/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Broadcom (AVGO) delivered a bombshell announcement that sent shares soaring 9.4% on Friday, revealing a massive $10 billion order from a mystery fourth customer for its custom artificial intelligence (AI) chips.

The chipmaker's fiscal third-quarter results exceeded expectations, with earnings of $1.69 per share beating the $1.65 estimate and revenue of $15.96 billion topping the $15.83 billion consensus. But it was CEO Hock Tan's revelation of the enormous new customer order that captured Wall Street's attention.

Multiple analysts identified the mystery customer as OpenAI, citing reports that the AI startup co-designed chips with Broadcom set to hit the market next year. This would add to Broadcom's existing roster of major clients, including Alphabet (GOOG) (GOOGL), Meta (META), and ByteDance.

"One of these prospects released production orders to Broadcom, and we have accordingly characterized them as a qualified customer for XPUs," Tan explained, referring to the company's custom AI accelerators. Tan suggested AI revenue growth could exceed his previous 50-60% guidance, with Mizuho analysts now projecting 76% growth to $35 billion next year.

Broadcom's AI revenue already jumped 63% to $5.2 billion in Q3, with expectations of reaching $6.2 billion this quarter. The company's total market cap has swelled to approximately $1.6 trillion as investors recognize its position alongside Nvidia in the AI infrastructure race.

With robust fourth-quarter guidance of $17.4 billion in revenue and a diversified business, including its successful VMware acquisition, Broadcom appears well-positioned to capitalize on the next phase of the AI boom.

A Strong Performance by Broadcom in Fiscal Q3

In fiscal Q3 of 2025 (ended in July), Broadcom reported a record adjusted EBITDA of $10.7 billion, indicating a margin of 67%. Comparatively, its free cash flow stood at $7 billion, providing the semiconductor giant with the flexibility to lower balance sheet debt and target accretive acquisitions. With gross margins of 78.4% and a conservative debt structure, Broadcom exhibits the financial discipline investors seek in volatile markets.

The VMware integration has exceeded expectations, delivering 93% gross margins and generating over $8.4 billion in total contract value during Q3. CEO Hock Tan's announcement of VMware Cloud Foundation 9.0 represents an alternative to public cloud solutions, positioning the company for sustained enterprise growth.

The non-AI semiconductor business, while currently subdued, shows encouraging signs with bookings up over 20% year-over-year (YoY). Broadcom's networking portfolio, particularly its Ethernet solutions for AI clusters, provides diversified exposure to infrastructure spending beyond custom chips.

Tan's commitment to remain CEO through 2030 provides continuity during a transformational period. It returned $2.8 billion to shareholders via dividends while maintaining disciplined capital allocation.

What Is the Target Price for AVGO Stock?

Analysts tracking AVGO stock forecast revenue to rise from $51.57 billion in fiscal 2024 to $157 billion in fiscal 2029. In this period, adjusted earnings are forecast to expand from $4.87 per share to $19.82 per share.

Today, AVGO stock trades at a forward price-to-earnings (P/E) multiple of 40.4x, which is higher than its 10-year average of 16.6x. If AVGO is priced at 30x forward earnings, it should trade around $600 in early 2029, indicating an upside potential of almost 90% from current levels.

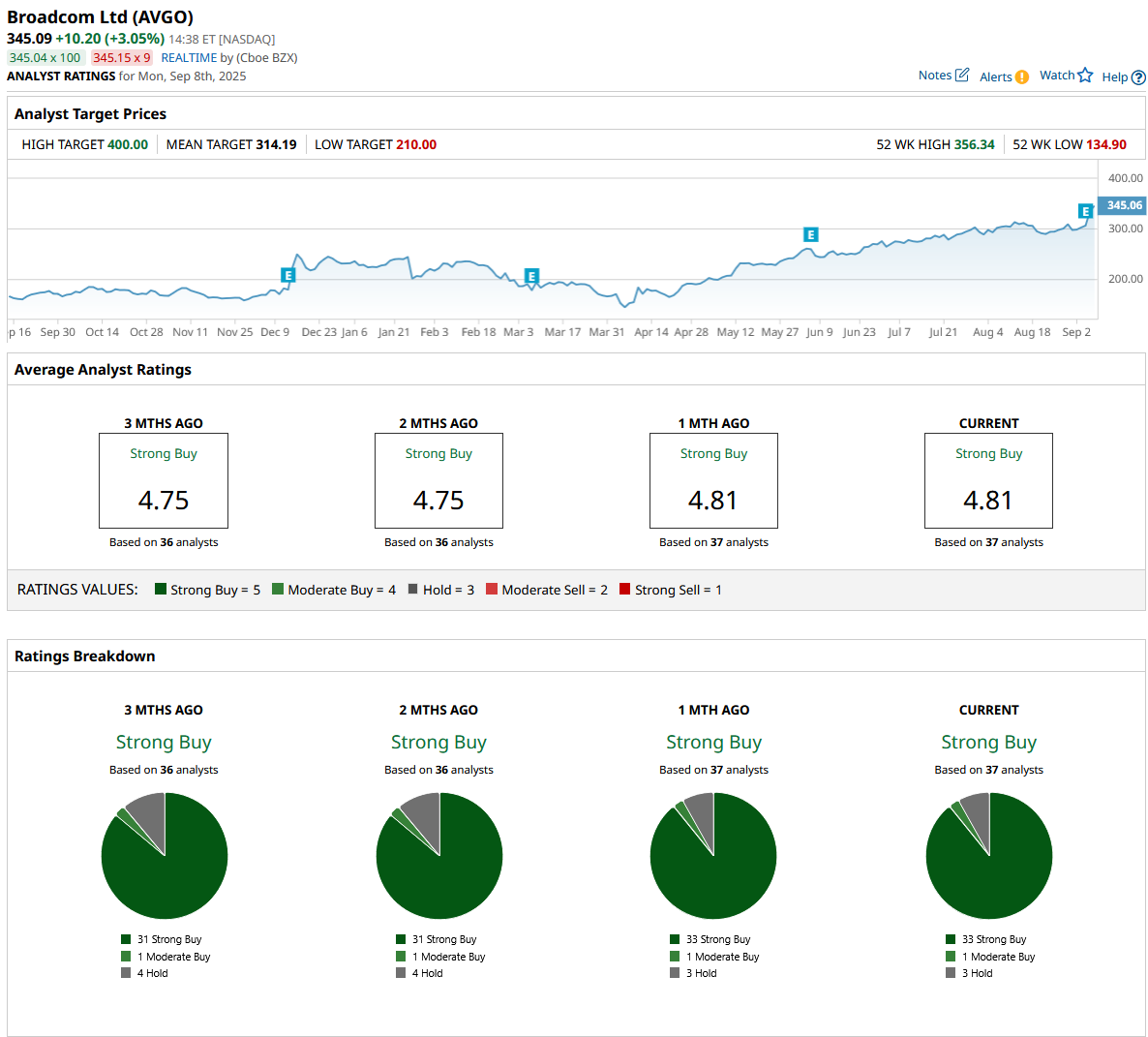

Out of the 37 analysts covering AVGO stock, 33 recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average AVGO stock price target is $314, below the current price of $345.

Broadcom's $110 billion backlog and record-breaking metrics support the growth narrative; however, investors should recognize the concentration risk associated with AI customers and the cyclical nature of semiconductor markets. The stock's premium valuation requires sustained execution, but the diversified revenue streams and proven management suggest Broadcom merits serious consideration for growth-oriented portfolios.