We all have retirement goals, whether it’s traveling, pursuing hobbies or spending more time with loved ones. These goals may differ from generation to generation.

According to the 25th Annual Transamerica Retirement Survey of Workers, millennials share many of the same retirement dreams as other generations, but with some distinct differences in how they envision their golden years.

Trending Now: 6 Key Signs You’ll Run Out of Retirement Funds Too Early

Read More: 4 Housing Markets That Have Plummeted in Value Over the Past 5 Years

Here’s how most millennials are planning to spend their retirement and whether they’re prepared financially to make this happen.

Traveling

Travel is a top retirement dream for many millennials, with 68% planning to go on vacations. While you can travel on a budget, frequent or long-distance trips can easily cost thousands each year. With the rising cost of travel, millennials will need a substantial amount set aside to fund these adventures without dipping into their retirement savings.

Try This: 10 Vacations That Need To Be on Every Middle-Class Retiree’s Bucket List

Spending More Time with Family and Friends

Fifty-eight percent of millennials plan to spend more time with their loved ones in retirement. Although this goal may not sound like an expense on its own, it can come with significant costs, especially if you plan to relocate closer to your family, dine out, buy gifts, or host gatherings.

Pursuing Hobbies

More than half of millennials (53%) see retirement as a chance to pursue hobbies they have always wanted to. While some hobbies are low-cost, others can be costly. Without carefully budgeting, these expenses could drain your savings faster.

Starting a Business

One in four millennials plans to start a business in retirement. A business could provide extra income but comes with risks. Funding a business requires startup capital and time commitment, and any losses could mean tapping into your savings. Millennials pursuing this path will need a strong financial cushion and a realistic plan for profitability.

Doing Volunteer Work

A quarter of millennials plan to give back through volunteer work. Even though this goal doesn’t require direct income, you’ll still need to have enough savings to cover transportation and supplies.

Are Millennials Prepared Financially?

While 85% of millennials are saving for retirement, they’ve accumulated a median of just $65,000 in household retirement accounts. This is relatively lower than Gen X’s $107,000 and baby boomers’ $270,000.

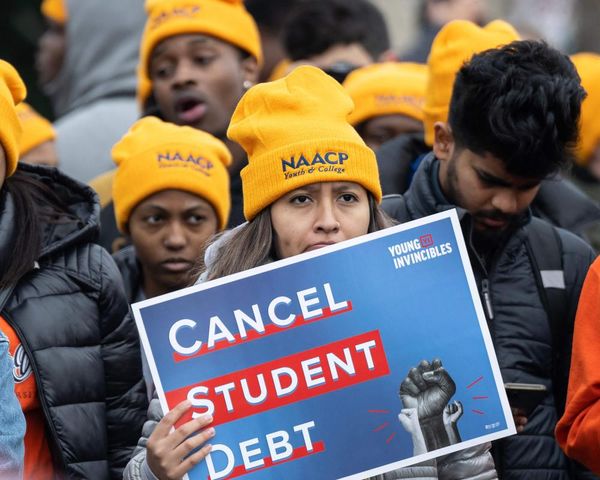

The survey also reveals that 59% of millennials say debt interferes with their ability to save for retirement, and 49% report trouble making ends meet. This generation entered the workforce during the Great Recession, accumulated record student loan debt and then faced another economic crisis during the pandemic.

Most millennials aren’t prepared financially, probably because they have faced a unique set of challenges. However, they still have time to turn their retirement dreams into a reality. They need to prioritize tackling debt and saving for retirement as much as they can.

More From GOBankingRates

- 7 McDonald's Toys Worth Way More Today

- 5 Old Navy Items Retirees Need To Buy Ahead of Fall

- 4 Things You Should Do When Your Salary Hits $100K

- 8 Common Mistakes Retirees Make With Their Social Security Checks

This article originally appeared on GOBankingRates.com: 5 Ways Millennials Are Planning To Spend Their Retirement: Are They Prepared Financially?