Retail investors buzzed about five stocks this week, from Sept. 29 to Oct. 3, on platforms like X and Reddit's r/WallStreetBets, amid government shutdown and AI enthusiasm.

The stocks, Tesla Inc. (NASDAQ:TSLA), Intel Corp. (NASDAQ:INTC), Advanced Micro Devices Inc. (NASDAQ:AMD), GameStop Corp. (NYSE:GME), and Opendoor Technologies Inc. (NASDAQ:OPEN), spanning auto, tech, gaming, and realty sectors, reflected diverse retail interests.

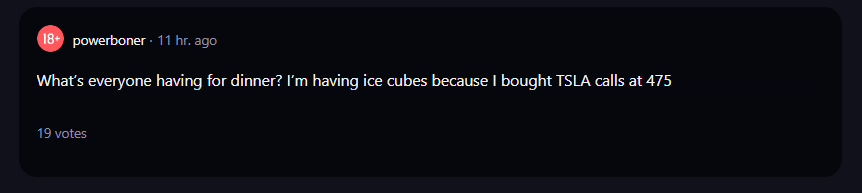

Tesla

- The Elon Musk-led company was at the center of retail discussion this week for both good and bad reasons as the Federal EV Credit officially ended on Wednesday, Oct. 1st, and the company announced record vehicle deliveries and energy deployments for the third quarter of 2025.

- However, the retail investors were seemingly dejected as their bullish calls on the stock were faced with losses after it fell on Thursday, following a 25.6% drop in its car sales in Italy.

- The stock had a 52-week range of $212.11 to $488.54, trading around $436 to $442 per share, as of the publication of this article. It was up 14.95% year-to-date and 81.17% over the year.

- Benzinga's Edge Stock Rankings showed that the stock had a stronger price trend in the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Intel

- The stock continued its impressive rally, as the U.S. government’s 10% stake value in the company significantly increased from $8.9 billion in August to roughly $16 billion, after a 55.42% rally in the stock over the month.

- Investors reinstated faith in INTC following its positive rally over the month.

- The stock had a 52-week range of $17.66 to $37.57, trading around $36 to $37 per share, as of the publication of this article. It was up 84.47% year-to-date and 67.57% over the year.

- The stock had a stronger price trend in the short, medium, and long terms, as per Benzinga's Edge Stock Rankings, with a poor growth ranking. Other performance details are available here.

Advanced Micro Devices

- AMD was in focus, fueled by multiple developments, as it announced a strategic collaboration with IBM (NYSE:IBM) and a report that competitor Intel was in early discussions to add AMD as a customer for its foundry business.

- Retailers were optimistic on AMD following the positive news flow.

- The stock had a 52-week range of $76.48 to $186.65, trading around $170 to $172 per share, as of the publication of this article. It was up 40.70% YTD and 4.22% over the year.

- According to Benzinga's Edge Stock Rankings, it had a strong quality ranking and it was maintaining a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

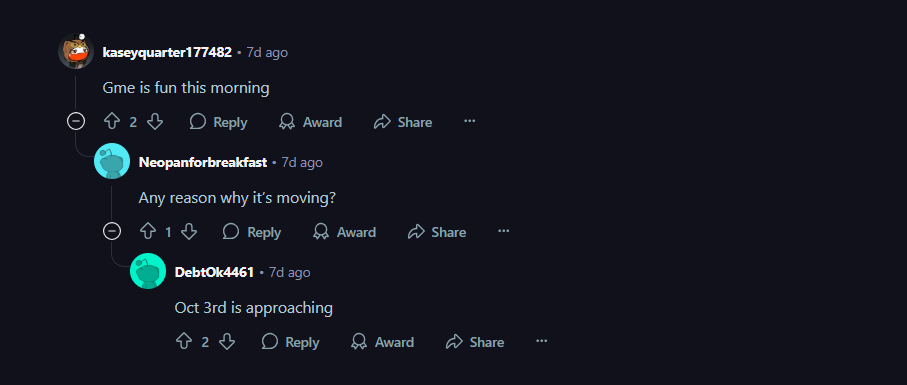

GameStop

- GME was trending this week following the strength of he broader video game sector after Electronic Arts announced it is being acquired in a $55 billion all-cash deal.

- Retail investors were bullish on the stock as the firm declared a special dividend of tradable warrants. For every ten shares held, shareholders of record as of Oct. 3 will receive one warrant, allowing shareholders to purchase a share of GameStop at an exercise price of $32.

- The stock had a 52-week range of $20.30 to $35.81, trading around $26 to $28 per share, as of the publication of this article. It was down 11.22% year-to-date but 28.40% higher over the year.

- It maintains a stronger price trend over the short, medium, and long terms with a robust growth ranking, as per Benzinga's Edge Stock Rankings. Additional performance details are available here.

Opendoor Technologies

- The newest retail favorite kept making headlines this week as Rep. Cleo Fields (D-La.) purchased the stock, and it got a preliminary approval from the U.S. District Court for a settlement pertaining to a derivatives case.

- Investors, as always, were bullish on the new social media favorite.

- The stock had a 52-week range of $10.87 to $0.51, trading around $8 to $9 per share, as of the publication of this article. It was up 403.77% year-to-date and up 315.03% over the year.

- While this stock had a poor growth ranking, Benzinga's Edge Stock Rankings showed that it had a strong price trend in the short, medium, and long terms. Additional performance details are available here.

Retail focus blended meme-driven optimism with future outlook and earnings narratives, as the S&P 500, Dow Jones, and Nasdaq scaled fresh highs during the week.

Read Next:

Photo: Shutterstock