Thinking about switching careers in midlife? You’re not alone. Many people seek a fresh start or more meaningful work after decades in the same field. But while the idea of a new path can be exciting, there are hidden costs that can catch you off guard. Changing careers in your 40s or 50s isn’t just about updating your resume—it can impact your finances, lifestyle, and even your health. Understanding these real costs of switching careers in midlife can help you make a smarter, more confident transition.

1. Reduced Income During Transition

The most obvious cost of switching careers in midlife is a dip in income. Many people take a pay cut to enter a new field, especially if they need to start in a junior role. Even if your new industry pays well, it may take years to climb back to your previous salary. You might also face gaps between jobs, especially if you need time to retrain or reskill. These periods without a steady income can strain your budget and savings. It’s important to plan for a possible reduction in earnings and create a financial cushion before leaping.

2. Training and Education Expenses

New careers often require new skills. Whether it’s a formal degree, a certification, or specialized training, these come with a price tag. Tuition, books, exam fees, and even travel or lodging for in-person courses can add up quickly. Unlike your college days, you may not qualify for as much financial aid or have the luxury of living cheaply. Balancing these expenses with household bills can be tough, especially if you’re also supporting a family. Don’t forget to factor in the time it takes to complete training, which can delay your return to full-time income.

3. Lost Retirement Contributions

When you’re in your prime earning years, every dollar you put toward retirement matters. Switching careers in midlife often means pausing or reducing your retirement contributions. If you’re earning less, it’s tempting to contribute the minimum or skip altogether. Some employers have waiting periods before you can join their retirement plans, causing further delays. The compound effect of these missed contributions can be significant, especially if retirement is only a decade or two away. It’s wise to use a retirement calculator to see the long-term impact and adjust your savings plan accordingly.

4. Health Insurance Gaps and Higher Costs

Health insurance is a major concern when switching careers in midlife. If your old job offered generous benefits, you might be surprised by the cost of coverage in your new role—or the lack of it. There could be waiting periods before your new insurance kicks in. If you’re self-employed or working part-time, you may need to buy your own policy, which can be expensive. Any gaps in coverage put you at risk for unexpected medical bills. Compare health insurance options carefully, and set aside funds to cover premiums and out-of-pocket expenses during the transition.

5. Relocation and Commuting Expenses

Sometimes a new career means moving to a new city or even state. Relocation costs can include moving services, deposits, and higher rents or home prices. Even if you stay local, a longer commute can mean higher fuel costs, more wear and tear on your car, or the need for public transportation. These expenses can sneak up on you and eat into your new salary. If you’re moving for a job, ask if your employer offers any relocation assistance. Factor in these ongoing costs when weighing the benefits of your new career.

6. Loss of Seniority and Perks

After years in one field, you may have built up valuable perks: extra vacation days, flexible hours, or a corner office. Switching careers in midlife usually means starting over. You may lose these benefits and have to prove yourself again. Some companies reserve their best perks for long-term employees, so you might need to work your way back up. The loss of seniority can also affect your job security and make you feel like a beginner, which can be tough emotionally and professionally.

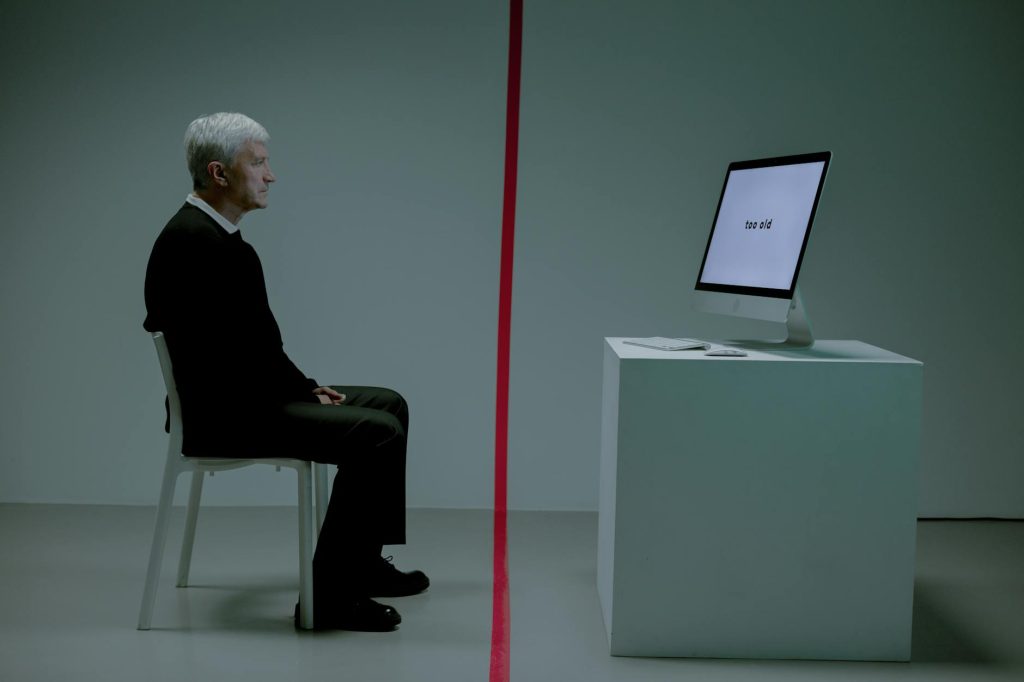

7. Emotional and Social Costs

While financial costs are significant, don’t overlook the emotional toll of switching careers in midlife. Leaving behind colleagues, mentors, and a familiar routine can be stressful. You may experience self-doubt or worry about what others think. Building a new professional network takes time and effort. Sometimes, family members also feel the impact—relocation or new schedules can disrupt routines. It’s important to acknowledge these feelings and seek support.

Making a Smart Move in Midlife

Switching careers in midlife is a major decision with both visible and hidden costs. By taking a close look at the real costs of switching careers in midlife, you can plan ahead and avoid surprises. Build a solid financial buffer, research your new field, and talk to people who’ve made similar moves. Don’t hesitate to seek professional advice from a fee-only financial advisor who understands career transitions. Your next chapter can be rewarding, but it pays to prepare for the bumps along the way.

Are you considering switching careers in midlife, or have you done it already? What hidden costs surprised you most? Share your thoughts in the comments below!

What to Read Next…

- 6 Trends That Suggest the Middle Class Is Dying in Suburbia

- 7 Retirement Perks That Come with Shocking Hidden Costs

- Are These 6 Helpful Budget Tips Actually Ruining Your Finances

- 7 Ways Your Neighbor Could Be Spying on You Without Breaking the Law

- 10 Money Mistakes People Make After Losing a Spouse

The post 7 Hidden Costs of Switching Careers in Midlife appeared first on The Free Financial Advisor.