/Apple%20store%20and%20shoppers%20-%20by%20PhillDanze%20via%20iStock.jpg)

Tech giant Apple (AAPL) has long carried the aura of a market maker — the world’s most admired innovator that redefined phones, tablets, and wearables. But lately, the story feels different. Instead of bold leaps, Apple has focused on fine-tuning its iPhone lineup with better cameras and faster chips. Useful, yes, but hardly the spark investors crave. Meanwhile, rivals like Alphabet (GOOGL) and Microsoft (MSFT) are racing ahead in artificial intelligence (AI), leaving Apple looking like the cautious tortoise rather than the bold hare in today’s innovation race.

That’s why the sudden chatter around a foldable iPhone feels like a plot twist. Reports suggest Apple has entered trial production in Taiwan, with Foxconn (HNHPF) already involved, and mass production potentially starting in India by 2026. If executed right, this would mark Apple’s first major hardware leap in years.

The smartphone market is mature, competition in foldables is fierce with Samsung and Huawei, and Apple must deliver more than just a late entry — it must redefine the category. With AAPL stock gradually nearing its all-time highs, is the prospect of a foldable iPhone enough to fuel another leg up? Or is it just another chapter in the long wait for Apple’s next big thing?

About Apple Stock

California-born Apple hardly needs an introduction. Since its 1976 founding by Steve Jobs, Steve Wozniak, and Ronald Wayne, it has continuously reshaped tech — from the Macintosh revolution to the iPod, iPhone, and beyond. With a staggering $3.7 trillion market capitalization, Apple drives innovation through the iPhone, iPad, Mac, AirPods, Apple Watch, and Apple Vision Pro.

Its six platforms — iOS, iPadOS, macOS, watchOS, visionOS, and tvOS — create a seamless ecosystem, powering services like the App Store, Apple Music, iCloud, and Apple TV+. Known for unmatched brand loyalty, smooth integration, and global scale, Apple is more than just a company. It is a trendsetter shaping the digital world.

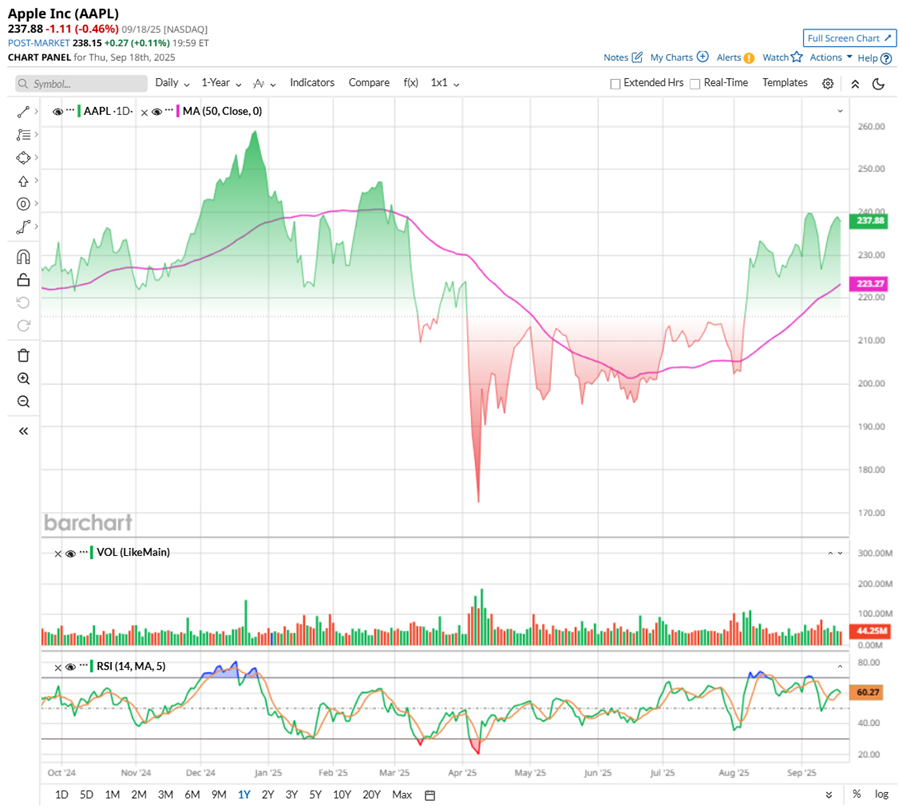

Apple may be the king of innovation, but AAPL stock hasn’t been immune to the turbulence of 2025. Shares are up only 1% year-to-date (YTD), pressured by escalating trade tensions, looming tariffs, and regulatory scrutiny. Add in intensifying AI competition, and investors have had plenty to worry about.

Yet, Apple’s resilience is showing. After sliding to the $200 zone in early August, AAPL stock staged a sharp comeback — a rebound that carried it past its 50-day moving average. The stock even surpassed the $250 mark this week. AAPL closed Sept. 24 at $252.30, just 3% shy of its 52-week high of $260.10.

Apple’s shares are not exactly a bargain. AAPL is priced at 34.8 times forward earnings and 9.7 times sales, clearly carrying a premium tag. But for Apple, premium doesn’t mean overpriced — it signals strength. Investors pay up because the company’s fortress-like ecosystem, global scale, and unmatched brand loyalty offer rare certainty.

That confidence trickles down to shareholders, too. Apple has raised dividends for 13 years straight, most recently paying $0.26 in August, bringing the annual payout to $1.04. The forward yield may be a slim 0.41%, but with just 13.8% of profits flowing out as dividends, Apple keeps plenty in reserve. That low payout ratio hints at future increases, reminding investors that the company’s premium valuation isn’t only about what it is today, but about the firepower and consistency still ahead.

A Snapshot of Apple’s Q3 Results

Apple’s third-quarter earnings report, unveiled on July 31, felt like déjà vu for anyone who’s followed the company — it was another blockbuster. Revenue rose 10% year-over-year (YOY) to $94 billion, the fastest growth since late 2021 and a record June quarter. Profits were just as strong, with EPS up 12% annually to $1.57, topping Wall Street’s estimates by more than 10%.

The iPhone led the charge, jumping 13% annually to $44.6 billion thanks to strong iPhone 16 demand. Services followed with their own record generating $27.4 billion, up 13%. Macs brought in $8.05 billion, iPads $6.6 billion, and gross margins stayed sturdy at 46.5%, right at the high end of Apple’s guidance.

Growth was not just from one region either — Americas, Europe, Greater China, Japan, and Asia Pacific all chipped in, pushing the installed base of Apple devices to all-time highs.

Investors weren’t left out. Apple returned over $25 billion last quarter — $3.9 billion in dividends and $21 billion in share buybacks. Even after that, the company still holds a hefty $36.3 billion in cash, showing its financial muscle.

Still, not everything was smooth. CEO Tim Cook highlighted $800 million in tariff costs this quarter, which could climb to $1.1 billion if trade tensions drag on. Apple is adding capacity in India and Vietnam, but China remains its main production base — a shift that takes time and money. Plus, U.S. calls for more domestic manufacturing could push up costs and test consumer price tolerance.

No surprise then that, despite stellar numbers, AAPL stock slipped on Aug. 1. Broader market weakness, tariff concerns, and fears of demand being pulled forward weighed on the mood. Yet Apple’s outlook remains solid. Management is guiding for mid-to-high single-digit revenue growth this quarter, with services still running at double-digit gains and gross margins projected between 46% and 47%.

Analysts monitoring the company remain optimistic, predicting EPS to be around $7.36 for fiscal 2025, up 9% YOY, before surging another 7% annually to $7.88 in fiscal 2026.

Apple Is Late But Not Out of the Race

For years, Apple has played it safe with incremental iPhone updates — better cameras, sharper displays, faster processors. However, whispers from Taiwan hint at Apple’s boldest move in years — a foldable iPhone. Trial production is underway with Foxconn, and a 2026 rollout, possibly in India, is on the horizon. With smartphone demand stagnating, such a launch could reignite upgrade cycles and ripple growth across Apple’s entire ecosystem.

Remember the MP3 player market before the iPod, or smartphones before the iPhone? Both categories existed, but Apple entered late, reimagined the design, polished the user experience, and suddenly the whole industry had to catch up. With its sticky ecosystem of iOS, AirPods, and Apple Watch, Apple is uniquely positioned to make foldables mainstream.

But the risks are just as real. Samsung, Huawei, and others have been in the foldable game for years, and even now, adoption is limited. Screens crease, hinges wear down, and price tags run high. Apple’s late arrival raises expectations — it can’t simply match rivals, it has to deliver a foldable that feels flawless. Even then, consumer demand is unproven at scale, and production costs could squeeze margins.

What Do Analysts Expect for Apple Stock?

Wall Street’s lens on Apple is sharpening, and the story analysts are telling is one of premium pricing with even bigger payoffs ahead. JPMorgan recently lifted its price target on the stock to $280 from $255, sticking with an “Overweight" rating. The bank sees “favorable demand indications” around the early iPhone 17 launch and is already baking in what could be the next game-changer – a foldable iPhone slated for fall 2026.

JPMorgan argues that the foldable device won’t just be a flashy product — it will trigger a stronger upgrade cycle in 2027, pushing iPhone revenue into low double-digit growth. The brokerage firm anticipates Apple’s overall revenue to climb 7% in fiscal 2026 and accelerate to 10% in 2027, powered by iPhone momentum, resilient Services, and stable gross margins. JPMorgan also pegs iPhone shipments at 236 million units in fiscal 2026, up 2% YOY, enough to sustain mid-to-high single-digit growth even before the foldable takes off. The only speed bump is rising operating expenses as Apple pours money into its Apple Intelligence push, tempering EPS upside even as gross profits surge.

Tigress Financial paints an even more bullish picture. The brokerage firm boosted its target to $305 while maintaining a “Strong Buy” rating. For Tigress, the core of Apple’s story is its “massive ecosystem,” fueled by accelerating Services, deep AI innovation, and greater U.S. supply-chain investments. The firm points to Apple’s strong Q3 results, its AI integration strategy, and the splashy “Awe Dropping” event that introduced the iPhone 17 lineup, iPhone Air, AirPods Pro 3, and Apple Watch Series 11 as proof of the company's staying power.

Tigress sees Apple Intelligence as the engine that speeds up new product cycles, boosting Services and ecosystem stickiness. With its fortress balance sheet and steady cash flow, Apple is also positioned to fund acquisitions, push deeper into AI, and keep rewarding shareholders with dividends and buybacks.

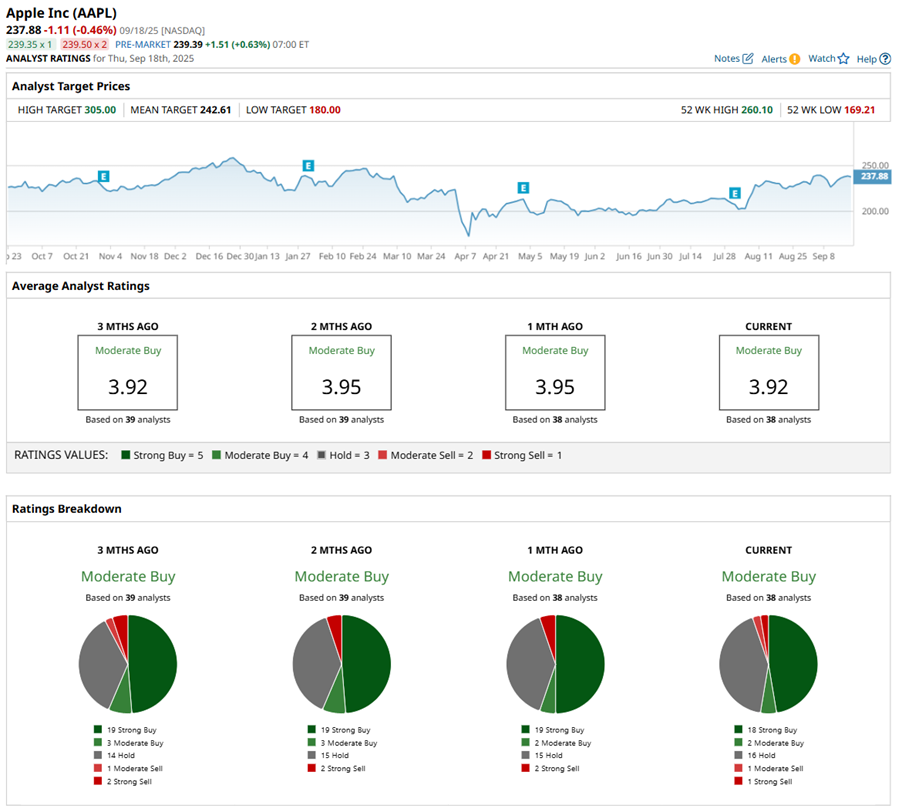

AAPL stock has a consensus “Moderate Buy” rating overall. Out of 38 analysts covering the tech stock, 18 recommend a “Strong Buy,” two give a “Moderate Buy,” 16 analysts stay cautious with a “Hold” rating, one has a “Moderate Sell” rating, and the remaining one analyst has a “Strong Sell” rating.

The average analyst price target for AAPL is $244.52, indicating potential downside of around 3% from here. However, the Street-high target price of $310 suggests that the stock could rally as much as 23%.

Final Thoughts on AAPL

Apple has never been about being first. It has been about being the one that gets it right. That’s why the foldable iPhone chatter is drawing so much attention.

On one hand, the potential is massive — a polished foldable could jumpstart upgrade cycles, extend Apple’s dominance, and add a spark to a product lineup that’s been coasting on refinements. With trial production underway and mass rollout targeted for 2026, the company clearly sees this as more than a side project.

But investors shouldn’t ignore the risks. Other players in this area have struggled to make foldables mainstream, and Apple faces higher costs, fragile designs, and lofty expectations. If Apple stumbles, Wall Street may question whether it still has the innovative edge it once commanded. Either way, the foldable gamble represents Apple’s boldest shot yet at reigniting the magic. The market will be watching closely.