Reliability pays. The past few months have shown us how quickly market hype can fade, but companies that have been building value through steady dividend growth and consistent capital investment tell the real story of what "boring" success looks like.

A great example of this are the Dividend Aristocrats, an elite group of S&P 500-listed companies that have increased their dividends for 25 or more consecutive years.

Why is this a big deal? Well, try to remember how much has changed in the last 25 years. Then, understand that these changes bring about seismic upheavals in consumer preferences, technological disruptions, and even the rise and fall of entire industries. These Dividend Aristocrats have survived it all.

So, let's take a look at the best Dividend Aristocrats that could make a quality, long-term investment, including what analysts think of their 12-month prospects.

How I Came Up With The Following Dividend Stocks

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- Dividend Payout Ratio: 25% – 100%. This is the range that indicates the company is sharing a sustainable percentage of its profits to reward investors.

- Annual Dividend Yield (FWD): Left blank to be sorted from highest to lowest.

- 5-YR Dividend Growth: More than 50%, to filter companies that have strongly and consistently increased their payouts

- Number of Analysts: 12 or higher. The more analysts, the stronger the consensus.

- Current Analyst Rating: 3.5 – 5. Moderate to Strong Buy, as I am only looking for companies that analysts expect to perform well

- Watchlists: Dividend Aristocrats. I am thinking of companies that have established their stability.

The results? 5 companies arranged from the highest to the lowest in terms of forward dividend yield.

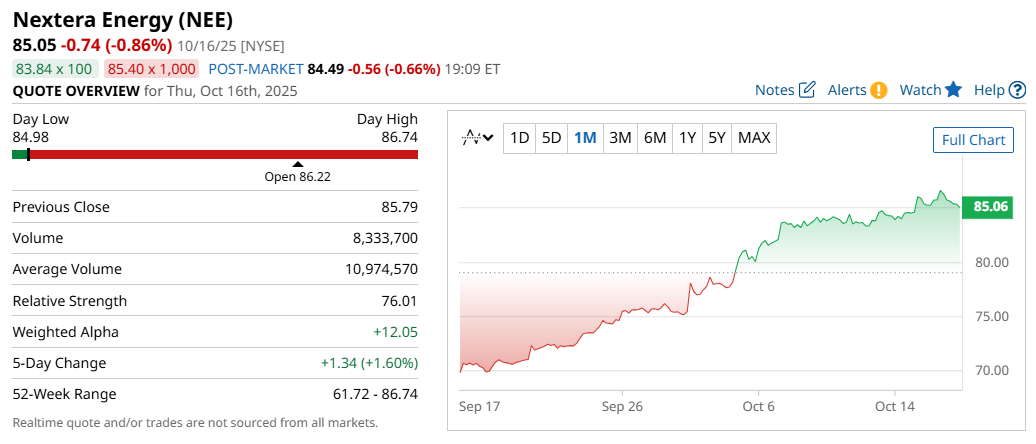

Nextera Energy (NEE)

NextEra Energy is an electric utility holding company that leads the revolution in the future of energy by scaling electricity and expanding its resources to U.S. energy infrastructure, unmatched by any other company in the country. The company was founded in 1925 under the name of Florida Power & Light (FPL) Company. Today, it focuses on meeting America’s increasing energy demand.

Just last month, NewEra announced that the U.S. Nuclear Regulatory Commission approved a 20-year license renewal for its Point Beach Nuclear Plant in Wisconsin, which allows the facility to operate through 2050 and 2053, supporting NextEra's revolutionary initiative.

In terms of its financials, NextEra’s most recent quarter reported sales rising 10.4% year-over-year to $6.7 billion. Its net income was also up 25% from the same quarter last year to $2.03 billion.

The stock is currently trading at $85.05, and the company pays a forward annual dividend of $2.27, translating to a yield of approximately 2.7%. The company has a dividend payout ratio of 59.95%, which is both healthy and sustainable for a utility stock.

A consensus among 21 analysts rates NEE a “Moderate Buy”, with a score of 4.05/5, a sentiment that has increased over the last three months. It is worth mentioning that one analyst suggested a Strong Sell, which, I believe, is due to concerns over rising interest rates and higher capex for renewable projects.

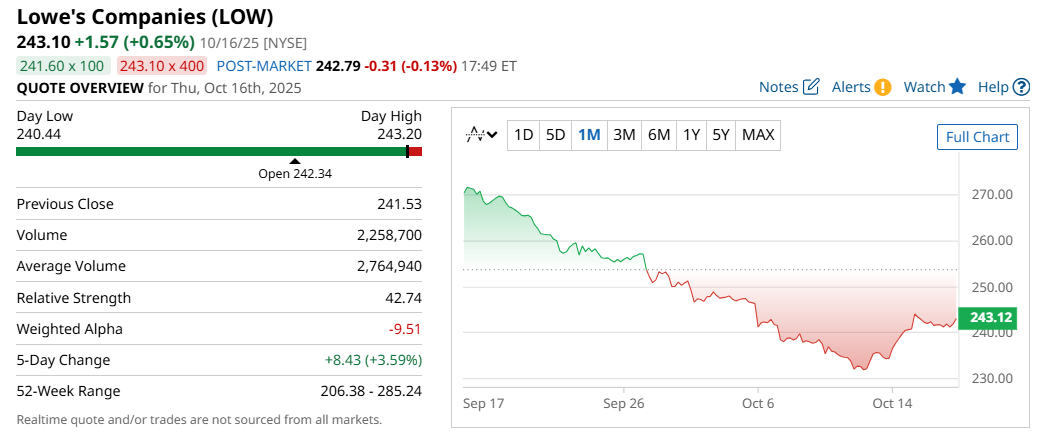

Lowe’s Companies (LOW)

The second Dividend Aristocrat is Lowe’s Companies. It is a leader in home improvement retail based in Mooresville, North Carolina. Lowe’s is proud of being America’s first choice for home improvements, helping people achieve their dream homes. Originally founded in 1921 as a small hardware store, today, they sell a wide range of products for DIY enthusiasts (like me) and professionals.

The company’s most recent financials reported sales were up 1.6% year-over-year to $23.96 billion, while its net income rose 0.6% to $2.4 billion.

Lowe’s stock is currently trading at $243.10, and the company pays a forward annual dividend of $4.80, which translates to a forward yield of just under 2%. The company’s dividend payout ratio is 38.46%, which means the company pays less than half of its profits as dividends- so there’s a lot of room to grow it down the line.

A consensus among 29 analysts rates LOW stock a “Moderate Buy”, with a score of 4.21/5, a sentiment that has decreased marginally over the past three months. Like Nextera, a single analyst rates the company a “Strong Sell”, perhaps due to the declining brick-and-mortar business here in the States.

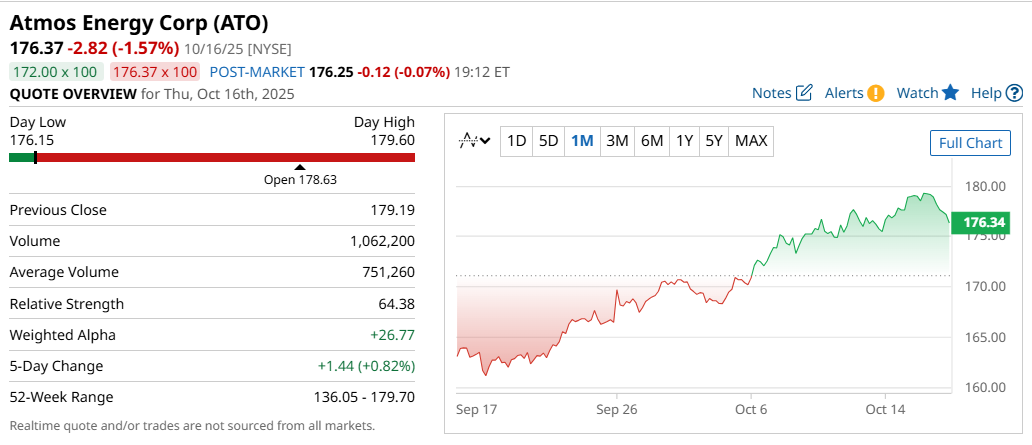

Atmos Energy Corp (ATO)

Next up is Atmos Energy Corp, another U.S.-based energy Aristocrat. Unlike NextEra, though, Atmos is a natural gas-only company and is the country’s largest and fully regulated natural gas distributor. The company has over three million customers across eight states.

Recently, Atmos Energy raised its full-year 2025 guidance and announced $2.6 billion in capital investments, mainly to improve safety and reliability.

In terms of financials, Atmos Energy reported sales rose 19.6% from the same quarter last year to $838.8 million. Net income was also up 12.6% year-over-year to $186.4 million.

Today, ATO stock currently trades at $176.37, and the company pays a forward annual dividend of $3.48, translating to a yield of approximately 2%. Atmos’s dividend payout ratio is 46.33%, which strikes a good balance, allowing the company to grow its dividend while setting aside sufficient funds for future growth.

A consensus among 14 analysts rates ATO stock a “Moderate Buy” with a score of 3.64/5, a sentiment that has been consistent, albeit marginally declining, over the last three months.

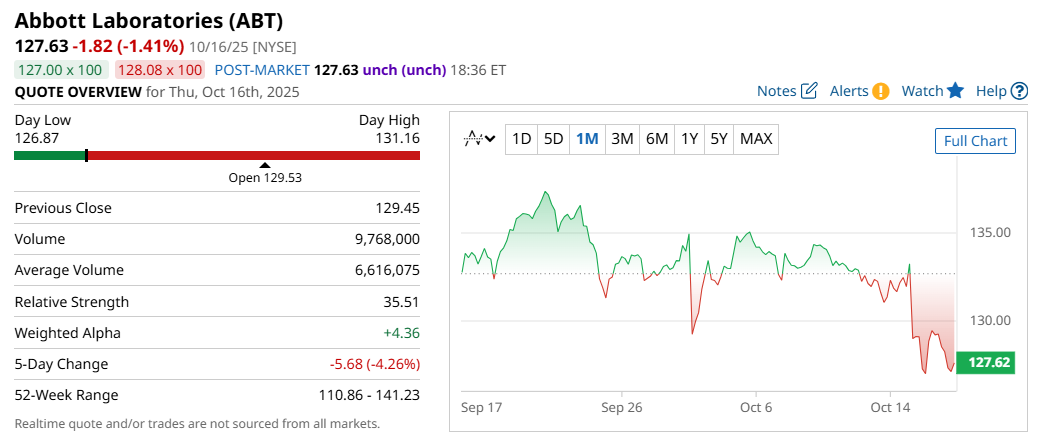

Abbott Laboratories (ABT)

The fourth Dividend Aristocrat on this list is Abbott Laboratories, a company I have covered a lot, so I’ll keep its introduction brief. Abbott is a diversified multinational healthcare company that supplies a wide range of products, from medical devices to nutritional products. Founded in 1888, they’ve grown to become one of the country’s most ethical pharmaceutical companies today.

The company’s most recent quarterly financials reported sales rose 7.4% year-over-year to $11.14 billion. Notably, Abbott's Cardiac Rhythm Management Business reported 10% sales growth thanks to the accelerating adoption of its AVEIR™ leadless pacemaker portfolio. Its global expansion and upgrades highlight the company's growth strategy. Abbott’s bottom line also increased 36.6% from the same quarter last year to $1.78 billion.

ABT stock currently trades at $127.63, and the company pays a forward annual dividend of $2.36, which translates to a yield of approximately 1.8%. The company’s dividend payout ratio is 46.06%, meaning there’s room to grow it while maintaining sufficient funds for R&D.

A consensus among 29 analysts rates ABT stock a “Strong Buy”, with a score of 4.45/5, strengthening from a “Moderate Buy” three months ago. This isn't surprising given Abbott's earnings growth and execution of its initiatives.

Linde Plc (LIN)

The last Dividend Aristocrat on this list is Linde Plc, the world’s largest industrial gases and engineering company. It supplies specialty gases, such as Oxygen, Nitrogen, Hydrogen, and more, to various industries, including healthcare and manufacturing. Linde was founded in 1879 in Wiesbaden, Germany. Today, it has expanded its operations to over 80 countries following the merger of Linde AG (Germany) and Praxair (United States).

Recently, Linde commissioned one of the world's largest helium storage caverns, located in Beaumont, Texas, which reinforces the company's global supply reliability and market dominance in helium. This new facility, with a capacity of over 3 billion cubic feet, enables Linde's infrastructure to meet the growing demand from various industries.

The company’s most recent financials reported sales are up 2.8% to $8.5 billion. Linde’s bottom line is also up 6.2% from the same quarter last year to $1.77 billion.

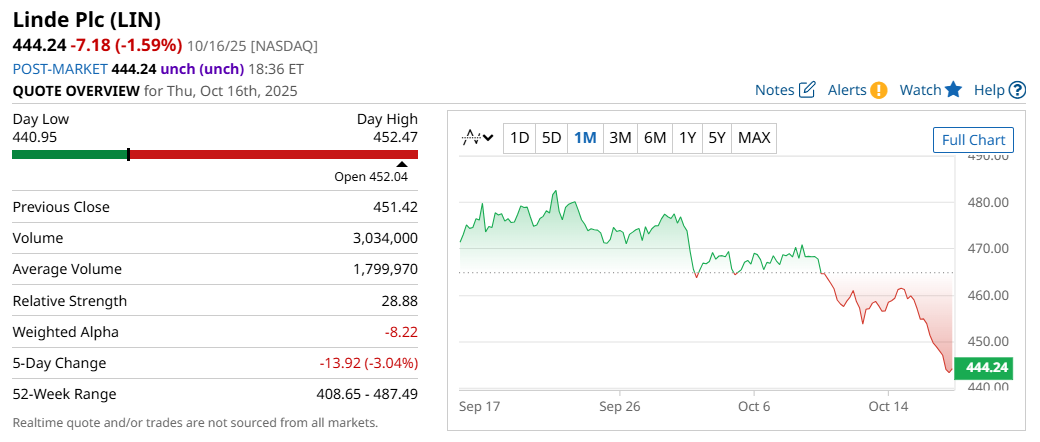

LIN stock currently trades at $444.24 with a forward annual dividend of $6.00, translating to a yield of approximately 1.4%. The company has a dividend payout ratio of 35.91%, the lowest on this list, and it highlights the company’s position for expansion and innovation.

A consensus among 27 analysts rates LIN stock a “Strong Buy” with a score of 4.41 out of 5, a sentiment that has been unchanged over the past three months. Notably, none of the analysts hold a “sell” rating for LIN.

Final Thoughts

There you have it, five Dividend Aristocrats with sustainable payout ratios, consistent dividend growth, and strong analyst confidence. These companies demonstrate their financial discipline and prove their ability to balance shareholder value with continued innovation and expansion. While any of these companies could be attractive for long-term investors, always do your own due diligence before hitting the buy button, as anything can change at a moment's notice.