In 1980, Lee Iacocca of Chrysler lobbied the U.S. government for a $1.2-billion grant to bail out the automaker. Shortly after, in an effort to show his willingness to save the company, he famously cut his salary to $1.

The top qualities of a leader like Lee Iacocca include a strong vision, receptiveness to change, the ability to self-motivate and be contagious, adaptability to new and changing markets and, most importantly, trust.

Some companies teetering toward failure have been met with extraordinary CEOs who make unpopular decisions that increase share prices, while taking debt off their balance sheets.

Here is a look at five CEOs who changed company culture and become pillars in the industry.

See Also: 5 Highest Compensated Women CEOs: Mary Barra, Lisa Su And More

Peter Cuneo - Marvel Entertainment

Before joining Marvel in a three-year turnaround, Cuneo previously saved six companies from going bankrupt.

In a 2010 Forbes interview, Cuneo was asked what his most significant strategic decision that helped launch Marvel's turnaround was. His response was that Marvel leaned into the existing library of well-known characters, revitalizing successful intellectual property with little capital, while avoiding the greater risk associated with creating new content. Disney (NYSE:DIS) acquired Marvel in 2009, for $54 per share.

Howard Schultz - Starbucks (NASDAQ:SBUX)

Schultz was the CEO of Starbucks twice; he stepped down in 2000 to assume the role as chairman, focusing on global strategy, and rejoined in 2008 after the company’s stock had fallen 42%.

After reinstalling his leadership team, he closed underperforming stores and strategically removed breakfast sandwiches to make the stores smell of coffee. Within one year, the stock recovered, gaining 143% from its lows.

Mary Barra - General Motors (NYSE:GM)

Barra took the helm at GM just five years after the company filed Chapter 11 bankruptcy. The recovery started externally when Barra invested $500 million in Lyft, the ride-share startup. Two years after the investment, the value of the stake doubled, setting the stage for GM's long-term transition.

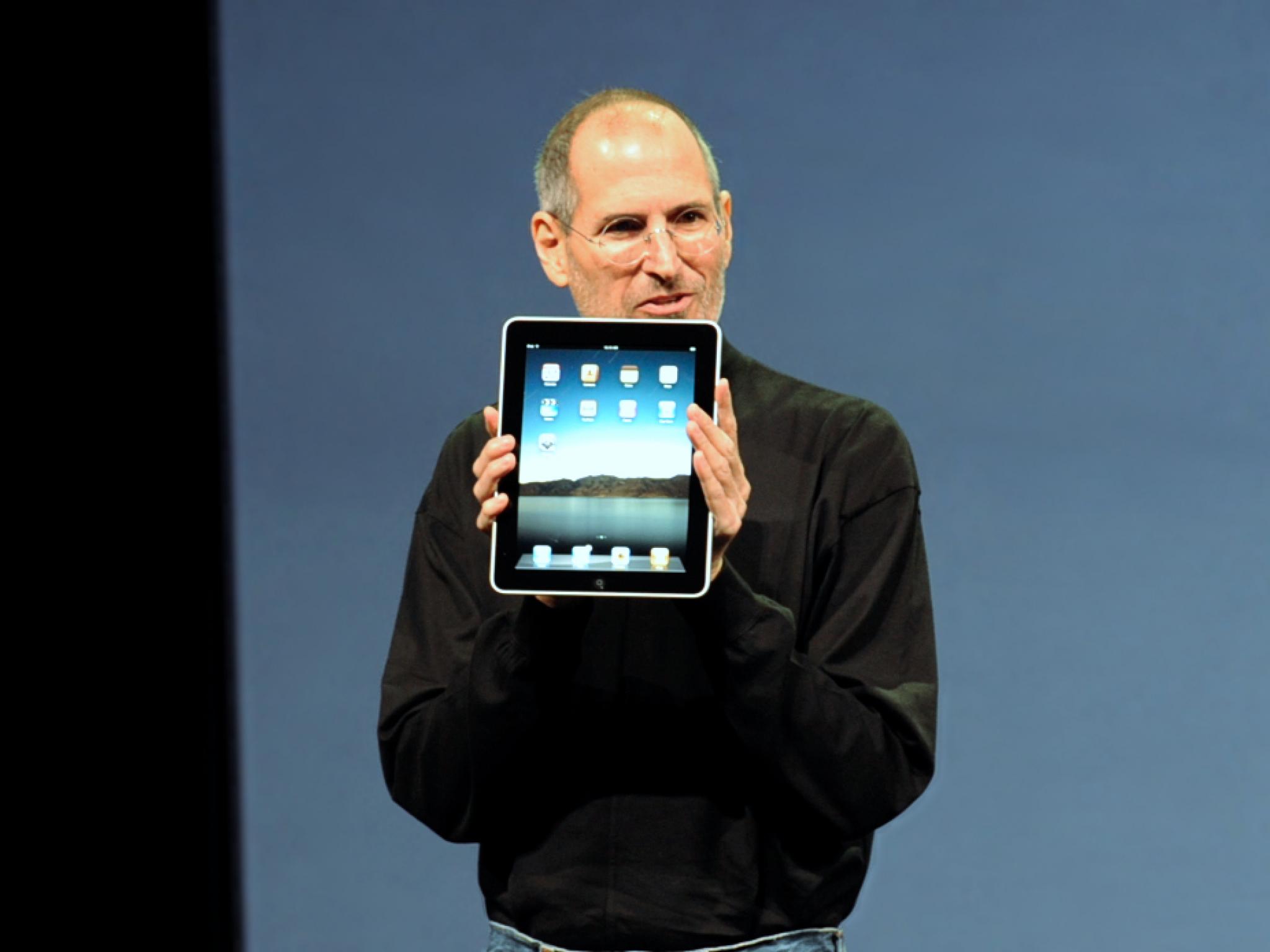

Steve Jobs - Apple (NASDAQ:AAPL)

Jobs originally left Apple in 1985, to start his rival company NeXT Inc. Gilbert Amelio, who was CEO at the time, fell under scrutiny from Apple's board of directors who hadn’t yet seen results of monetary promises.

In 1997, Jobs returned to Apple as CEO where he formed an alliance with Microsoft and secured a $150-million investment from the rival company. In 2001, Apple introduced iTunes, which brought the birth of the iPod, a flagship product.

Doug Conat - Campbell's Soup (NYSE:CPB)

Conat's mission to change the company’s culture began internally in 2001, he called the company’s culture "toxic." Low employee engagement, coupled with falling stock prices, led Conat to wear a pedometer and walk 10,000 steps at the headquarters per day engaging with disgruntled employees and executives.

Conat developed a leadership model that consistently delivered shareholder value, and increased employee engagement, earning him the Gallup organization’s “Great Workplace Award.”

Photo by Matt Buchanan via Wikimedia.