The biotech sector has long offered investors high-risk, high-reward stocks. While large players are making headlines, the next wave of breakthroughs may come from companies flying well below Wall Street’s radar. These five under-the-radar biotech stocks could see spectacular growth in 2026.

Biotech Stock #1: Inovio Pharma (INO)

Valued at $123.8 billion, Inovio Pharma (INO) is a clinical-stage biotech company that uses its own CELLECTRA delivery technology to create DNA-based medicines that help the body make its own proteins to combat diseases like HPV, cancer, and infectious diseases.

The company remains on track to submit its Biologics License Application (BLA) for INO-3107, its lead candidate for recurrent respiratory papillomatosis (RRP), in the second half of 2025. The company anticipates FDA approval and commercial launch by 2026.

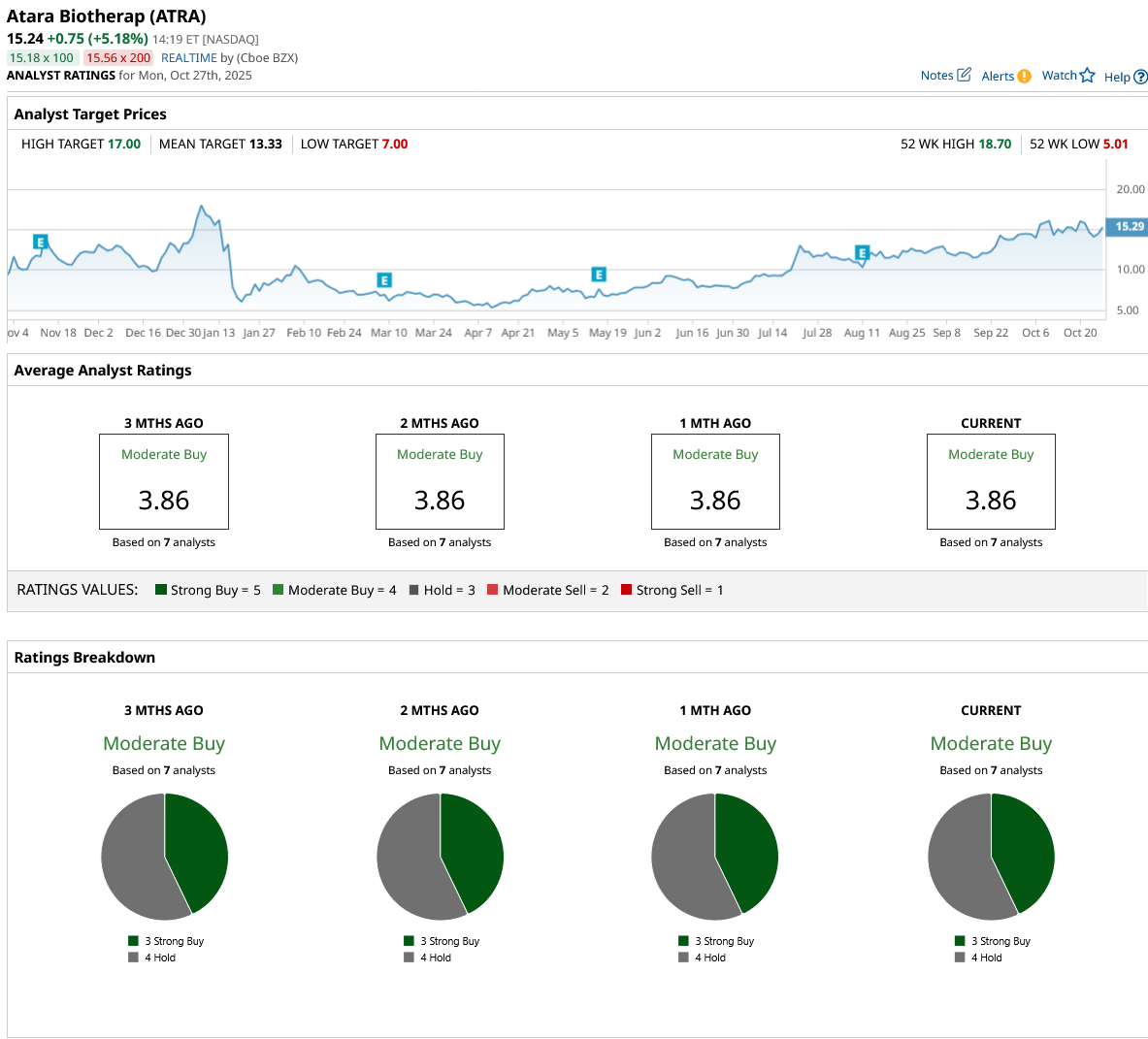

Overall, the consensus for INO stock is a “Moderate Buy.” Out of the seven analysts in coverage, four rate it a “Strong Buy,” and three recommend a “Hold.” Based on the mean target price of $7.47, the stock has a potential upside of 200% from current levels. Plus, its high price estimate of $13 indicates the stock could gain as much as 425% in the next 12 months.

Biotech Stock #2: Terns Pharmaceuticals (TERN)

Valued at $679.9 billion, Terns Pharmaceuticals (TERN) is a clinical-stage biopharma company advancing small-molecule therapies for serious diseases, with a focus on oncology and obesity. Its lead candidate, TERN-701, is currently in a Phase 1 clinical trial to test for a next-generation treatment for chronic myeloid leukemia (CML) and has shown encouraging early results.

The company has also decided to discontinue development of TERN-601, its candidate for oral GLP-1 receptor agonist for obesity, due to its low efficacy and emerging safety findings from the Phase 2 FALCON trial. It has also decided to cease investing in other metabolic studies in favor of TERN-701, which is expected to produce new clinical results later this year.

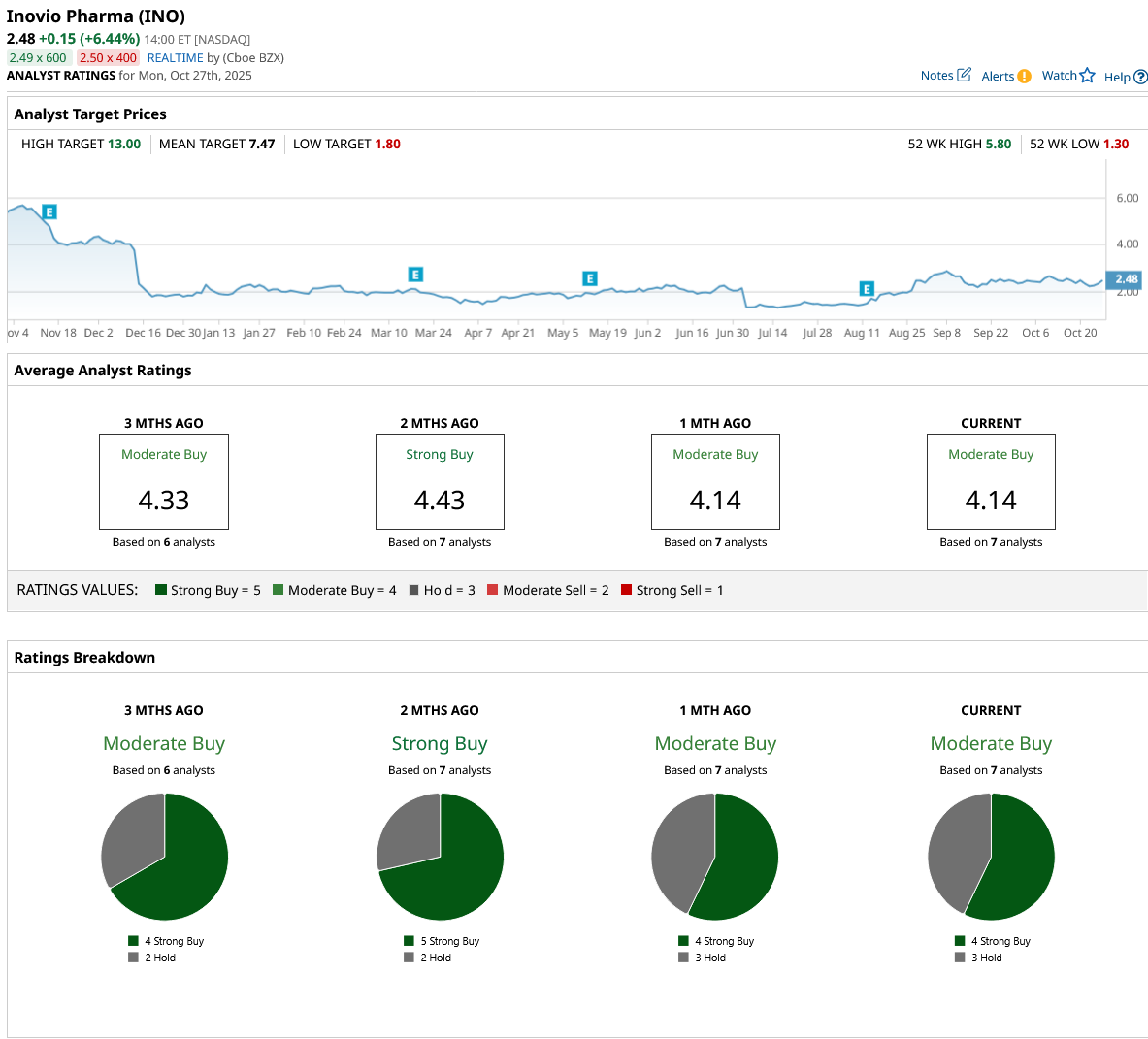

Overall, the consensus for TERN stock is a “Strong Buy.” Out of the 12 analysts in coverage, nine rate it a “Strong Buy,” while three recommend a “Hold.” Based on the mean target price of $15.83, the stock has a potential upside of 101% from current levels. Plus, its high price estimate of $28 indicates the stock could gain as much as 257% in the next 12 months.

Biotech Stock #3: Cardiol Therapeutics (CRDL)

Valued at $145.02 million, Cardiol Therapeutics (CRDL) is a clinical-stage biotechnology company developing anti-inflammatory and anti-fibrotic therapies for heart diseases. Its lead drug candidate, CardiolRx (a pharmaceutically manufactured cannabidiol oral solution) for acute myocarditis, showed encouraging topline results from its Phase 2 ARCHER trial.

It showed good clinical evidence as a potential treatment for inflammatory heart disorders like myocarditis, cardiomyopathies, and heart failure. Management stated that the drug was well-tolerated, highlighting its potential to treat critical cardiac disorders that currently lack FDA-approved treatments.

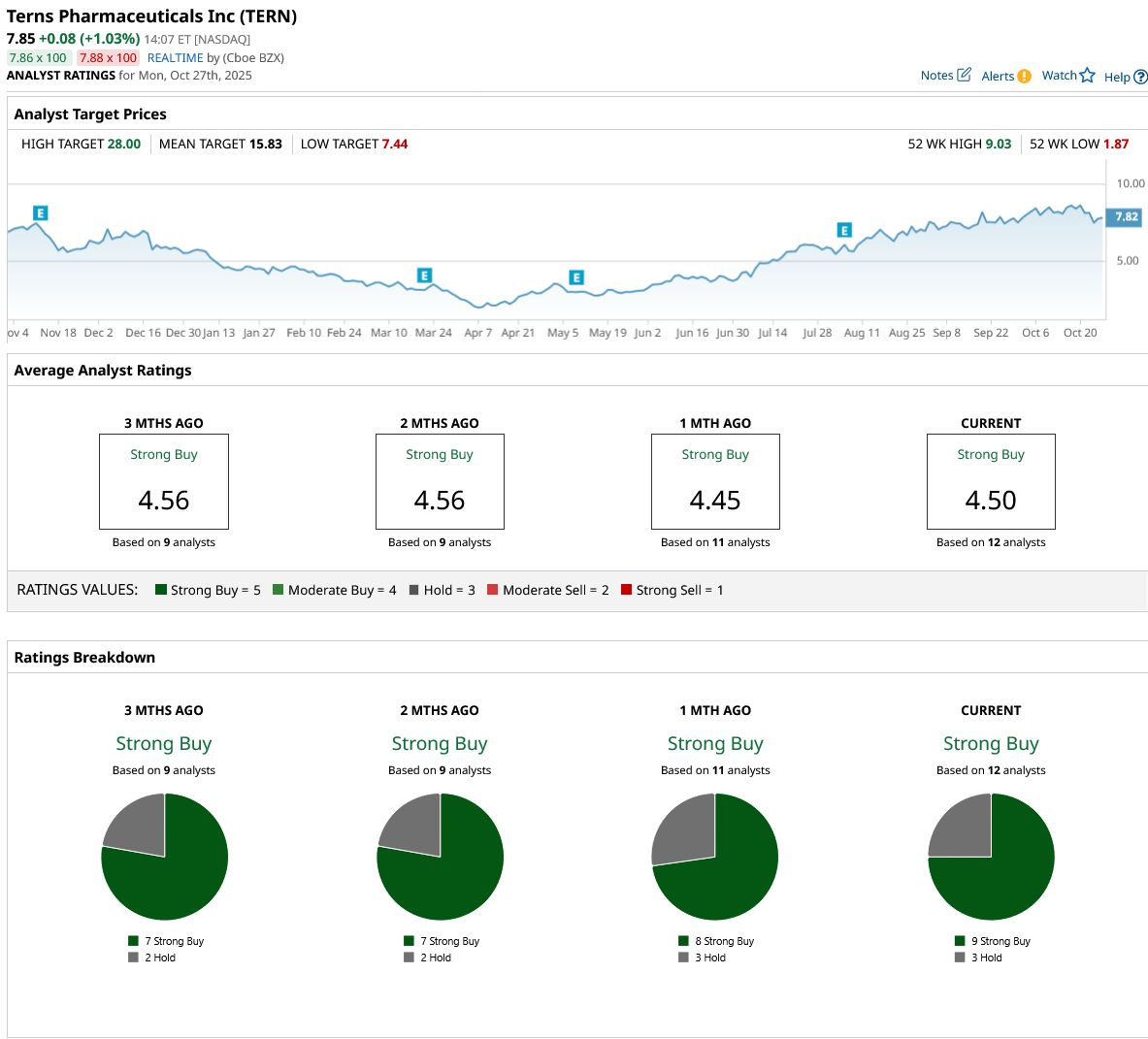

Overall, the consensus for CRDL stock is a “Moderate Buy.” Out of the five analysts in coverage, three rate it a “Strong Buy,” one recommends a “Moderate Buy,” and one says it is a “Hold.” Based on the mean target price of $8.50, the stock has a potential upside of 602% from current levels. Plus, its high price estimate of $11 indicates the stock could gain as much as 809% in the next 12 months.

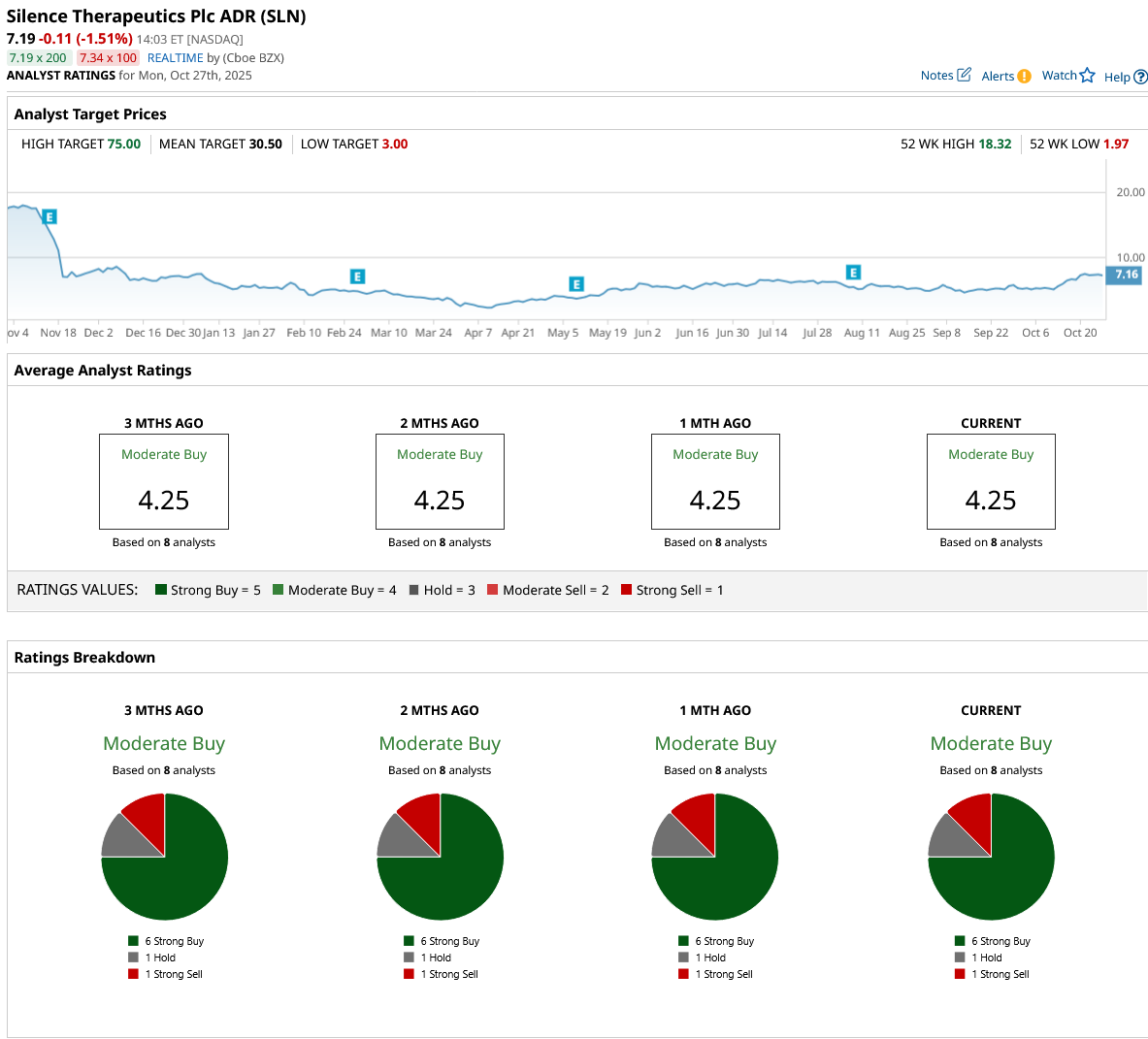

Biotech Stock #4: Silence Therapeutics (SLN)

Valued at $344.8 million, Silence Therapeutics (SLN) is a biotech company that develops siRNA (short interfering RNA) medicines to “silence” disease-causing genes, primarily targeting the liver to treat problems in hematology, cardiovascular, and rare diseases.

The Phase 1 trial for its candidate, divesiran, a potential first-in-class siRNA treatment for polycythemia vera (PV), produced encouraging results. This month, Silence finished enrolling for the Phase 2 trial. The company also progressed its cardiovascular candidate, zerlasiran, to Phase 3 and continued preclinical work on extrahepatic siRNA targeting.

Overall, the consensus for Silence stock is a “Moderate Buy.” Out of the eight analysts in coverage, six rate it a “Strong Buy,” one recommends it as a “Hold,” and one says it is a “Strong Sell.” Based on the mean target price of $30.50, the stock has a potential upside of 324% from current levels. Plus, its high price estimate of $75 indicates the stock could gain as much as 943% in the next 12 months.

Biotech Stock #5: Atara Biotherapeutics (ATRA)

Valued at $196.7 million, Atara Biotherapeutics (ATRA) is a biotech company that develops off-the-shelf T-cell immunotherapies to treat cancer and autoimmune conditions. Its medications use Epstein-Barr virus (EBV)-specific T cells that can be maintained and administered to patients without genetic modification or donor matching, with the goal of harnessing the immune system to more effectively target critical diseases.

Recently, the company announced that the FDA has accepted its BLA for Tabelecleucel (tab-cel), a potential first-in-class treatment for EBV-positive post-transplant lymphoproliferative disorder (PTLD), with a decision expected on Jan. 10, 2026. Atara has a commercialization agreement with Pierre Fabre Laboratories and will earn a $40 million milestone payment if and when the drug is approved.

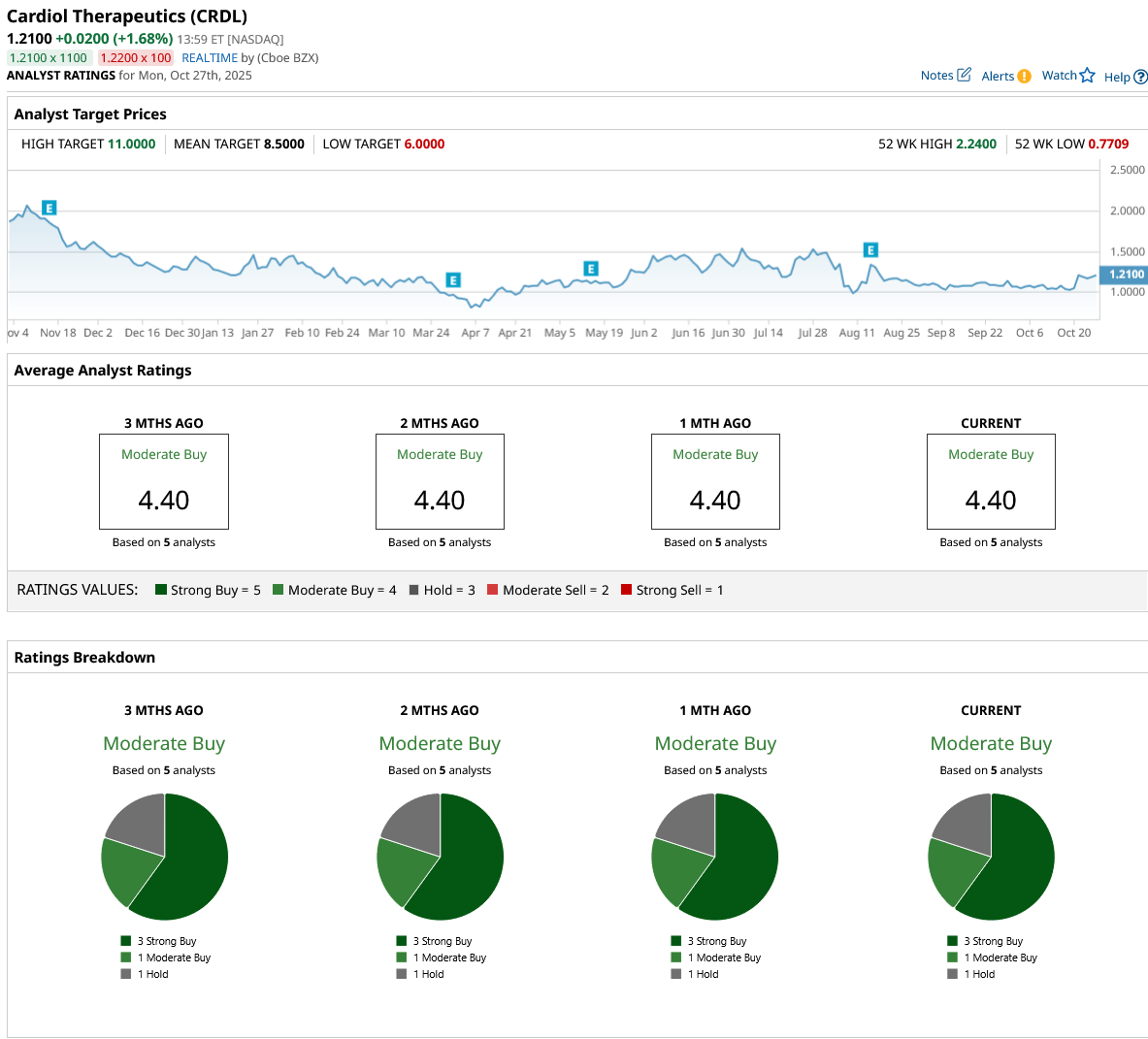

Overall, the consensus for ATRA stock is a “Moderate Buy.” Out of the seven analysts in coverage, three rate it a “Strong Buy,” and four recommend it as a “Hold.” The stock has already surpassed its mean target price of $13.33. However, its high price estimate of $30 indicates the stock could still gain as much as 96% in the next 12 months.