Five healthcare stocks have emerged as standout performers, posting remarkable week-on-week momentum gains according to the latest Benzinga Edge Ranking report.

Top 5 Supercharged Healthcare Stocks

Sonoma Pharmaceuticals Inc. (NASDAQ:SNOA), Evoke Pharma Inc. (NASDAQ:EVOK), KALA BIO Inc. (NASDAQ:KALA), Ginkgo Bioworks Holdings Inc. (NYSE:DNA), and Soligenix Inc. (NASDAQ:SNGX) have captured investor attention with explosive price movements, signaling potential breakout opportunities in the healthcare sector.

These stocks, spanning specialty pharmaceuticals and biotechnology, are flashing strong momentum signals, driven by a mix of innovative pipelines, niche market focus, and heightened trader interest.

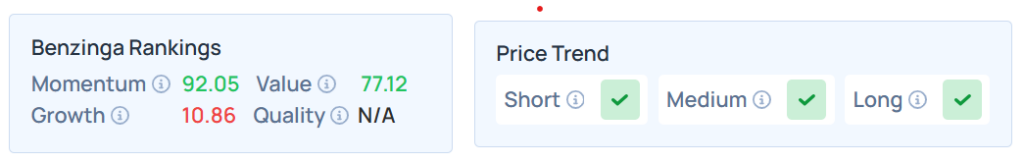

Sonoma Pharmaceuticals

- A micro-cap specialty pharmaceutical company with a market cap of $8.30 million leads the pack with a staggering 66.73-point momentum score jump, soaring from 25.32 to 92.05.

- Focused on antimicrobial and dermatology products, Sonoma's recent price action suggests a potential catalyst, such as positive developments in its pipeline of wound care and skincare solutions.

- The stock has surged 44.60% over the last month and 89.93% on a year-to-date basis.

- SNOA maintains a stronger price trend over the short, medium, and long terms with a robust value ranking. Additional performance details are available here.

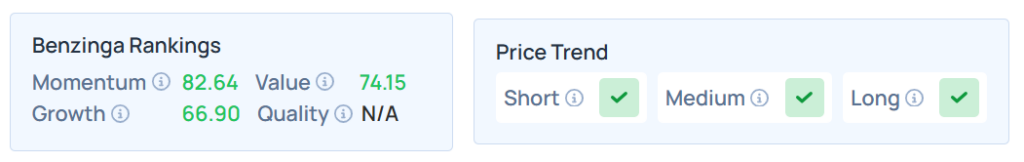

Evoke Pharma

- Another micro-cap with a $10.60 million market cap, saw its momentum score climb 51.09 points, from 31.55 to 82.64.

- Specializing in gastrointestinal treatments, Evoke's lead product, Gimoti, a nasal spray for diabetic gastroparesis, has likely contributed to its recent price surge.

- While EVOK has soared 25.38% in a month, it was up 30.43% YTD.

- The stock has solid value and growth rankings with a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

See Also: Hidden Gems: Undervalued Tech Companies Surging In Value Rankings This Week

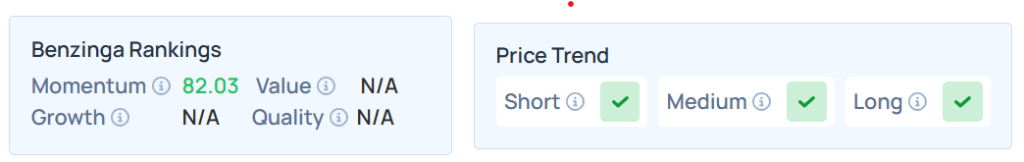

KALA BIO

- A biotechnology firm with a $57.15 million market cap posted a 48.96-point momentum increase, moving from 33.07 to 82.03.

- Focused on therapies for rare ocular diseases, KALA's recent price strength may reflect optimism around its pipeline, including potential treatments for corneal conditions.

- The stock has zoomed 46.32% in a month and 8.17% YTD.

- KALA maintains a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

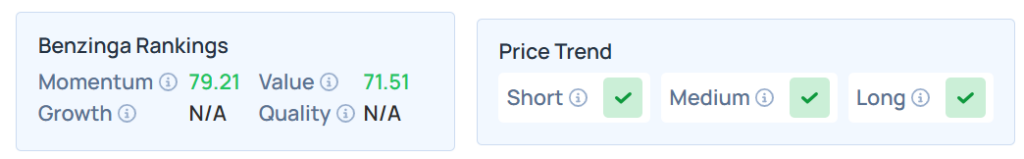

Ginkgo Bioworks Holdings

- A synthetic biology leader with a $693.23 million market cap, saw its momentum score rise 42.72 points, from 36.49 to 79.21.

- Unlike its micro-cap peers, Ginkgo's larger scale and innovative platform for bioengineering applications have drawn significant investor interest.

- DNA was up 2.39% over the last month and 13.41% YTD.

- With a strong value ranking, it has had a positive price trend over the short, medium, and long terms. Additional performance details are available here.

Soligenix

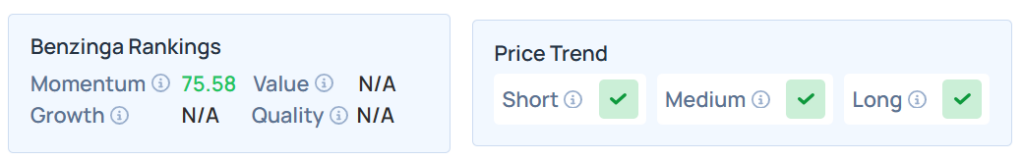

- Rounding out the top five, Soligenix, a $11.56 million market cap biotech, posted a 42.51-point momentum increase, from 33.07 to 75.58.

- Focused on rare diseases, including cutaneous T-cell lymphoma, Soligenix's price surge may be tied to clinical updates or investor optimism about its specialized pipeline.

- The stock has surged by a staggering 159.71% over a month and 22.79% YTD.

- SNGX maintains a strong price trend over the short, medium, and long terms. Additional performance details are available here.

What Does Benzinga Edge’s Momentum Ranking Entail?

The Benzinga Edge Rankings report defines momentum as a measure of a stock's relative strength based on price movement patterns and volatility over multiple timeframes, ranked as a percentile against other stocks.

The dramatic momentum gains for these healthcare stocks reflect a combination of strong price performance and heightened volatility, as captured by the Benzinga Edge momentum metric. However, several factors could be driving these rallies.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Thursday. The SPY was down 0.28% at $636.33, while the QQQ declined 0.24% to $564.53, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: PeopleImages.com – Yuri A via Shuttestock