Middle-class life has always involved trade-offs. You work hard, pay your dues, and hope your paycheck will stretch far enough to cover the essentials and a little comfort. But in some states, that hope is quietly being crushed, not by flashy headlines or sweeping federal changes but by slow, strategic tax policies that are bleeding middle-income earners dry.

While many politicians tout “no new taxes” or claim to protect working families, what often goes unnoticed are the layers of indirect taxation, regressive structures, and cost-of-living hikes that are hitting the middle class the hardest. If you live in one of these seven states, you might be part of a demographic under siege without even knowing it.

Why the Middle Class Is the Perfect Target

The wealthy have tax shelters, business loopholes, and investment write-offs. Low-income families often qualify for relief programs or exemptions. The middle class? You’re too “rich” for help, too “poor” for loopholes. That makes you the perfect target for quiet tax increases that appear small but add up fast: rising property taxes, increased sales taxes, sneaky gas hikes, and local fees dressed up as “service charges.”

Add in inflation, stagnant wages, and the rising cost of everything from groceries to housing, and the average middle-class household is stretched thinner than ever. In some places, it’s not just inconvenient. It’s unsustainable.

Let’s break down the seven states where the middle class is quietly being taxed into extinction.

1. Illinois

Illinois is infamous for having the highest combination of state and local taxes in the US. Middle-income homeowners are particularly vulnerable. Unlike the ultra-wealthy, who can flee to another state or offset the burden with investment income, average residents are stuck with rising assessments and limited options.

What’s worse? Illinois has the highest property taxes in the nation. This is because the state relies heavily on property taxes to fund schools and local services, often shifting the burden to homeowners instead of finding balanced budget solutions. Even modest homes in modest neighborhoods can come with crushing tax bills.

To compound the states’ woes, Illinois also has a massive underfunded public pension debt, high sales taxes (6.25%) and high corporate income tax rate (9.5%).

2. New Jersey

New Jersey might boast proximity to New York City and strong public schools, but those perks come with a price. Between property taxes, income taxes, and tolls, the Garden State manages to nickel-and-dime its residents more creatively than most.

Part of the reason for New Jersey’s high tax rate is due to fragmented governance. The state has over 550 municipalities, many of which are small. Each municipality typically has its own police, public works, fire department, school board and administrative staff. This leads to duplication of services and duplication of administrative costs.

The middle class in New Jersey often earns too much to qualify for substantial state aid but not enough to handle the compound costs of living, commuting, and paying school levies. If you’re raising a family, owning a home, and trying to build a future, chances are you’re watching more and more of your income disappear each year with no clear relief in sight.

3. California

California has long been associated with high costs, but beyond the obvious (housing, gas, and rent), it’s the tax structure that quietly wears down the middle. Sales taxes in California are among the highest in the U.S., and they apply broadly, even to items families buy daily.

Add that to high income tax brackets that don’t scale favorably for middle earners, and California’s middle class often finds itself paying more percentage-wise than the ultra-rich, many of whom find clever ways to shield their income. What’s left is a population that struggles to get ahead, even when earning six figures.

4. Connecticut

On paper, Connecticut looks wealthy…and it is. But behind the hedge funds and affluent suburbs lies a deepening crisis for the state’s working professionals. Property taxes, car taxes, and even taxes on retirement income make it one of the most expensive states for average families.

The biggest issue? Connecticut’s tax structure assumes everyone is rich, but the cost burden falls unevenly. Towns rely heavily on local taxation, which can skyrocket in areas with declining infrastructure or school funding gaps. Middle-class families are often caught between wanting good services and facing unaffordable tax hikes to maintain them.

5. New York

You don’t need to live in Manhattan to feel the financial pinch of New York. Due to an aggressive combination of state and local taxes that include a graduated income tax, sales tax, and property tax, and a top individual income tax rate of 10.9% as well as a combined state and local sales tax rate averaging 8.54%, New York is one of the most heavily taxed states in the nation.

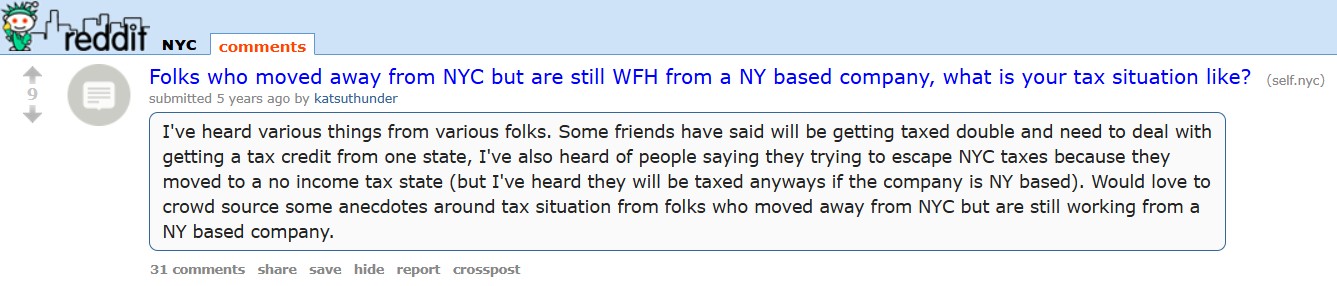

These direct taxation rates, combined with a high cost of basic services, toll-heavy transportation networks, and relentless housing inflation, and you have a state where it’s increasingly difficult to live comfortably on a middle-class salary. Many residents have fled to neighboring states, but even then, lingering tax obligations often follow.

Here is an excellent example of this trend, from a reddit user named katsuthunder.

6. Vermont

Vermont is a picturesque, progressive state with a reputation for environmental consciousness and charming towns. But for middle-class residents, especially those trying to raise a family or retire with dignity, it can be financially brutal.

Per The Tax Foundation, Vermont has some of the nation’s highest income tax and property tax rates.

The income tax system doesn’t offer many breaks for moderate earners, and property taxes are steep relative to home values. Healthcare costs and energy bills also rank among the highest in the nation. For many middle-class Vermonters, the lifestyle they moved there for quickly becomes unaffordable.

7. Oregon

Oregon is often praised for not having a sales tax, but that doesn’t mean living there is cheap. Income taxes range from 4.75% to 9.9% with a top rate that kicks in far earlier than in other states. That means middle-income families are often paying high rates before they’ve even reached financial stability.

Oregon also aggressively taxes tobacco (nearly $10 for a pack of cigarettes) and gasoline while placing high usage fees on things like vehicle registrations and overnight hotel stays.

Add rising housing costs (especially in Portland), property taxes, and escalating service fees, and the no-sales-tax advantage starts to look more like a distraction than a deal.

What This Means for the Future of the Middle Class

Middle-class families in these states face a frustrating reality: they’re being pushed closer to the edge by policies that rarely make the news but always hit the wallet. The long-term impact? Many are leaving for lower-tax states. Others are cutting back on essentials, delaying retirement, or skipping opportunities because the cost of just existing is too high.

Worse yet, many of these taxes fund systems that don’t benefit the middle class equally. Public schools underperform. Roads still fall apart. Services are cut while fees go up. It’s a lose-lose cycle, especially when the wealthy are increasingly insulated, and the poor are given targeted aid.

What You Can Do to Push Back

If you’re stuck in one of these states, it may feel like there’s no way out, but there are small, strategic steps you can take:

-

Advocate for tax reform at the state and local level, especially around property and sales taxes. Today, many special interest groups are attempting to rein in wild tax laws across the country.

-

Audit your tax deductions and consult a financial advisor to reduce your exposure legally. Take all deductions that you are legally entitled to take. Tax minimization is not the same thing as tax evasion.

-

Research relocation options: You don’t have to move to a tax haven, but choosing a city or town with lower local levies can help. This is especially the case if you expect an inheritance or other large windfall.

-

Get politically involved: Middle-class voices are often drowned out. Make yours heard.

This Isn’t Just About Taxes. It’s About Survival

We’re not just talking numbers here. This is about the growing emotional and financial toll on people who did everything “right”—worked hard, paid taxes, raised families—only to be punished by a system which has deemed them an easy target.

The middle class is being taxed quietly, strategically, and disproportionately. And if we don’t shine a light on where and how the extinction of this vital economic group won’t be a slow fade. It’ll be a crash.

Are you feeling the financial squeeze in your state? What hidden tax or fee do you think is most unfair?

You Might Also Enjoy…

The Top Cities Where Seniors Are Disproportionately Targeted By Scammers

13 Cities On The Brink Of Destruction – Why You Should Get Out Now

6 States With The Lowest Property Taxes

Is Buying a Home Still Worth It? What $300K Gets You in Different States