The latest Benzinga Edge growth rankings reveal that several financial sector stocks are struggling to deliver expansion in both revenue and earnings, leaving them among the weakest growth percentile performers compared to peers.

Financial Names Fail To Break Out of Low-Growth Percentiles

DeFi Technologies Inc. (NASDAQ:DEFT), Pathfinder Bancorp Inc. (NASDAQ:PBHC), GoHealth Inc. (NASDAQ:GOCO), Carver Bancorp Inc. (NASDAQ:CARV), and LM Funding America Inc. (NASDAQ:LMFA) all remain at the bottom of the growth spectrum, reflecting limited progress across both short-term and long-term measures.

The steep declines for DEFT, PBHC, and GOCO stand out as the most severe drops, while CARV and LMFA illustrate that even small improvements have yet to move them out of the lowest growth categories.

DeFi Technologies

- The stock saw its growth ranking collapse from 62.95 to 9.98, marking a steep drop of nearly 53 points — underscoring its inability to sustain revenue growth in the digital assets space.

- It has declined 27.37% year-to-date, and it was up 8.81% over a year.

- DEFT maintains a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

Pathfinder Bancorp

- PBHC slid from 66.94 down to 24.93, a decline of almost 42 points in its growth rankings, highlighting sluggish expansion at the community banking level.

- It was down 14.30% YTD and 8.63% over a year.

- With a poor momentum ranking, Pathfinder has a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

See Also: Hidden Gems: Undervalued Tech Companies Surging In Value Rankings This Week

GoHealth

- The stock tumbled from 99.7 to 62.10, losing over 37 points as it continues to underperform against other digital insurance brokers.

- GOCO stock dropped 61.22% YTD and 31.86% over the year.

- Maintaining a weaker price trend over the short, medium, and long terms, GOCO scored poorly on its value and momentum rankings. Additional performance details are available here.

Carver Bancorp

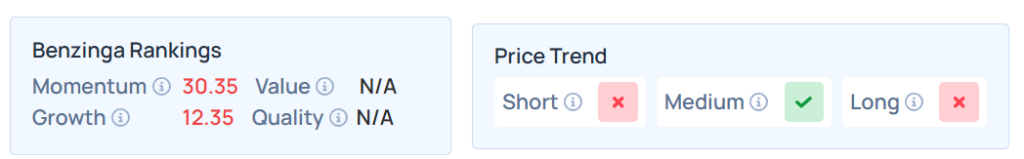

- CARV, while improving marginally from the bottom ranks, still sits at 12.35, leaving it in weak percentile territory relative to peers.

- Its stock was down 8.47% YTD and 12.93% over a year.

- Having a weaker price trend in the short and the long term, the stock had a stronger trend in the medium term. Additional performance details are available here.

LM Funding America

- LMFA showed similar issues, climbing only to 13.27 from 9.54, but remaining stuck in the lower decile of growth rankings.

- The stock plunged 43.88% YTD and 56.54% over the year.

- It also had a poor momentum ranking with a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

What Does Benzinga Edge’s Growth Ranking Entail?

Growth, in the Benzinga Edge framework, measures historical expansion in earnings and revenue across multiple timeframes. The placement of these stocks in the lower tiers indicates an ongoing lack of momentum relative to the financial sector at large.

For investors, the weak growth profiles highlight ongoing structural challenges, whether it be scalability hurdles for fintech names or slower-than-expected performance at smaller regional banks. In a market increasingly rewarding visible momentum, the lack of growth potential here may weigh heavily on valuation outlooks.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Friday. The SPY was up 0.26% at $637.20, while the QQQ advanced 0.21% to $564.46, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Credit: Kimberly P. Mitchell / USA TODAY NETWORK via Imagn Images