Ameriprise Financial’s Parents & Finances study found that 72% of parents teach their children money skills. Most also help them start saving and avoid unwise spending.

Read More: Here’s Why Couples Fight About Money and How They Can Stop, According to Rachel Cruze

Find Out: 7 Tax Loopholes the Rich Use To Pay Less and Build More Wealth

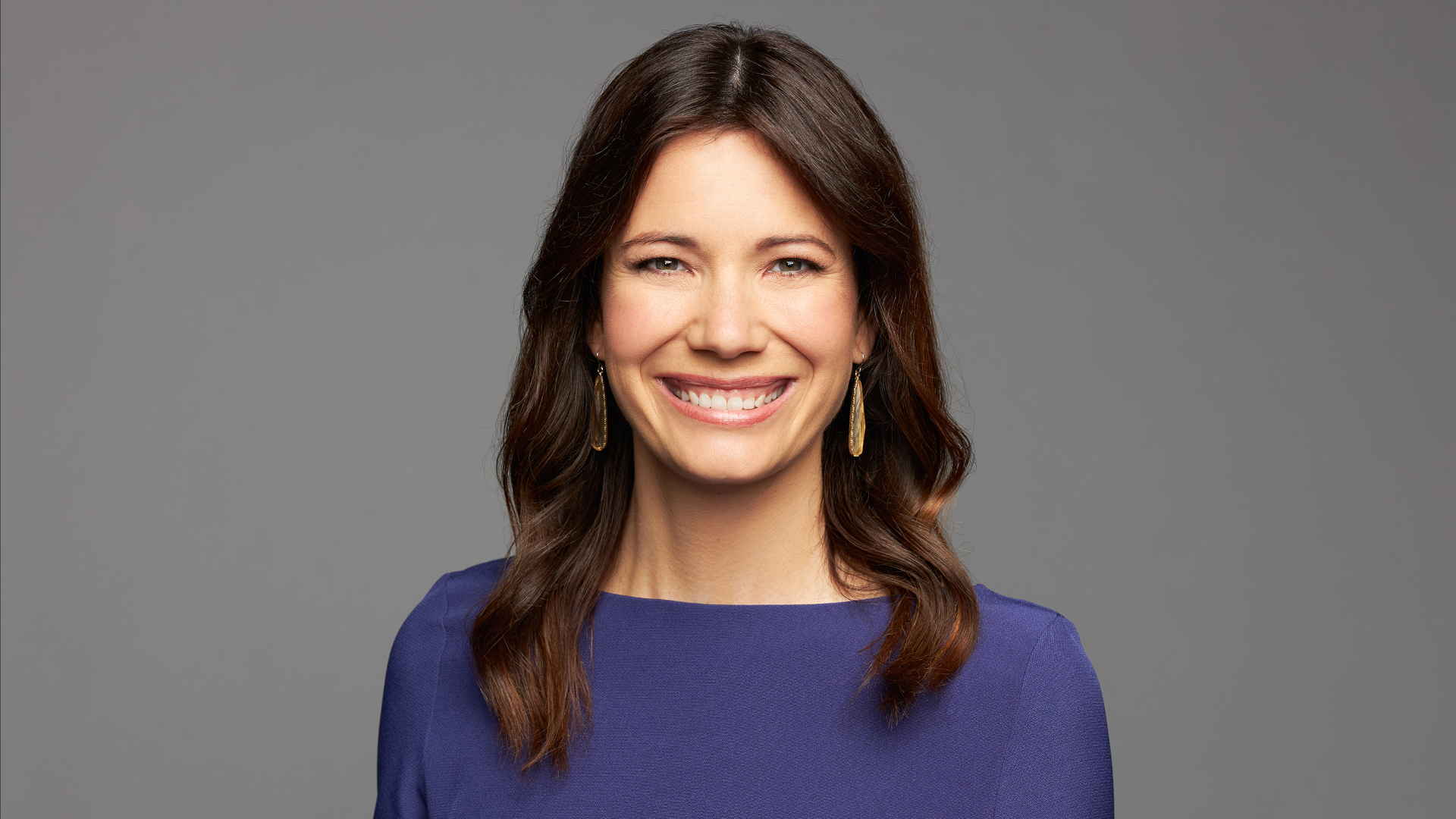

When you raise your kid to be financially savvy from a young age, they’re more likely to manage money better as adults. In a recent video, money expert Rachel Cruze discussed five easy ways you can teach your kids important financial lessons. These are relevant regardless of your family’s income level.

Teach Gratitude

Cruze explained that being grateful is a crucial skill that even many adults struggle with. She described it as being thankful for what you and your family have, even if others have much more. But it doesn’t mean you can’t still encourage your kids to work toward something more.

One simple step is teaching your kids to say “thanks” when they receive a gift or help. You can also discuss being grateful for having your family’s basic needs met, such as housing and food. Cruze said that parents modeling gratitude was also important for teaching this skill.

Learn More: J.P. Morgan: 3 Reasons the US Dollar Is Losing Value — and Why It Might Be Good for Your Wallet

Teach How To Hear ‘No’

Entitlement is common among kids who get used to always getting what they ask for and not hearing their parents say “no.” Cruze said that even small, frequent purchases can contribute to the issue, which may cause kids to later treat their money as if it were unlimited and take on debt as adults.

She said, “When you have the ability to say ‘no’ and to stand your ground, get the repercussions of maybe like the tantrum or whatever the thing is, it is so key because our kids have to learn boundaries.”

Besides not always buying your kids something they ask for, you can demonstrate financial restraint yourself. That might look like saying “no” to something you want to purchase and discussing why, such that it doesn’t fit into the family’s budget or gets in the way of saving for a goal.

Let Your Kids Participate

Having your kids regularly contribute to the household teaches both responsibility and the importance of hard work. The experience will help them when they become adults and need to make wise financial decisions, start formal jobs and handle basic household tasks.

Cruze discussed some age-appropriate chores to consider, such as having your young child tidy up their room or your older child take the dishes out of the dishwasher. Other ideas include helping feed or walk pets, putting away groceries and vacuuming.

You can pay your kids a reasonable amount for doing these tasks. In a blog post, Cruze discussed a weekly rate of $1 or $2 per year of age, so a 10-year-old might get $10 to $20 per week. To teach another essential skill along the way, encourage your kids to save some of these earnings.

Encourage Patience

Cruze discussed how the ability to get things almost instantly causes people to become less patient. Your child might learn this behavior from you and rush to buy toys with their allowance or become upset if you don’t buy them something right away. When kids don’t learn to be patient and think through their money decisions, they may face financial instability as adults.

Cruze suggested, “Have the patience and have them have a goal of something that they’re saving up for, something that’s kind of out of reach for them, but it’s good for them not to get in the moment, but to do that.”

It also helps if you show your kids how you make spending decisions and plan times when the family doesn’t make nonessential purchases at all.

Teach Handling Disappointment

You might feel tempted to do everything possible to help your kids avoid struggling. But Cruze said that dealing with disappointment and challenges is a life skill that kids must learn for resilience.

It’s also important since there are many emotional aspects to money. If you tend to throw money at the family’s problems, there’s the risk that your kids will spend money as a way to feel better as adults. Cruze suggested instead talking with your kids when they’re upset and showing them that disappointment is a reality sometimes.

More From GOBankingRates

- 6 Costco Products That Have the Most Customer Complaints

- This is the Most Frugal Generation (Hint: It's Not Boomers)

- 6 Popular SUVs That Aren't Worth the Cost -- and 6 Affordable Alternatives

- 8 Common Mistakes Retirees Make With Their Social Security Checks

This article originally appeared on GOBankingRates.com: 5 Ways To Raise Financially Wise Kids, According to Rachel Cruze