/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)

Artificial intelligence (AI) has quickly become one of the biggest investment themes of the decade, with tech heavyweights like Microsoft (MSFT) and Amazon (AMZN) pouring billions into cloud infrastructure to power next-generation AI systems. But while the spotlight often falls on U.S. firms, Europe is quietly mounting its own challenge in the race for AI dominance.

One of the most ambitious moves comes from SAP SE (SAP), the German software powerhouse best known for its enterprise solutions. The company recently announced plans to invest more than 20 billion euros ($23 billion) into sovereign cloud AI infrastructure across Europe over the next decade. This push aims not only to strengthen data sovereignty under strict EU privacy rules but also to position SAP as a central player in Europe’s AI transformation.

For investors looking beyond Silicon Valley, SAP’s massive bet could make this underdog AI stock worth a closer look.

About SAP Stock

Based in Walldorf, Germany, SAP is a global leader in enterprise application software, providing solutions that support business operations across a wide range of industries. SAP develops software products that help organizations manage processes more effectively. The company’s flagship product, SAP S/4HANA, is an advanced enterprise resource planning suite that supports finance, risk management, project management, procurement, manufacturing, and supply chain operations.

Valued at $322 billion by market cap, SAP’s stock has rallied about 15% from April lows of $232 after a Q1 beat and upbeat cloud targets. However, investors later pared gains when Q2 results merely maintained guidance, and August’s AI jitters trimmed momentum.

In terms of valuation, SAP currently trades at a price-to-sales (P/S) ratio of 7.48 compared to the sector median of 3.39 and a price-to-book (P/B) ratio of 6.54 compared to 3.59. These metrics suggest the stock may be trading at a premium relative to its peers.

SAP Cloud Push

According to recent news, SAP will invest over €20 billion ($23 billion) to build a European sovereign cloud, making digital sovereignty central to its AI strategy. The plan ensures sensitive data stays in Europe, meeting strict rules like GDPR and the upcoming EU AI Act. SAP’s new cloud stack includes its own infrastructure, on-site deployments, and the Delos public-sector cloud in Germany, all designed for regulated industries and public agencies.

This move positions SAP alongside AWS, Microsoft, and Alphabet (GOOG) (GOOGL), which also launched EU-only cloud services. SAP says its edge lies in integrating business software with sovereign AI tools, allowing companies to run the full SAP Business Suite and AI services in Europe without handing data to non-EU providers.

Q2 Results: Growth with Caution

SAP’s latest quarter shows robust demand for cloud and AI offerings and ample cash to fund this investment, but also a cautious tone. For Q2 2025, SAP reported total revenues of €9.03 billion, up 9% year-over-year (YoY). Cloud subscription and support revenues grew 24%, led by a 30% jump in Cloud ERP Suite bookings to €4.42 billion. Profitability was also strong; non-IFRS operating profit rose 35% to €2.57 billion, and net cash from operations jumped 71% to €2.58 billion.

The balance sheet remains healthy. SAP still holds roughly €7 to 8 billion in cash and equivalents (down from €11.3B in Q1), partly due to share repurchases and investments.

SAP reaffirmed its full-year guidance. It still expects 2025 cloud revenues of about €21.6 to €21.9 billion, up 28% in constant currency, and roughly €33.1 to €33.6 billion in cloud+software sales. Non-IFRS operating profit is guided to €10.3 to 10.6B. As CFO Dominik Asam noted, SAP remains “cautiously optimistic” but is mindful of geopolitical uncertainties.

What Do Analysts Think About SAP Stock

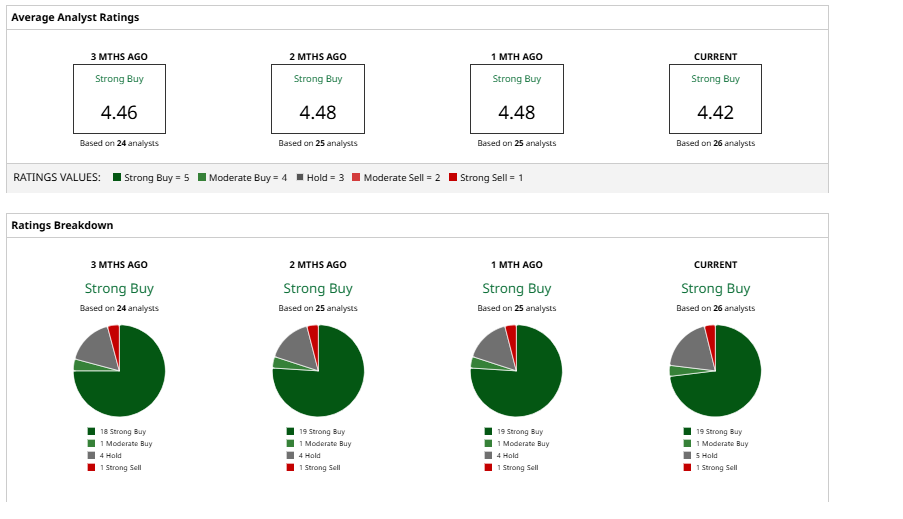

Wall Street analysts are closely tracking SAP’s AI and cloud initiatives and remain bullish on the stock’s prospects. Among 26 analysts covering the company, the consensus rating stands at “Strong Buy.” The breakdown includes 19 “Strong Buy,” one “Moderate Buy,” five “Hold,” and a single “Strong Sell.” The average 12-month price target of $330 suggests an expected upside of about 22% from the current level.