The semiconductor industry is experiencing a remarkable surge, with several stocks demonstrating robust momentum gains that have propelled them into the top 10th percentile of their peers.

4 Chipmakers With Strong Technicals And Momentum

Based on the latest momentum percentile rankings, four chipmakers—Amtech Systems Inc. (NASDAQ:ASYS), Lam Research Corp. (NASDAQ:LRCX), Silicon Motion Technology Corp. (NASDAQ:SIMO), and Wolfspeed Inc. (NYSE:WOLF) stand out for their impressive week-on-week momentum increases.

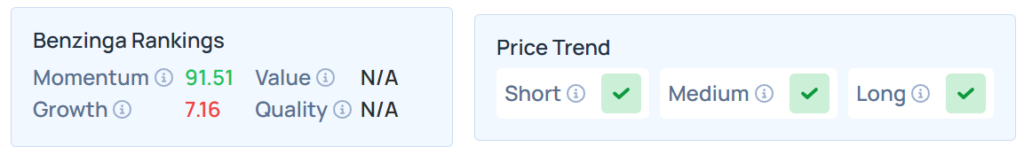

Amtech Systems

- ASYS has shown a notable momentum gain, with its score rising from 89.38 to 91.51, a delta of 2.13. This upward trajectory reflects strong price movement and reduced volatility, positioning it as a stock to watch.

- The stock has jumped by 58.93% year-to-date and 54.25% over a year.

- It maintains a stronger price trend over the short, medium, and long term, with a poor growth ranking. Additional performance details are available here.

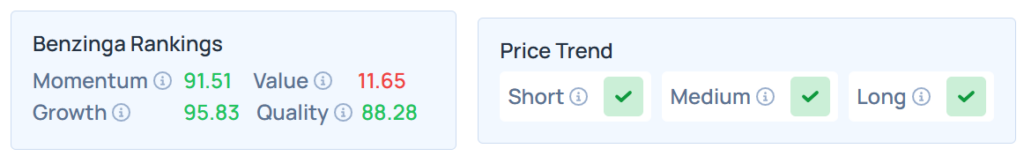

Lam Research

- LRCX, a key player in semiconductor equipment, saw its momentum score increase from 89.14 to 91.51, a change of 2.37, underscoring its solid technical performance.

- The stock was higher by 102.91% YTD and 81.22% in a year.

- This stock maintained a stronger price trend over the short, medium, and long terms with robust quality rankings. Additional performance details are available here.

Silicon Motion Technology

- SIMO also made strides, with a momentum score jump from 89.91 to 92.49, a delta of 2.58, indicating steady upward momentum

- The stock advanced 86.77% YTD and 67.36% over the year.

- It had a stronger price trend in the short, medium, and long terms, with a moderate growth ranking. Additional performance details are available here.

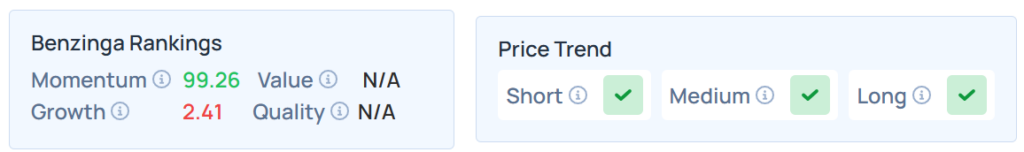

Wolfspeed

- WOLF leads the pack with a dramatic rise from 2.57 to 99.26, a staggering delta of 96.69, signaling a significant breakout in its price strength.

- The stock has risen by 272.40% year-to-date and 186.76% over a year.

- It maintains a stronger price trend over the short, medium, and long term, with a poor growth ranking. Additional performance details are available here.

What Does Momentum Ranking Mean?

Momentum, as defined by Benzinga Edge Stock Ranking descriptions, measures a stock's relative strength based on price movement patterns and volatility over multiple timeframes, ranked as a percentile against other stocks.

The substantial gains for these chipmakers suggest a bullish trend, likely driven by increasing demand for advanced semiconductor technologies.

Price Action

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Friday. The SPY was up 0.21% at $670.62, while the QQQ rose 0.23% to $607.12, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Credit: NESPIX from Shutterstock