While many investors chase high-growth stories, others hunt for value, seeking quality companies trading at a discount. For those investors, identifying potentially undervalued stocks is key. Here's a look at some software and semiconductor stocks that are flashing strong signals on value metrics.

Benzinga's Edge Rankings: What Does Value Ranking Mean?

Benzinga's Edge Rankings system assigns scores to stocks based on momentum, growth, quality, and value. The value score is a composite of traditional valuation metrics, including Price-to-Earnings (P/E), Price-to-Sales (P/S), and Price-to-Book (P/B) ratios, benchmarked against industry peers. A higher score suggests the stock may be undervalued.

Identifying significant upward moves in a stock’s value score can help investors spot opportunities before they are recognized by the broader market. Benzinga's rankings system flagged six software and semiconductor stocks that experienced significant positive changes in their value ranking over the past week.

6 Undervalued Tech Names To Watch

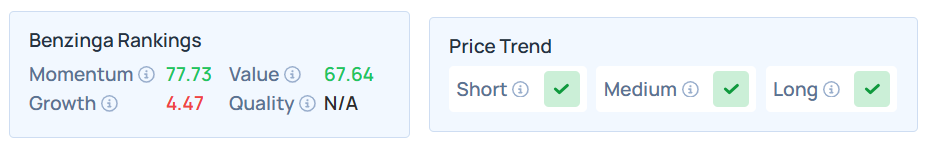

IPG Photonics Corp. (NASDAQ:IPGP)

- The manufacturer of high-performance fiber lasers and amplifiers saw its value score jump from the 10.26th percentile, seven days ago to 67.38.

- IPGP’s forward P/E stood at 64.516, according to Benzinga Pro, down from 93.689 industry average.

- It maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on growth rankings. Additional performance details are available here.

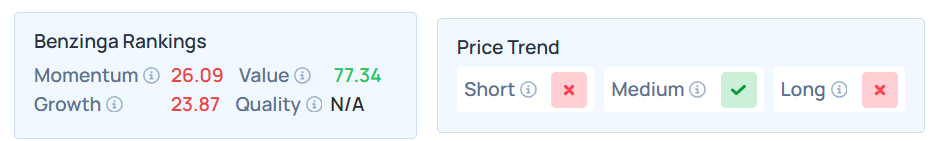

inTest Corp. (NYSE:INTT)

- A supplier for the semiconductor and defense/aerospace industries, inTest saw its value score jump significantly from 8.46 to 76.77, giving it one of the highest absolute scores on the list within the sector.

- inTest’s trailing P/S ratio was 0.688, down from the 8.72 industry average.

- Other rankings indicate that INTT maintains a stronger price trend in the medium term but a weaker trend in the long and short terms. The stock scores poorly on growth rankings. Additional performance details are available here.

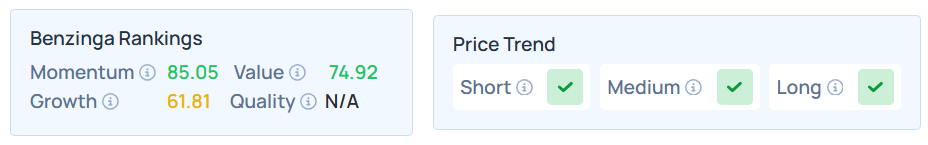

Mogo Inc. (NASDAQ:MOGO)

- This digital payments and financial technology company experienced a strong surge in its value ranking, with its score climbing from 10.12 to the 73.84th percentile.

- The firm’s trailing P/E ratio was 14.527, according to Benzinga Pro.

- MOGO has a stronger price trend in the short, medium, and long terms. The stock scores moderately on growth rankings. Additional performance details are available here.

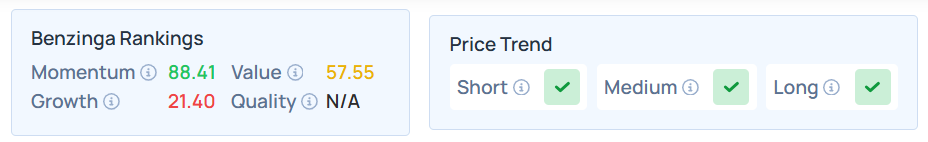

Marqeta Inc. (NASDAQ:MQ)

- Known for its modern card issuing platform, Marqeta's value score rose from 14.75 to 56.53 in a week, signaling a positive shift in its valuation metrics.

- Marqeta’s trailing P/S ratio was 5.576, according to Benzinga Pro.

- MQ maintains a stronger price trend in the short, medium, and long terms. However, the stock scores poorly on growth rankings. Additional performance details are available here.

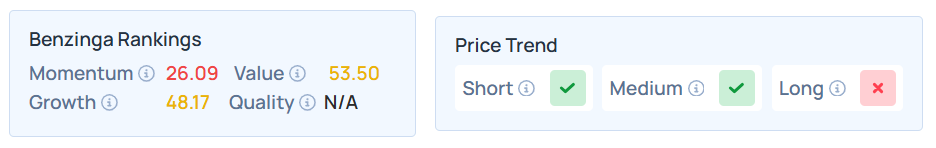

Synaptics Inc. (NASDAQ:SYNA)

- A developer of human interface hardware and software, Synaptics saw its score increase from 15.78 to 52.63.

- SYNA had a forward P/E of 16.026, down from the 37.030 industry average.

- Other rankings indicate that Synaptics maintains a stronger price trend in the short and medium term but a weaker trend in the long term. The stock scores poorly on momentum rankings. Additional performance details are available here.

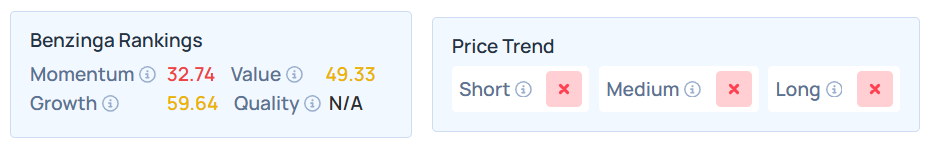

LiveRamp Holdings Inc. (NYSE:RAMP)

- The software-as-a-service (SaaS) company that focuses on data connectivity saw its value score climb to 8.31 from 49.58 last week.

- The firm’s trailing P/S ratio was 2.305, lower than the industry average of 66.35.

- It maintains a weaker price trend in the short, medium, and long terms. However, the stock scores moderately on growth rankings. Additional performance details are available here.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Monday. The SPY was down 0.12% at $642.67, while the QQQ declined 0.21% to $576.11, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: YAKOBCHUK V on Shutterstock