/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Big Tech industry darling Alphabet (GOOGL) is betting big on artificial intelligence (AI), which is expected to be hugely accretive to the company’s operations. At a conference, Google Cloud CEO Thomas Kurian stated that the company is capturing customers more quickly due to product differentiation, which is based on years of investment in AI.

The rapid monetization of AI is proving profitable for Alphabet, as Kurian stated that the firm is growing its revenue and improving operational efficiency. At this point, Alphabet’s remaining performance obligations (RPO) amount to a staggering $106 billion, which implies growth higher than its revenue. More than half of this figure is expected to convert into revenue over the next two years.

Therefore, this might be the opportunity for investors to invest in GOOGL stock now.

About Alphabet Stock

Alphabet, the parent company of Google, is based in Mountain View, California, at the iconic Googleplex campus in the heart of Silicon Valley. Beyond its tech roots, Alphabet has broadened its focus to include groundbreaking new ventures in AI. Through divisions like DeepMind and Google AI, the company is pushing boundaries in machine learning, language models, and generative AI.

Innovations such as Gemini and innovative features in Google’s products highlight its artificial intelligence integration. Subsidiaries like Waymo further extend AI into fields like autonomous driving, reinforcing Alphabet’s role as a leader in shaping the future of intelligent technology. As of now, this tech behemoth has a market capitalization of $2.9 trillion.

Alphabet’s cloud business and AI-driven offerings have seen strong growth, and its digital ad revenue has rebounded. As a result, GOOGL stock has appreciated. Over the past 52 weeks, the stock has gained 56%, while it is up 27% year-to-date (YTD). Shares reached a 52-week high of $242.25 on Sept. 11, and are only down 1% from this high. This was likely based on the company avoiding strict punishments from an antitrust lawsuit and the RPO announcement.

GOOGL stock trades at a premium compared to the industry. Its price sits at 24.07 times earnings, which is higher than the industry average.

Alphabet’s Q2 Results Were Better Than Expected

On July 23, Alphabet reported solid second-quarter results that exceeded market expectations. Revenue increased 14% year-over-year (YOY) to $96.43 billion. Alphabet CEO Sundar Pichai stated that AI is “positively impacting” every part of the company’s business. The company's topline figure also surpassed the $94 billion that Wall Street analysts were expecting for the period.

Alphabet’s robust revenue growth was based on solid expansion in advertising revenue. Google’s advertising revenue grew 10.4% from the year-ago value to $71.34 billion. Google services in total had revenue of $82.54 billion, up 11.7% YOY.

Coming to its profitability, Alphabet reported notable gains in its bottom line. Total income from operations increased 14% from the prior-year period to $31.27 billion. This was primarily based on Google Services’ operating income growing 11.4% YOY to $33.06 billion. Notably, Google Cloud’s operating income also more than doubled YOY to reach $2.83 billion.

Alphabet’s EPS expanded by 22.2% annually to $2.31, which surpassed the $2.18 figure that Wall Street analysts were expecting.

The company reported that its annual revenue run rate has now exceeded $50 billion. Moreover, with the observed growth in cloud services, Alphabet increased its investment in capital expenditures for this year to approximately $85 billion.

Wall Street analysts are optimistic about Alphabet’s future earnings. They expect the company’s EPS to climb by 9.9% YOY to $2.33 for the current quarter. For the current fiscal year, EPS is projected to surge 24% annually to $9.99, followed by 6% growth to $10.59 in the next fiscal year.

What Do Analysts Think About Alphabet Stock?

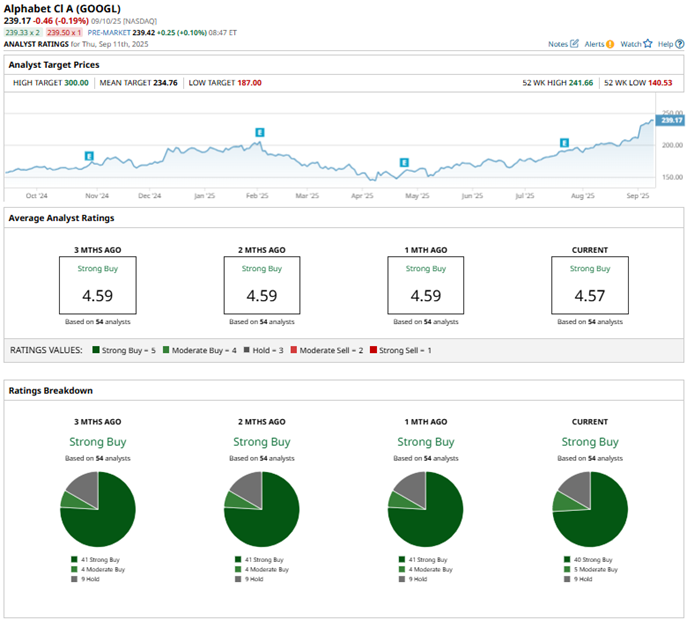

GOOGL stock has been in the spotlight on Wall Street. Analysts are still optimistic about this industry darling’s prospects. Recently, Evercore ISI maintained an “Outperform” rating, while raising the price target from $240 to $300. Following Evercore’s sixth quarterly proprietary search survey, the price target was raised based on the finding that Google continues to maintain a dominant position despite rising competition.

Citing AI-powered leading position “across every major secular technology trend,” analysts at Tigress Financial Partners maintained a “Strong Buy” rating on the stock. Tigress raised the price target on GOOGL shares to $280. Meanwhile, analysts at BofA Securities maintained a “Buy” rating and a $252 price target on the stock, citing reduced uncertainty following the recent ruling on search.

Alphabet continues to be favored on Wall Street, with analysts awarding GOOGL a consensus “Strong Buy” rating overall. Of the 54 analysts rating the stock, a majority of 40 analysts rate it a “Strong Buy,” five analysts suggest a “Moderate Buy,” and nine analysts play it safe with a “Hold” rating. The consensus price target of $235.45 represents 2% potential downside from current levels. However, the Street-high price target of $300 indicates 25% potential upside from here.