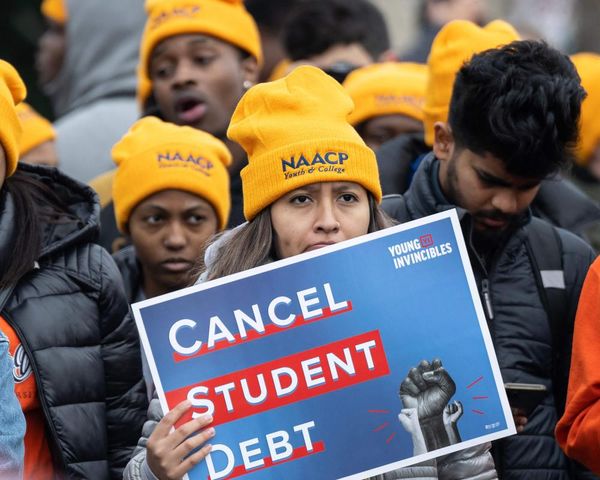

The holidays are expensive enough without derailing your entire financial plan. Millennials already face unique money challenges, from student loans to sky-high housing costs, making holiday budget protection even more important.

Read Next: How Much Money Is Needed To Be Considered Middle Class in Your State?

Explore More: 8 Frugal Habits You Should Never Quit, According to Frugal Living Expert Austin Williams

The season between Thanksgiving and New Year’s can easily drain bank accounts and max out credit cards faster than you can digest Aunt Edna’s brick-like fruit cake. But, never fear! With some strategic planning, you can enjoy the holidays without the January financial hangover.

Here are five money hacks every millennial should implement before holiday spending begins.

Create a Holiday Spending Cap (And Stick To It)

We know, we know. You’ve heard this one a million times, but only because it’s true. The biggest holiday money mistake is not setting a firm spending limit before the season starts. Without a clear budget, it’s easy to justify “just one more” purchase until your credit card is maxed out.

Calculate how much you can realistically spend without affecting your other financial goals. Include gifts, travel, food, decorations and entertainment in this number. Then divide it across all your holiday expenses to see what you can afford in each category.

The key is treating this cap as non-negotiable. Put that in all caps and bold it if you need to. It’s that serious. When you hit your limit, you’re done spending. No exceptions for “perfect” gifts or last-minute deals.

Many millennials like using the 50/30/20 rule modified for holidays. Take your “wants” category (the 30% portion) and allocate part of it to holiday spending for November and December.

Check Out: Here’s How to Fix Your Budgeting Problems, According to Kumiko Love

Start Your Holiday Fund Now

Most financial advice says to start saving for holidays in January, but that doesn’t help if you’re reading this later in November. The good news is that even a few weeks of saving can make a difference.

Open a separate savings account specifically for holiday expenses. Even if you can only save $50 to $100 per week, that’s $200 to $400 more than you’d have otherwise. Set up automatic transfers so the money moves without you thinking about it.

If your bank allows it, set up multiple savings accounts for different holiday categories: gifts, travel, food and entertainment. This makes it easier to track spending in each area. You can also pick up a temporary side gig for holiday cash.

Master the Art of Strategic Gift Giving

Gift giving doesn’t have to break your budget if you’re strategic about it. The key is focusing on thoughtfulness rather than dollar amounts.

Set individual spending limits for each person on your list. Don’t feel pressured to spend equally on everyone. A $20 limit for coworkers and a $50 limit for close friends is perfectly reasonable.

Consider experiential gifts instead of material ones. Concert tickets, cooking classes or museum memberships often cost less than expensive gadgets, and they create lasting memories. Homemade gifts can be incredibly meaningful without costing much. Baked goods, photo albums or handwritten letters show effort and thoughtfulness that expensive purchases can’t match. (Just ask your mom!)

Group gifts work well for expensive items. Coordinate with siblings or friends to buy one meaningful gift together rather than multiple smaller ones.

Wisely Plan Your Holiday Travel

Travel costs can destroy holiday budgets faster than any other expense. But smart planning can keep transportation and accommodation costs manageable.

Book flights and hotels as early as possible but also monitor prices for drops. Apps like Hopper and Google Flights can alert you to price changes. You can also consider alternative travel dates. Flying on actual holidays (like Christmas Day) is often cheaper than traveling the days before or after.

Look into house swapping or staying with friends instead of hotels. Split Airbnb costs with other family members who are traveling to the same destination.

Drive instead of flying for trips under 500 miles. Factor in gas, wear and tear on your car, and parking costs, but driving is often cheaper for shorter distances.

Use travel rewards credit cards if you have good credit and can pay off balances immediately. The key is never carrying a balance just to earn rewards.

Plan for Post-Holiday Financial Recovery

The smart money moves don’t end when the holidays are over. Plan now for how you’ll recover financially in January and February.

If you do accumulate any holiday debt, create a specific payoff plan before you spend the money. Know exactly how you’ll eliminate balances and by what date.

Plan to dial back spending in January and February to rebuild your savings. Many millennials find success with “no-spend” challenges in the new year.

Use any holiday bonuses, tax refunds or gift money to boost your emergency fund rather than extending holiday spending into the new year.

Start saving for next year’s holidays immediately. Even $25 per month means you have $300 by next November, making the following year much easier.

And finally, review what worked and what didn’t about your holiday budget. Adjust your strategy for next year based on this year’s experience. Happy holidays and happy spending!

More From GOBankingRates

- 6 Costco Products That Have the Most Customer Complaints

- This is the Most Frugal Generation (Hint: It's Not Boomers)

- 8 Common Mistakes Retirees Make With Their Social Security Checks

- How Much Money Is Needed To Be Considered Middle Class in Your State?

This article originally appeared on GOBankingRates.com: 5 Money Hacks Millennials Need To Try To Get Ahead of Holiday Spending