Four software stocks have achieved significant growth ranking improvements, each edging near the top 10th percentile according to this week’s update. This surge signals robust expansion in earnings and revenue, validated by the scores tracked in the latest growth percentile report.

4 Software Stocks Displaying Promising Growth

The uptick in growth scores for DoubleVerify Holdings Inc. (NYSE:DV), Fortinet Inc. (NASDAQ:FTNT), MongoDB Inc. (NASDAQ:MDB), and Versus Systems Inc. (NASDAQ:VS) each indicates a steady trajectory, potentially marking consistent execution and strong demand for their technology platforms.

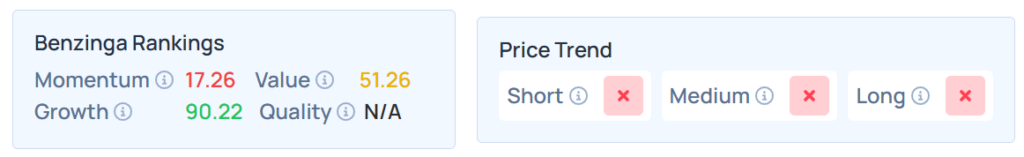

DoubleVerify Holdings

- DV displayed a week-on-week increase of 0.52 percentile points, reaching a current growth ranking of 90.22 from the 89.70th percentile.

- The stock has tumbled by 28.35% year-to-date and 23.08% over a year.

- It maintains a weaker price trend over the short, medium, and long terms with a moderate value ranking. Additional performance details are available here.

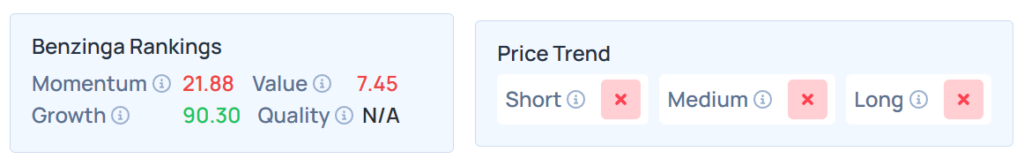

Fortinet

- FTNT also climbed 0.52 percentile points, achieving a new growth ranking at the 90.30th percentile.

- Lower by 16.12% in the YTD, the stock was up 3.71% over the year.

- With a poor value ranking, this stock maintained a weaker price trend over the short, medium, and long terms. Additional performance details are available here.

See Also: These 4 Precious Metals Stocks Outshine As Gold Rallies

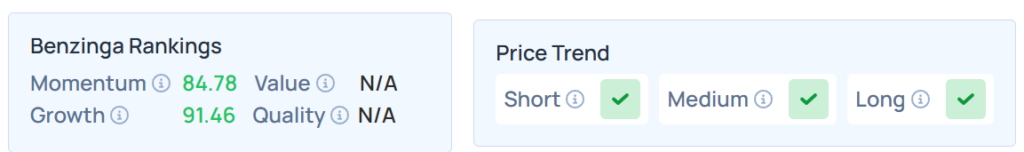

MongoDB

- MDB showed an exceptional improvement of 40.21 percentile points over the past week, moving from 51.25 to the 91.46th percentile ranking—reflecting robust acceleration in its business expansion and revenue growth.

- The stock advanced 36.89% YTD and 12.87% over the year.

- It had a strong price trend in the short, medium, and long terms. Additional performance details are available here.

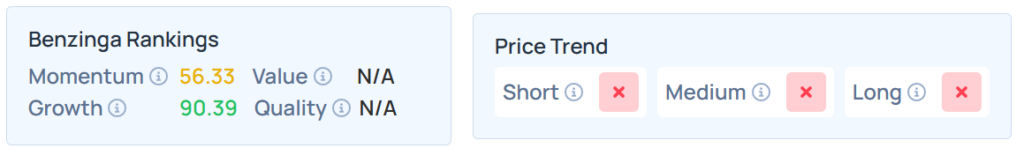

Versus Systems

- VS progressed by 0.52 percentile points, securing a growth ranking at the 90.39th percentile.

- It was up 31.37% over a year, but lower by 12.23% YTD.

- The stock had a weaker price trend in the short, medium, and long terms with a moderate momentum ranking. Additional performance details are available here.

Growth Analysis: What Does It Mean?

The Benzinga Edge Stock Rankings growth metric represents a stock's combined historical expansion in both earnings and revenue, placing emphasis on long-term trends and recent performance relative to peers. Percentile scores are updated weekly, enabling a consistent measure of improvement or decline.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 and Nasdaq 100 indices, respectively, were higher in premarket on Thursday. The SPY was up 0.24% at $653.80, and the QQQ advanced 0.34% to $582.69, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzing

Photo: Shutterstock