/Uber%20Technologies%20Inc%20logo%20outside%20offices-by%20Sundry%20Photography%20via%20iStock.jpg)

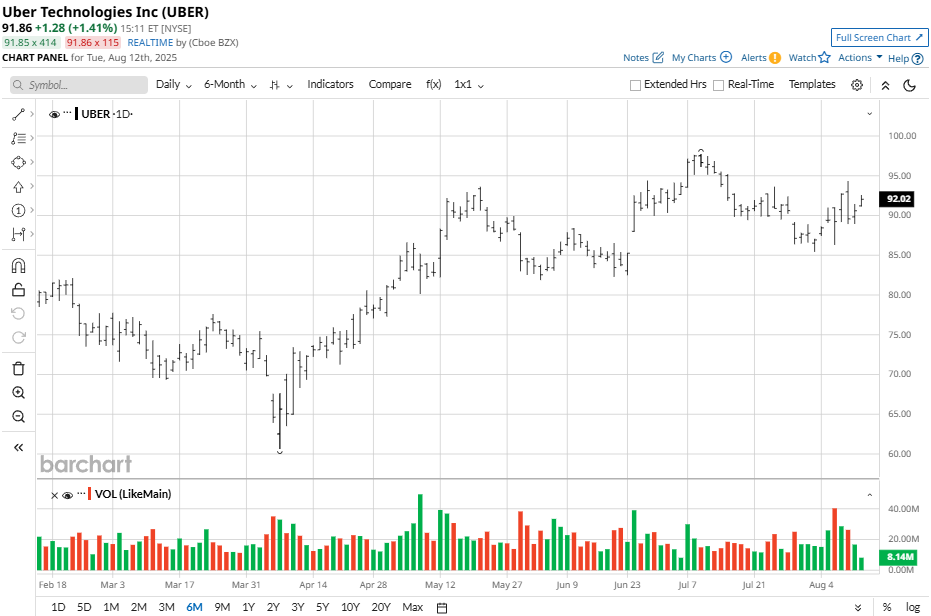

Uber’s (UBER) stock has outperformed the market this year, gaining more than 50% in the year to date, significantly outperforming the S&P 500 Index’s ($SPX) more modest 9.9% rise. The stock reached an all-time high above $97, although it has since pulled back.

Although it likely needs no introduction, Uber is a global ride-hailing and mobility company. Its platforms connect millions of riders, offering grocery and grocery delivery, as well as freight logistics. The company manages approximately 36 million trips daily, with more than 180 million monthly active users.

Uber’s Strong Quarter Amid Buyback Plans

Uber Technologies reported strong Q2 2025 financial results, surpassing analyst expectations. The company posted earnings per share (EPS) of $0.63, beating the consensus estimate of $0.62 and marking a 34% increase year-over-year. Total revenue rose 18% to $12.7 billion, also exceeding analyst estimates of around $12.46 billion. Both figures reflect robust growth driven primarily by expanded platform usage and increased trips across Uber’s core segments.

In terms of key financial indicators, Uber’s adjusted EBITDA climbed 35% year-over-year to $2.1 billion, with margin expansion to 4.5% of gross bookings. Gross bookings grew 18% to $46.8 billion, while net income surged to $1.4 billion.

The company generated $2.6 billion in operating cash flow and $2.5 billion in free cash flow, underscoring strong cash generation. End-of-quarter unrestricted cash and marketable securities totaled $7.4 billion.

CEO Dara Khosrowshahi expressed confidence in steady consumer demand and highlighted Uber’s advances in autonomous vehicle partnerships with firms like Waymo, Apollo Go, and others. Uber announced a new $20 billion stock buyback program, signaling optimism about its growth and profitability.

Looking ahead, Uber raised its outlook for Q3 2025, projecting gross bookings growth of 17% to 21% year-over-year and adjusted EBITDA growth of 30% to 36%.

Should You Buy UBER Stock?

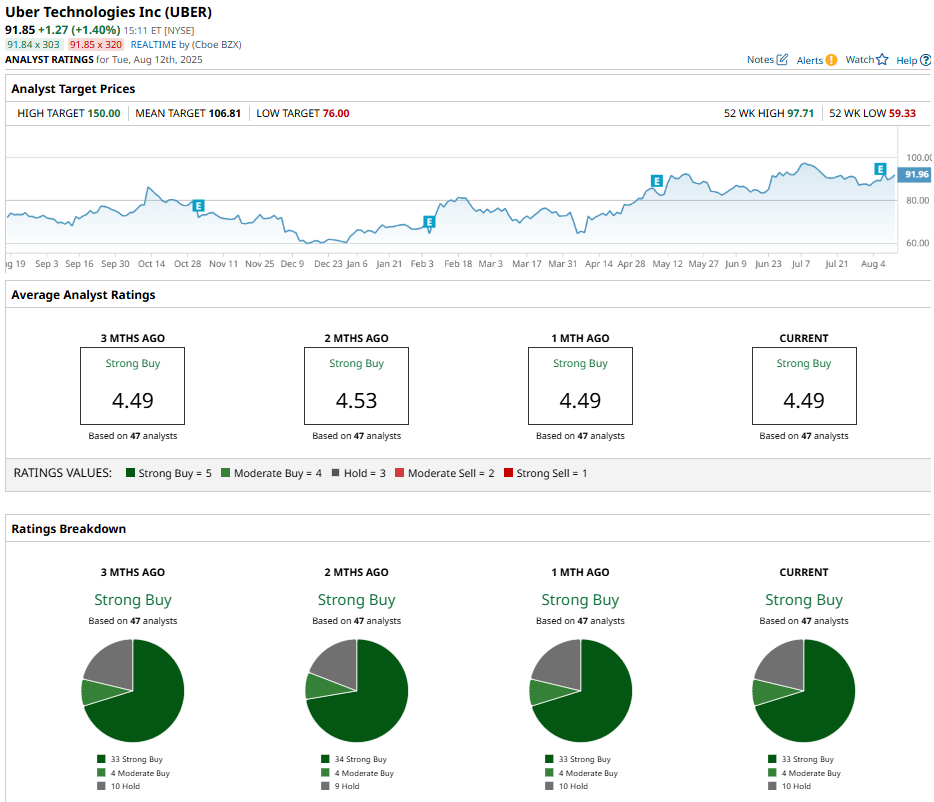

Uber has plenty of support on Wall Street. The stock has a “Strong Buy” consensus rating with a mean price target of $106.81, reflecting upside potential of 16% from current price levels.

The stock has been reviewed by 47 analysts while receiving 33 “Strong Buy” ratings, four “Moderate Buy” ratings, and 10 “Hold” ratings.