Oklo (OKLO) is an advanced nuclear technology company focused on developing next-generation fission power plants for clean, reliable, and affordable energy at scale. Oklo specializes in compact fast reactors, including the Aurora Powerhouse, which utilizes recycled nuclear waste as fuel and features inherent safety mechanisms. The company has secured major customer agreements in the data center sector and plans to deploy its first commercial plant by 2027. Oklo remains a key innovator, aiming to transform nuclear energy’s role in meeting future demand.

Founded in 2013, the company is headquartered in Santa Clara, California.

Oklo Outperforms Market

OKLO stock has delivered spectacular results in 2025, rising 1,195% over the past 52 weeks and 229% year-to-date (YTD), despite a recent pullback of about 1% in the last five days and a 3% loss for the month. The last six months saw OKLO surge 178%, far outperforming the Russell 2000 index, which is up just 7.2% YTD and remains roughly 13% above in the 52-week timeframe.

Oklo’s extraordinary rally highlights strong investor enthusiasm for nuclear innovation, but volatility and lack of near-term profitability remain key risks compared to the small-cap benchmark’s steadier performance.

Oklo’s Q2 Results

In the second quarter of 2025, Oklo reported an EPS of -$0.18, missing analysts' expectations of -$0.11. The company did not generate any revenue due to its pre-commercial status and posted a GAAP net loss of $24.7 million, a slight improvement from the previous year. Cash and marketable securities totaled $683 million, significantly exceeding market forecasts, thanks to a recent public offering.

Financially, Oklo's operating loss widened to $28.0 million YoY, influenced by higher research and development expenses and administrative costs tied to the Atomic Alchemy acquisition and expansion into the radioisotope sector. Cash consumed in the first half of 2025 reached $30.7 million. With total assets of $731.1 million and limited liabilities, the company maintains a solid balance sheet to support the development of its Aurora Powerhouse reactor. Key milestones included a successful regulatory review and the formation of commercial partnerships.

Looking forward, Oklo reaffirmed its annual cash use forecast of $65 to $80 million, assuring investors the company has enough funds to operate for at least the next 12 months. It reiterated plans to advance licensing and construction for the Aurora reactor, targeting commercial operation in late 2027 or early 2028, supported by ongoing regulatory progress and strategic partnerships.

Oklo Unveils New Tennessee Plant

Oklo has announced plans to design, construct, and operate a groundbreaking nuclear fuel recycling facility in Tennessee, marking the first private plant of its kind in the U.S. The $1.68 billion project aims to convert spent nuclear fuel into usable fuel for Oklo’s advanced small modular reactors, with operations expected to start in the early 2030s. The company has completed licensing plans with the Nuclear Regulatory Commission and is now in pre-application discussions to begin operations.

Oklo is also engaging with the Tennessee Valley Authority (TVA) to recycle waste from the utility’s nuclear plants and explore potential electricity sales from its planned Aurora Powerhouse reactor. With over 94,000 metric tons of used nuclear fuel stored across U.S. plants, recycling this waste could unlock energy equivalent to 1.3 trillion barrels of oil. Oklo CEO Jacob DeWitte emphasized that recycling nuclear fuel at scale is key to lowering costs, securing U.S. supply chains, and enabling the deployment of advanced nuclear power for clean, affordable energy.

Should You Get Oklo?

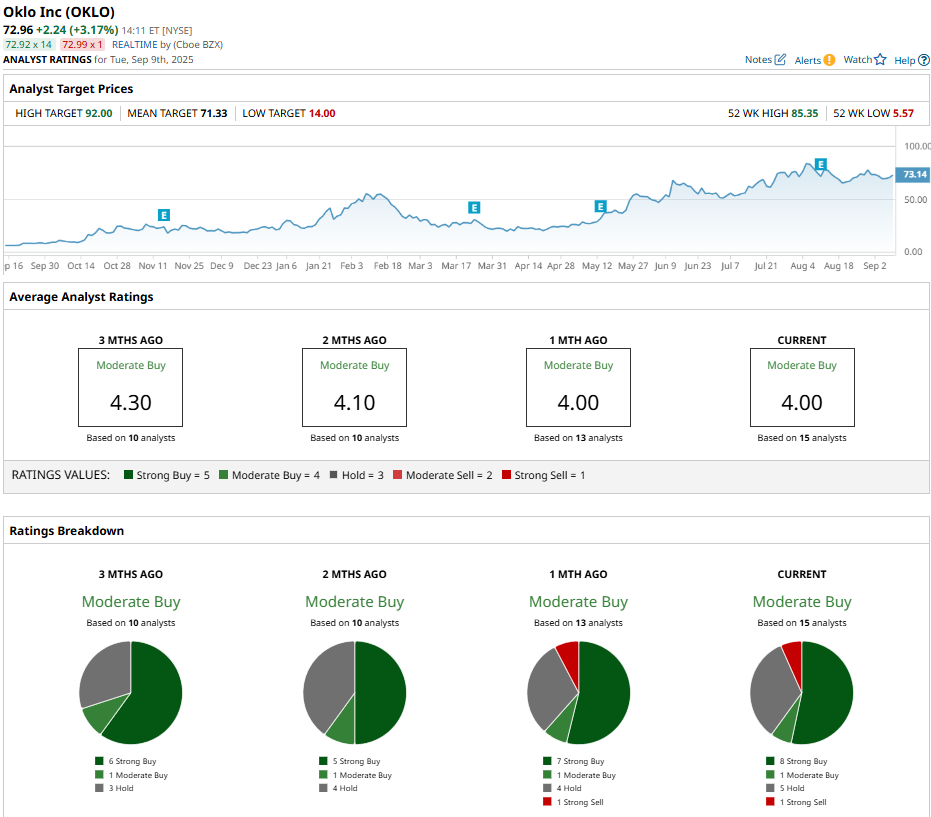

Oklo’s stock is well received by Wall Street experts, who have given it a consensus “Moderate Buy” rating alongside a mean price target of $71. 33, which is slightly below its trading price, reflecting the stock to be fairly valued at present.

Among the 15 analysts covering OKLO, eight have issued a “Strong Buy” rating, one has given a “Moderate Buy,” five recommend “Hold,” and one analyst rates it as a “Strong Sell.”