/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) shares surged nearly 8% on Sept. 15 after the artificial intelligence (AI)-focused cloud infrastructure provider revealed a $6.3 billion order from Nvidia (NVDA), under which Nvidia is obligated to buy any unsold capacity through April 2032. The deal underscores CoreWeave’s deep reliance on Nvidia GPUs, which it rents to clients, and strengthens their strategic partnership. Nvidia already owns about 7% of CRWV stock.

The company, although with a bottom line in the red, is steadily increasing its revenue. With marquee clients like OpenAI backing multi-billion-dollar deals, there could be significant upside ahead for CRWV stock.

Investor enthusiasm remains high amid the AI growth, and Nvidia is trusting CoreWeave as a strategic partner. Thus, this deal makes a strong case for shares of CoreWeave being worth serious consideration now.

About CoreWeave Stock

Headquartered in Livingston, New Jersey, CoreWeave was founded in 2017 and has evolved into a leading provider of GPU-optimized cloud infrastructure for AI training and inference. With a market capitalization of around $59 billion, the company is steadily strengthening its position in the sector.

Since its March 2025 initial public offering (IPO), investor interest has been strong, driven by soaring AI demand and high-profile collaborations with the likes of OpenAI, Microsoft (MSFT) and Nvidia. CRWV stock debuted at $40 per share but soon skyrocketed to a high of $187 on June 20 as retail investors looked for new AI opportunities.

Most recently, the stock jumped 7.6% on Sept. 15, propelled by the excitement around the Nvidia deal, closing the session at $120.47 per share. CRWV stock is up by a robust 8% over the past five days and 25% over the past month.

The stock is currently trading at 16.8 times forward sales, which is a premium compared to its peers.

CoreWeave's Strong Topline Growth

On Aug. 12, CoreWeave posted its second-quarter results, highlighting impressive growth fueled by surging AI demand. Revenue soared 207% year-over-year (YOY) to $1.2 billion, topping expectations, while the company’s backlog expanded to $30.1 billion as of June 30.

Still, profitability remained pressured by escalating costs, with a net loss of $290.5 million, or $0.60 per share. That's compared to a $323 million loss, or $1.62 per share, a year earlier. Adjusted net loss also widened significantly to $130.8 million from just $5.1 million in the prior-year quarter.

On a brighter note, adjusted EBITDA rose to $753.2 million with a 62% margin, and adjusted operating income improved to $199.8 million with a 16% margin. Management expressed confidence in sustained demand, raising full-year revenue guidance to between $5.15 billion and $5.35 billion and projecting Q3 revenue of $1.26 billion to $1.3 billion.

Analysts anticipate the company's loss per share to increase 100% YOY to $2.52 in fiscal 2025, before improving by 45% to reach $1.38 in fiscal 2026.

What Do Analysts Expect for CoreWeave Stock?

Recently, Cantor Fitzgerald reiterated an “Overweight” rating on CRWV stock with a $116 price target, citing momentum from the new $6.3 billion Nvidia order. Cantor Fitzgerald expects the deal to boost the company’s backlog by 21% from its Q2 2025 level of $30.1 billion.

Citizens JMP also upgraded CoreWeave from “Market Perform” to “Market Outperform” with a $180 price target, highlighting strong momentum. The firm expects diversification around GPUaaS to mitigate risks and drive long-term sustainability.

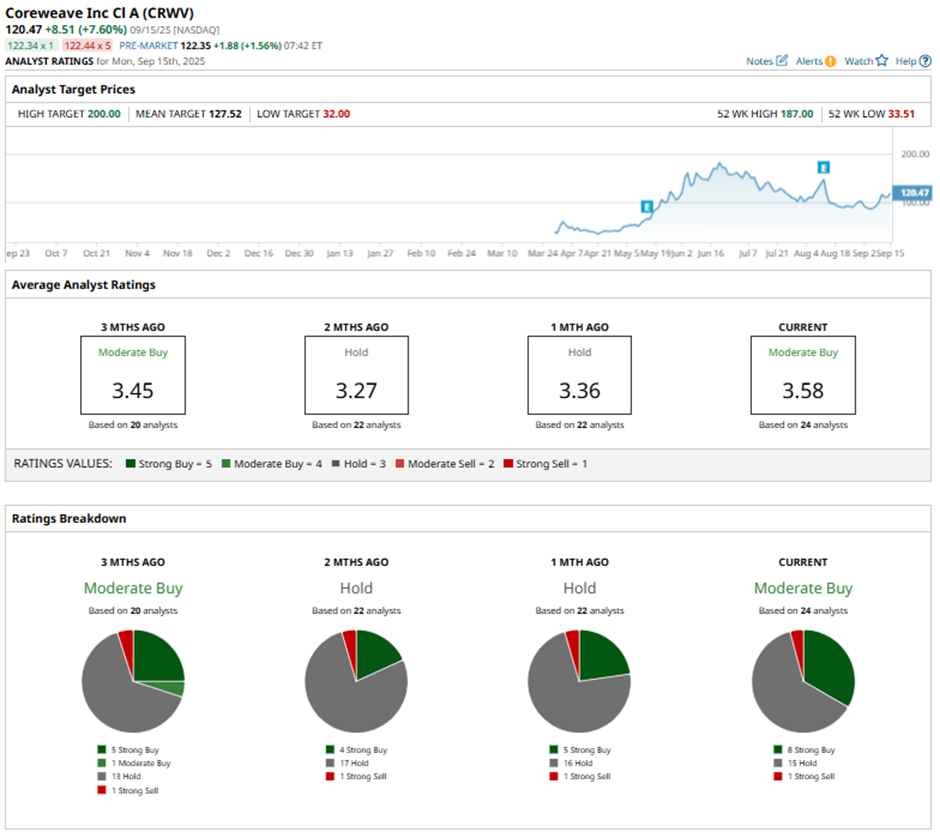

CoreWeave stock has a consensus “Moderate Buy” rating overall. Out of 25 analysts covering the tech stock, nine recommend a “Strong Buy,” 1 has a “Moderate Buy,” 14 analysts stay cautious with a “Hold” rating, and one has a “Strong Sell” rating.

CRWV stock’s average analyst price target of $129.91 indicates potential upside of 7% from here. Nevertheless, the Street-high target price of $200 suggests 65% upside ahead.