/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Microsoft (MSFT) has inked a multi-year agreement with Nebius (NBIS) to tap into its artificial intelligence (AI) infrastructure, securing access to over 100,000 Nvidia’s (NVDA) GB300 chips.

The deal, worth $17.4 billion with the option to expand it by another $2 billion, positions NBIS as a key neocloud partner in MSFT’s strategy to scale generative AI capacity.

Nebius stock extended gains on the Microsoft news and is now trading about 6x its price in April.

Why the Microsoft Partnership Is a Big Deal for Nebius Stock

Investors are cheering the Microsoft deal this morning primarily because it stands to boost Nebius’ revenue and serves as a validation of its infrastructure capabilities.

As Microsoft reallocates workloads to neocloud providers, NBIS becomes a strategic enabler of OpenAI model deployment and Azure scalability.

The transaction also places Nebius in elite company alongside CoreWeave (CRWV) and Lambda, signaling its technical credibility.

With MSFT’s cloud chief Scott Guthrie describing the artificial intelligence race as a “land-grab,” NBIS stock is now part of the front-line effort to meet surging demand.

This agreement is a long-term anchor client win for Nebius, with potential for expansion as Mirosoft’s AI ambitions grow.

Are NBIS Shares Worth Owning in 2025?

While Nebius shares aren’t inexpensive to own at a price-sales (P/S) ratio of over 230x currently, the exceptional pace at which it’s growing its revenue makes it suitable for long-term investors with adequate risk tolerance.

In its latest reported quarter, the Nasdaq-listed firm more than doubled its revenue sequentially to about $105 million, achieving positive adjusted EBITDA in its core business as well.

Moreover, a debt-to-assets ratio of nearly 26% suggests NBIS isn’t overly reliant on debt financing and retains flexibility to raise fresh capital if needed for expansion or strategic initiatives.

NBIS shares remain attractive for long-term investors also because the company’s transformation from Yandex to a global AI player headquartered in Amsterdam adds geopolitical insulation and strategic clarity.

What’s Wall Street’s View on Nebius Group?

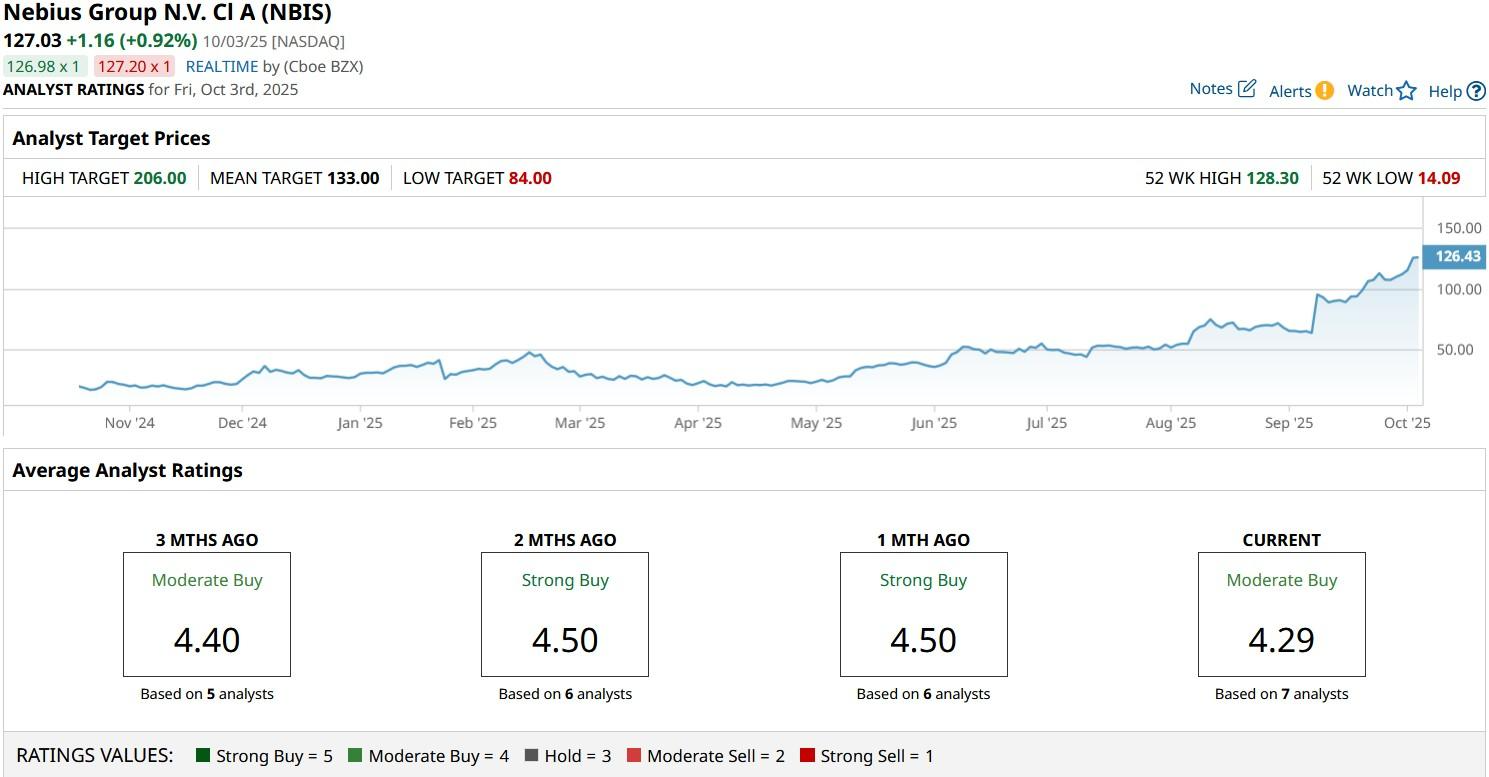

What’s also worth mentioning is that Wall Street continues to forecast potential for further gains in NBIS shares.

The consensus rating on Nebius stock currently sits at “Moderate Buy” with price targets going as high as $206, indicating potential upside of another 65% from here.