Four real estate stocks have shown a marked decline in momentum in recent weeks, even as the Federal Reserve advanced into a rate-cutting cycle.

4 Realty Stocks See Weakening Momentum

Despite expectations that lower interest rates might buoy real estate equities, these four names, Cherry Hill Mortgage Investment Corp. (CHMI), National Storage Affiliates Trust (NSA), Sachem Capital Corp. (SACH), and Smith Douglas Homes Corp. (SDHC), have slipped to the bottom 10% in momentum rankings, suggesting broader headwinds remain for the sector's risk appetite and investor sentiment.

What Does Momentum Ranking Entail?

Momentum, as described by the Benzinga Edge Stock Ranking methodology, assesses a stock's relative strength based on its price movement and volatility, ranked as a percentile versus other equities. A sharp move lower in this ranking signals not only underperformance versus peers but also negative near-term sentiment.

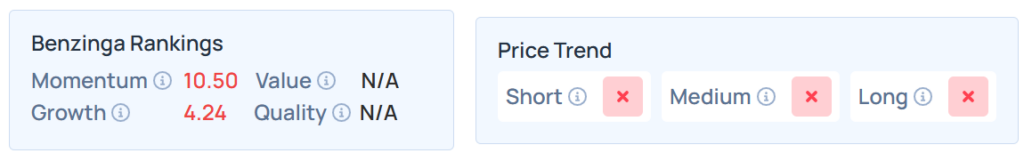

Cherry Hill Mortgage Investment

- CHMI’s momentum score decreased from 10.68 last week to just 10.50, a week-on-week drop of 0.18 percentile points. This underscores sustained selling pressure in this mortgage REIT despite a favorable rate environment.

- The stock has fallen by 3.82% year-to-date and 30.58% over a year.

- It maintains a weaker price trend over the short, medium, and long term, with a poor growth ranking. Additional performance details are available here.

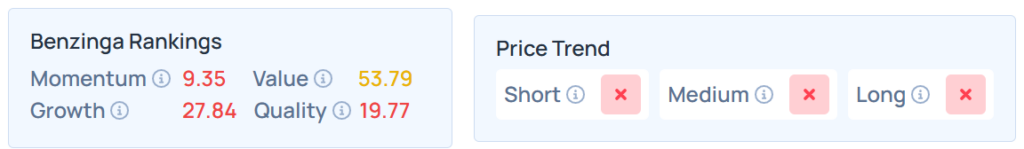

National Storage Affiliates Trust

- NSA, an industrial REIT, saw its momentum percentile slip from 10.68 to 9.35—a 1.33 point decrease. This signals diminished confidence in self-storage operators, possibly due to oversupply concerns or muted demand.

- Lower by 18.98% YTD, the stock was down 37.14% over the year.

- This stock maintained a weaker price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details are available here.

See Also: 4 Biotechnology Stocks That Outshine In Momentum Amid Strong Technicals

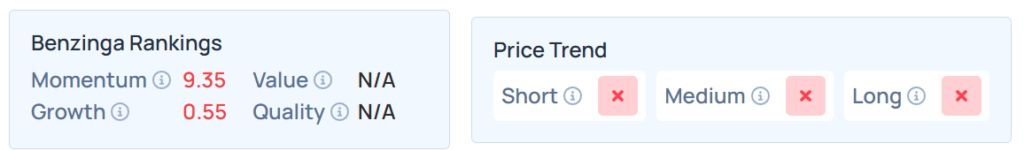

Sachem Capital

- SACH also experienced a shift from a 10.68 momentum score to 9.35, mirroring NSA's 1.33 percentile point decline. As a mortgage REIT, Sachem's continued weakness highlights ongoing caution towards leveraged real estate lenders.

- The stock declined 11.11% YTD and 55.56% over the year.

- It had a weaker price trend in the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

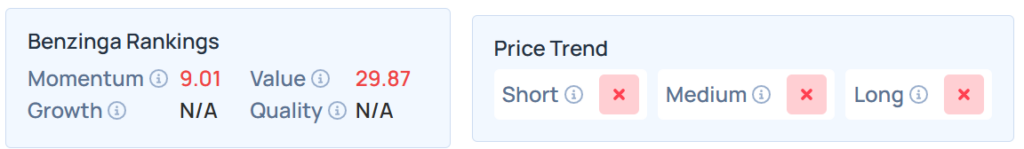

Smith Douglas Homes

- SDHC's ranking ticked down from 10.11 to 9.01, a reduction of 1.10 percentile points week-on-week. The homebuilder's lackluster relative strength may reflect persistent uncertainty around housing starts and affordability, even with lower borrowing costs.

- The stock has fallen by 28.35% year-to-date and 52.78% over a year.

- It maintains a weaker price trend over the short, medium, and long term, with a relatively poor value ranking. Additional performance details are available here.

The underperformance of these four realty stocks is notable because the Fed's rate reductions are typically expected to stimulate real estate sectors by lowering costs of capital and boosting demand.

However, the retreat in momentum percentile rankings suggests that company- or segment-specific risks—such as credit quality, supply imbalances, or cyclical sensitivity—are currently outweighing the macro-level tailwinds.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Monday. The SPY was up 0.28% at $663.68, while the QQQ rose 0.46% to $598.73, according to Benzinga Pro data.

Meanwhile, SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA), tracking the Dow Jones, ended 0.16% higher at $463.04.

The futures of the S&P 500, Dow Jones and Nasdaq 100 indices were mixed on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock