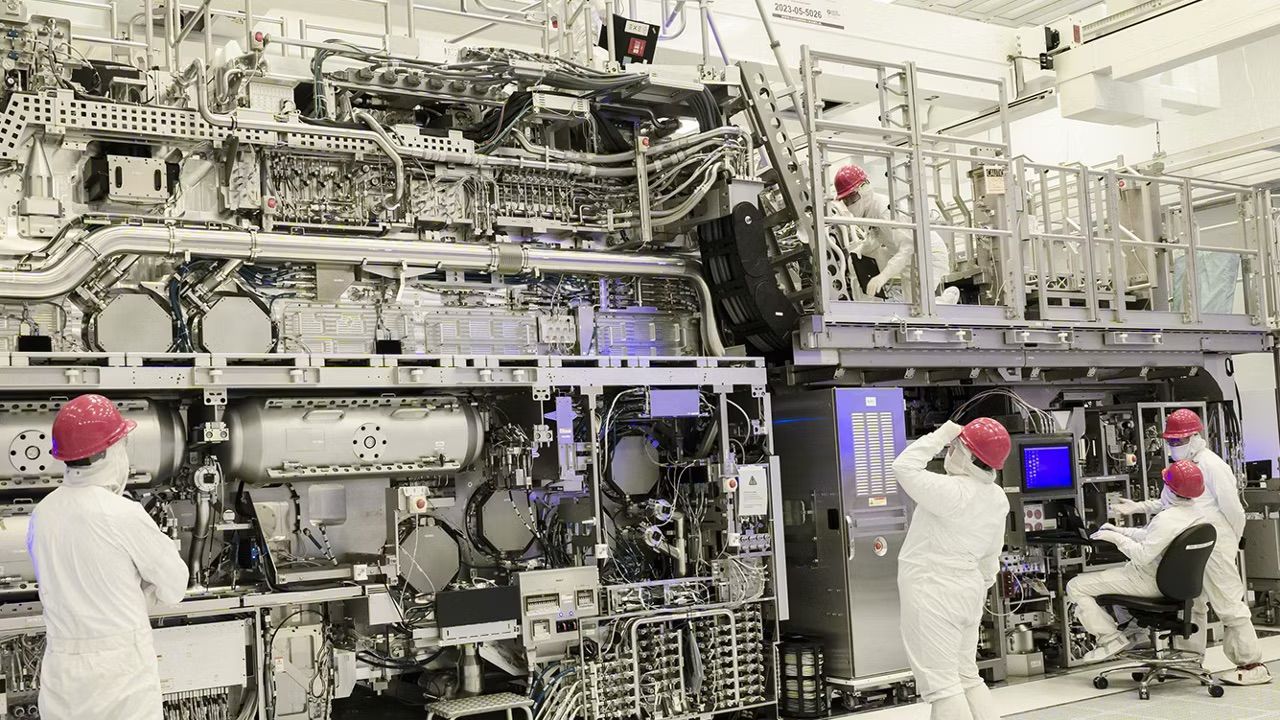

And while the rare earth element's unique thermal and chemical properties are used in a number of advanced manufacturing processes, from jet engines to medical equipment, it's also a vital component in chip production, both in the US and abroad.

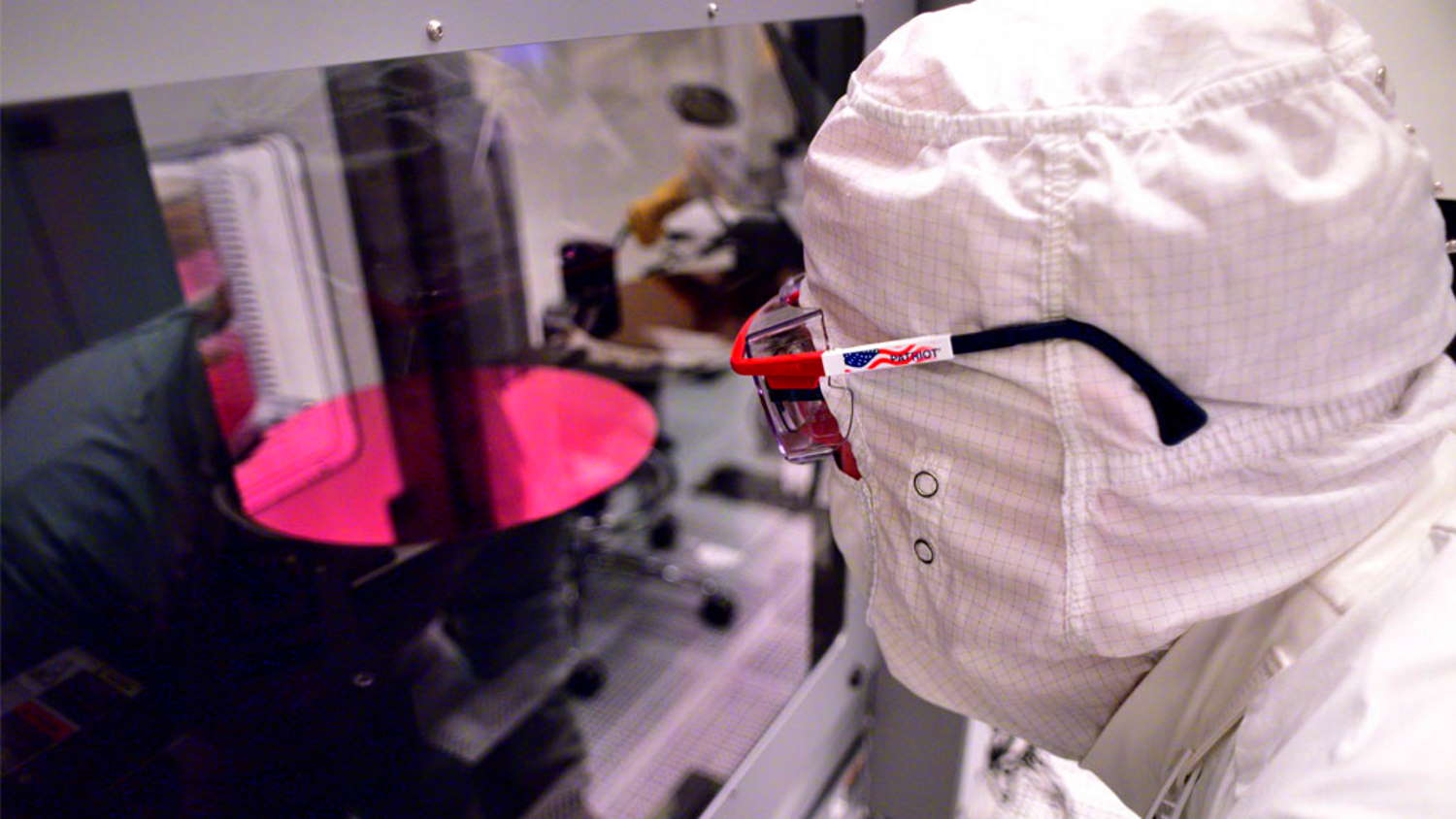

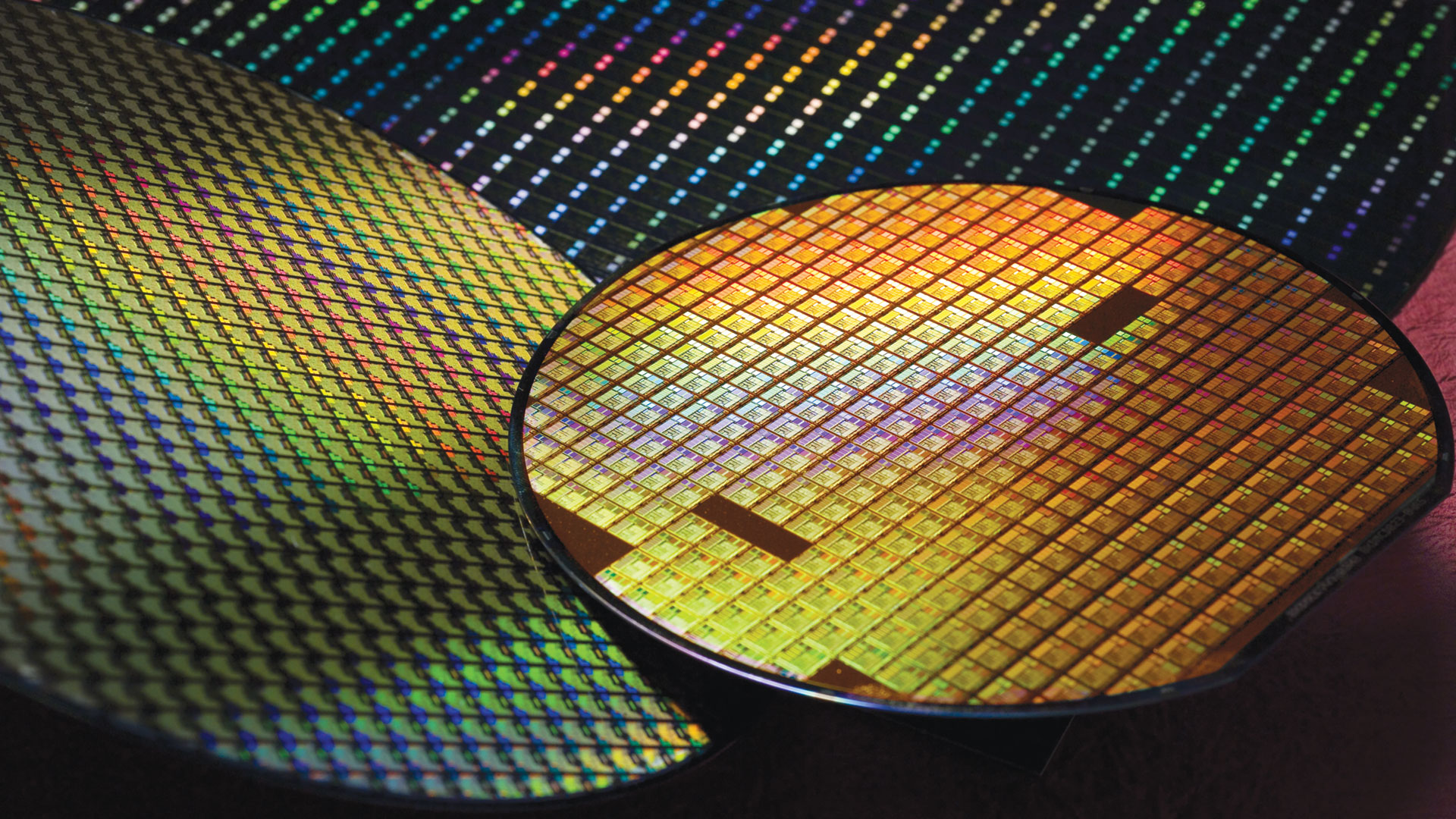

Yttrium oxide films are used as insulating and protective layers during advanced chip production processes, shielding sensitive components from being damaged by harsh environments created during their manufacture. These high-purity coatings enhance the efficiency and reliability of the process, which results in higher yields.

The current heavy demand for advanced chips, combined with the difficulty in obtaining yttrium as a result of Chinese export restrictions, is said to be driving prices sky high—which might go some way to explaining the US government's continued negotiations with China regarding rare earth supply. The Trump administration has been keen to champion chip production on US soil, and a kink in the supply chain for something as vital as yttrium could potentially hamper those goals.

Speaking to Techspot, an industry executive described the supply problem as a "nine out of ten" in severity, while Great Lakes Semiconductor CEO Richard Thurston said he believed that "shortages will increasingly become a real chokepoint."

That being said, there are glimmers of hope. While stockpiles of yttrium outside of China range in estimates between one to 12 months worth of supply, some large manufacturing firms like Mitsubishi and Siemens have reported that their operations are currently stable, with the latter saying that it's working to diversify away from Chinese suppliers.

US company ReElement Technologies is also said to have plans to produce between 200 to 400 tons of yttrium oxide per year starting in December, with the latter figure potentially accounting for the majority of the 470-ton annual US demand.

And of course, there's always the possibility that a renegotiation of terms between China and the US, or a change in Chinese government policy, could help to solve the current shortage both in the US and the rest of the world.

Certainly, the world's chip manufacturers will be hoping that China's tight grip around yttrium supply loosens in the months to come—before the effects of this shortage translate to slow production lines and potentially higher prices for us all.