/A_O_%20Smith%20Corp_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $10 billion, A.O. Smith Corporation (AOS) is a leading global manufacturer of water heating and water treatment products for residential, commercial, and industrial applications. The Milwaukee, Wisconsin-based company designs and produces energy-efficient water heaters, boilers, water filtration systems, and related technologies.

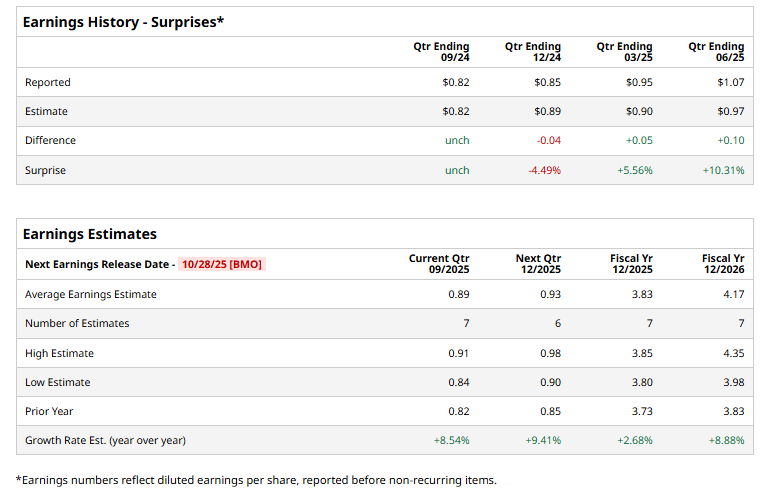

The industrial giant is set to unveil its third-quarter results before the market opens on Tuesday, Oct. 28. Ahead of the event, analysts expect AOS to report non-GAAP earnings of $0.89 per share, up 8.5% from $0.82 per share reported in the year-ago quarter. The company has surpassed or matched the Street’s bottom-line projections in three of the past four quarters, while missing on another occasion.

For the current year, its earnings are expected to come in at $3.83 per share, up 2.7% from $3.73 per share reported in the year-ago quarter. Additionally, in fiscal 2026, its earnings are expected to rise 8.9% year-over-year to $4.17 per share.

AOS stock has declined 17.8% over the past 52 weeks, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 14.8% surge and the S&P 500 Index’s ($SPX) 17.4% uptick during the same time frame.

On July 24, A.O. Smith shares rose 3.6% following Q2 results. Its EPS of $1.07 surpassed analysts’ estimate of $0.97. Revenue came in at $1 billion, exceeding the projected $990.9 million. The company now anticipates full-year adjusted EPS of $3.70–$3.90 and revenue between $3.85 billion and $3.93 billion.

The consensus opinion on AOS is reasonably bullish, with a “Moderate Buy” rating overall. Of the 14 analysts covering the stock, opinions include four “Strong Buys,” nine “Holds,” and one “Strong Sell.” Its mean price target of $80.09 suggests a 12.7% upside potential from current price levels.