Goldman Sachs has highlighted six stocks that have a high probability of being acquisition targets in the next year.

Six Stocks Seen as Likely M&A Targets By Goldman

The bank reported that the total dollar value of M&A deals has risen 29% year-over-year, with deal volumes in 2025 climbing 8%. The bank projects an additional 15% increase in new deals in 2026.

Goldman’s Chief U.S. equity strategist, David Kostin, in a note on Monday, identified six stocks with a 30% to 50% chance of being acquired in the next 12 months, reported Business Insider. These stocks are the most likely merger-and-acquisition targets within a group of 49 companies identified by the bank.

The stocks are:

- Insmed (NASDAQ:INSM), in the health care sector, with 102.50% year-to-date growth.

Benzinga's Edge Rankings place Insmed in the 92nd percentile for Momentum. Check the detailed report here.

- Madrigal Pharmaceuticals (NASDAQ:MDGL), in the health care sector, with 41.21% year-to-date growth.

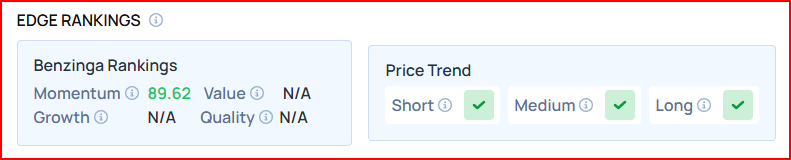

Madrigal holds a momentum rating of 89.62%, according to Benzinga's Proprietary Edge Rankings. Check the detailed report here.

- Krystal Biotech (NASDAQ:KRYS), in the health care sector, with a 12.94% year-to-date growth.

According to Benzinga Edge Stock Rankings, Krystal Biotech has a value score of 27.40% and a momentum rating of 30.09%. Click here to see how it compares to other leading healthcare companies.

- Mineralys Therapeutics (NASDAQ:MNTA), in the health care sector, with a 221.22% year-to-date growth.

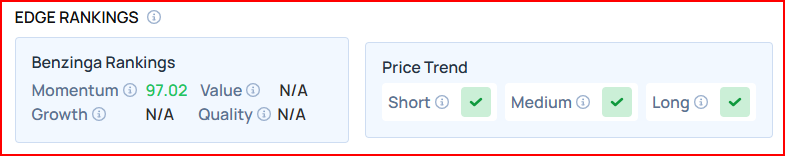

Benzinga's Edge Rankings place Mineralys in the strong 97th percentile for momentum. Check the detailed report here.

- TripAdvisor (NASDAQ:TRIP), in the travel sector, with a 13.74% year-to-date growth.

TripAdvisor holds a momentum rating of 68.47% and a growth rating of 91.65%, according to Benzinga's Proprietary Edge Rankings. Check the detailed report here.

- Vera Therapeutics (NASDAQ:VERA), in the health care sector with a 31.52% year-to-date decline.

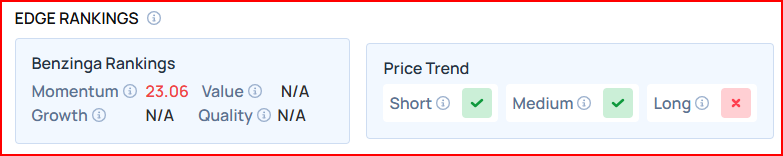

Benzinga Edge Stock Rankings shows that Vera Therapeutics had a stronger price trend over the short and medium term but a weaker trend over the long term. The details of other metrics are available here.

The bank noted that these stocks have outperformed the S&P 1500 by seven percentage points since the start of September, coinciding with a surge in M&A activity.

See Also: Cardano Founder Says Bitcoin On ADA Could Trigger Open DeFi Floodgates For Billions – Benzinga

M&A Deals Across Media, Tech Sectors

The M&A landscape has been vibrant in 2025, with several high-profile deals making headlines. Notably, Electronic Arts (NASDAQ:EA) recently announced a $55 billion all-cash acquisition, marking the largest leveraged buyout ever. This development has sparked a surge in the stock prices of potential M&A targets, as highlighted by Goldman Sachs.

Ares Acquisition Corporation II (NYSE:AACT) plunged 14.53% over the past five days following a rally earlier last week, after the company secured funding for its upcoming merger with Kodiak Robotics, a developer of autonomous vehicle technology.

Earlier this month, Shares of Walt Disney Co. (NYSE:DIS) and Netflix Inc. (NASDAQ:NFLX) were potentially weighed down by reports that a Paramount Skydance Corp. (NASDAQ:PSKY) consortium is preparing a bid for Warner Bros. Discovery Inc. (NASDAQ:WBD), a move that could pose fresh competition for the streaming giants.

Investors are keeping a close eye on companies that could potentially be acquired in the next 12 months, and Goldman Sachs’ list provides valuable insights for those looking to capitalize on the M&A trend.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.