Small regional banks in the U.S. witness a surge in their “Quality” scores, with big improvements over the past seven days alone, signaling robust financial health and stability.

The Top 5 Regional Banks With The Biggest Improvements

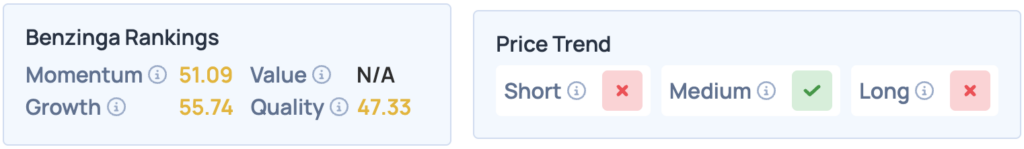

Benzinga’s Edge Stock Rankings assigns scores to stocks based on Value, Momentum, Growth and Quality. The quality score of a stock is determined by its operational efficiency and financial health, alongside historic profitability and fundamental strength relative to peers.

See Also: 3 Supercharged Stocks Flashing Strong Momentum Signals

Over the past week, we’ve seen big improvements in the Quality score of several regional banks, and here are the top 5 stocks with the biggest improvements.

1. Citizens Financial Services Inc.

Pennsylvania-based Citizens Financial Services (NASDAQ:CZFS) witnessed the biggest week-over-week bump in its Benzinga Edge Quality score, from 12.83 to 67.81.

The company has received a string of analyst upgrades from firms such as Jefferies, Citigroup, Evercore ISI and UBS in recent weeks. Its Price Target at the high end now stands at $65, representing an upside of 14.63%.

Additionally, its non-performing assets fell during the second quarter, resulting in a lower provision for credit losses, all of which hint at improving fundamentals and sound financial health at the bank.

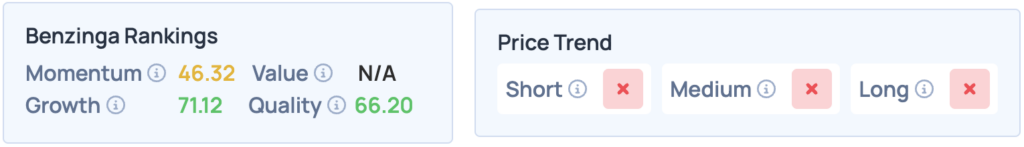

According to Benzinga’s Edge Stock Rankings, Citizens Financial Services scores high on Growth and Quality, but has an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the company, its peers and competitors.

2. Republic Bancorp Inc.

Republic Bancorp’s (NASDAQ:RBCAA) quality score increased from 16.97 to 69 within just a week, largely the result of its net interest margins, which rose to 3.72% from 3.46% a year earlier, driven by a decline in the cost of interest-bearing deposits and higher asset yields.

The consensus Price Target for the stock stands at $78, representing an upside of 9%, as the company was aided by stronger line-of-credit profitability, a lower provision and reduced marketing expense during its recent third quarter results.

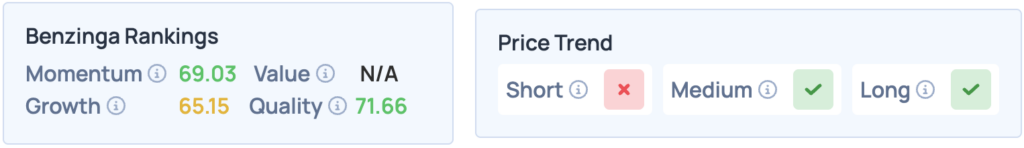

Republic Bancorp scores high on Momentum and Quality in Edge rankings, with a favorable price trend in the medium and long terms. Click here for deeper insights into the stock.

3. Webster Financial Corp.

Connecticut-based Webster Bank (NYSE:WBS) saw its score rise from 30.81 to 80.3 over the past week, primarily driven by a strong second-quarter performance, where it was aided by a strong net interest margin of 3.44%, compared to 3.39% the prior year.

Besides this, the bank saw its provisioning costs drop to $46.5 million, while past-due loans declined sequentially. Capital remained strong with a CET1 ratio of 11.33%.

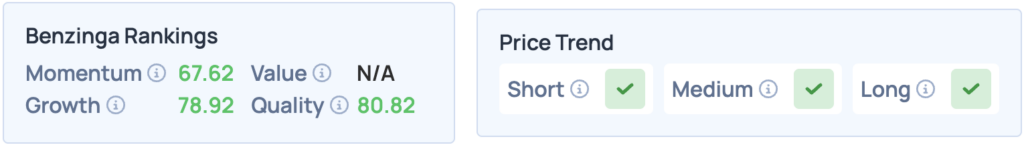

Webster scores high on Momentum, Growth and Quality, with a favorable price trend in the short, medium and long terms. If you want to know more about the stock and its other key metrics, click here for deeper insights.

4. Timberland Bancorp

One of the oldest banks in the U.S., this Washington-based Timberland Bancorp (NASDAQ:TSBK) saw its quality scores jump 48.24 points, from 25.85 to 68.36.

Besides its strong third-quarter performance, the company saw its net interest margin expand to 3.80%, improving 27 basis points from the prior year, while its efficiency ratio strengthened to 54.47%. Asset quality remained strong, with non-performing assets at just 0.21% of total assets.

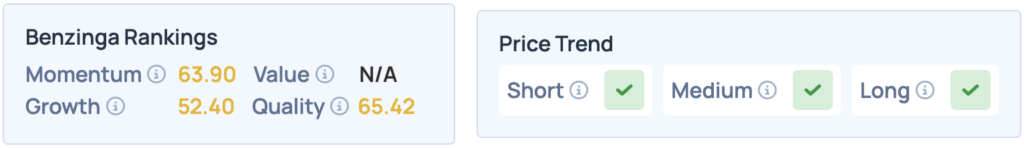

Despite its monumental improvement in recent weeks, Timberland doesn’t fare too well in Benzinga Rankings, but has a favorable price trend in the short, medium and long term. Click here for more insights on the stock, the company, and its finances.

5. CVB Financial Corp.

This California-based bank, CVB Financial (NASDAQ:CVBF), scores 46.96 in Benzinga’s Edge Stock Rankings, which isn’t ideal, but it marks a significant increase from 4.48 just a week ago.

The reason behind this rise in its quality score is the strong improvement in its net interest margin, at 3.31%, up from 3.05% a year ago, with the cost of funds easing to 1.03% sequentially.

Credit quality held firm as the bank recorded no provision for credit losses, while profitability and capital remained robust with a return on assets of 1.34% and a CET1 ratio near 16.5%.

The company scores poorly across the board, but the improvement in its Quality metrics is certainly a start. It has an unfavorable price trend in the short and long terms, but fares well in the medium term. Click here for more insights on the stock.

Read More:

Image via Shutterstock