A stimulus package is being devised by policymakers at the Finance Ministry in a bid to ward off effects of flagging exports and unstable domestic politics, a recipe for Thailand's dejected economic growth outlook this year.

While details of these stimulus policies have not been officially announced to the public, the objective is aimed at revving up domestic demand through tourism spending, tax deductions and much-touted special mortgage loans.

Boosting domestic demand is a short-term priority for the military-led government because the economy is losing steam, marred by the US-China trade spat and growing domestic political uncertainty.

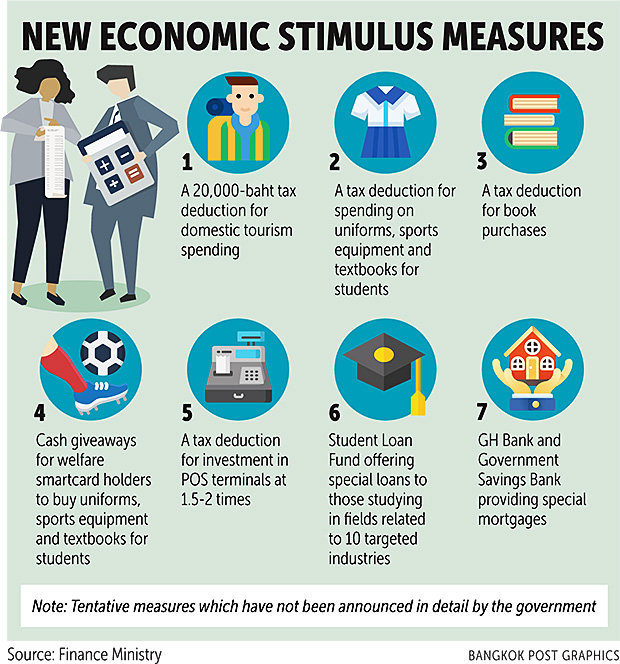

The Finance Ministry said on April 19 that an economic stimulus package containing seven measures worth a combined 20 billion baht would seek cabinet approval in two weeks.

The highlights are a tax deduction for domestic tourism spending worth up to 20,000 baht; a 500-baht handout per child to welfare smartcard holders to buy stationery, school uniforms and textbooks; a 1,000-baht cash giveaway to farmers who are government welfare recipients; and an additional 200-baht-per-month subsidy to be given until September to disabled people who are welfare smartcard holders.

Potential measures to stimulate the property sector would include a tax deduction for property buyers.

A planned 1,500-baht cash handout for tourism spending across 55 second-tier provinces has been scrapped by the government.

"These measures are a stopgap for lacklustre economic growth momentum in the first quarter, while domestic politics is fanning a downturn outlook for the economy in the second and third quarters," said independent academic Somjai Phagaphasvivat.

PSYCHOLOGICAL EFFECTS

Concerns are swelling about Thailand's economic growth outlook, with the World Bank projecting this year's GDP growth at 3.8%, a downturn compared with last year's 4.1% expansion.

"The second-quarter economic outlook warrants profound concern as overall private consumption remains in the doldrums," said Amonthep Chawla, head of research at CIMB Thai Bank.

Besides implementing short-term stimulus policies, the government should simultaneously try to enhance private investment as well, Mr Amonthep said.

Private investment contracted 0.6% year-on-year in February, down from January's 1.8% expansion, according to Bank of Thailand data.

Policies related to tax perks, lower interest rates and property incentives will have to be evaluated thoroughly because these measures should only be implemented when necessary, as Thailand has been facing budget deficits for several years, Mr Somjai said.

"These measures are not really necessary for Thailand's economy, as GDP is expected to expand by 3.5% this year, considered an acceptable rate amid slower global economic growth," he said. "But these measures have psychological and political effects in terms of creating a feel-good sentiment for the incumbent government."

Kiatipong Ariyapruchya, senior economist for Thailand at the World Bank, said Thailand's ratio of public debt to GDP is 41.8% and the 1.75% benchmark interest rate provides room for further fiscal stimulus, but public investment is the main driver of economic growth.

Failure to implement public investment projects in a timely fashion and increase public investment disbursement rates poses the biggest domestic risk to Thailand's economic growth, the World Bank said in its latest East Asia and Pacific Economic Update report titled "Managing Headwinds".

The disbursement rate for public investment was less than 60% in fiscal 2017 and fiscal 2018.

NOT ATTRACTIVE ENOUGH

Despite an alleged boon for tourism, tourism service operators have expressed mixed reactions to fresh stimulus measures planned to boost tourism during the upcoming low season.

Some hoteliers say the tax incentive, offering a 20,000-baht tax deduction for domestic tourism spending, might not stimulate tourism that much because the second and third quarters are the rainy season with no long holidays.

"Generally, travellers who are in the tax system are working people and they would prefer taking trips whenever they have long holidays," said Supawan Tanomkieatipume, president of the Thai Hotels Association. "Thus this scheme might not be attractive enough for them to take a vacation."

Last year, the 15,000-baht tax deduction for tourism spending in 55 second-tier provinces helped raise the number of trips to these areas significantly. Based on the statistics of the Tourism and Sport Ministry, 90 million people travelled to secondary provinces in 2018, up from 79 million in 2016.

If officials want the measure to function efficiently, the tax perk should be extended throughout the year instead of two quarters, as the final quarter is the favourite time for making trips, Mrs Supawan said.

She suggested the government consider implementing such a tax incentive for two or three years continuously in order to build awareness among tourists and stakeholders, then assess the outcome of the scheme along with the number of registered businesses entering the tax system.

At present, a large number of small hospitality operators, including hotels and resorts, do not run their businesses legally, barring them from issuing legal documents for clients to claim tax deductions.

LONGER EXTENSION

While a tourism stimulus measure is needed, the government should employ the scheme over a longer period in order to persuade tourism operators to enter the tax scheme that enables them to issue receipts for customers to claim tax deductions later on, said Sittidaj Pongkijvorasin, associate professor in Chulalongkorn University's Faculty of Economics.

Last year's scheme allowed taxpayers who spent up to 15,000 baht on tourism services and products in second-tier provinces to deduct such spending from their personal income tax.

However, many travellers did not fully benefit from the scheme, since their spending went to operators whose businesses were not registered with authorities.

Mr Sittidaj said the scheme should be applied not only to private businesses, but also government agencies when arranging seminars in provincial areas.

"Spending from such large agencies is a bigger sum, which is more attractive compared with expenses from individuals," he said.

The 20,000-baht tax incentive might not be a substantial amount to incentivise travellers to visit destinations in second-tier provinces, he said, while operators may see the amount and a brief period of implementation as not worthwhile compared with the complexity and expense of registering their businesses in the tax system.

The government should use the money to improve the transport system, create new routes to connect with main and secondary cities and develop a booking platform for private transport similar to Grab and Uber for travellers to roam local sites and attractions more conveniently, Mr Sittidaj said.

IMMEDIATE ANNOUNCEMENT

Pawarun Udomsiri, managing director for townhouse and semi-detached house project development at SET-listed Golden Land Property Development Plc, said property tax incentives could help improve the market by 10% after it was weakened by 20% by the new lending curbs.

For the overall low-rise segment, the impact of the new lending rules are estimated at around 15% and 30% for the condo market. This will eventually cause the property market to drop by 10% year-on-year in the second quarter.

"If the government wants to use property tax incentives to boost consumer sentiment, it should be announced immediately to avoid a delay in customers' decision-making," Mr Pawarun said.

He suggested that property tax incentives, if implemented, should remain for around two years in line with the down payment period, which is affected by the lower loan-to-value limit.

Phattarachai Taweewong, associate director of Colliers International Thailand's research department, said the planned property tax incentives should start as soon as possible and should be in place for at least six months.

"Developers and buyers will have enough time to prepare and get full benefits from the policy," Mr Phattarachai said. "The incentives should cover all prices and all buyers."

He said the property tax incentives could help boost housing demand by 20% after the market was dampened by the stricter mortgage lending rule.

The number of housing transfers jumped in the fourth quarter last year, with the figure expected to continue rising in the first quarter as buyers hurry to both buy and receive unit transfers to avoid new loan-to-value limits.