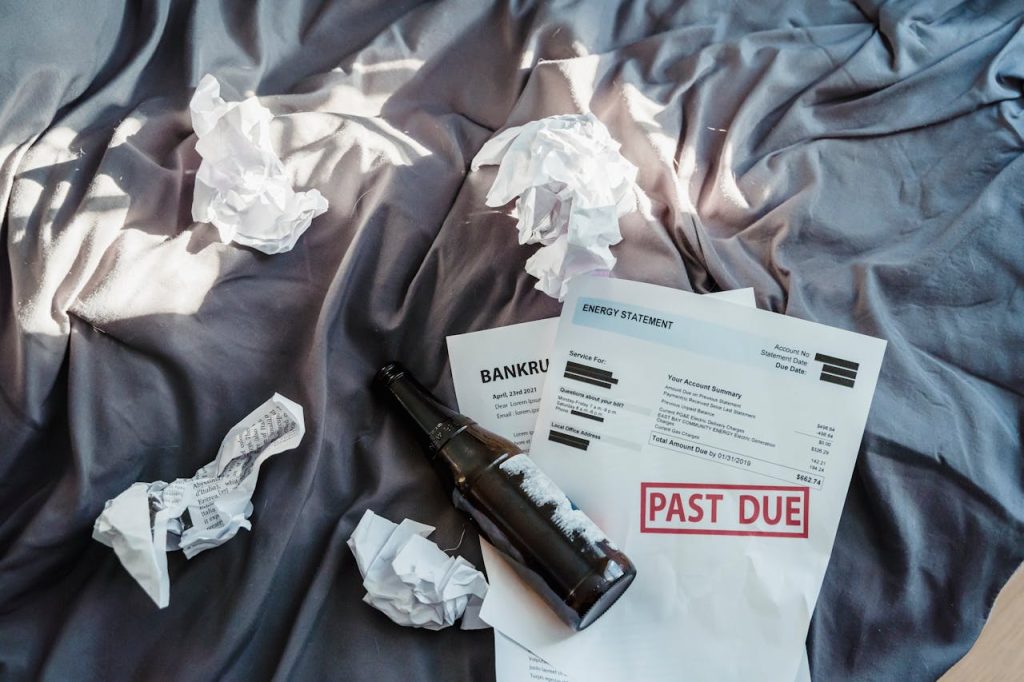

It’s easy to think of bankruptcy as something that happens suddenly—a lost job or major medical bill. But for many in the middle class, financial ruin sneaks up slowly. The real threats are often subtle, woven into daily routines and financial habits. Understanding what quietly bankrupts the middle class can help you spot trouble early, make better choices, and keep your finances stable. Let’s look at seven common traps and how to avoid them before they drain your hard-earned money.

1. Lifestyle Inflation

As incomes rise, spending tends to rise right along with it. This phenomenon, called lifestyle inflation, is one of the main things that quietly bankrupts the middle class. When you get a raise or bonus, it’s tempting to upgrade your home, car, or wardrobe. But these changes often come with bigger monthly bills and leave little room for saving or investing. Over time, even small increases in spending can add up, making it tough to build wealth or handle financial setbacks.

The key is to resist the urge to match every new dollar earned with a new expense. Instead, commit to saving a portion of every raise. Keeping your standard of living in check is a simple way to protect your financial future.

2. Underestimating Small Expenses

It’s easy to overlook the impact of daily coffee runs, streaming subscriptions, or takeout meals. But these small expenses can quietly bankrupt the middle class by draining hundreds, even thousands, of dollars each year. Because they seem minor, they rarely trigger concern—until you add them up and see the real cost.

Tracking your spending, even for a month, can be eye-opening. Look for patterns and decide which small luxuries are truly worth it. Cutting back on just a few can free up money for savings or debt repayment without making you feel deprived.

3. Relying on Debt for Everyday Living

Credit cards and personal loans can be helpful in emergencies, but relying on them to cover everyday expenses is risky. Interest charges pile up quickly, making it harder to pay down balances. Over time, this cycle quietly bankrupts the middle class by eroding financial security and limiting future options.

If you find yourself using debt to cover gaps in your budget, it’s time to reassess your spending. Building an emergency fund and living within your means are the best defenses against this silent threat.

4. Ignoring Retirement Savings

Many middle-class families put off saving for retirement, thinking there’s plenty of time to catch up. But the longer you wait, the harder it is to build a comfortable nest egg. Missing out on employer matches or the power of compound interest can quietly bankrupt the middle class in the long run.

Even small contributions add up over time. Prioritize retirement savings, especially if your employer offers a 401(k) match. Automate your contributions so you don’t have to think about it—and your future self will thank you.

5. Buying Too Much House

Homeownership is a big part of the American dream, but buying more house than you can afford is a common way the middle class goes broke. Large mortgages, high property taxes, and maintenance costs can consume a huge portion of your income. When finances get tight, home-related expenses are hard to cut.

Before buying, use conservative estimates for what you can afford. Factor in all housing costs, not just the mortgage. Remember, banks may approve you for more than is wise for your budget. Staying well below your maximum allows you to save and invest for other goals.

6. Failing to Prepare for Medical Costs

Medical bills are one of the leading causes of bankruptcy in the United States. Even with insurance, deductibles, co-pays, and uncovered procedures can add up fast. Many in the middle class assume their employer coverage is enough, only to be caught off guard by an unexpected illness or accident.

To avoid this trap, review your health insurance annually and consider supplemental coverage if needed. Building a dedicated health savings fund can also help cover expenses when they arise.

7. Not Having a Financial Plan

Without a clear financial plan, it’s easy to drift from paycheck to paycheck. This lack of direction quietly bankrupts the middle class by making it harder to reach goals, handle emergencies, or retire comfortably. Many families avoid planning because it feels overwhelming or they don’t know where to start.

Taking time to set goals, track progress, and adjust when needed can make a huge difference. There are plenty of free resources and tools online, like the Consumer Financial Protection Bureau, to help you get started. Even a simple plan is better than none at all.

Building a More Secure Financial Future

The things that quietly bankrupt the middle class are often the hardest to spot. They hide in plain sight—spending habits, overlooked bills, or a lack of planning. But the good news is that small, consistent changes can make a big impact. By becoming aware of these pitfalls and taking action early, you can protect your finances and build a more stable future for yourself and your family.

What’s one subtle financial trap you’ve noticed in your own life? Share your experience in the comments below!

What to Read Next…

- 6 Trends That Suggest the Middle Class Is Dying in Suburbia

- Are These 7 Little Expenses Quietly Costing You Thousands a Year?

- How Many of These 8 Middle Class Habits Are Keeping You Poor?

- 10 Places Where Middle Class Americans Are Quietly Disappearing

- 10 Ways You’re Wasting Money Just Trying to Keep Up Appearances

The post 7 Things That Quietly Bankrupt the Middle Class appeared first on The Free Financial Advisor.