/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

Elastic (ESTC) finds itself back in the news following the announcement of a $500 million share-repurchase authority, a development that highlights management's confidence in the execution and balance sheet of the company. This comes on the back of an excellent first quarter of the FY 2026, during which Elastic outpaced Wall Street forecasts across the board on the back of gaining traction for its AI-powered search, security, and observability offerings.

The buyback move arrives with the larger software industry experiencing pressure from valuation rewrites and dual-cloud spending trends. But Elastic’s double-digit growth resuming, growing AI footprint, and increasing free cash flow are distinguishing the company. With the upside to fair value seen sharply by analysts and management gesturing to renewed shareholder payouts, investors are reevaluating whether the ESTC stock is undervalued prior to the next phase of growth.

About Elastic Stock

Elastic is an enterprise software company headquartered in San Francisco, focused on the development of AI-powered search and analytics software for observability, cybersecurity, and enterprise search. The Search AI platform of the company helps organizations convert scalable datasets into automation and real-time insights. Elastic’s market capitalization is close to $9 billion, and the company serves more than half of the Fortune 500 corporations with essential infrastructure for faster, smarter data recovery and protection.

Elastic shares ranged between $70.14 and $118.84 within the previous 52 weeks and recently traded around $82, down some 30% in recent weeks from their year-high. Year-to-date (YTD), ESTC remains modestly negative in comparison with the S&P 500 Index ($SPX), which has gained approximately 11% during the comparable time frame. Nonetheless, its 3% gain in the prior five days signals renewed purchasing power following strong financials and capital-return news.

From a valuation standpoint, Elastic trades at 6.2 times price-to-sales (P/S) and 9.46 times price-to-book (P/B), showing investors believe in its model of recurring revenue and expansion of margins. Unprofitable on a GAAP basis with a -7.3% profit margin, the firm's better cash-flow generation and $1.5 billion in cash buffers tighten its balance sheet. Compared with the peers in the cloud software space, the multiple of the stock is below the premium-rated observability peers, and this may leave room for rerating in case the company shows improvement in terms of profitability.

Elastic did not pay dividends recently, choosing rather to invest in AI product development and strategic share repurchases.

Elastic Beats on Earnings and Approves Buyback

Elastic reported a spectacular first-quarter fiscal 2026 (ended July 31, 2025) report, beating the higher end of guidance in all metrics. Total revenue increased 20% year-over-year (YoY) to $415 million, and subscription revenue increased 20% to $389 million. Cloud revenue, the key growth pillar, increased 24% to $196 million, showing steady movement towards Elastic Cloud. The company clocked non-GAAP operating income of $65 million (16% margin) and EPS of $0.60, beating the consensus view. Free cash flow of $116 million reasserted rising capital efficiency.

CEO Ash Kulkarni attributed outperformance to strong execution and growth in AI adoption, stating that "AI is now clearly shaping tech decisions," but also highlighted Elastic's uniqueness in vector search and analytics. Product momentum also came with new launches like Elastic AI SOC Engine (EASE) for security and Logs Essentials for observability workloads, along with new vector-search algorithm upgrades (ACORN-1 and BBQ).

The report’s issuance following that was Elastic’s board’s approval of a $500 million share-repurchase program with no expiration. CFO Navam Welihinda commented the move signifies “confidence in the strength of Elastic’s business, strategy, and execution.” The company had $1.49 billion in cash and investments and is in the position to invest in internal growth as well as shareholder returns, a rather unusual dual capability among mid-cap software peers.

For the third quarter ending Oct. 31, management provides revenue guidance in the range of $415 million to $417 million (+14% YoY at the midpoint) and non-GAAP EPS of $0.56 to $0.58, in line with double-digit margin expansion extension through FY 2026.

What Do Analysts Expect for ESTC Stock?

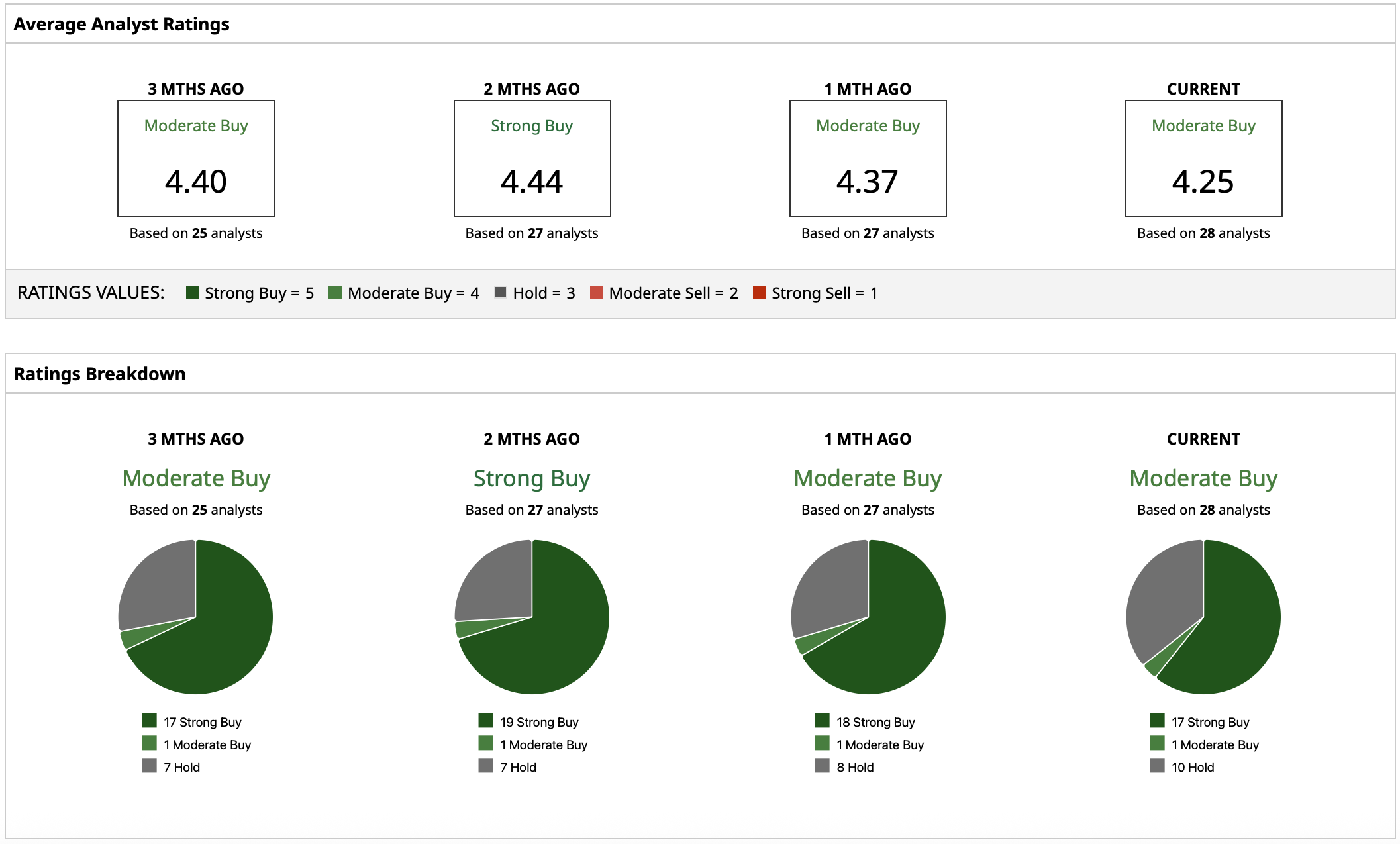

ESTC has a “Moderate Buy” consensus rating and a $118.33 consensus target price. The $150 top target assumes much higher re-rating potential if Elastic can maintain 20%+ revenue growth and sustain margin expansion.