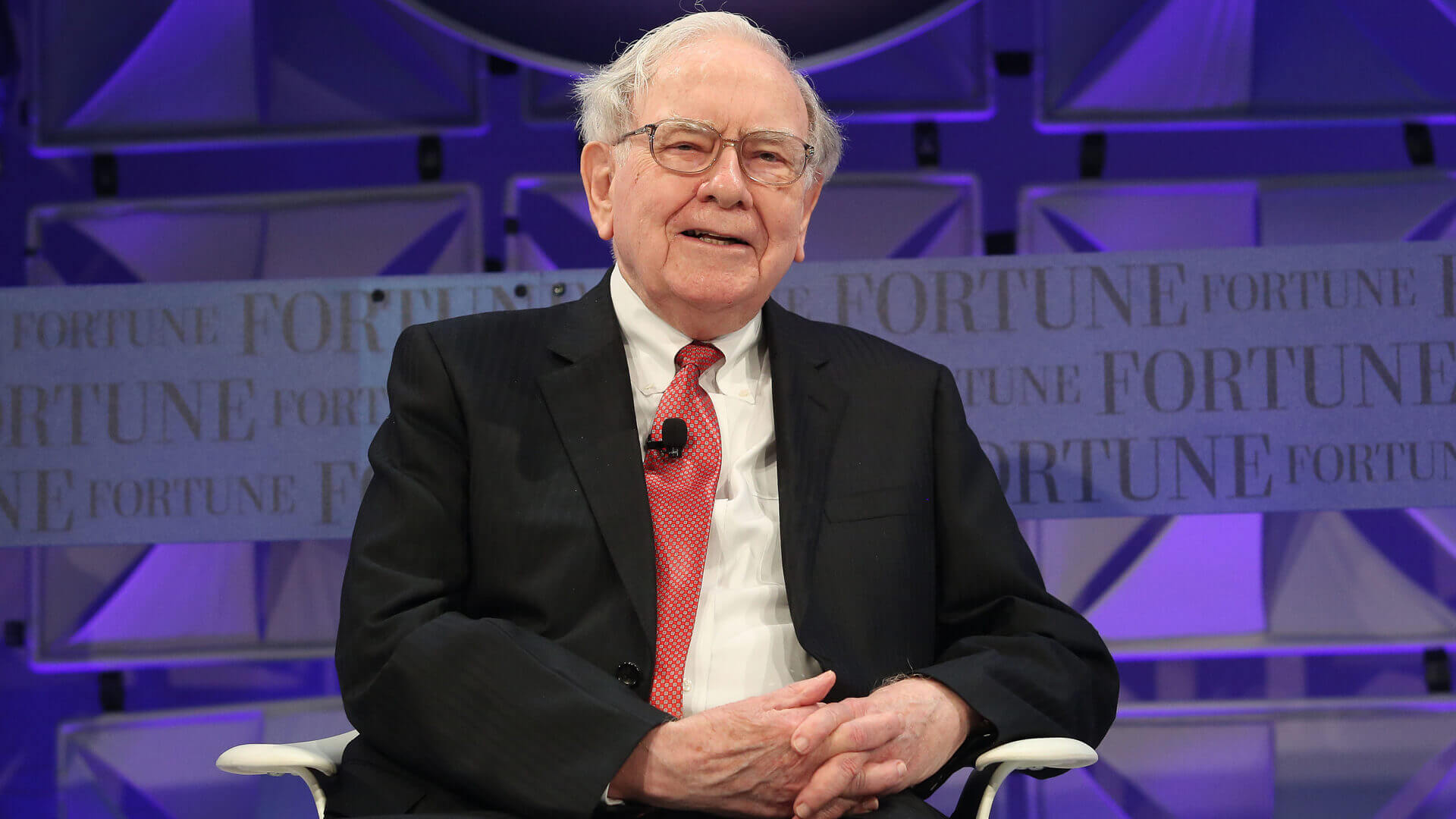

Warren Buffett is the most prolific investor of the last 50 years. His holding company — Berkshire Hathaway — has outperformed the S&P 500 since the 90s and Buffett always has a keen eye for buying good companies at reasonable prices.

Trending Now: Warren Buffett’s Top 4 Tips for Getting Richer

Check Out: How Much Money Is Needed To Be Considered Middle Class in Your State?

While Buffett has been a net seller of stocks over the last few years, he has spent a few billion picking up stocks that he finds attractive for his portfolio. Below are five stocks that Buffett recently invested in.

Also here are seven stocks Buffett has sold so far this year.

Constellation Brands Inc. (STZ)

Buffett’s Berkshire Hathaway added to their position in Constellation Brands (STZ) in Q1 2025, with a total investment worth over $1 billion at this point. The alcohol importer that owns famous brands like Corona, Modelo and Robert Mondavi Winery. While STZ stock has performed poorly due to news of import tariffs, it still holds a majority of the Mexican import market in the U.S., according to Yahoo Finance.

Constellation Brands is starting to include more non-alcoholic options to meet the growing demand, which could boost profit. This is a typical Buffett value stock pick and could be poised for growth in 2025 and beyond.

Pool Corp. (POOL)

Pool Corporation is the world’s leading distributor of pool supplies and other outdoor products. Pool demand spiked in 2020 during lockdowns and now these newly installed pools need parts and maintenance items, making POOL an in-demand company.

Buffett’s holding company added to their position, buying more POOL stock in Q1 of 2025, with holdings totaling near $450 million. Another stock that has dropped heavily as new pool installation demand waned post-pandemic, but Buffett now sees the company as a value hold.

Domino’s Pizza Inc. (DPZ)

Dominos Pizza (DPZ) is the largest pizza chain in the world and Buffett has picked up his own slice of DPZ starting in 2024 and as recently as Q1 2025. While DPZ stock has dropped over 14% since mid-2024 due to labor costs and missing revenue forecasts (per Yahoo Finance), the company continues to churn out pizza all over the world.

Domino’s earnings reports have missed expectations recently, but the stock price continues to hold steady. Buffett most likely sees this as a value investment opportunity and continues to scoop up shares when the price is right.

Sirius XM (SIRI)

Sirius XM is a satellite radio provider that Buffett owns nearly 35% of — probably because he’s a fan of dividend stocks. SIRI currently pays over a 5% dividend to shareholders and Buffett added to his position in Q1 2025 for a total of about $2.7 billion in SIRI holdings.

Sirius XM has suffered a massive price drop in recent years, with stock prices nearly cut by 60% since 2022. Its profit has dropped in recent years, but Buffett probably enjoys the dividend along with a low price-to-earnings ratio (P/E), making it an attractive buy.

Heico Corp (HEI)

Heico Corp is an aircraft and defensive system parts company that Buffett started investing in in late 2024 and added to his position in early 2025. With global conflict and tensions rising, Heico has grown in profit and continues to exceed analyst expectations.

The stock is up 32% in 2025 alone, per Yahoo Finance, meaning Buffett has already seen a handsome profit. HEI is poised to continue growing and Buffett seems to be on board for the ride.

Other Investment Considerations

Buffett also added to his positions in a few other companies in his most recent 13F filing.

- Occidental Petroleum (OXY): Buffett is a fan of OXY — an oil and gas company — and Berkshire Hathaway owns nearly 30% of the company. He even stated in a recent shareholder letter they might own the stock forever.

- Verisign (VERI): While Buffett recently reduced their position in Verisign to get below 10% ownership for regulatory reasons, they still own over 9% of the company and added to their position in Q1 2025. Verisign has seen steady growth and a lower price-to-earnings ratio than many other stocks on this list, per Morning Star.

More From GOBankingRates

- New Law Could Make Electricity Bills Skyrocket in These 4 States

- I'm a Self-Made Millionaire: 6 Ways I Use ChatGPT To Make a Lot of Money

- 5 Strategies High-Net-Worth Families Use To Build Generational Wealth

- How Far $750K Plus Social Security Goes in Retirement in Every US Region

This article originally appeared on GOBankingRates.com: 5 Stocks Warren Buffett Has Bought So Far in 2025