The year will be over before you realize it; and, if you’re not careful, critical opportunities to build your wealth will be gone, too.

Learn More: We’re a Family of 5 Living on One Salary: Here’s Our Monthly Budget

See Next: The 10 Most Reliable SUVs of 2025

Fortunately, there are plenty of moves to make it through the remaining summer, fall and winter seasons. Doing this now ensures you’re hitting your financial goals and kicking 2026 off with a bang when it comes to your money.

Keep reading for our full list of 50 money moves to make before the year ends.

Also see money moves you should make in every decade of your life.

Understand How the ‘Big Beautiful Bill’ Will Impact Your Finances

President Donald Trump’s tax and spending megabill, the One Big Beautiful Bill Act, will impact the finances of virtually all Americans. It’s important to understand which benefits associated with this bill may work in your favor.

Mark Gelbman, financial advisor and owner of Strategic Wealth Solutions, outlined a few areas for families and individuals to consider:

- The 2017 tax cuts have received a permanent extension, providing long-term certainty for households regarding their tax liabilities.

- The child tax credit has increased from $2,000 to $2,200.

- “Trump Accounts” have been introduced with a one-time deposit of $1,000 from the federal government for children born from 2024 to 2028. According to Gelbman, families receive a “baby bonus” via the savings vehicle for the next four years — which allows for tax-free growth on contributions up to $5,000 annually until the child turns 18.

- Americans ages 65 and over will be allowed a $6,000 deduction for tax relief purposes. However, Gelbman said qualifying seniors are individuals who earn no more than $75,000 a year or married couples who make $150,000.

Additional considerations include, but are not limited to, increased standard deductions, the ability to deduct tip income and the temporarily raised cap on SALT deductions. Set aside time to meet with a financial advisor to see which aspects of this bill you need to know about before the start of the new year.

Find Out: 8 Frugal Habits Americans Are Ridiculed for — and Why You Shouldn’t Care

View Next: Clever Ways To Save Money That Actually Work in 2025

Clearly Define Your Financial Goals

What will you do with your money in 2026? Now’s the time to set clear financial goals and prioritize them accordingly. Some of these goals may include buying a home or a car, planning a wedding, having a baby, paying off debt, building an emergency fund and more.

Janelle Sallenave, chief spending officer at Chime, recommends making money goals as clear as possible. Doing so not only allows you to break each goal down into manageable steps, but it also gives your money direction and keeps you focused on what matters most for your financial future.

Try This: 9 Downsizing Tips for the Middle Class To Save on Monthly Expenses

Max Out Employer Retirement Contributions

The fall season is a good time to see whether you’re on track to max out contributions in your employer-sponsored retirement account.

In 2025, you can contribute up to $23,500 in a 401(k) — if you’re age 50 or older, you can add an additional $7,500 via catch-up contributions.

Max Out Your IRA

For 2025, the maximum contribution is $7,000 for an IRA. Those ages 50 and older are allowed to make a $1,000 catch-up contribution as well.

Fully Fund Your Health Savings Account (HSA)

“An HSA offers triple tax benefits (deductible contributions, tax-free growth and tax-free withdrawals for qualified medical expenses),” Gelbman explained. “Many people contribute to an HSA to offset current healthcare expenses, but the balance carries over each year, which means that money can also be invested for the future.”

Contribute To a 529 Savings Plan

Another tax-advantaged account worth funding is a 529 plan for education expenses. Qualifying expenses — private school tuition for K-12, college tuition, room and board, books, computers and more — can be paid using these funds at any time.

Plan To Use Your Flexible Spending Account (FSA)

Austin Kilgore, consumer finance expert and analyst with the Achieve Center for Consumer Insights, recommends checking your flexible spending account (FSA) balance. If you have funds in this account, you need to make plans to use them.

How soon should you use the funds? Kilgore said to check your plan documents or check in with your HR department for the year-end date associated with your plan. Once you know your given date, use the FSA money on the products or services you need, or you will lose these benefits.

That’s Interesting: 4 Surprising Things That Could Impact Your Wallet If a Recession Hits

Determine Your Eligibility for Extended Deadlines

What if you reside in a federally declared disaster area? Robby J. Graham, CPA and wealth strategist at Waddell & Associates, said you may be eligible to make 2024 contributions to IRAs and HSAs beyond the standard deadlines.

He recommended “consulting a qualified tax professional to confirm your eligibility and the specific postponement date applicable to your state to take advantage of this opportunity.”

Build an Emergency Fund

Don’t already have an emergency fund as a financial safety net? Start building one now that can cover three to six months’ worth of expenses (at a minimum).

Rebuild Your Emergency Fund

Did you dip into your emergency fund this year to pay for an expected medical bill or another critical expense? Use the remaining part of this year to rebuild this fund.

See Whether Your Employer Offers an Emergency Savings Account

Feeling overwhelmed thinking about how to save three to six months of expenses with five months left in the calendar year? Your workplace may offer an emergency savings account (ESA) to help automate the process.

Devin Miller, CEO and co-founder at SecureSave, recommends finding out whether your employer offers an ESA and signing up to have contributions in this emergency fund come directly from your paycheck.

Create a Realistic Budget

Your financial goals in 2026 might be different than those in 2025 and your budget should be updated to reflect these changes. Gelbman recommends analyzing your 2025 spending and income to create a realistic 2026 budget.

Discover More: 8 Frugal Habits You Should Never Quit, According to Frugal Living Expert Austin Williams

Identify Important Luxuries in Your Budget

If you create an extremely restrictive budget, chances are highly likely you won’t stick to it.

Ahead of next year, Erica Sandberg, consumer finance expert at BadCredit.org, said to review your spending and consider purchases or experiences you value most. This can be — as examples — attending a baseball game with your family, getting manicures at a nail salon or going out to dinner with friends. Build these important luxuries into your budget and get rid of things and/or activities you don’t need.

Plan To Pay Off High-Interest Debt

After creating a budget and a fully funded emergency fund, your next priority will be to pay off any high-interest debt you may have accumulated. Consider using the snowball or avalanche repayment methods.

The snowball method knocks out debt with lower interest rates and builds up to those with higher rates while the avalanche method starts with highest-interest debt and works down to debt with smaller rates.

Put Your Bonus Toward Debt

If you’re receiving a year-end bonus, Gelbman recommends putting it toward the balance of any debt you’re paying off.

Put Your Bonus Into Savings

Don’t have any debt? Put your upcoming year-end bonus into your savings account.

Put Your Bonus Into Your Retirement Savings Account

Still need to top off your IRA or Roth IRA contributions for 2025? Transfer your upcoming year-end bonus into this account.

Check Out: 25 Creative Ways To Save Money

Talk to Your Creditors If You Experienced Hardship This Year

If you experienced hardship this year and are trying to pay off your credit cards, Kilgore recommends checking in with your creditors and explaining your situation.

According to Kilgore, these creditors might be open to changing credit terms, arranging payment plans, deferring payments or waiving interest.

Consider Personal Loans With Lower Interest Rates

Can’t pay off all your debt this year alone? Kilgore recommends seeing whether you qualify for a personal loan at a favorable rate.

Doing so will allow you to pay off debt with higher interest and then just have the one loan leftover with a lower rate.

Look Into Credit Counseling

“Sometimes credit counseling can provide a decrease in a credit card interest rate,” said Kilgore.

Explore a Debt Settlement

This option is ideal for someone who has lost their job or is dealing with major medical expenses and is struggling to make even the minimum payments on what they owe. Debt settlement, Kilgore said, negotiates with creditors to lower principal balances due.

Set Up Automatic Savings

This money move is as powerful as it is easy. Sandberg said nearly every bank and credit union has a free system that allows customers to have a fixed amount of money seamlessly divert from a checking account into a savings account on a regular basis.

“I recommend smaller increments made twice a month over one big lump sum once a month,” she said. “For example, you may want to have $50 moved from your checking account on the 1st and then again on the 15th. By the end of the year, you’ll have $1,200 saved.”

Explore Next: 7 Frugal Habits of the ‘Shark Tank’ Stars

Strive To Save 10% From Every Paycheck

You may be financially able to do this as soon as this year or you might need to wait until 2026. In any event, as you set up automated savings, make it a point to save 10% or more from every paycheck.

Plan Holiday Budgets

From buying Halloween costumes to paying for a Thanksgiving feast and taking a year-end vacation, now’s a good time to start assessing your upcoming holiday spending and set aside enough money to cover those expenses.

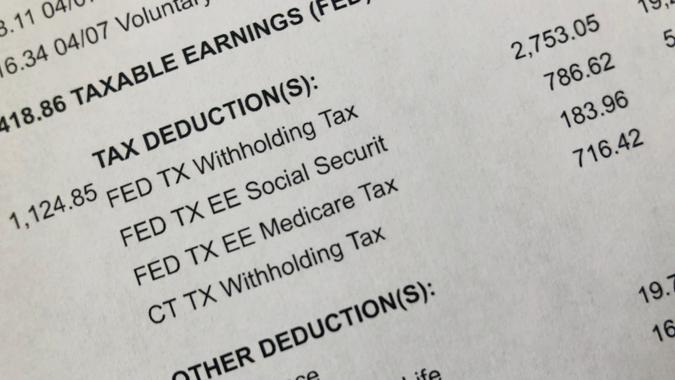

Track Any Tips or Overtime You Earn

This ties back in with the new Big Beautiful Bill legislation. Gelbman said taxes on tips and overtime will be deductible for many Americans.

Ahead of next year’s tax season, Kasey Pittman, CPA and managing director of tax policy at Cherry Bekaert, recommends monitoring upcoming guidance from the IRS and Treasury Department for more information on how new compensation-related provisions will be implemented. This is vitally important for taxpayers who receive a significant portion of their income from tips or overtime. Pittman said it will affect reporting and withholdings.

Review and Adjust Your Tax Withholding

Before 2025 ends, Gelbman recommends reviewing your income and deductions for the year. This ensures your tax withholding from your paycheck or estimated tax payments are sufficient.

“If you anticipate owing a significant amount come tax time,” he said, “adjusting your withholding or making an additional payment before year’s end can help you avoid underpayment penalties.”

Reevaluate Whether You Should Itemize Your Deductions

If you typically take the standard deduction when filing taxes, consider revisiting this strategy.

“The new $40,000 cap on the state and local tax (SALT) deduction — up from the longstanding $10,000 cap — may make itemizing more beneficial for those with significant SALT payments,” Pittman said. “However, high-income individuals may begin to phase out of this benefit under the new overall itemized deductions limitation, so it’s worth running the numbers now.”

For You: If You’re 55+, Here Are 10 Senior Discounts You Are Missing Out On

Seniors: Review Your Social Security Income

Pittman said Social Security income has not been excluded from taxation under the new law, despite misinformation to the contrary. Rather, a temporary $6,000 deduction was created for eligible seniors — with benefits starting to phase out for individuals earning more than $75,000 (or $150,000 for joint filers).

“Social Security income remains partially taxable depending on other income levels. Seniors should confirm how these thresholds affect their 2025 return,” Pittman said.

Take Any Required Minimum Distributions (RMDs) From Qualified Retirement Accounts

To do this properly, Richard Craft, CEO of Wealth Advisory Group, said you need to calculate the required minimum distribution (RMD) amount from all qualified sources.

The distribution can be taken from any combination of your retirement accounts. However, Craft said it does need to come out of each account specifically. Otherwise, the IRS imposes a 25% excise tax on the amount you were supposed to take out but did not.

Explore New Long-Term Savings Options for Children

Earlier, we mentioned “Trump Accounts” as a new savings vehicle for children. If you’re expecting a child in 2025, Pittman said it’s worth discussing long-term savings strategies now to take advantage of this provision once it goes into effect.

Plan Charitable Giving

Before Dec. 31, Gelbman said to make charitable donations to claim the tax deductions for 2025. He recommends donating appreciated securities to avoid capital gains taxes while supporting the causes you care about.

Make a Qualified Charitable Distribution

A qualified charitable distribution is specific to those ages 70 ½ and older. Gelbman said a QCD from an IRA can satisfy your required minimum distributions (RMDs) while also reducing taxable income.

Be Aware: Warren Buffett Reveals 10 Things Poor People Waste Money On

Make a Significant Contribution To a Donor-Advised Fund

Ideally, this money move should be made by those who regularly find themselves in a high tax bracket or have experienced a liquidity event, like a business sale. Graham said it could provide a current-year tax deduction and flexibility for future charitable giving.

Make Gifts of $19,000 Per Recipient Under the Annual Gift Tax Exclusion

Craft said gifting money today, without any transfer tax, allows the money to grow outside of your estate for the benefit of the person who receives the gift. Consider making this financial gift to your child, if you’re able.

“This allows the money to grow for the child’s benefit, which is generally at a lower income tax rate,” Craft said. “Better yet, give your child money to contribute to an IRA or Roth IRA — which can grow tax deferred or tax free over their lifetime.”

Don’t Miss Federal Incentives for Clean Energy Vehicles

Do you plan to buy a new or used clean energy vehicle? Don’t push this purchase out to next year. Make it before the end of September.

“Under the new tax bill, clean vehicle tax credits are only available for purchases made through Sept. 30, 2025,” Pittman said.

Explore Home Solar Tax Credits ASAP

Another clean energy initiative, which is homeowner specific, are tax credits for residential energy efficiency improvements and home clean energy systems. According to Pittman, these expire after Dec. 31.

Small Business Owners: Consider Changing Your Business Structure

If you run a small business incorporated as a pass-through entity, like an S Corporation, Pittman recommends assessing the impact of expanded business provisions. A few considerations include changes to depreciation methods, interest expense deductibility and research-related activities.

“The law also raises income thresholds for the Qualified Business Income (QBI) deduction. Some small business owners may find it beneficial to evaluate whether operating as a Qualified Small Business C Corporation makes sense under the new rules,” said Pittman.

Read Next: 5 ‘Necessities’ Frugal People Don’t Buy, According to Frugal Living Expert Austin Williams

Consider Making an After-Tax Contribution To an IRA

This is known as a backdoor Roth contribution. It can grow tax-free for decades and with no RMDs due. However, Craft recommends carefully understanding this strategy and how it must be done before moving forward with it.

Rebalance Your Portfolio

Graham said the recent market rally may mean now is a good time to rebalance your portfolio.

“In some cases, aligning your asset allocation with your current risk tolerance can also assist in reducing downside volatility and maintaining long-term investment discipline,” he said.

Explore Tax-Loss Harvesting

To properly do this, Gelbman said you’ll need to review your investment portfolio for underperforming assets and sell those investments at a loss. Doing so can help offset capital gains taxes and up to $3,000 of ordinary income.

Gelbman said, “Make sure you comply with IRS wash-sale rules, which state that you cannot sell a security at a loss for tax benefits, but then turn around and buy the same or a similar security within 30 days.”

Consult a Tax Advisor

Do you need help optimizing the tax-loss harvesting strategy or have questions about how the Big Beautiful Bill may impact your taxes next year? Reach out to a tax advisor for the answers to get ahead for 2026.

Check Your Credit Report

Can’t remember the last time you checked your credit report? Make a point to do it before the year ends. Kilgore said you can obtain reports from major credit reporting bureaus like Experian and Equifax at no charge.

Carefully review these reports and see whether there are any inaccuracies. If there are, you can follow the directions on the agency’s website to correct them.

Trending Now: 6 Things the Middle Class Should Sell To Build Their Savings

Check Your Bank Accounts (Daily)

Start getting into the habit of checking your savings and checking accounts every day for the remainder of 2025 and beyond.

Doing so allows you to know exactly how much money you have available and stop any potential fraud in its tracks.

Take Advantage of Financial Tools

Speaking of checking your accounts, now’s a good time to download banking apps to better understand what’s happening with your money and to stay on top of your finances on a regular basis.

Update Financial Account Passwords

Can’t recall the last time you updated the passwords on your financial accounts? Kilgore recommends updating these passwords for additional strength to make them less vulnerable to hackers.

Have the Right Cards

When’s the last time you did an audit in your wallet? Sandberg recommends examining your plastic portfolio before the year wraps and review where you want to pare down or add as needed.

Seek Out Small Ways To Save Money

Get in the habit of becoming a smart spender and look for small ways you can save money on bills. A few recommendations include washing clothes in cold water, making meals based on what’s in your pantry or freezer and walking instead of driving if your destination is a short distance away.

View More: 5 Frugal Habits Suze Orman Still Follows Even Though She Can Afford Almost Anything

Pay Your Bills on Time

Admittedly, a lot of what you’re reading can sound overwhelming if you haven’t checked it all off your list yet. So, let’s toss in an easy money move to make: Paying your bills on time.

If you’re already doing this, great job. If not, set up a system like getting an alert from an online calendar or writing it down on a whiteboard at home. That allows you to see all your due dates and know exactly when to make payments.

Talk About Money

The end of the year brings with it more occasions for spending money — and embarrassment or anxiety if you’re not comfortable telling family or friends you can’t afford it.

Sallenave recommends leaning into the habit of talking about finances with your partner, family members and friends.

Meet With a Financial Advisor

If you made it to the end of this list, you might have questions and thoughts regarding your financial bigger picture. Make time to meet with a financial advisor, ask questions and get answers to better plan for the year ahead.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 50 Money Moves To Make Before the End of 2025