REITs joined the rest of the stock market last week in the steady selling of shares as investors began to anticipate the effects of higher interest rates. These five sold off the most and are worth watching ahead of Wednesday’s Federal Open Market Committee meeting where rate hikes may be announced.

Power REIT (NYSEAMERICAN: PW) (-6.17%) is diversified among three industries: controlled environment agriculture (greenhouses), solar farm land and transportation. No dividend is being paid. With a price-earnings (P/E) ratio of 10 and trading at a 22% discount from book value, the REIT may fit the value stock profile.

Despite the 6.17% one-day loss, the REIT managed to remain above the mid-July support level where a great deal of buying volume came in.

Check out: This Little Known REIT Has Produced Double-Digit Annual Returns For The Past Five Years

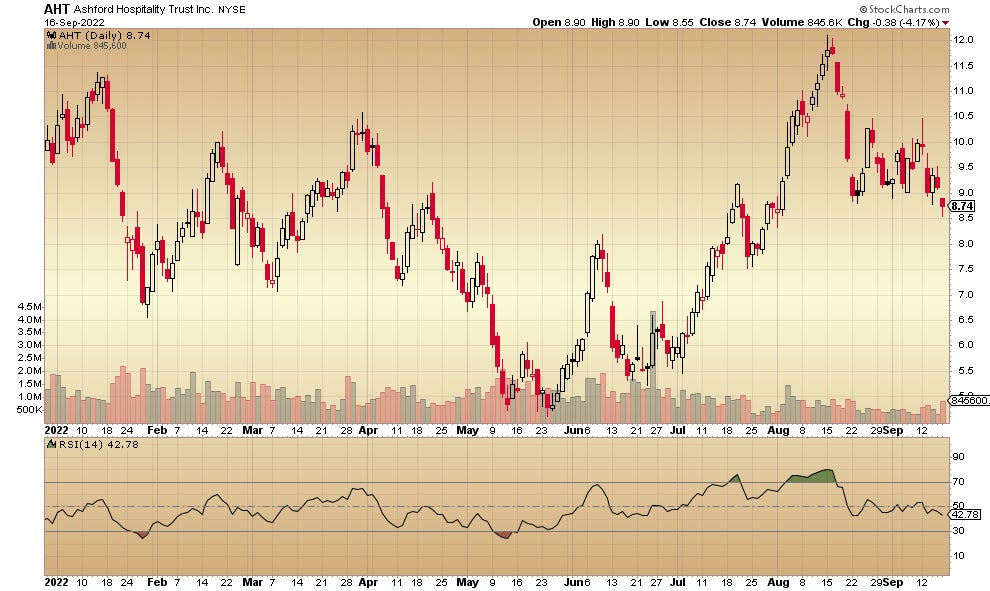

Ashford Hospitality Trust Inc (NYSE:AHT) ( - 4.17%) is a hotel and motel real estate investment trust (REIT) that does not now pay a dividend. The Dallas, Texas-based firm focuses mostly on upscale hotel properties.

Despite the Friday selling, the REIT remains well above the lows of May and June.

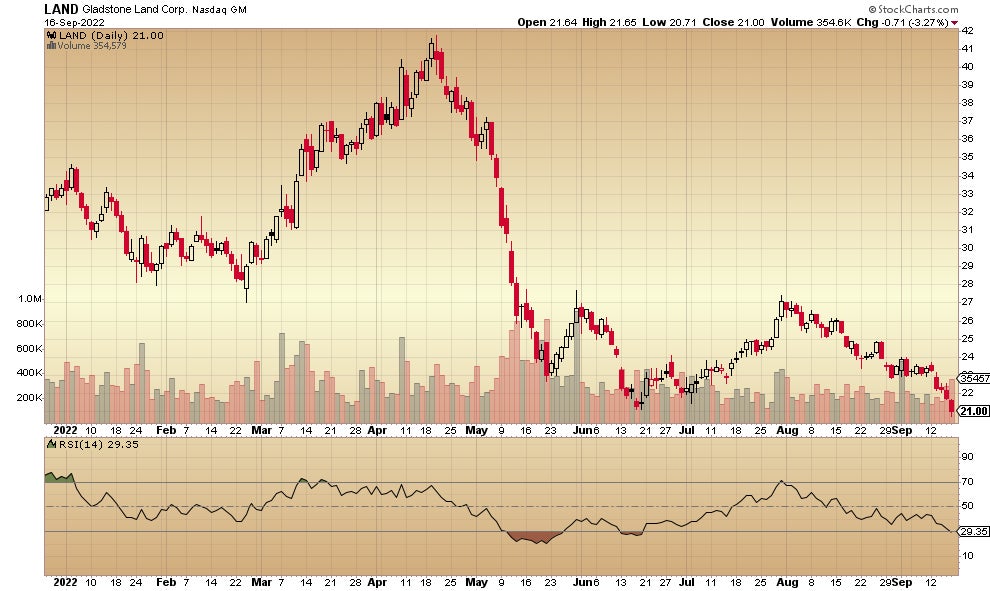

Gladstone Land Corp. (NASDAQ:LAND) ( -3.27%) is an industrial REIT based in McLean, Virginia, now actively acquiring farmland in the United States. Gladstone pays a dividend of 2.60%.

The heavy selling takes the price to a new 2022 low, not a positive sign from a pure chart analysis view – the downtrend remains intact.

The Rexford Industrial Realty REIT (NYSE:REXR) (-2.37%) has headquarters in Los Angeles, California, investing in industrial properties in Southern California. Rexford Industrial Realty is paying a 2.15% dividend.

The heavy selling volume on such a big down day is not a good look. On the other hand, the REIT is still staying higher than the August low prices.

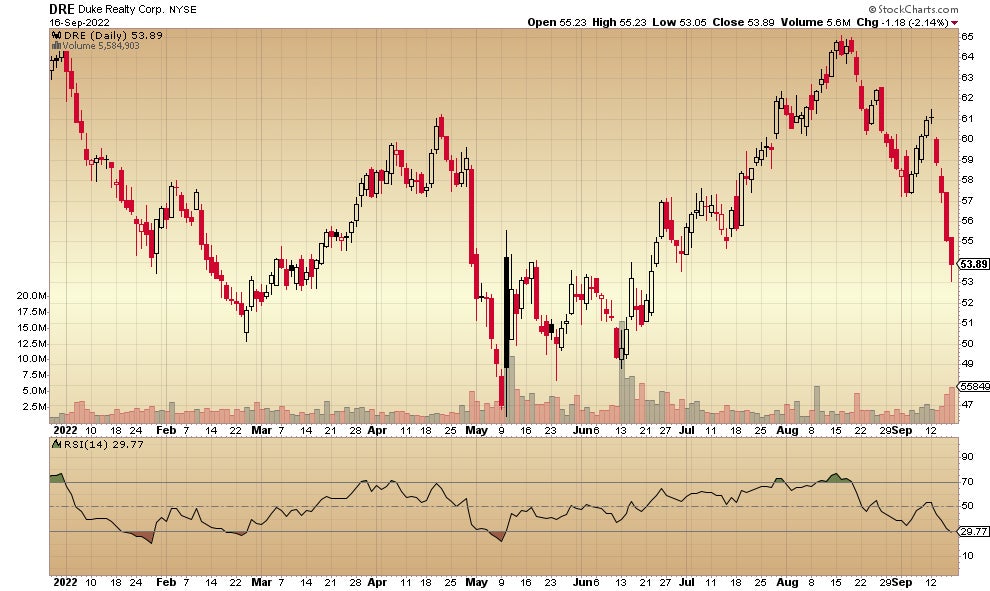

Duke Realty Corp. (NYSE:DRE) (-2.14%) The company is based in Indianapolis, Indiana, and it specializes in logistics real estate with an emphasis on the e-commerce industry. Duke Realty pays a dividend of 2.08%.

That’s a lot of volatility — from 65 at the beginning of the year down to 47 by May and then a rally back up to 65 and now a sell-off down to 53. With four straight red daily selling bars, maybe the REIT can rest up and consolidate for a few days.

Looking for high dividend yields without the price volatility?

Real estate is one of the most reliable sources of recurring passive income, but publicly-traded REITs are just one option for gaining access to this income-producing asset class. Check out Benzinga's coverage on private market real estate and find more ways to add cash flow to your portfolio without having to time the market or fall victim to wild price swings.

Latest Private Market Insights:

- Arrived Homes expanded its offerings to include shares in short-term rental properties with a minimum investment of $100. The platform has already funded over 150 single-family rentals valued at over $55 million.

- The Flagship Real Estate Fund through Fundrise is up 7.3% year to date and has just added a new rental home community in Charleston, SC to its portfolio.

Find more news, insights and offerings on Benzinga Alternative Investments

Not investment advice. For educational purposes only.

Charts: courtesy of StockCharts