/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

Unusual Machines (UMAC) has seen new life after the company announced it had won an order worth $12.8 million for drone parts in support of Strategic Logix’s Rapid Reconfigurable Systems Line (RRSL). The shares surged over 7% during the opening trade as the market responded positively to the defense order announcing the company’s positioning as a key provider of U.S.-made NDAA-compliant UAV technologies.

The order, comprised of over 160,000 parts, sees burgeoning requirements for affordable, flexible, and secure drone platforms. As U.S. military and commercial customers seek to shun foreign-sourced parts use, Unusual Machines’ expanding position in the drone supply chain emerges at an era of peak geopolitical as well as technological imperative.

About Unusual Machines Stock

Unusual Machines is an aerospace and defense company headquartered in Florida that deals in drone parts, such as flight controllers, ESCs, analog cameras, and ground stations. It is classified as the main NDAA-compliant-ready provider and features on the Department of Defense’s BLUE UAS list. Currently worth about $455 million in market capitalization, the company is making its way into the next-gen UAV space.

Its stock has been on a roller coaster ride, though. In the last 52 weeks, the share has risen from the all-time low of $1.28 to the all-time high of $23.62. Currently, the share is trading at about $16.42 per share, an increase of over 28% in the last week compared to the about 5% growth in the S&P 500 Index ($SPX) during the same time span.

Valuation ratios indicate the riskiness and potential for investors. UMAC has an elevated price-to-sales (P/S) ratio of 81.31 as well as an 8.77 price-to-book (P/B) ratio. Although its adverse margins—-574% profit margin as well as a -52% ROE—reflect a present lack of profitability, the company holds $81 million cash on hand along with being free of debt for stability when it expands. Investors are already certainly paying a premium for growth prospects with no dividend to boot.

Unusual Machines Narrows Losses as Growth Accelerates

During the second quarter of 2025, Unusual Machines announced record second-quarter revenue of $2.12 million, representing 51% year-over-year (YoY) growth. It was the fifth consecutive quarter where the company recorded record revenue. Enterprise sales contributed roughly 31% of the sales margin, and gross margins reached 37%, the highest ever for the company.

Despite improvement, the GAAP results recorded a net loss of $6.9 million due mostly to equity compensation. In an adjusted context, non-GAAP net loss was anywhere near $0.8 million. Management stressed that cash flow discipline is the number one priority, with a 2026 route for cash flow positivity.

The $12.8 million Strategic Logix order represents a major validation of UMAC’s growth trajectory. The deal will begin deliveries in Q4 2025 and underlines how U.S. defense demand can drive scale for domestic UAV component suppliers. Management also highlighted the company’s improved liquidity, having raised $40 million in Q2 and another $48.7 million shortly after, bringing its cash balance above $80 million with no debt.

Although tariffs as well as regulatory changes pose possible challenges ahead, UMAC seems to be working on accelerating orders for NDAA-compliant drones.

What Do Analysts Expect for UMAC Stock?

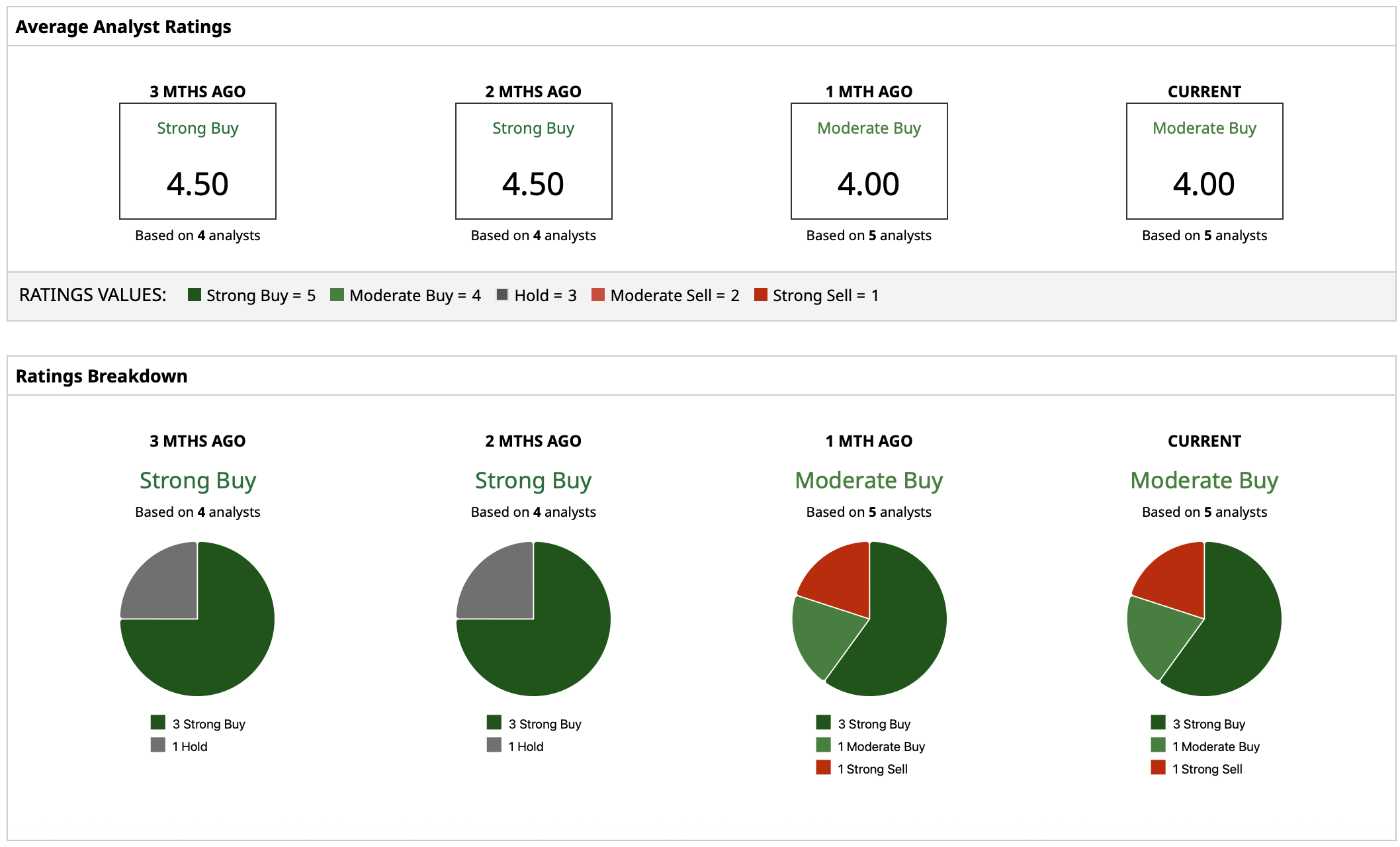

Coverage on the Street stays modest with a “Moderate Buy” rating consensus and an average target value of $16.50. Its current market value of $16.42 positions it below the consensus just by a hair but suggests manageable short-term stability.

The higher estimate of $20 implies a possible gain of roughly 22%, whereas the lower estimate of $10 reveals potential downside risk of 39%. Those ranges both capture the speculative nature of the valuation of UMAC as well as the caustic growth potential associated with defense contracting as well as enterprise adoption.