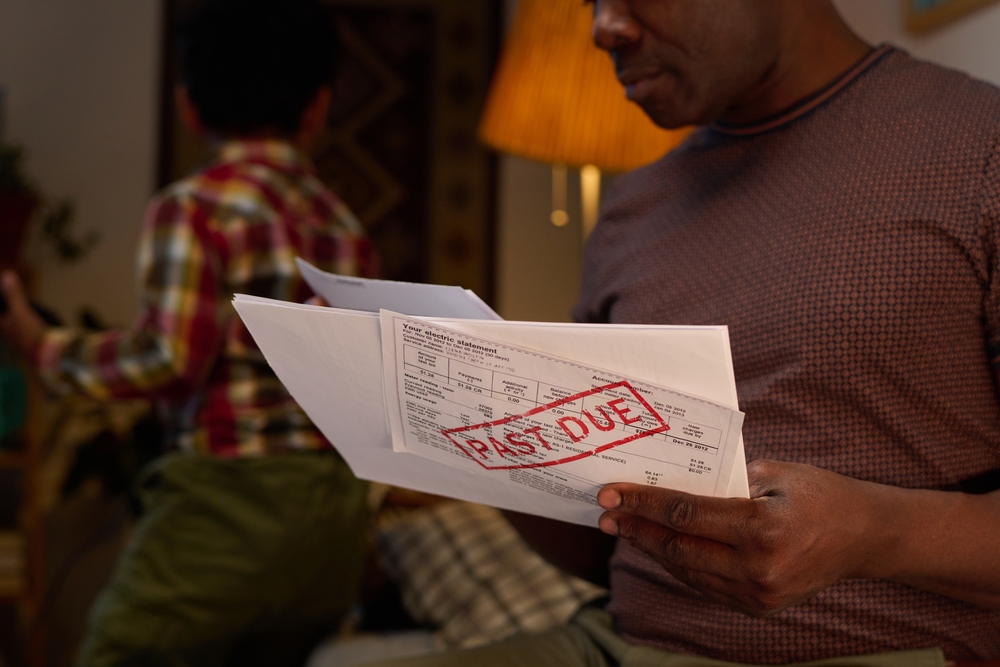

Debt is one of those things that can sneak up on you without warning, almost like a financial ninja in the night. One day, you’re sipping your latte and paying your bills on time, and the next, you’re juggling multiple due dates and wondering where all your money went. It doesn’t always show itself with obvious red flags like missed payments or overdraft fees. Often, it starts small, with tiny habits and unnoticed patterns that quietly multiply over time. Recognizing these sneaky signs early is the key to staying in control before debt turns into a full-blown money crisis.

1. You Constantly Transfer Balances Or Borrow To Pay Bills

One of the clearest signs debt is creeping up is when you start using one debt to pay another. Credit card balance transfers, short-term loans, or borrowing from friends might seem like temporary fixes, but they often hide a bigger problem. It creates a cycle where you’re not actually reducing your debt—you’re just moving it around. The more you do this, the harder it becomes to see the full picture of your financial health. If you find yourself constantly hopping from one payment solution to another, it’s a red flag that debt is quietly stacking up.

2. Your Minimum Payments Are Becoming The Norm

Paying only the minimum on credit cards or loans might feel manageable, but it’s a classic sign that debt is starting to dominate your finances. Minimum payments are designed to keep you in the game for the long haul, not to help you get ahead. When you start defaulting to minimums month after month, interest accumulates, and balances can balloon without you noticing. Over time, this habit drains your financial flexibility and leaves less room for essentials or savings. If you’re seeing your payments linger at the minimum line more than your budget allows, it’s time to pay attention.

3. You Avoid Checking Your Accounts

Ignoring account statements, bank apps, or credit card notifications may feel like a stress-free strategy, but it’s one of the most dangerous signs that debt is piling up. Avoidance doesn’t make debt disappear—it makes it grow silently, often faster than you realize. Missing updates on balances, due dates, or interest charges can lead to late fees, penalties, and more stress. The anxiety of knowing you’ve ignored your finances can spiral into a vicious cycle of avoidance and accumulating debt. Regularly checking your accounts, even when it’s uncomfortable, is essential to staying on top of things.

4. Everyday Purchases Require Credit

If you find yourself reaching for a credit card for things you used to pay with cash, it might be a sneaky indicator that debt is increasing. Small, routine purchases—like groceries, gas, or coffee—add up quickly when you rely on credit instead of money you actually have. This behavior often reflects a gap between income and expenses, which can spiral into bigger financial problems if left unchecked. While it may not feel urgent now, repeated reliance on borrowing for everyday spending is a clear warning. Tracking where your money goes and catching these habits early can prevent small purchases from turning into a mountain of debt.

5. You Feel Constant Stress About Money

Debt doesn’t just affect your finances—it affects your mental and emotional state, too. If you’re constantly worrying about bills, budgeting, or what to pay first, it’s a strong sign that debt may be quietly accumulating. Chronic financial stress can influence decisions, leading to impulsive spending or avoiding the problem entirely. It’s often subtle at first, like a background noise you barely notice, until it starts dictating daily decisions and your overall mood. Paying attention to how you feel about money can give you an early warning that debt is creeping higher, even if balances look manageable on paper.

Catch Debt Early Before It Takes Over

Debt doesn’t always announce itself with alarms or flashing lights. Sometimes it sneaks in through small habits, quiet patterns, and unnoticed behaviors that slowly tighten their grip. Recognizing signs like relying on credit for everyday purchases, avoiding statements, and feeling constant financial stress can save you from bigger trouble down the line. Awareness is the first step to regaining control and planning a path out of debt.

Have you noticed any of these sneaky signs in your own finances? Share your experiences, insights, or tips in the comments section below.

You May Also Like…

Accelerate Your Debt Repayment Using Our Powerful Snowball Method.

5 Debt Strategies Redditors Recommend When You’re Drowning But Financial Advisors Say Are Stupid

What Really Happens If You Ignore a Debt Collector’s Voicemail

7 Things You Should Never Say to a Debt Collector on the Phone

The post 5 Sneaky Signs That Debt Is Adding Up appeared first on The Free Financial Advisor.