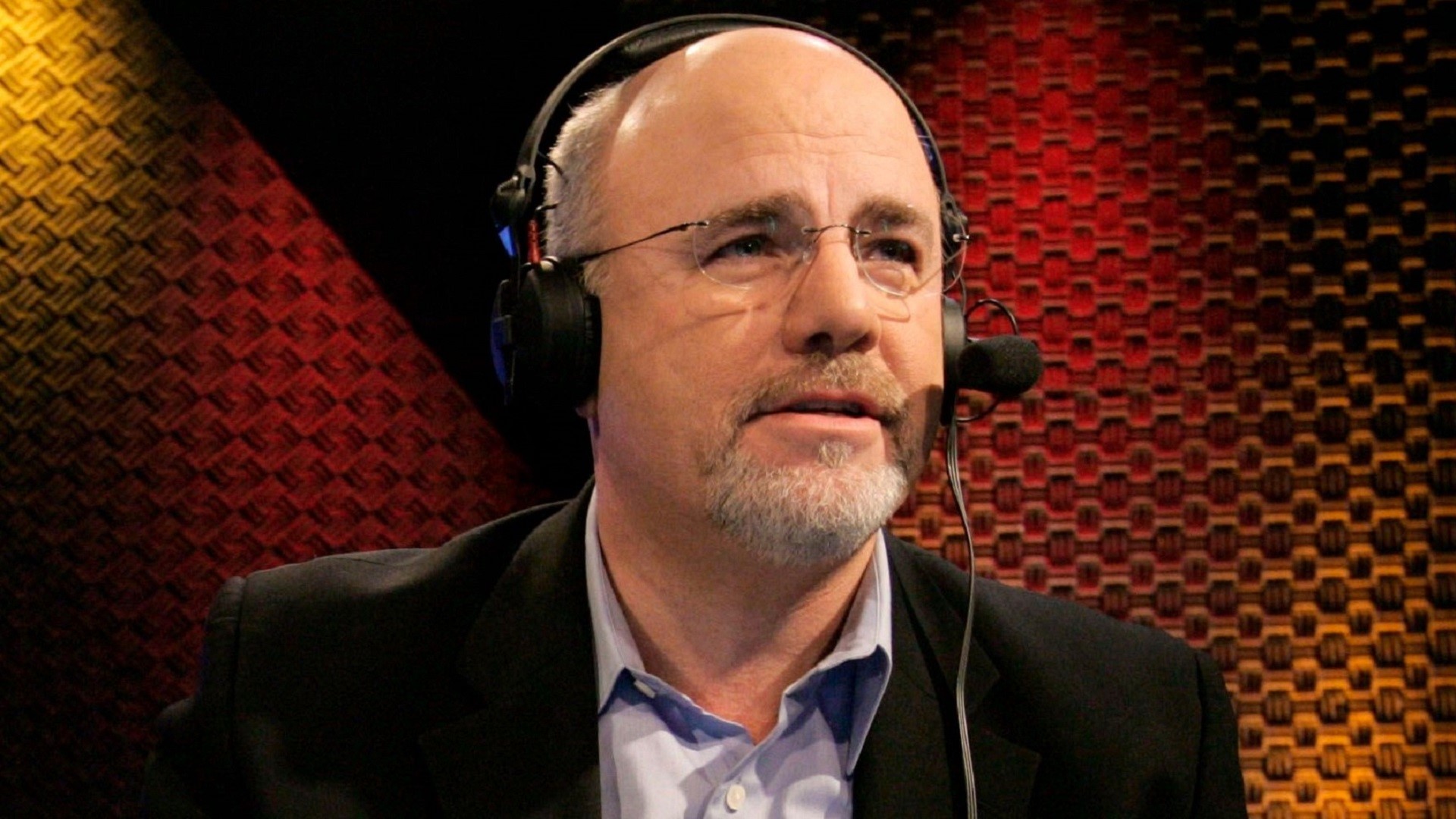

In the realm of financial influencers, many recognize the name Dave Ramsey. Ramsey began helping people iron out their money issues in 1992 by founding the company Ramsey Solutions.

Check Out: Suze Orman’s Top Tip for Building Wealth Is a ‘Very Easy One’

Read Next: 10 Used Cars That Will Last Longer Than an Average New Vehicle

With over 30 years of Ramsey giving financial advice on wealth building, here are four things that have stood the test of time.

Make a Budget

Wealth building doesn’t happen by luck. You need a strategy for financial success, and Ramsey has said that strategy is a budget. Ramsey recommended creating a budget by following these steps:

- List your monthly earnings: Write down any money that you have coming in, including paychecks, side gigs and passive income.

- List your monthly costs: Track your spending over several months to determine your fixed and variable expenses. Don’t forget to include savings, investments and debt payments.

- Subtract your costs from earnings: If your total isn’t zero, you’re either overspending or you haven’t given every dollar a job. With a positive number, add extra cash toward a goal. With a negative number, cut spending or find a way to increase your income.

- Track your spending: Whether you use an app or pen and paper, keep track of where your money goes. Look at the trends and strive for improvement.

Learn More: I’m a Financial Advisor: My Wealthiest Clients All Do These 3 Things

Get Out of Debt

Building wealth just isn’t possible if you’re in debt. Ramsey pointed out that the best resource you have for building wealth is your income, and if your income is only going toward paying off what you owe, you’ll never get anywhere.

Over the years, Ramsey has been adamant about using one of two methods to get out of the red. The debt snowball method works by helping you gain momentum and a sense of accomplishment as you pay down your debt. To do this, list out all of your debts from largest to smallest. While you must make the minimum payments on each debt, you’ll put more toward the smallest until it’s gone completely. Then use all of the money you’d regularly put toward the smallest debt toward the next smallest and watch your debts disappear.

Similarly, the debt avalanche method works by listing your debts by interest rates. You’ll pay off the highest interest rate first and then move on to the second highest. It may take time to feel the momentum building with the avalanche method. However, paying off the highest interest rate first will save you money in the long run and mean having more to contribute to what you owe.

Spend Less Than You Earn

A point that Ramsey, as well as many other personal finance experts, has been adamant about is spending less than you make. In Ramsey’s long history of helping others, he’s met people who make as little as $30,000 a year but manage to save money. They can do this by being intentional about where and when they use their money. Similarly, he’s met people who make $130,000 annually and are always stuck in debt because they overspend. Being able to control your spending and stick to your budget will help you build wealth that lasts.

Save for Retirement

Ramsey has long encouraged people to start planning and setting retirement goals from a young age. You can start saving by putting at least 15% of your gross income into either a 401(k) or a Roth IRA. This money will continue to grow and compound over time, no matter how your plans change.

He also suggested paying off your mortgage as early as possible. Once you’re out of debt, you can contribute more toward your retirement. You may also be eligible for Social Security benefits. The earlier you decide to begin receiving Social Security, the less you’ll receive per month. It’s best to have an idea of when you’d like to start taking those payouts and how they factor into your other savings and income. However, Ramsey cautioned against leaning too heavily on Social Security, as it may not be around in the same capacity forever.

More From GOBankingRates

- 7 McDonald's Toys Worth Way More Today

- 4 Companies as Much as Tripling Prices Due To Tariffs

- Here's the Minimum Salary Required To Be Considered Upper Class in 2025

- 6 Hybrid Vehicles To Stay Away From in Retirement

This article originally appeared on GOBankingRates.com: 4 Things Dave Ramsey Gets Right About Building Wealth in 2025