/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

CoreWeave (CRWV) jumped close to 12% this week after signing a humongous $14.2 billion Meta Platforms (META) cloud infrastructure contract. It's just the addition to CoreWeave's swift contract pace that incorporates a commitment worth a whopping $22.4 billion with OpenAI as well. These high-profile contract victories shine a light on CoreWeave’s growing status as an integral AI infrastructure backbone.

The firm has emerged as a leading participant in what some describe as the “neocloud” revolution, constructing purpose-built data centers designed for optimization on Nvidia (NVDA) GPUs. In a rush to pre-empt hyperscalers and AI labs vying for compute muscle, CoreWeave’s rapid scale-up makes it one of the fastest-growing cloud infrastructural players around. Investors now wonder if this newest Meta agreement seals the stock’s long-term course.

About CoreWeave Stock

CoreWeave has its headquarters in Roseland, New Jersey, as a dedicated cloud infrastructure firm that specializes in offering GPU-driven computing for artificial intelligence as well as high-speed workloads. The firm’s market cap now stands over $66 billion after its rocket-like trajectory in the year 2025.

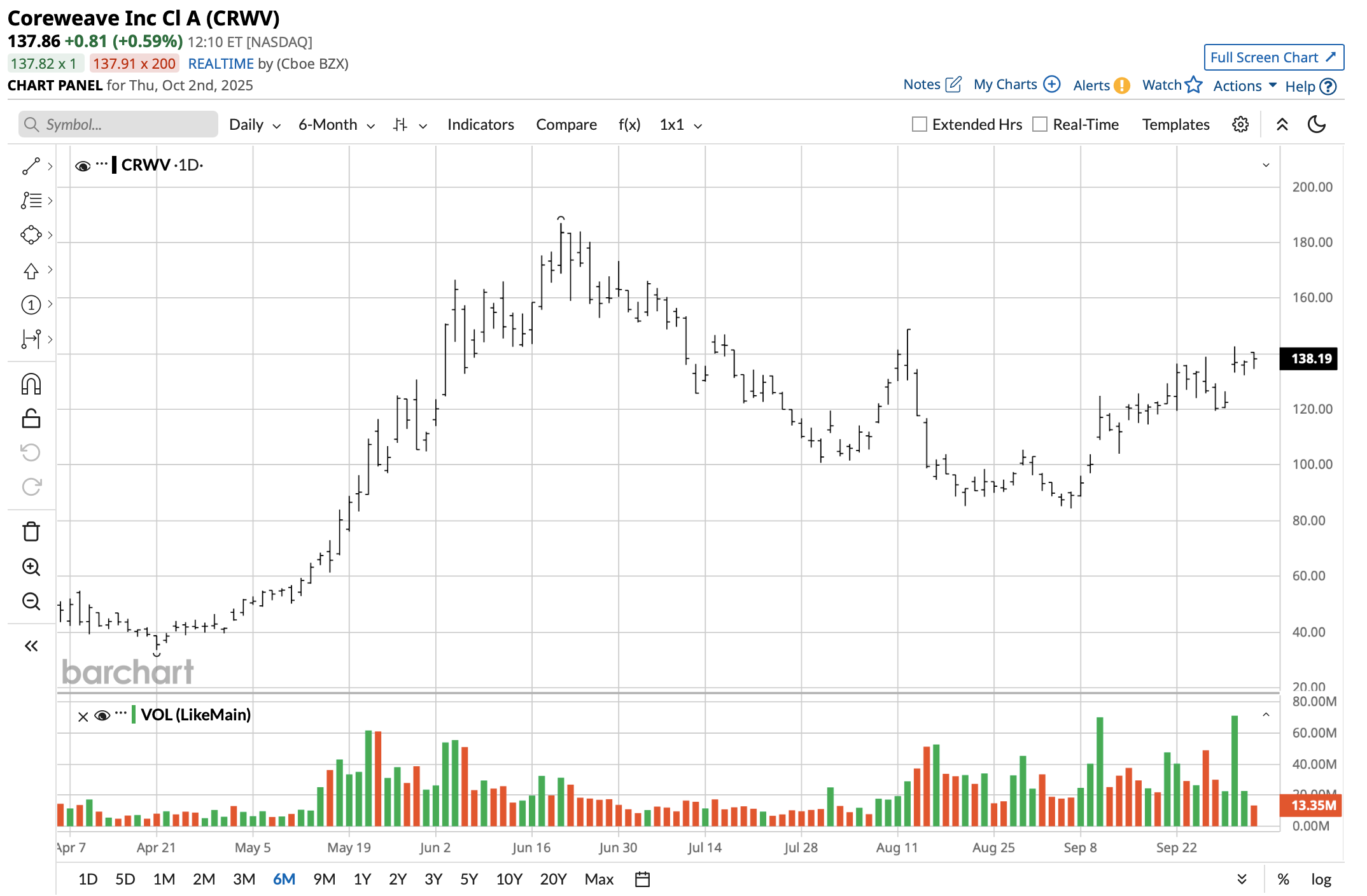

CRWW stock has come back after reaching a 52-week low of $33.51, up as far as $187 before returning to around $137.79. That’s a 310% increase compared to the previous year, significantly more than the S&P 500’s ($SPX) around 15% during the corresponding span. Recent gains indicate increasing confidence on investors’ behalf that CoreWeave can obtain long-term hyperscale agreements.

Valuation stays extended. CoreWeave exchanges hands at 18.97x price-to-sales (P/S) as well as 23.59x price-to-book (P/B) ratios that significantly outrank common cloud peers. Profitability is far off the horizon with a -48.96% profit margin as well as a debt-to-equity ratio of 4.16. This means that although the growth prospects are enormous, investors will need to offset execution perils against forging leverage as well as adverse cash flow.

Unlike established cloud behemoths, CoreWeave doesn't pay a dividend, and the stock is a pure growth play. These are due to its focus on artificial intelligence adoption and infrastructural demand.

CoreWeave Increases Backlog by $14.2 Billion Meta Contract

CoreWeave’s results for the second quarter of 2025 were a celebration of its swift contract victories and scale development. It announced a revenue backlog stood at $30.1 billion as of June 30th, with roots in expansions with OpenAI, new hyperscaler customers, and companies such as BT Group (BTGOF), Cohere, LG CNS, and Woven by Toyota (TOYOF).

The recently renewed $14.2 billion Meta contract reinforces this trend, providing CoreWeave with an anchor customer in social media and artificial intelligence-driven software. The contract incorporates rights for Meta to grow its commitments as far out as 2032 against CEO Mark Zuckerberg’s multi-decade AI infrastructure strategy.

Operationally, CoreWeave keeps growing its power footprint, closing Q2 with 470 MW of operating capacity and 2.2 GW under contract. First to deploy Nvidia's GB200 NVL72 systems at scale, it achieved record-level MLPerf benchmarks. Outside compute, its purchase of Weights & Biases bolsters its developer tools and observability functions.

To finance this growth, CoreWeave issued $2 billion in senior unsecured notes at 9.25% interest rates to mark strong appetite as well as persistent capital intensity. Risks in execution are still present, but the Meta agreement ought to give revenue visibility into the next decade as well.

What Do Analysts Expect for CRWV Stock?

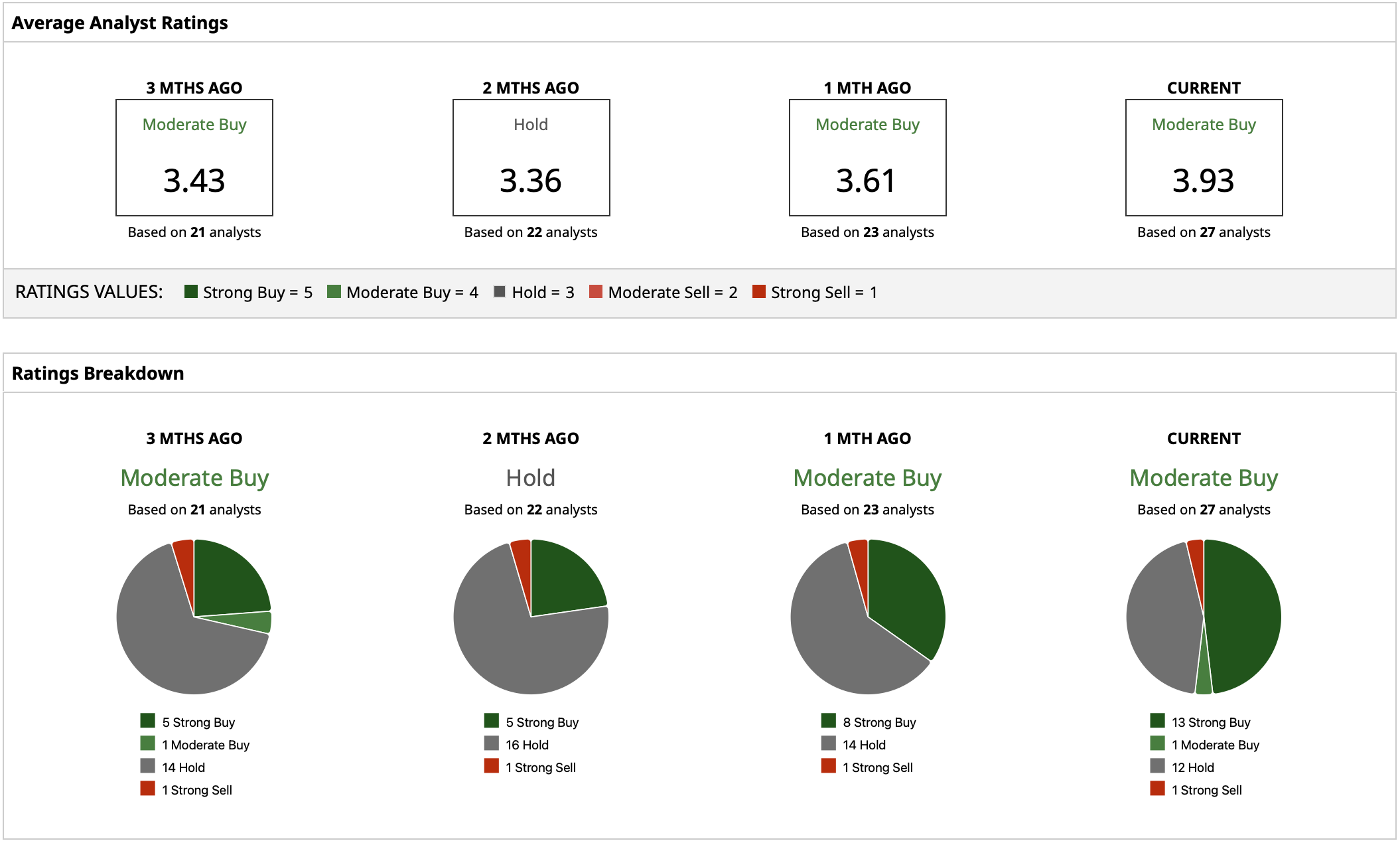

Analyst sentiment stays cautiously optimistic. CoreWeave has a “Moderate Buy” rating consensus, with prices ranging widely across a range that spans a low estimate of $32 up to a high estimate of $200. Its mean target of $139.08 prices gives an upside of around 1% compared to a given estimate based on prevailing levels since CRWV stock trades close to consensus fair value.

.jpg?w=600)