Inheritance disputes can turn families upside down. One small mistake—like a missing signature—can lead to years of stress, legal fees, and broken relationships. You might think your will or trust is airtight, but even a single oversight can unravel everything. These disputes don’t just affect the wealthy. Anyone with assets, no matter how modest, can face these problems. Understanding how a missed signature can spark chaos helps you avoid the same fate. Here are eight real-world scenarios where a single missed signature led to inheritance disputes, and what you can do to protect your family.

1. The Unwitnessed Will

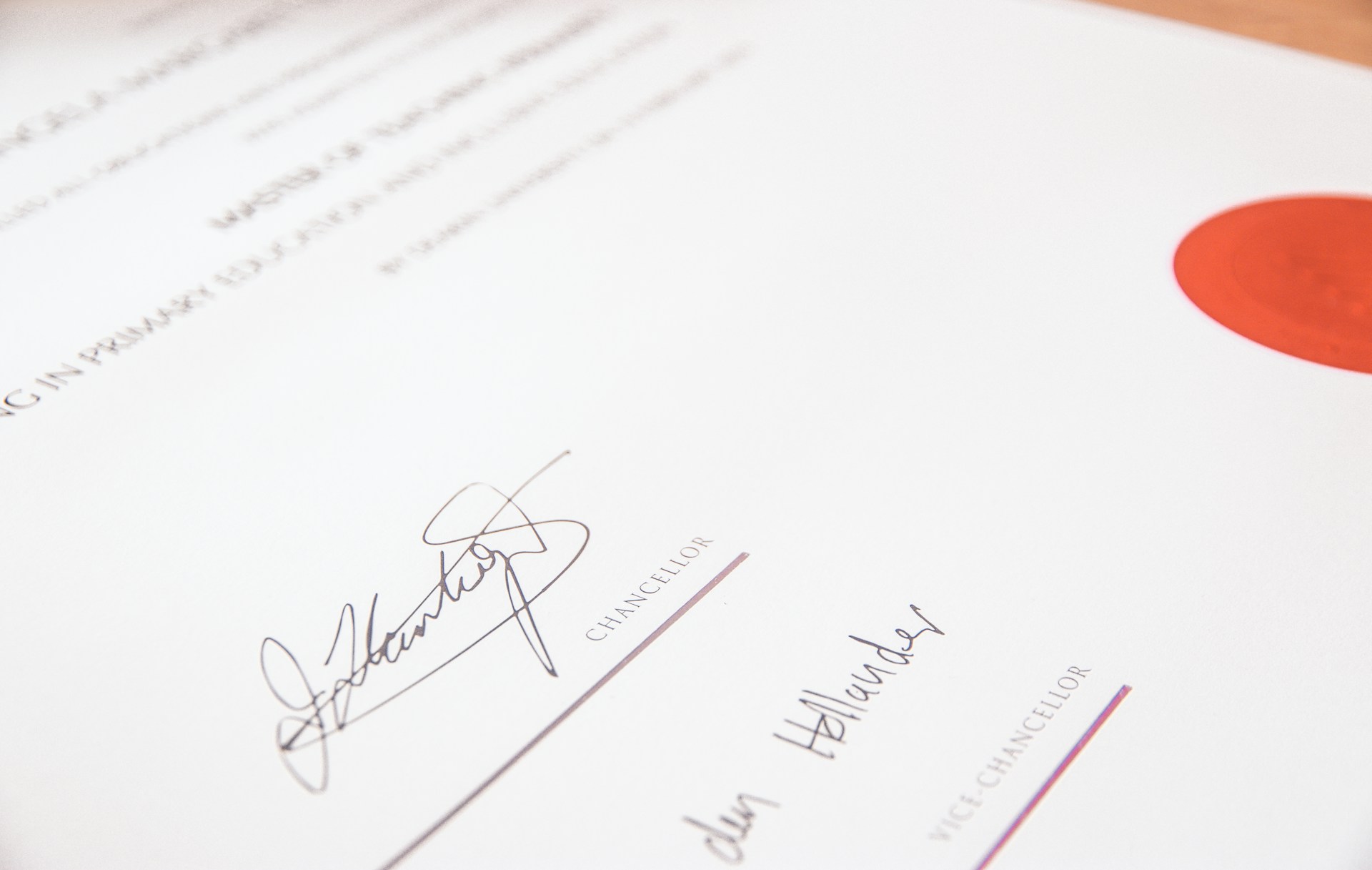

A will without the right signatures is just a piece of paper. In many places, a will must be signed by the person making it and witnessed by at least two people. If even one signature is missing, the court may declare the will invalid. This means the estate could be divided according to state law, not the person’s wishes. Families often end up fighting over what the deceased “really wanted.” To avoid this, always check your state’s requirements and make sure every signature is in place.

2. The Forgotten Beneficiary Form

Retirement accounts and life insurance policies often require a separate beneficiary form. If you forget to sign this form, the money might not go where you intended. Sometimes, the default is your estate, which can trigger probate and delay payments. Other times, the money goes to a previous spouse or relative. This can lead to bitter disputes and even lawsuits. Always double-check that your beneficiary forms are signed and up to date.

3. The Unfinished Trust

Trusts are supposed to keep assets out of probate and make things easier for your heirs. But if you forget to sign the trust document, it’s not valid. This can mean your assets end up in probate anyway, defeating the purpose of the trust. Family members may argue over who should get what, especially if the trust was supposed to override an old will. If you set up a trust, make sure every page is signed and notarized if required.

4. The Joint Account Mix-Up

Joint bank accounts can be a simple way to pass on money. But if the paperwork isn’t signed by both parties, the account may not transfer as planned. Banks may freeze the account, leaving family members without access to needed funds. This can lead to arguments and even court battles over who the money belongs to. Always confirm that all joint account forms are properly signed and filed with the bank.

5. The Real Estate Title Error

Real estate is often the most valuable asset in an estate. If a deed transfer or title change is missing a signature, the property can get stuck in limbo. Heirs may have to go to court to sort things out, which can take months or even years. Disputes over who owns the property can get ugly fast. Before you transfer property, make sure every required signature is present and the paperwork is filed with the right office.

6. The Power of Attorney Problem

A power of attorney lets someone act on your behalf if you can’t. But if the document isn’t signed correctly, it’s worthless. This can leave your family unable to pay bills or manage your affairs. Inheritance disputes can arise if someone tries to use an invalid power of attorney to change beneficiaries or transfer assets. Always sign these documents in front of a notary and keep copies in a safe place.

7. The Handwritten Note

Some people try to change their will with a handwritten note. If it’s not signed and witnessed, it usually won’t hold up in court. Family members may disagree over whether the note accurately reflects the deceased’s true wishes. This can lead to expensive legal battles and lasting resentment. If you want to change your will, do it formally and ensure that all necessary signatures are in place.

8. The Digital Document Dilemma

More people are using online tools to create wills and trusts. But digital documents often require electronic signatures or notarization. If you miss a step, the document may not be valid. Courts are still figuring out how to handle these cases, which can add confusion and delay. If you use an online service, follow every instruction and confirm that your digital signature is legally binding.

Why a Missed Signature Can Cost You Everything

A single missed signature can undo years of planning. It can turn a simple inheritance into a legal nightmare. The best way to avoid these disputes is to check every document, every time. Don’t assume your lawyer or financial advisor caught every detail. Take responsibility for your own paperwork. If you’re unsure, ask for help.

Have you or someone you know faced an inheritance dispute because of a missed signature? Share your story or advice in the comments.

Read More

No Sharing: 8 Reasons He Won’t Share His Vulnerabilities or His Money With You

10 Budgeting Apps That Collect More Than Just Your Money

The post 8 Inheritance Disputes Sparked by a Single Missed Signature appeared first on Clever Dude Personal Finance & Money.