You and I are becoming the shock absorbers on the proverbial racing car that is Donald Trump’s tariff increases. As if the cost of living wasn’t already high enough, prices are skyrocketing again. Businesses are being hit hard. And many have no choice but to pass the price onto consumers. Just to survive. Things are getting real. And it’s happening fast.

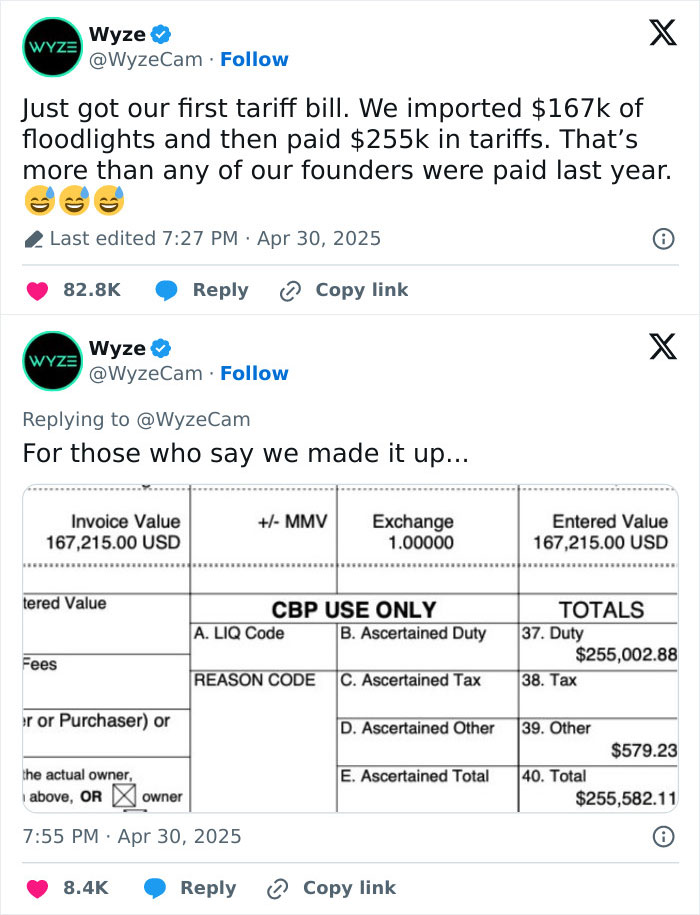

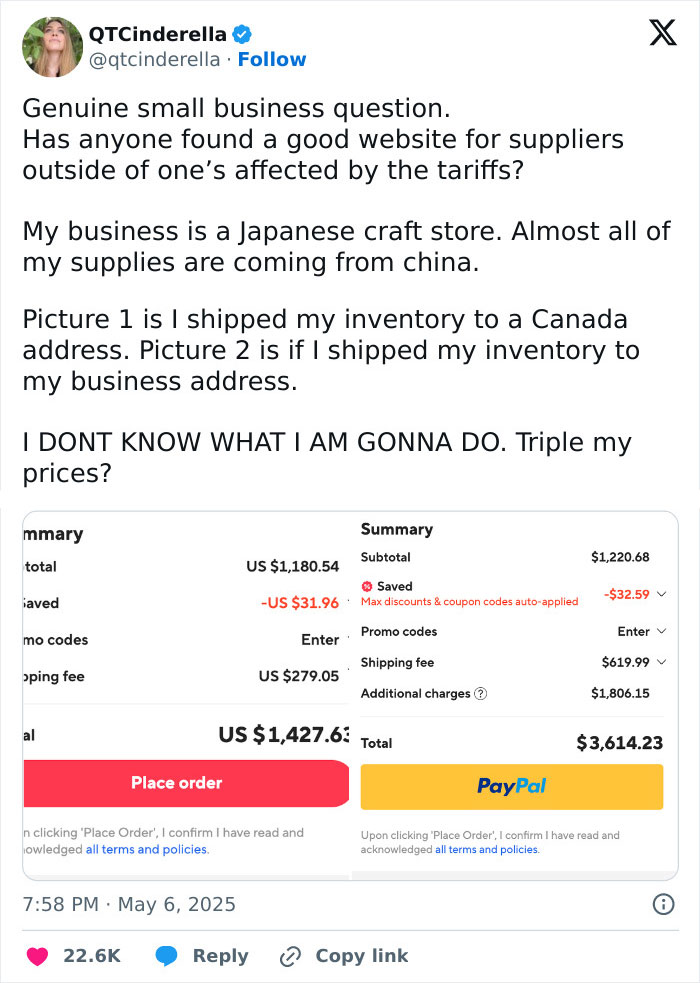

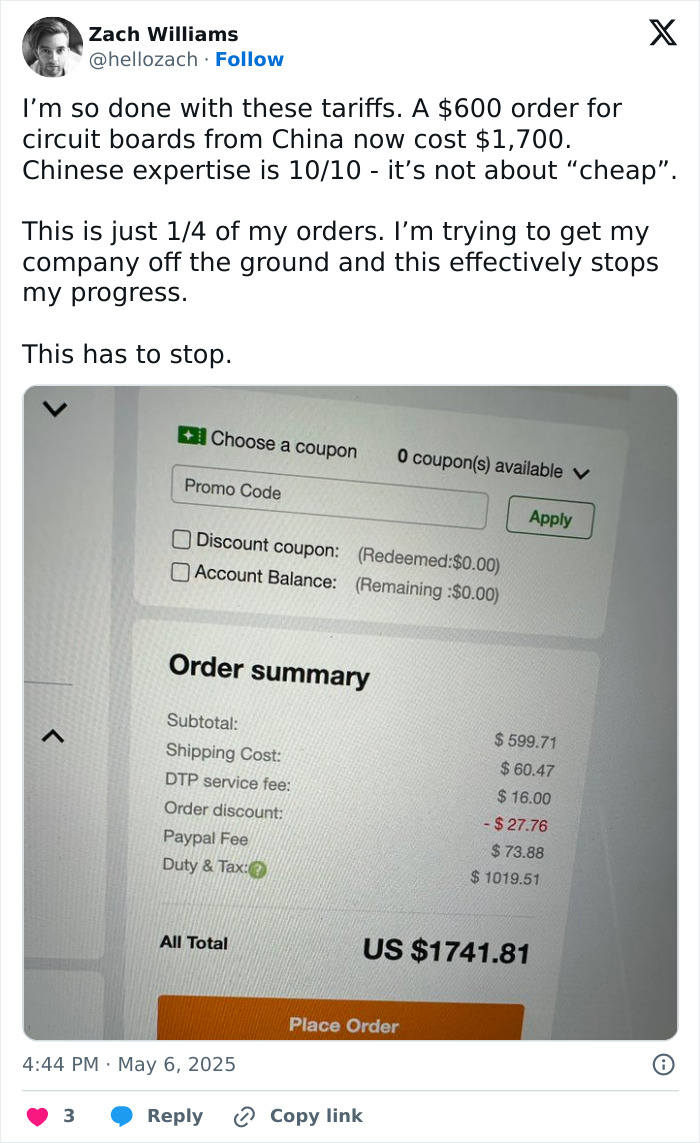

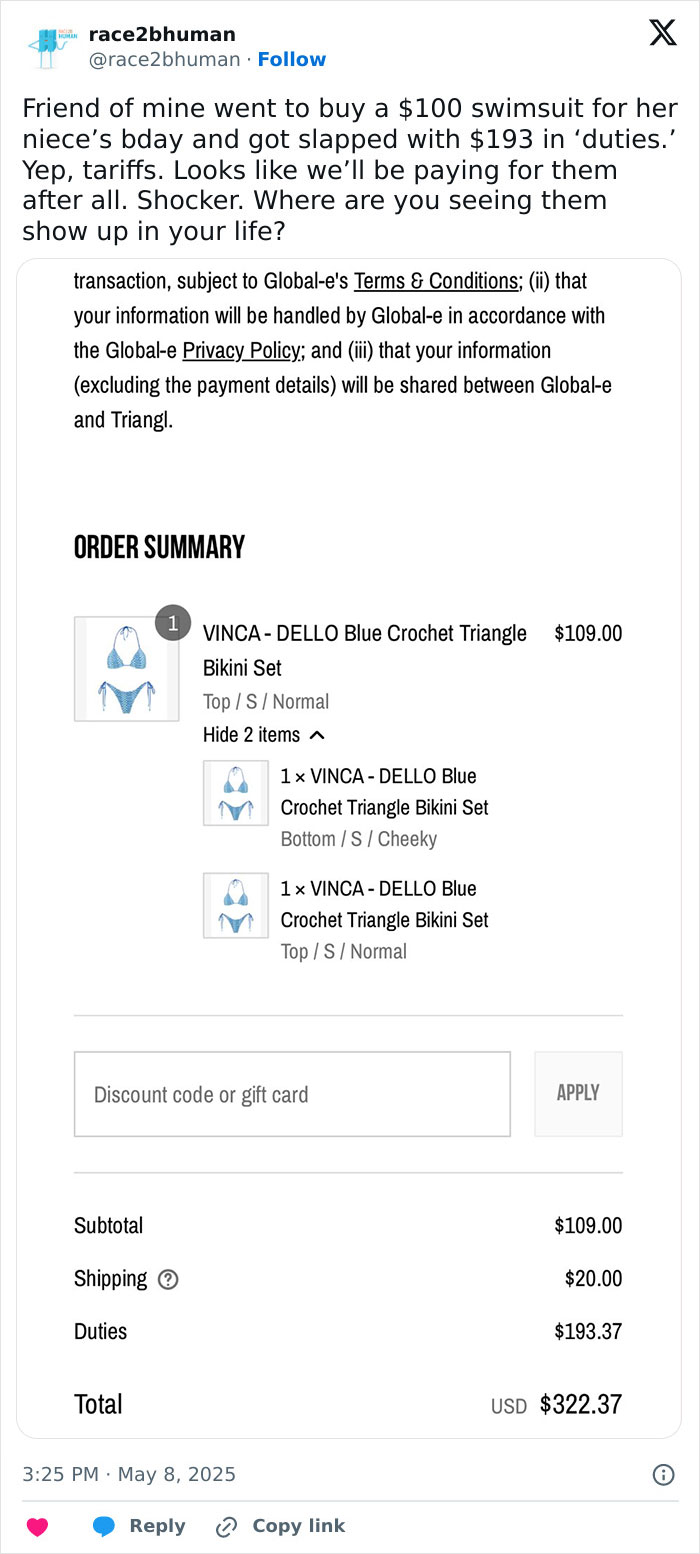

To drive the message home, people have been sharing real receipts of how Trump’s tariff hikes are impacting them. One company tweeted how it paid a whopping $255,000 in tariffs on an import of floodlights, which cost $167,000. Another got hit with more than $2,800 in tariffs for a purchase of under $2,000. Some business owners are rolling with the punches, while others are really worried.

Bored Panda has put together a list of some of their tariff receipts to show just how wild things are out there. We also spoke to WalletHub's financial writer and analyst Chip Lupo to unpack how the tariff hikes affect ordinary Americans and business owners. You'll find that information between the screenshots.

#1

Image credits: jrhp2016

It was almost like a late April Fool's prank for some... On 2 April 2025, President Donald Trump imposed a 10% baseline tariff on all imports into the US. Dozens of the country's trading partners were also hit with even higher import taxes, sparking a trade war where there are more losers than winners. Trump made the "Liberation Day" announcement at a White House Rose Garden ceremony. But many were feeling anything but liberated afterwards...

While some of the big tariffs were put on pause, the impact of the ones in place are being felt far and wide. Prices are increasing, as small and large businesses battle to survive. For many business owners, it's become a toss-up between passing the tariff cost to consumers, or absorbing the shock themselves.

"Tariffs are taxes on imported goods," WalletHub's financial writer and analyst, Chip Lupo tells us during an interview, adding that Trump imposed the higher tariffs to "boost U.S. manufacturing, protect American jobs, and reduce the trade deficit by imposing taxes on imported goods, particularly from countries believed to be unfair trading partners."

But many ordinary Americans and business owners are struggling to buy into the idea. "When tariffs are implemented, the cost of goods usually rises, which can lead to higher prices for businesses and consumers. Companies may pass their extra costs onto the consumer, making everyday items more expensive, explains Lupo. "This can slow economic growth, increase inflation, and hurt industries that rely on exports if other countries retaliate with tariffs of their own. In practical terms, that means paying more for everyday goods and potentially more uncertainty in the job market."

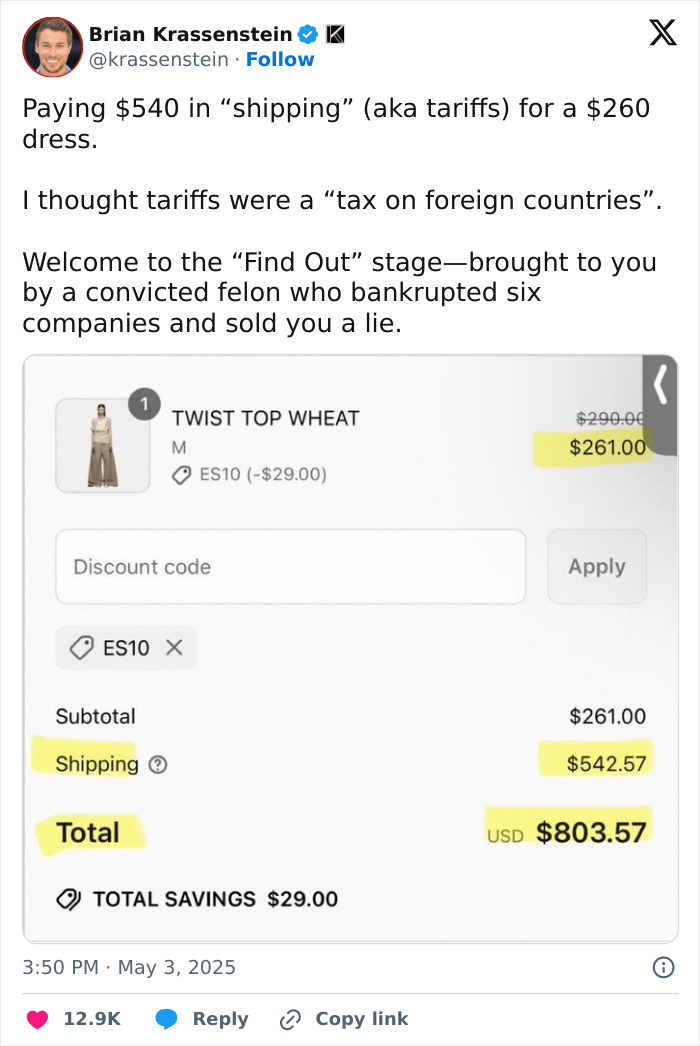

#2

Image credits: krassenstein

In April, we brought you the story of content creator and small business owner Lexi Larson. She went viral after sharing how her dream was being crushed by Trump's tariff hikes. And how she was left in shock and speechless after finding out she stands to lose thousands because of sudden skyrocketing import taxes.

Larson revealed that she simply doesn't have the money to continue buying goods for her small business. And because of that, she might have to return to the corporate world and risk facing burnout once again. Larson is one of many in the same sinking boat... Trying to navigate some very choppy waters.

"The latest tariffs have placed many businesses in a holding pattern as they wait to see what future trade rules will look like," Lupo says. "While recent tariff rollbacks for some goods will provide at least some short-term relief, the overall uncertainty is making it tough for businesses to plan and invest confidently."

Some companies, especially the smaller ones, aren't left with much of a choice. If they carry the tariff costs themselves, they face going out of business. It's become a fight for survival. So they're increasing the prices of their imported goods, while trying to be as transparent as possible.

"Maybe they're going to lose customers because of the higher rates, but at least being transparent will help reduce the damage," venture capitalist and associate professor of management at Babson College, Peter Cohan told Business Insider.

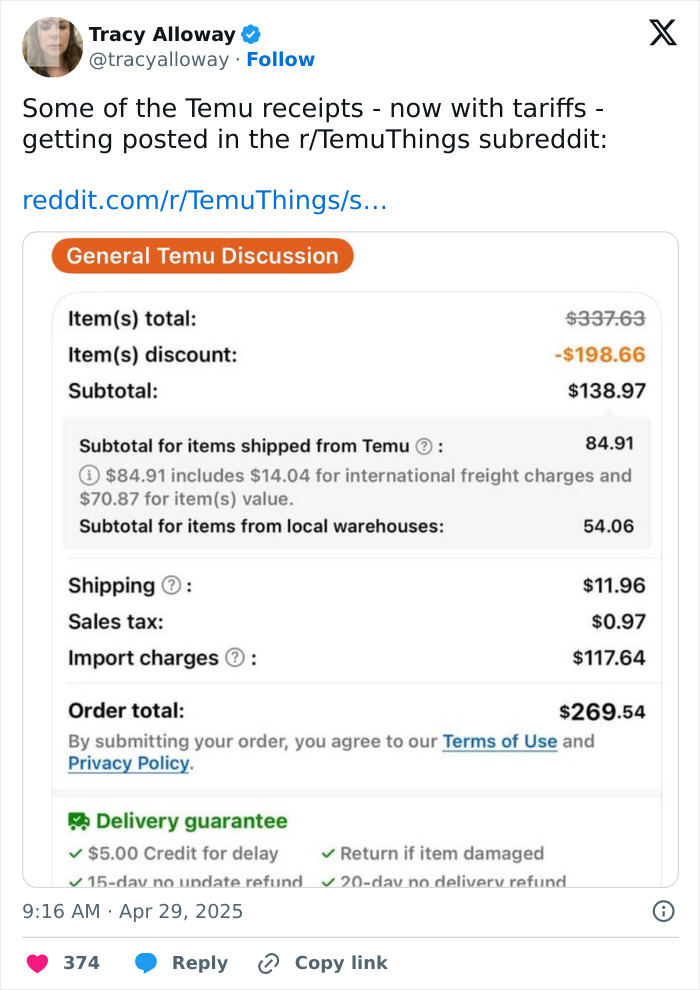

#3

Image credits: tracyalloway

Many consumers were expecting to feel the effects of the tariff increase. A recent survey conducted by the Economist and YouGov found that 75% of people polled thought that Trump's tariffs would increase prices. 61% of the of 1,850 adults surveyed said they'd like businesses to display how much of a purchase price goes toward paying tariffs.

But this isn't something the U.S. government is keen on. "The obvious reason why the White House wouldn't want businesses to show tariff costs is because it makes it obvious how much their policy is costing consumers," Cohan explained. "It's going to drive down the poll ratings because consumers will be extremely aware of how much more they're paying and who's causing them to pay it."

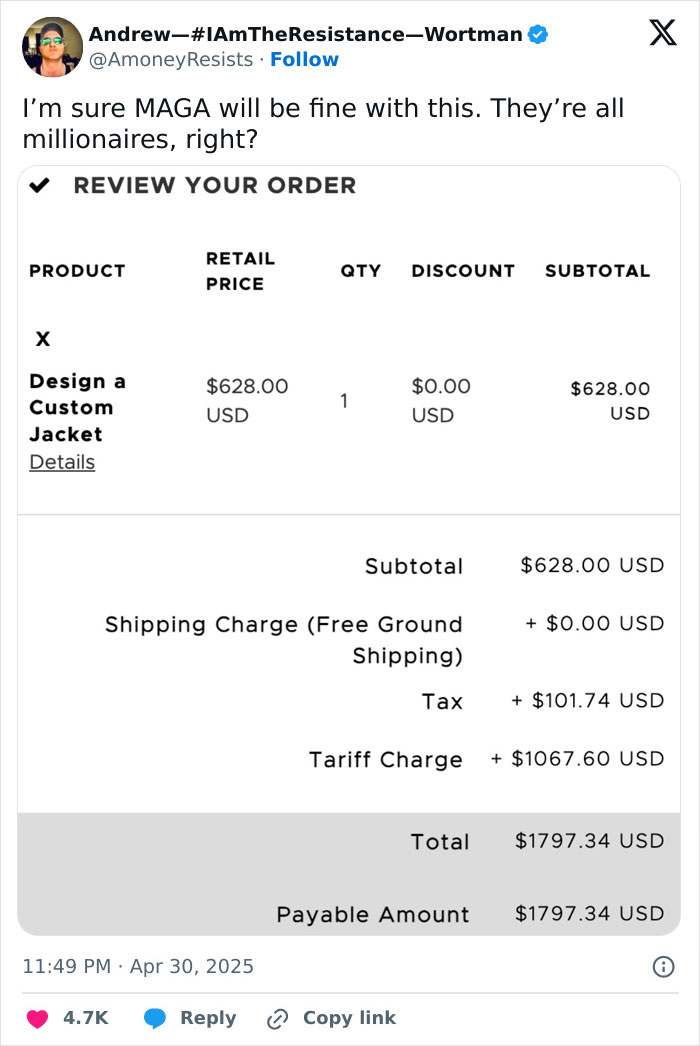

#4

Image credits: AmoneyResists

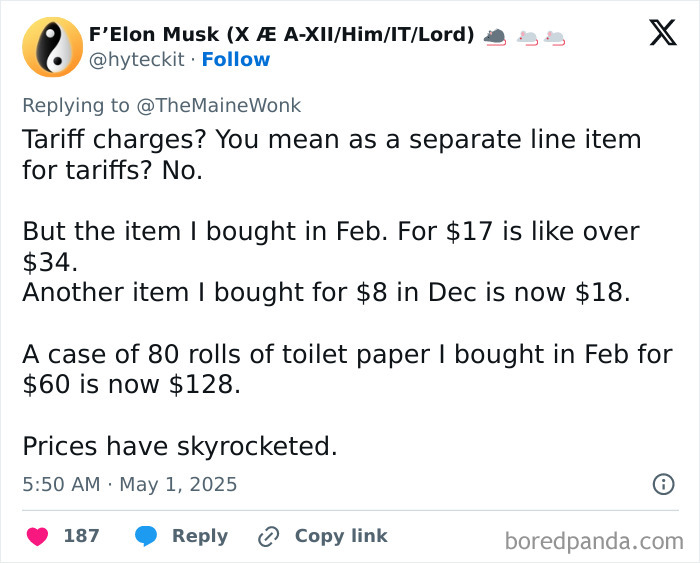

#5

Image credits: hyteckit

Ordinary Americans are divided on whether the tariff hikes are indeed necessary. The survey found that 46% believe that tariffs "are harmful to the economy and consumers, with no real long-term benefits," while 39% were willing to weather the storm, saying that "they may cause short-term economic pain, but they lead to long-term economic growth."

The pain is already being felt, and it's not just big-ticket items that are getting much pricier. Everything from sugar, tea, coffee and cars are set to increase in cost. And here's the kicker: On average, U.S. consumers should expect to spend about $3,800 more this year because of the hikes. That's according to Ernie Tedeschi, who is the director of economics at the Budget Lab at Yale.

"Consumers are currently seeing moderate increases in the prices of goods as the inflation outlook remains uncertain due in large part to the tariff situation," Lupo tells Bored Panda. "But it’s inflation, not tariffs specifically, that Americans are most worried about, according to WalletHub research. As goods become more expensive due to tariffs, credit card debt and financial instability will continue to be growing issues for families."

#6

Image credits: oyemyachinghead

Tedeschi told Business Insider that the cost of clothing items is expected to increase by about 8%, while pantry staples like sugar and coffee could go up in price by about 1.3%. Your fresh fruit and veg is also about to get more expensive, with Tedeschi predicting a 2.2% increase. But fortunately, it doesn't apply to all fresh produce.

The United States-Mexico-Canada Agreement means that most agricultural products, textiles, apparel, and other goods coming from Mexico for example have "zero-tariff treatment." But, if you get certain fruits from afar, you might have to either go without or be willing to splurge.

#7

Image credits: WyzeCam

#8

Image credits: qtcinderella

#9

Image credits: hellozach

"The luxury of eating our favorite fruits and vegetables regardless of the season is based on global imports with much coming from Central and South America," says one expert. Margaret Kidd is an instructional associate professor of supply chain and logistics technology at the University of Houston. Kidd believes the tariff hikes will make many fresh foods unaffordable."

#10

Image credits: race2bhuman

#11

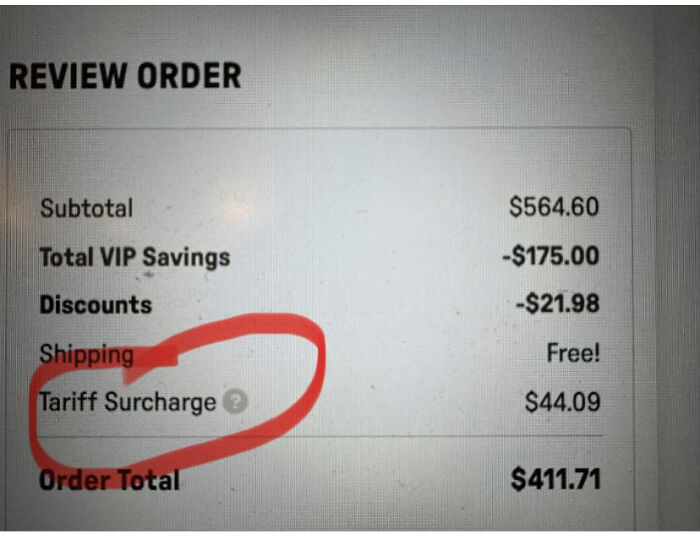

Wife's friend bought a bunch of summer clothes for her kids from Fabletics and they hit her with a TARIFF SURCHAGE cost. I am sure this is going to be the new norm when buying.

Image credits: ProperMod

#12

Image credits: TheGhiliSuit

As is often the case, the poor are expected to bear the brunt. And many will have to seriously reconsider what they can and can't afford. According to Tedeschi, lower-income households will spend about two and a half times more of their share of income than the highest-earning households will.

"Lower-income households are more likely to purchase imports. They spend a larger share of their income than higher income households do, and so they are more vulnerable to tariffs than higher income households are," explained the expert. "And obviously people care about food for food's sake, but that also has distributional implications as well. The more the price of food goes up, the more that disproportionately affects lower-income families as well."

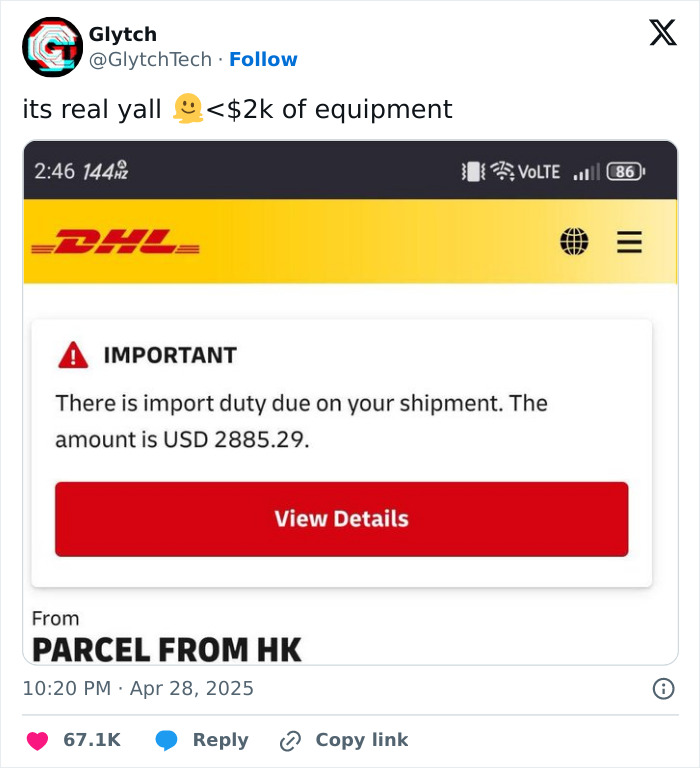

#13

Image credits: GlytchTech

#14

Image credits: FlyingDutchPall

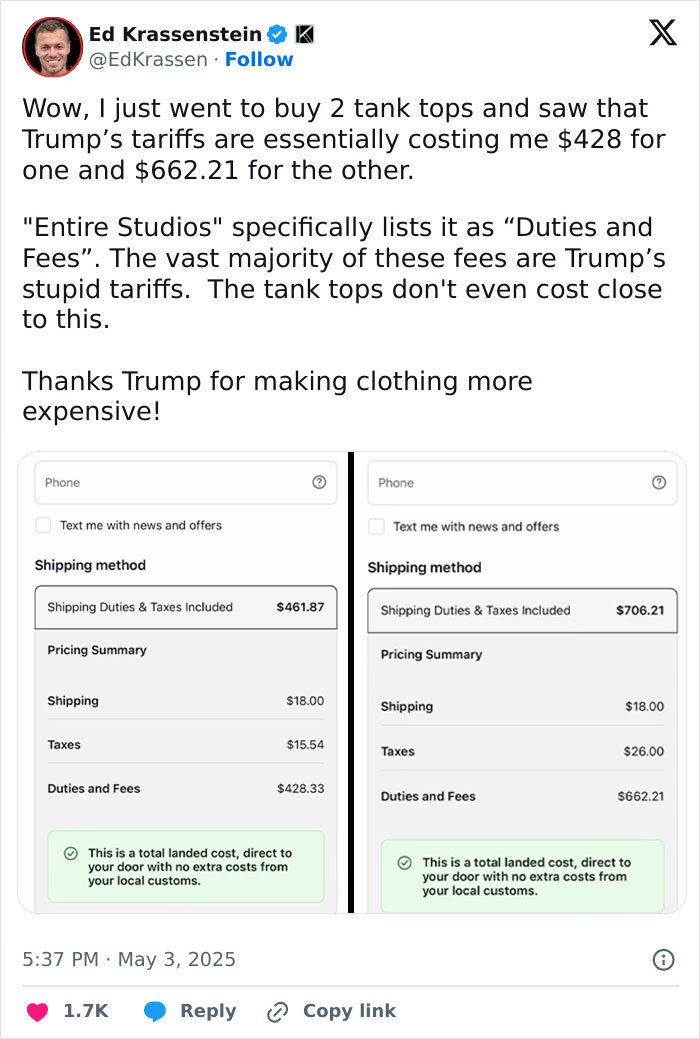

#15

Image credits: EdKrassen

The Center for American Progress (CAP) has also warned that Trump's tariff hikes will be felt most by low- and middle-income consumers. The Washington-based think tank estimates that the levies could cost households an average of $5,200 every year. And the Center's experts don't believe it's worth it. The tariffs are unlikely to create jobs, improve U.S. economic competitiveness, or improve America’s standing in the world, they say.

In an article published on CAP's site, Ryan Mulholland raises questions about what he calls "the cost of Trump’s reckless trade wars for Americans." The international economic policy expert believes that the tariff hikes and "chaotic trade wars" are "dragging down investment, eliminating American jobs, and raising prices for American families."

#16

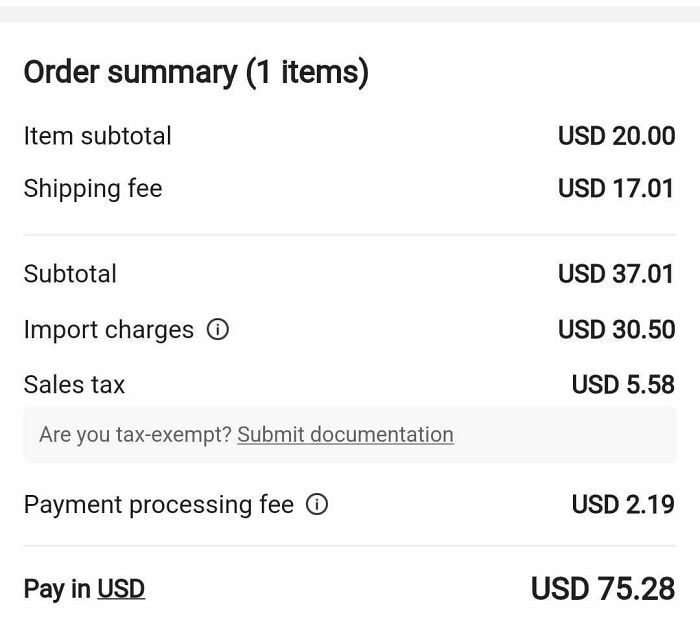

Wasn't China supposed to be paying for all of this?

As an American consumer where is my reimbursement from China on all of this?

When is the MAGA sending me a check for the tariff reimbursement cause I thought that was their grand scheme and end game for all of this?

Wasn't taxes for Americans supposed to go down? Where is a $20 item under the MAGA tariff converted now to $76 item lowering taxes for us Americans???

Image credits: Emergency-3030

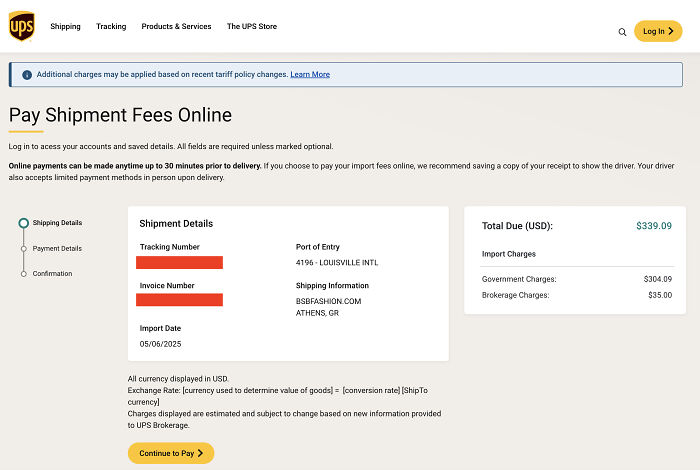

#17

Ordered some clothes from a reputable, brick-and-mortar store in Greece. Got hit with an invoice of $340 upon delivery to America. Turns out one of the items (€115) was made in China. Surprise! Charge is non-negotiable and irreversible. If I refuse the package I will still owe the money.

Image credits: labyrinth-luminary

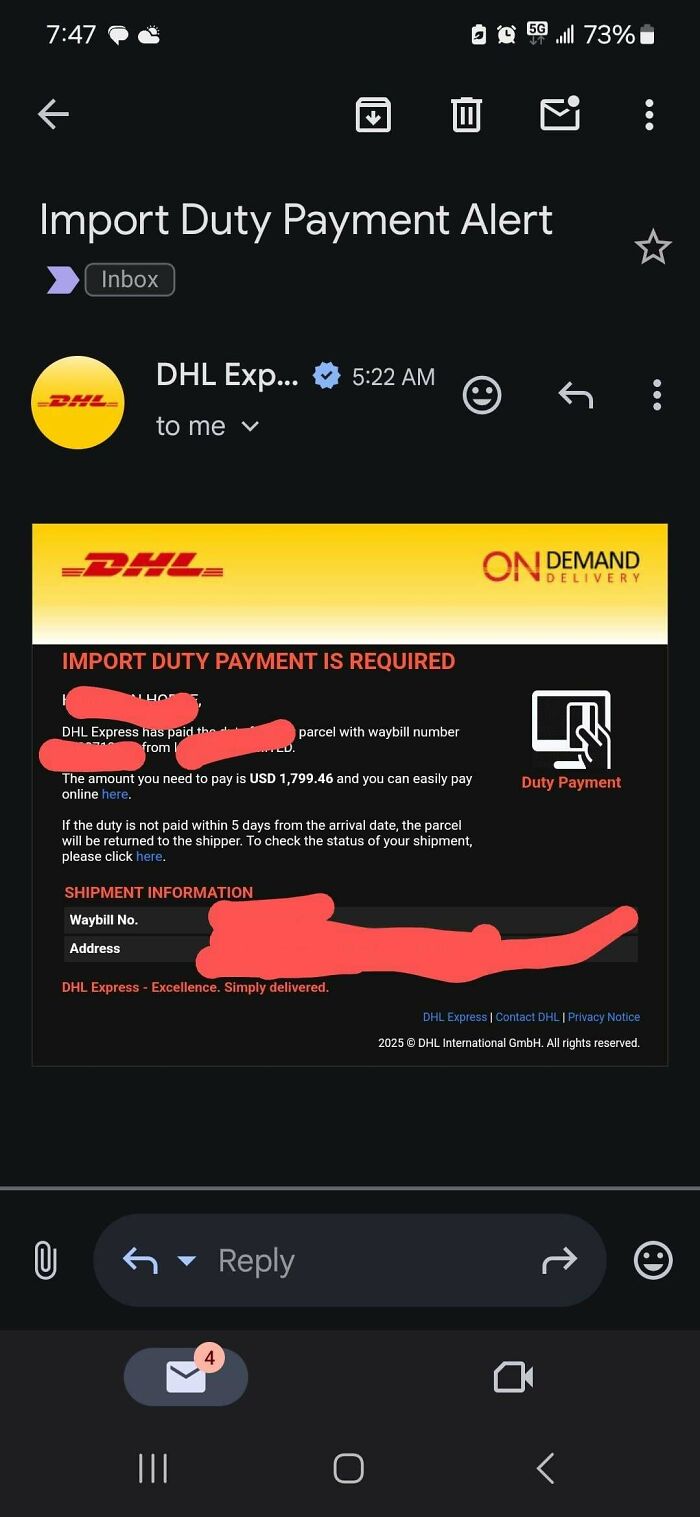

#18

I ordered a motorcycle jacket and liner from the UK to the US. The total price for my order was 833.32 pounds or $1128.78.

The shipment was held up at customs for two weeks, with the new import rules I believe it has to be a formal import or something like that. Once it made it through I got this email stating it would be $1800 in duty fees, around 160% the cost of the goods.

I figured at that price I would let them send it back as the email says they would do it I didn't pay. They then paid the duty fee, shipped it to my city, and charged me a $180 holding fee in 1 day.

I decided to pay the fee to prevent things from getting out of hand and being on the hook for what I can imagine would be insane return shipping and import fees.

DHL duty dispute won't answer the phone, they have an automated machine that just says they are to busy and won't take calls then it hangs up. Normal customer service won't talk to me. I'm unable to download my duty and vat documents from the website or app, it's saying they're being prepared for 3 days now. Ive emailed the duty dispute email twice and they haven't contacted me back.

Image credits: StorminTF

President Trump hasn't denied that consumers could feel the pinch. As CBS reported, he seemingly acknowledged that stepped-up tariffs could result in higher costs for some goods. "Maybe the children will have two dolls instead of 30 dolls," the U.S. leader said in an April 30 Cabinet meeting. "And maybe the two dolls will cost a couple of bucks more than they would normally."

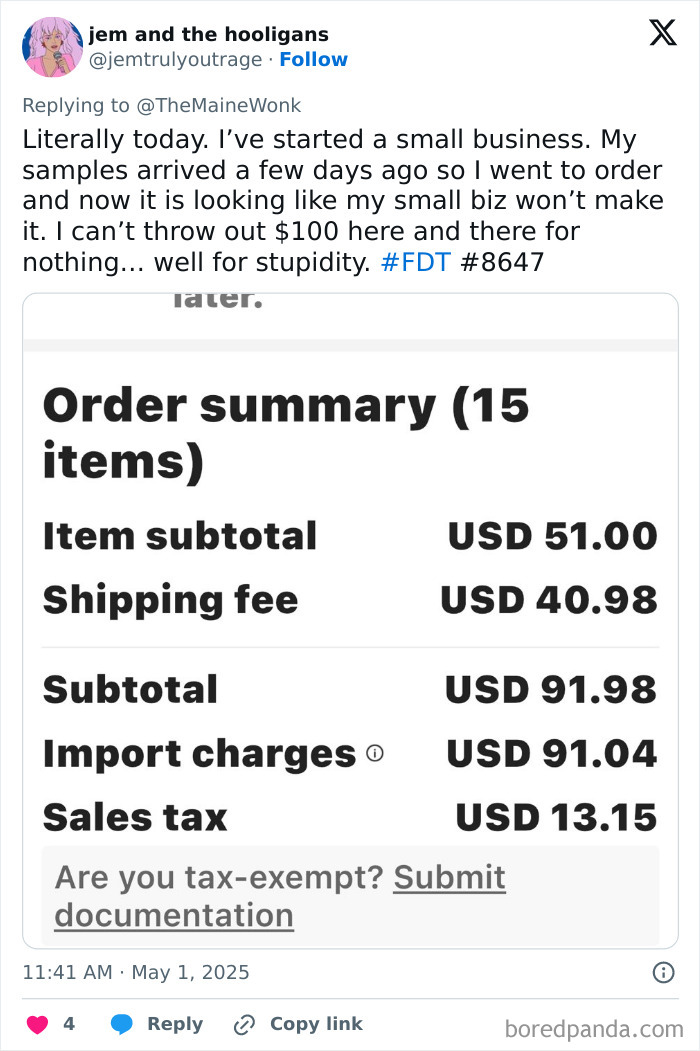

#19

Image credits: jemtrulyoutrage

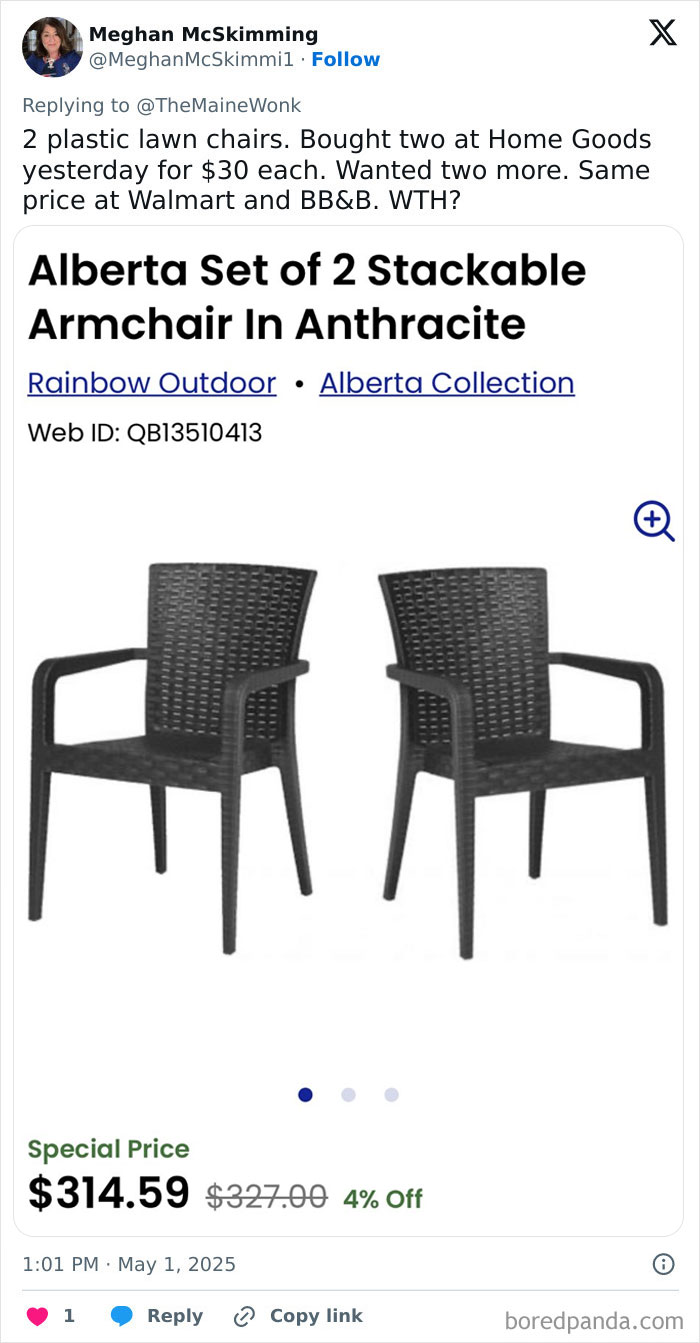

#20

Image credits: MeghanMcSkimmi1

#21

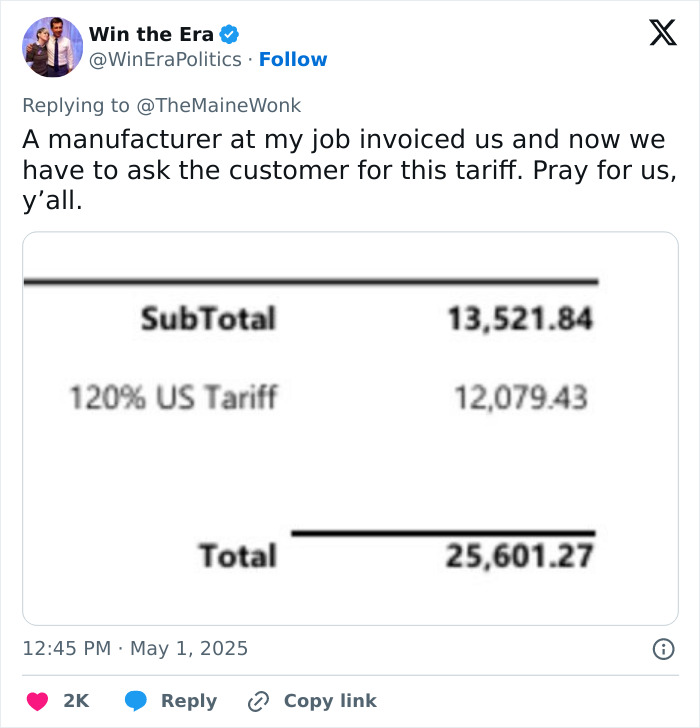

Image credits: WinEraPolitics

#22

Image credits: CandiHeckathorn

#23

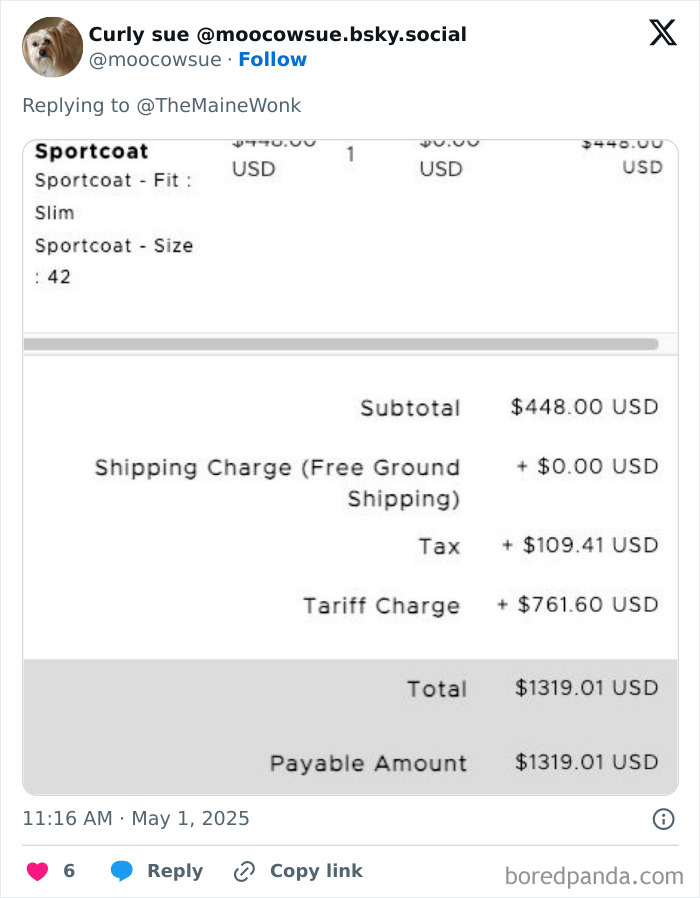

Image credits: moocowsue

#24

Image credits: erindebruyn

#25

Image credits: Mellyfax

#26

Image credits: CoraCHarrington

#27

A couple of weeks ago I bought a pre-owned Louis Vuitton wallet from a Japanese seller. The item shipped from Japan. I paid $80 for the wallet, plus US sales tax ($116.91 in total).

I just got a notice from DHL that my tariff fees are $83.10!!!

Image credits: TrekEmonduh

#28

Image credits: JudyRien

#29

Image credits: tavreviewseverything

#30

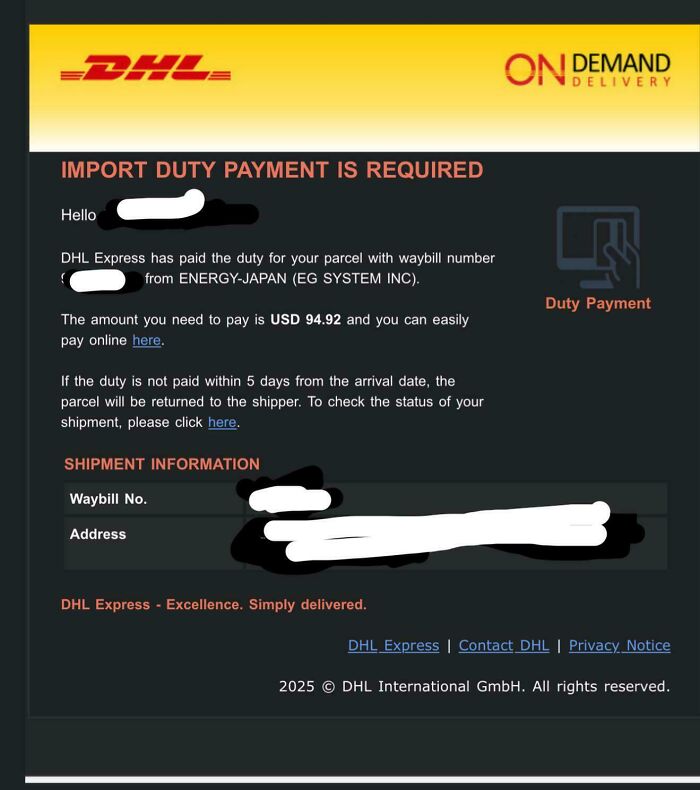

They just email me and ask about pay duty for $94.92 for package value $105.. that’s so insane and on april 8 my package that value $400 it arrived so fast and no duty at all. Also from ebay japan too. Is this right? Should i pay it or if not are they will not release my package and will send it back to japan?

Image credits: KnownStudent7851

#31

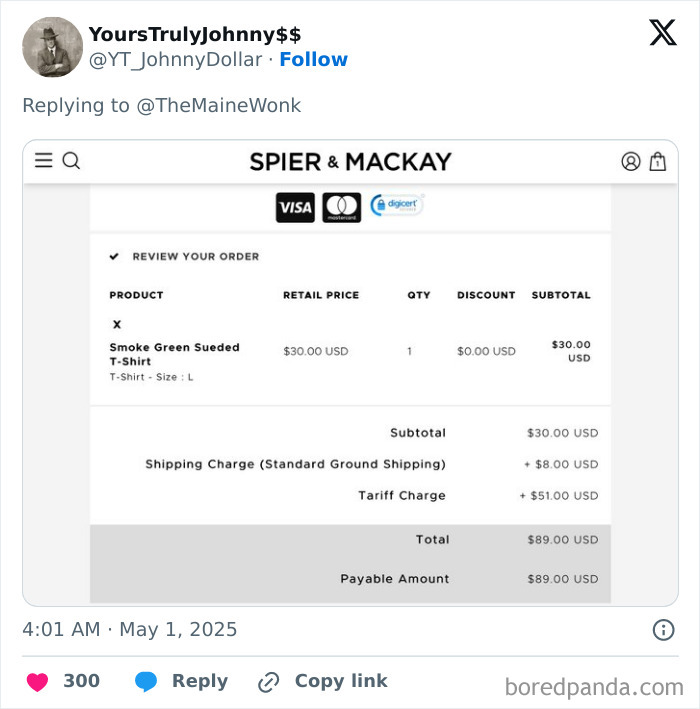

Image credits: YT_JohnnyDollar

#32

Image credits: MelTay0311

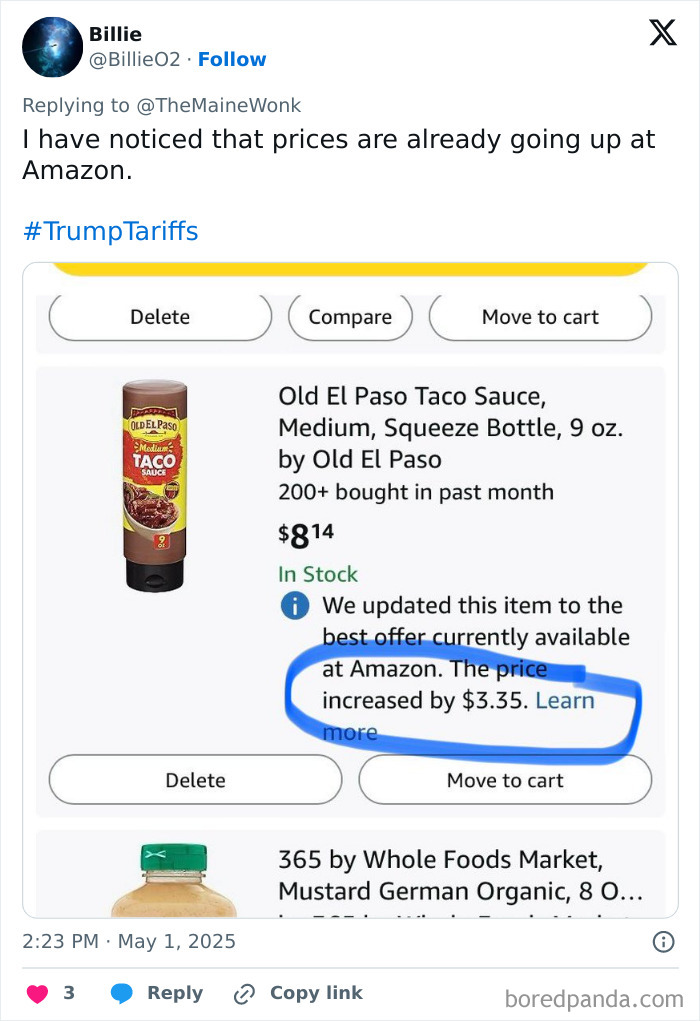

#33

Image credits: BillieO2

#34

Image credits: flowabug

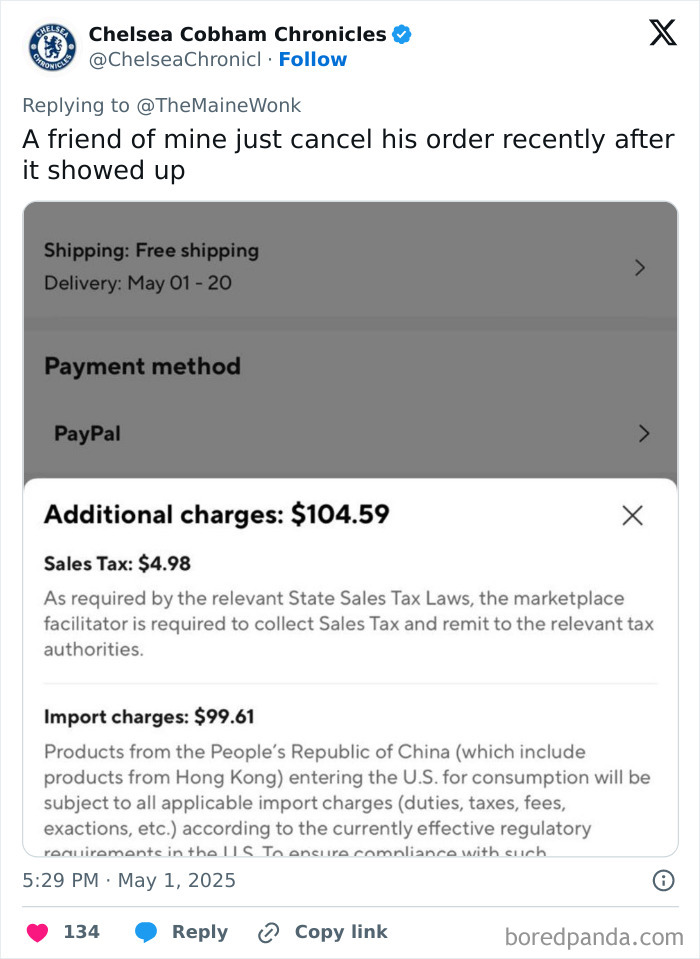

#35

Image credits: ChelseaChronicl

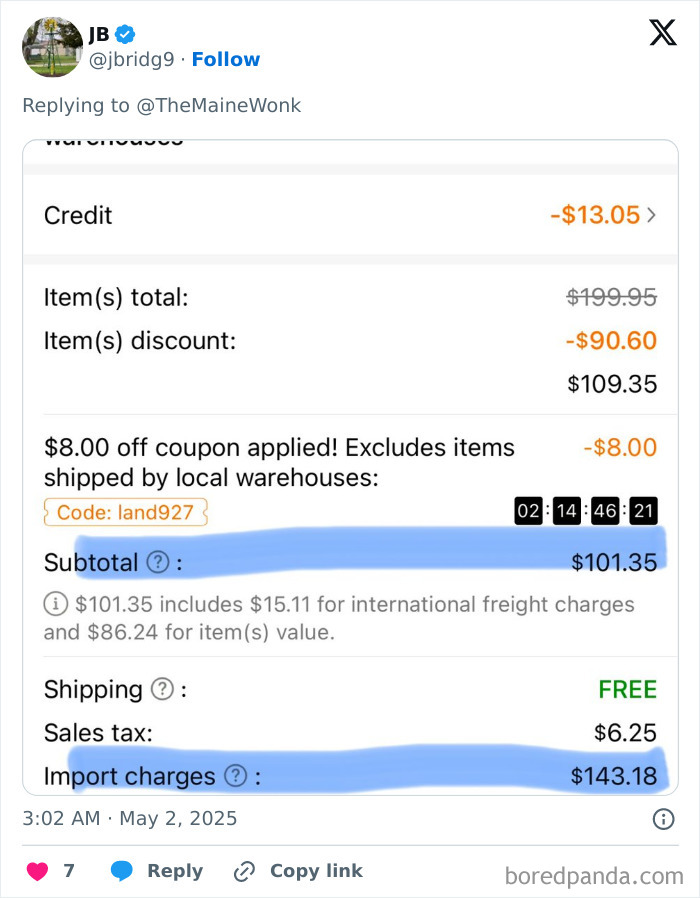

#36

Image credits: jbridg9

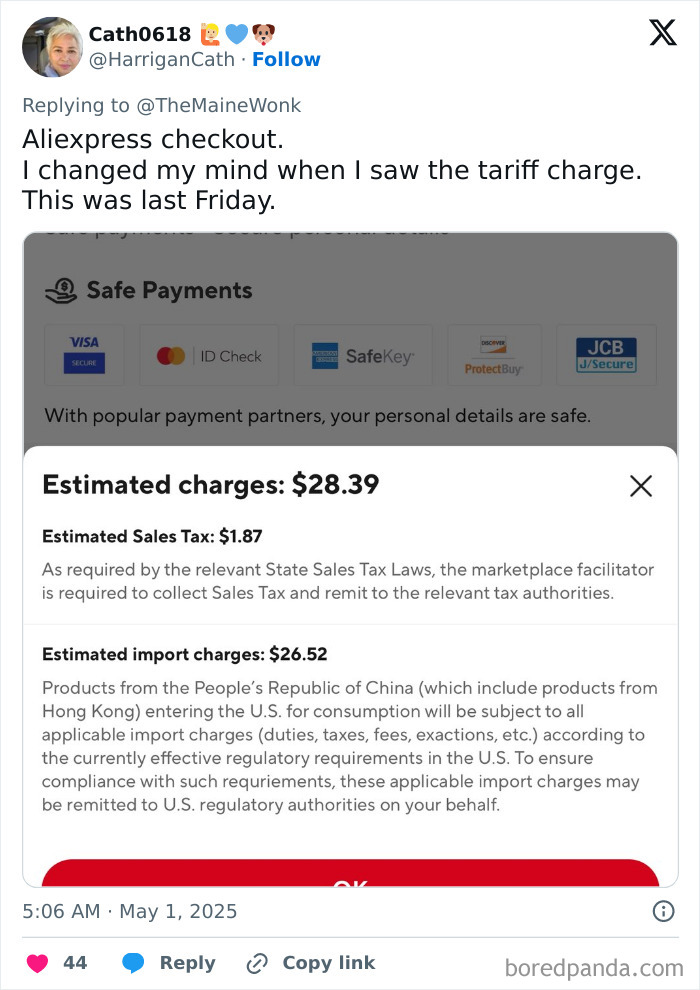

#37

Image credits: HarriganCath

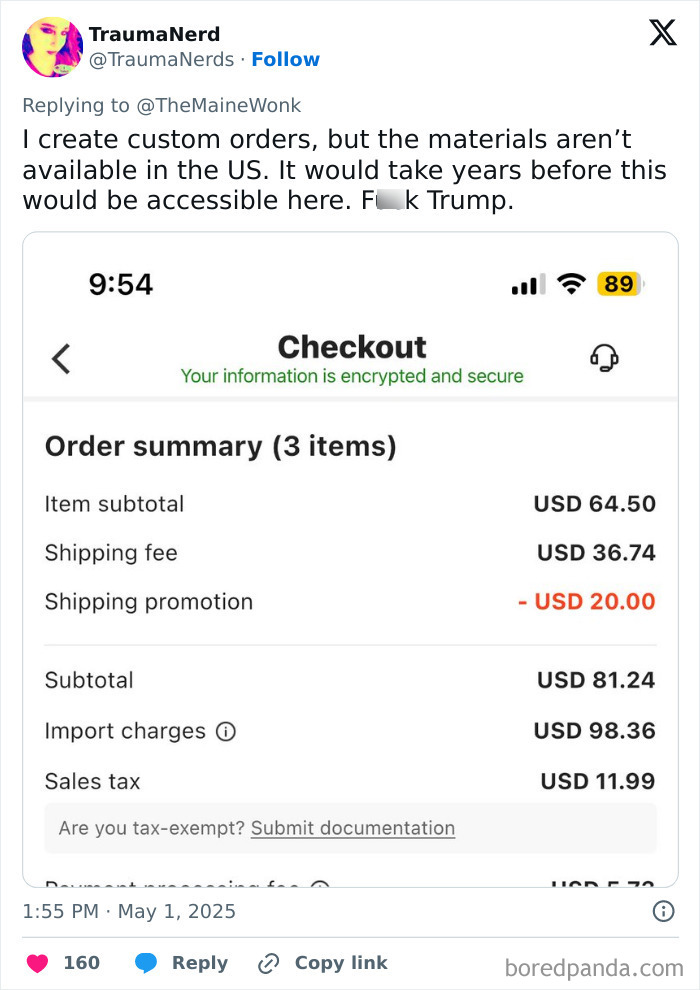

#38

Image credits: TraumaNerds

#39

Image credits: barbiehines

#40

Just got my first Tariff bill from imported figures. $29 bill from Fedex. Here we go folks.

So everything came from japan but some of it is listed as made in china and some is listed as japan.

Image credits: theoriginalmofocus

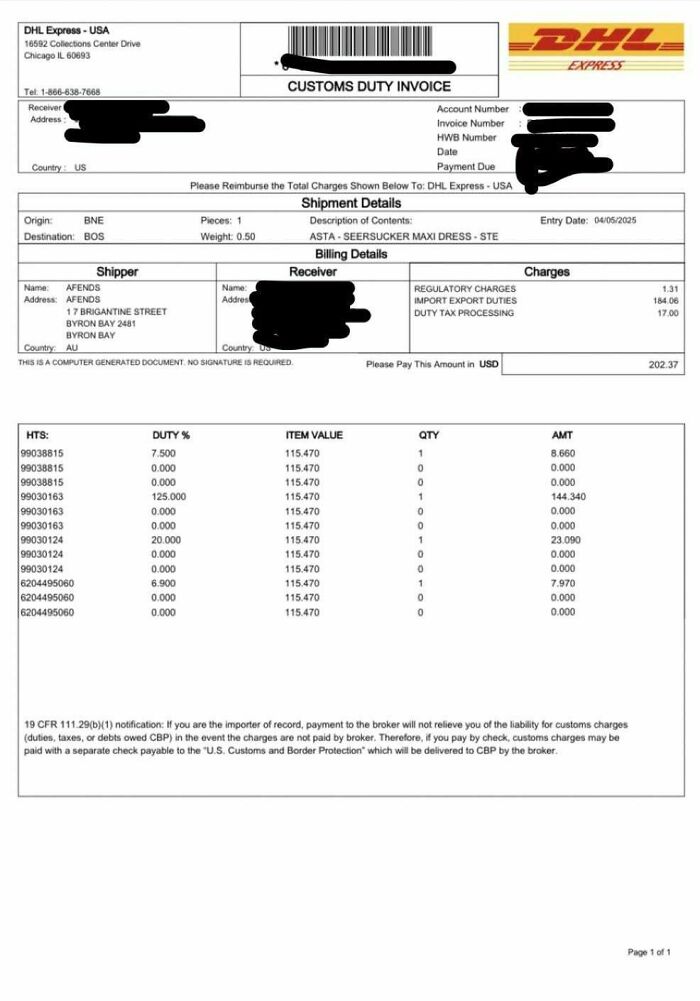

#41

I paid $120 USD (with express shipping) for this dress from an online retailer in Australia. Imagine my surprise when I got an email that I need to pay a whopping $202 to get my package!! Is this accurate (Trump tariffs, I know) or is it possible that DHL made a mistake in the classification of the package?

Also, what happens if I don’t pay it? I imagine DHL could try to come after me somehow to collect, but I’m curious about the likelihood of that happening.

Image credits: kirwin402

#42

Image credits: ilenes57

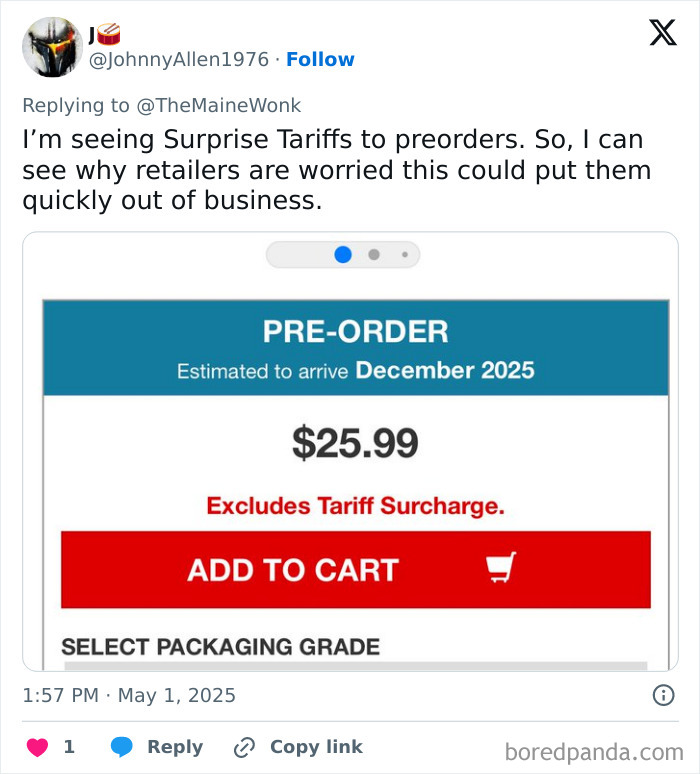

#43

Image credits: JohnnyAllen1976

#44

Image credits: _heyyitsEmilyy_

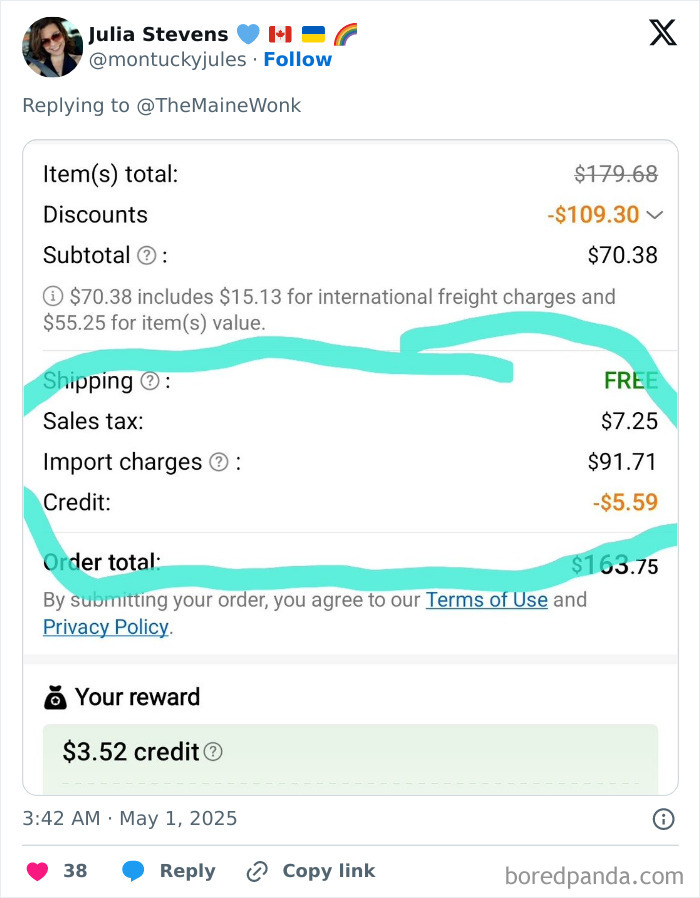

#45

Image credits: montuckyjules

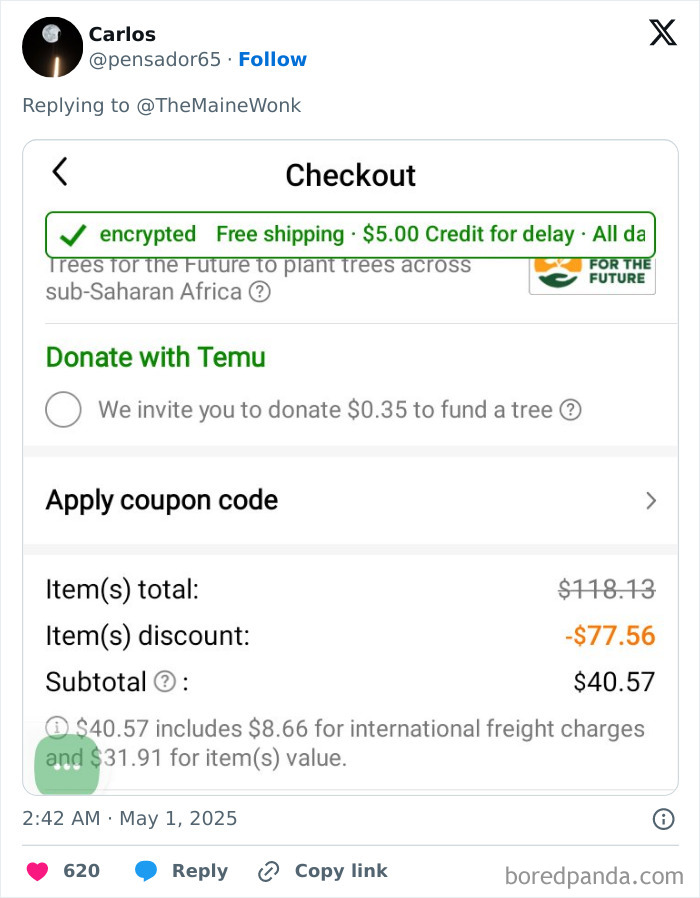

#46

Image credits: pensador65

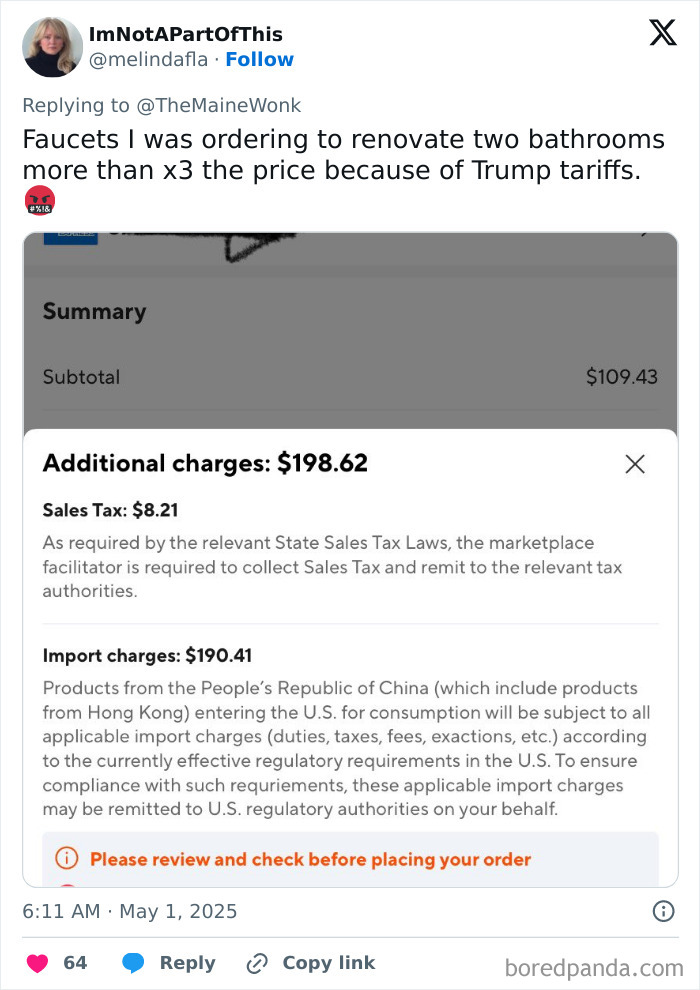

#47

Image credits: melindafla

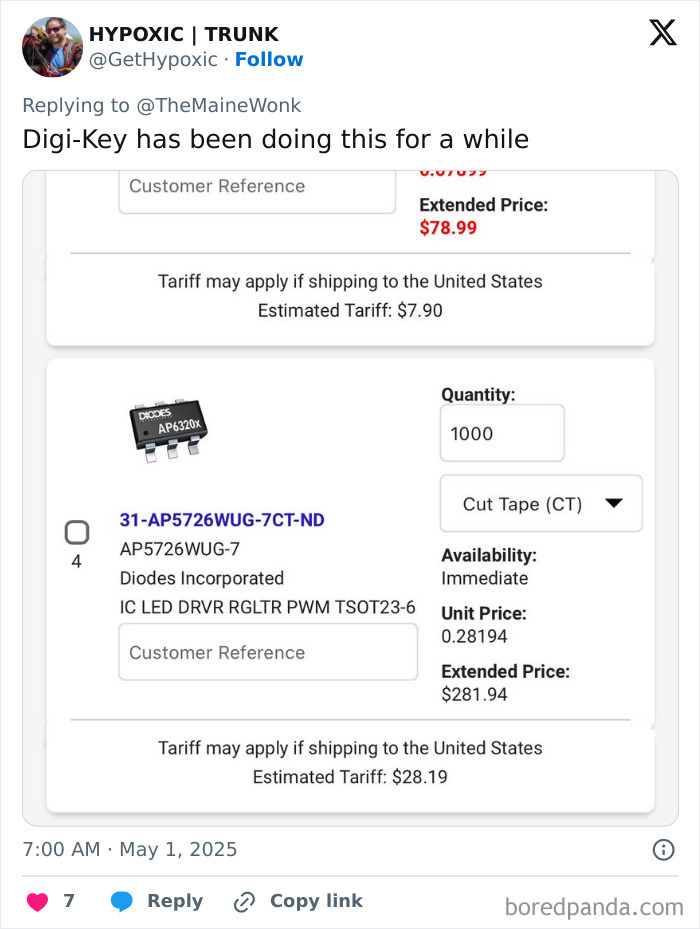

#48

Image credits: GetHypoxic

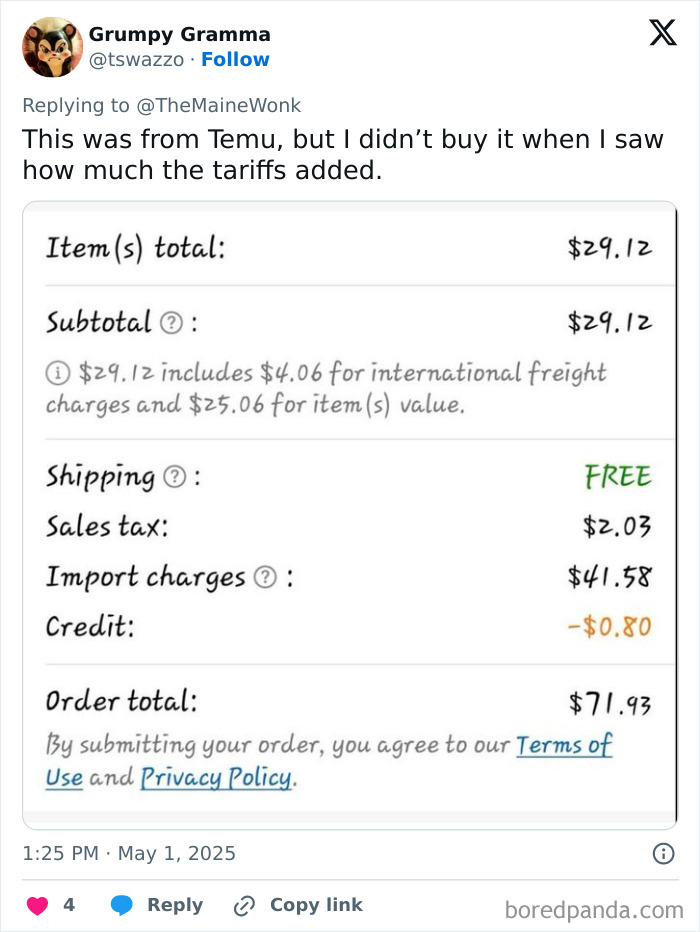

#49

Image credits: tswazzo

#50

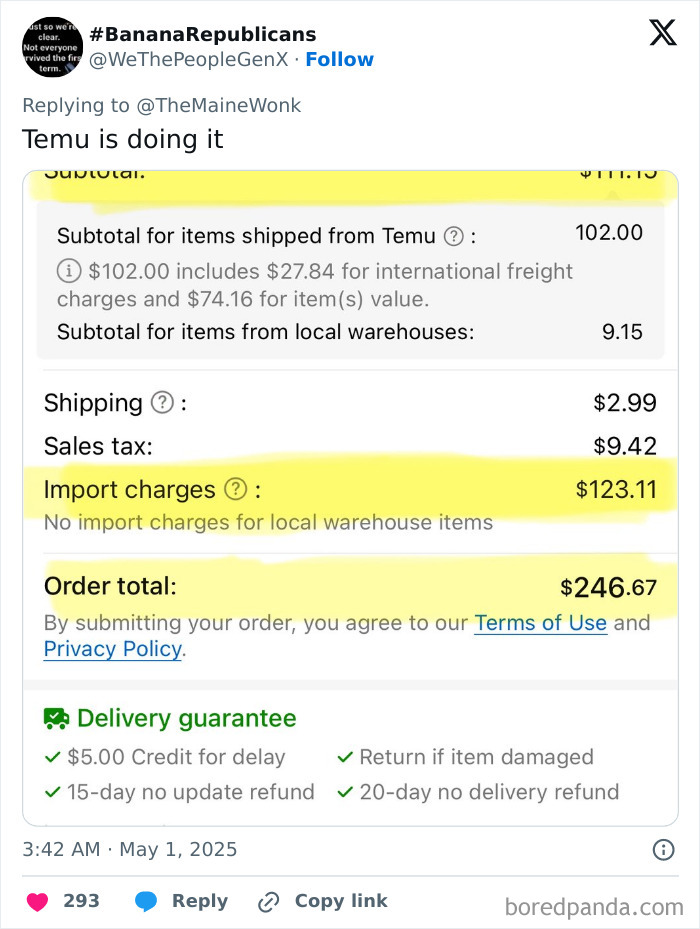

Image credits: WeThePeopleGenX

#51

Image credits: Douglas_Wolf_

#52

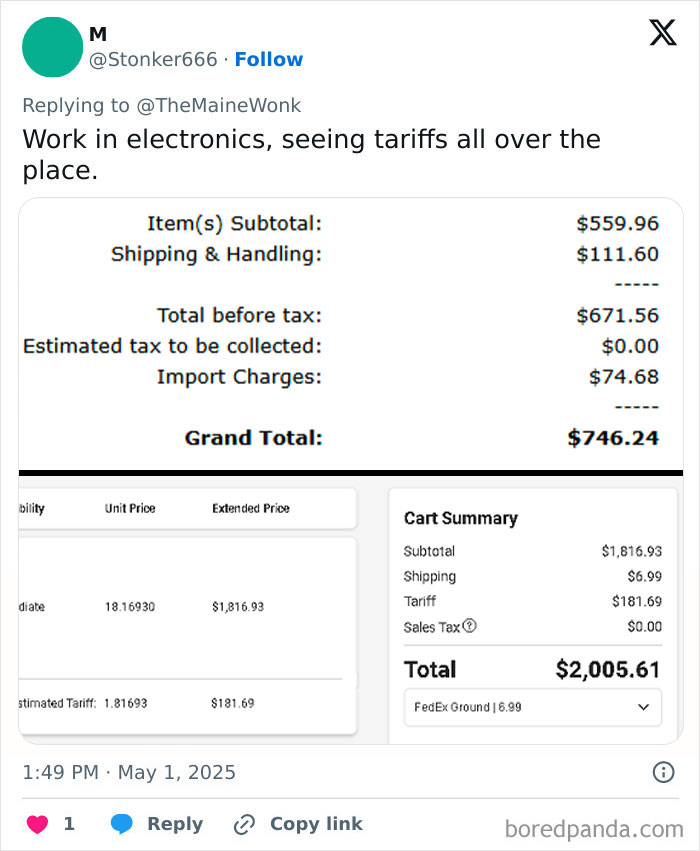

Image credits: Stonker666

#53

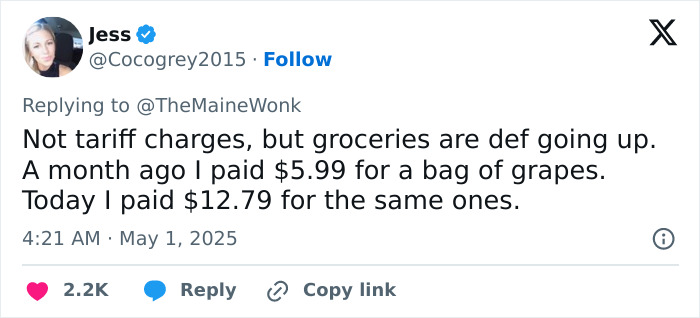

Image credits: Cocogrey2015

#54

Image credits: SiaIwu

#55

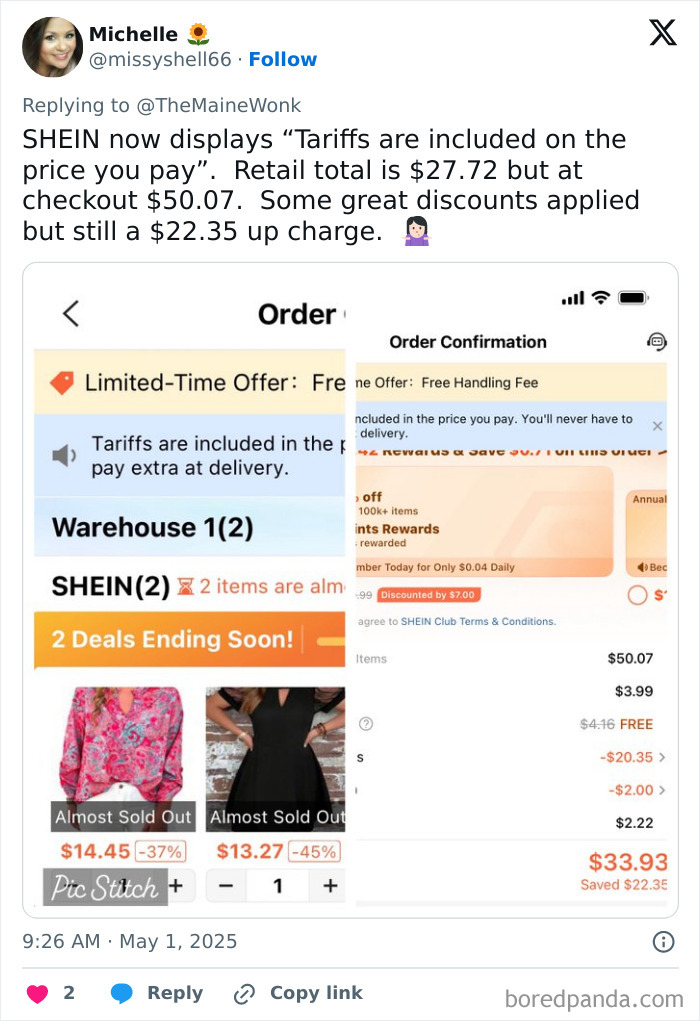

Image credits: missyshell66

#56

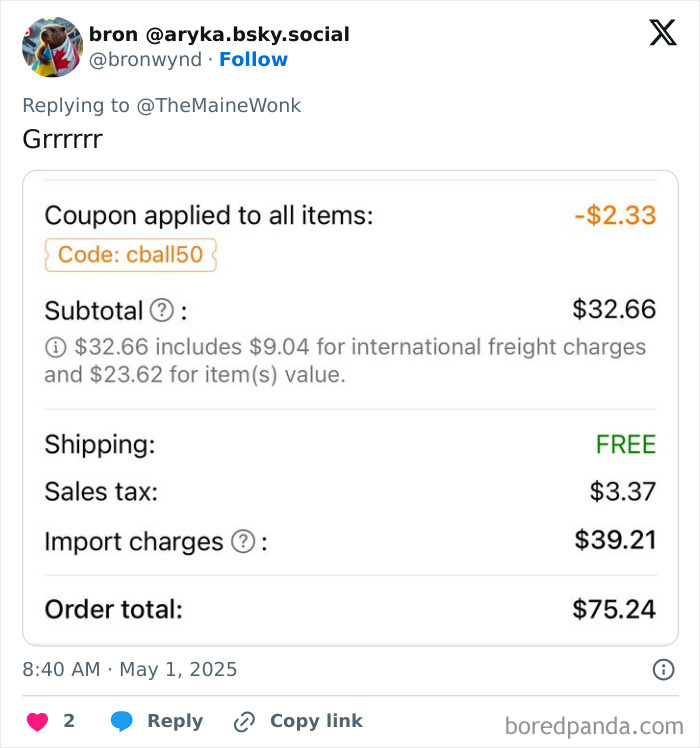

Image credits: bronwynd

#57

Image credits: Bergermiste