/Semiconductor%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Marvell Technology (MRVL) soared this week after it launched a fresh $5 billion stock buyback program to accompany its earlier authorization and initiate a $1 billion accelerated buyback. The announcement demonstrates optimism by management in balance sheet condition as well as long-term growth perspective, particularly in artificial intelligence infrastructure.

The report follows strong second-quarter earnings results in which revenue hit 58% year-over-year (YoY) growth to an all-time high for the company. On top of rising demand for artificial-intelligence semiconductors and across-the-board excitement about sector-wide bets on infrastructure, Marvell's positioning itself among more promising stocks for investors to take notice of in late 2025.

About Marvell Stock

Marvell is a chip company headquartered in Santa Clara, California, that deals in data infrastructure and provides custom silicon, networking, storage, and electro-optic solutions. Its market capitalization is over $70 billion, and it competes in a highly consolidated space along with Nvidia (NVDA), Broadcom (AVGO), and AMD (AMD).

MRVL stock has varied over a wide 52-week range from $47.08 to $127.48 and thus shows volatility across the chip sector. At $82.61 per share, the stock has gained close to 5% in the previous half-dozen trading days, though it remains below its 2025 highs and lags the Nasdaq Composite's ($NASX) double-digit gains this year.

On valuation, Marvell is trading at 34.9x forward earnings and 11.2x sales, which is a premium over its traditional semiconductor peers but justified by its robust AI-driven growth momentum. With a price/earnings-to-growth ratio of 0.90, it continues to suggest that MRVL stock is undervalued in relation to its earnings growth. With modest debt (0.33 debt-to-equity) and increasing profitability metrics, Marvell appears financially healthy.

Unlike some of its competitors, Marvell isn't dividend-driven, favoring repayment of capital largely in buybacks. The recently raised $5 billion authorization is more shareholder-friendly in how it deploys capital.

Marvell Beats on Earnings

Marvell announced historic Q2 fiscal 2026 revenue of $2.006 billion, rising by 58% over the prior year and slightly higher than guided. GAAP EPS was $0.22, and non-GAAP EPS of $0.67 beat Wall Street estimates. Operating cash flow of $462 million demonstrates strong cash generation, which is crucial to fund both growth and buybacks.

Ahead, revenue in Q3 was guided by management to $2.06 billion (+/-5%) with further gross margin expansion to possibly as high as 60% on a non-GAAP basis. Non-GAAP EPS is guided at $0.74 with optimism regarding demand resiliency despite losing out on Automotive Ethernet business in August.

CEO Matt Murphy signaled record custom AI design engagement with over 50 new deals across 10+ customers, underscoring Marvell's leadership position in the AI buildout in infrastructure. Aside from AI, the firm is also seeing a robust rebound in enterprise network and carrier infrastructure segments, diversifying revenue growth.

What Do Analysts Expect for MRVL Stock?

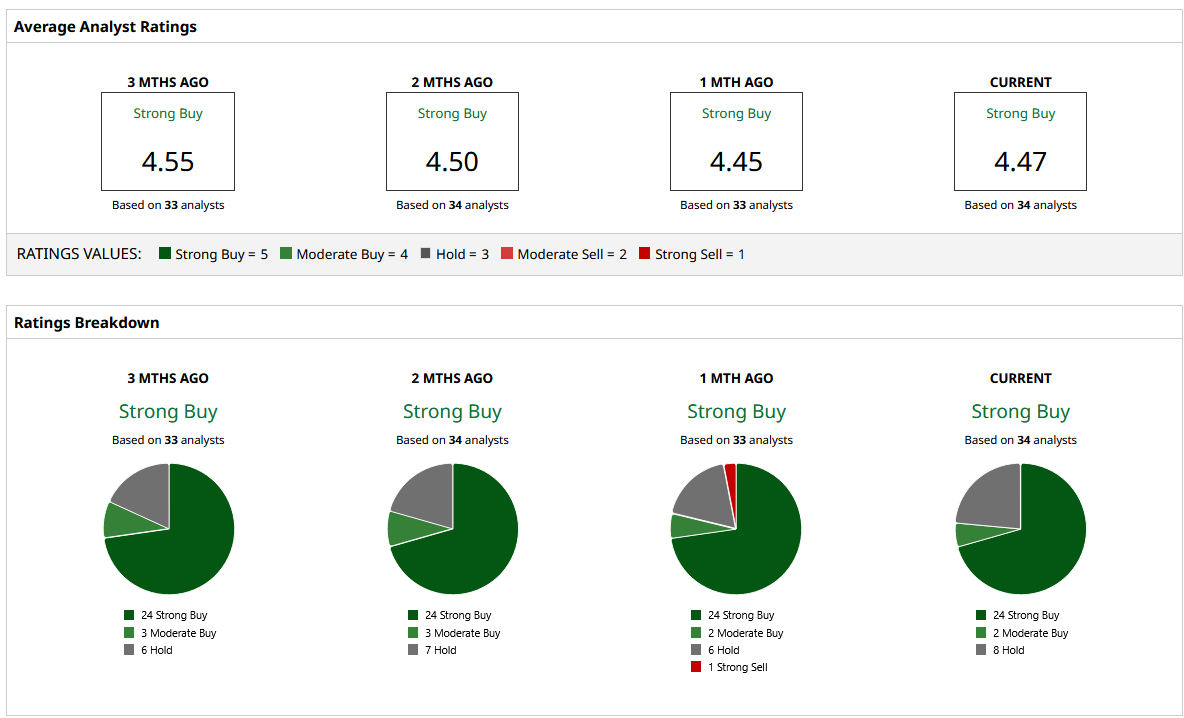

Wall Street remains optimistic about Marvell, assigning a consensus “Strong Buy” rating for MRVL stock. Revisions have been positive in increasing numbers over recent months as AI tailwinds gather momentum.

The consensus target price from analysts for MRVL is $87.78, which implies roughly 6% potential gains from here. The Street-high target of $122 would imply significantly greater possible gains if momentum from artificial intelligence continues to leave estimates in the dust. However, volatility in the chip cycle risks is embodied by the downside estimate of $58.