With the Federal Reserve moving away from its prior efforts to tighten money supply, the measure theoretically provides relief for many economic entities. Under basic economic principles, reduced costs of borrowing encourage capital expenditures, investments and other growth-centered activities. However, one of the more obvious beneficiaries is the housing market.

Earlier this year, the U.S. housing market inked the slowest month of May for existing-home sales since 2009, underscoring the harsh reality behind elevated mortgage rates and record prices. At the time, National Association of Realtors chief economist Lawrence Yun characterized the numbers as "very stable, but at the sluggish sales activity level."

Interestingly, though, Yun provided this hope for optimism: "if mortgage rates decrease … expect home sales to increase." Undergirding the hypothesis was evidence (at the time) of stronger income growth and healthier inventories. Most significantly, the Fed had signaled its intention to reduce the benchmark interest rate.

In September, that moment finally arrived, with the central bank moving to cut the rate by 25 basis points to a range between 4.00% to 4.25%. The widely anticipated move ended a nine-month policy pause. Even better for proponents of dovish strategies, the Fed again cut rates late last month by another 25 basis points, thereby targeting a range of 3.75% to 4.00%.

Significantly, policymakers stated that they would stop reducing holdings of Treasury and agency mortgage-backed securities on Dec. 1, marking the end of the quantitative tightening program that began in mid-2022.

As stated earlier, reduced borrowing costs should help multiple economic agents, with prospective buyers and refinancers representing one of the key beneficiaries. Since elevated mortgage standards forced many buyers out of the picture, the policy pivot could potentially spark a baseline demand increase.

Still, economic matters are rarely solved easily. While reducing the benchmark interest rate helps some of the administrative burdens tied to homeownership, many structural concerns remain. For example, University of Michigan economist Justin Wolfers stated that slower job growth and high unemployment amid elevated inflation points to stagflation.

Nevertheless, economic realities have influenced a specific path for the Fed — and that path looks decidedly accommodative. Subsequently, some investors are intrigued by the prospects of new opportunities in the housing market.

The Direxion ETF: For investors who are intrigued by shifting dynamics in real estate and its surrounding ecosystem, financial services provider Direxion offers an ultra-leveraged exchange-traded fund. Called the Direxion Daily Homebuilders & Supplies Bull 3X Shares (NYSE:NAIL), the fund tracks 300% of the performance of the Dow Jones U.S. Select Home Construction Index.

Fundamentally, the NAIL ETF provides a convenient mechanism for speculation. Generally, those seeking leveraged positions must engage the options market, which may carry complexities not suitable for every trader. In contrast, Direxion ETFs are exclusively debit-based transactions, thus operating very much like any other publicly traded security. This familiar process helps mitigate the learning curve.

However, prospective participants should be cognizant of the risks involved. Primarily, ultra-leveraged funds are far more volatile than their non-leveraged counterparts that track benchmark indices like the S&P 500. Moreover, Direxion ETFs are designed for exposure lasting no longer than one day. Holding onto these vehicles for longer than recommended may expose traders to positional decay stemming from the daily compounding effect.

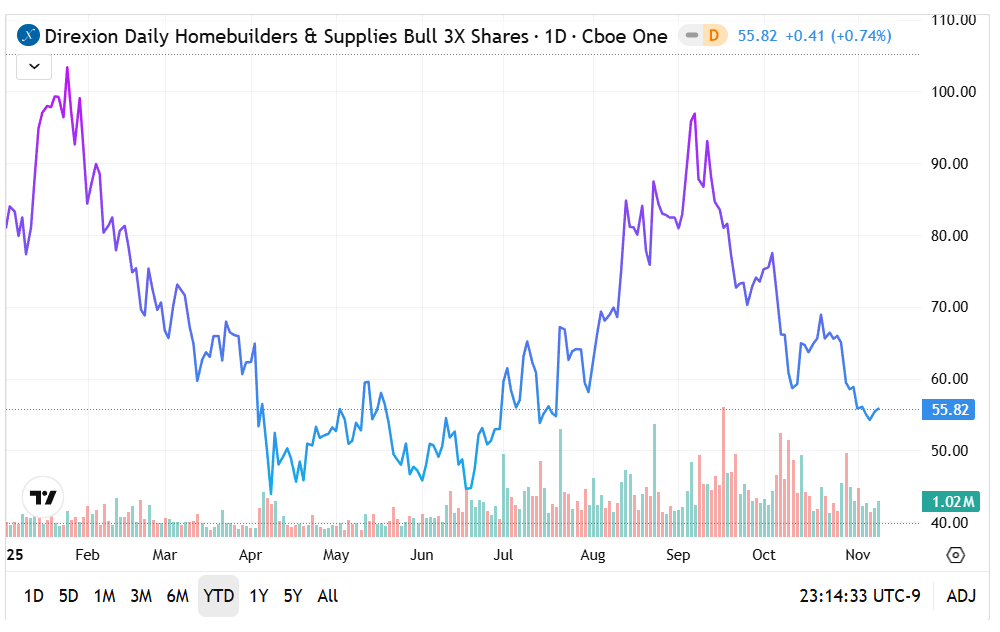

The NAIL ETF: Since the start of the year, the NAIL ETF has lost nearly 34% of market value. In the last six months, the red ink was substantially mitigated to 6%.

- At the moment, the NAIL ETF is mired in a negative cycle, with the price action firmly below multiple moving averages.

- After witnessing a rise in acquisition volume that coincided with a lift in NAIL, the leveraged fund has dipped considerably since early September.

- One potential source of optimism is that downside momentum could be fading. If so, optimists will be looking for the $50 psychological support line to hold.

Featured image from Shutterstock