Amid a historic rally in gold (GCZ25), as depicted by the SPDR Gold ETF (GLD), I have a question for traders. Can gold be both of these things at once?

- Still a great way to potentially make a ton of profits.

- As prone to a major decline as it ever has been.

I not only think the answer is YES, they can both be true at the same time. I think the broad U.S. stock market and the “AI trade” can be described the same way. These are the times we live in. So what do we do about it?

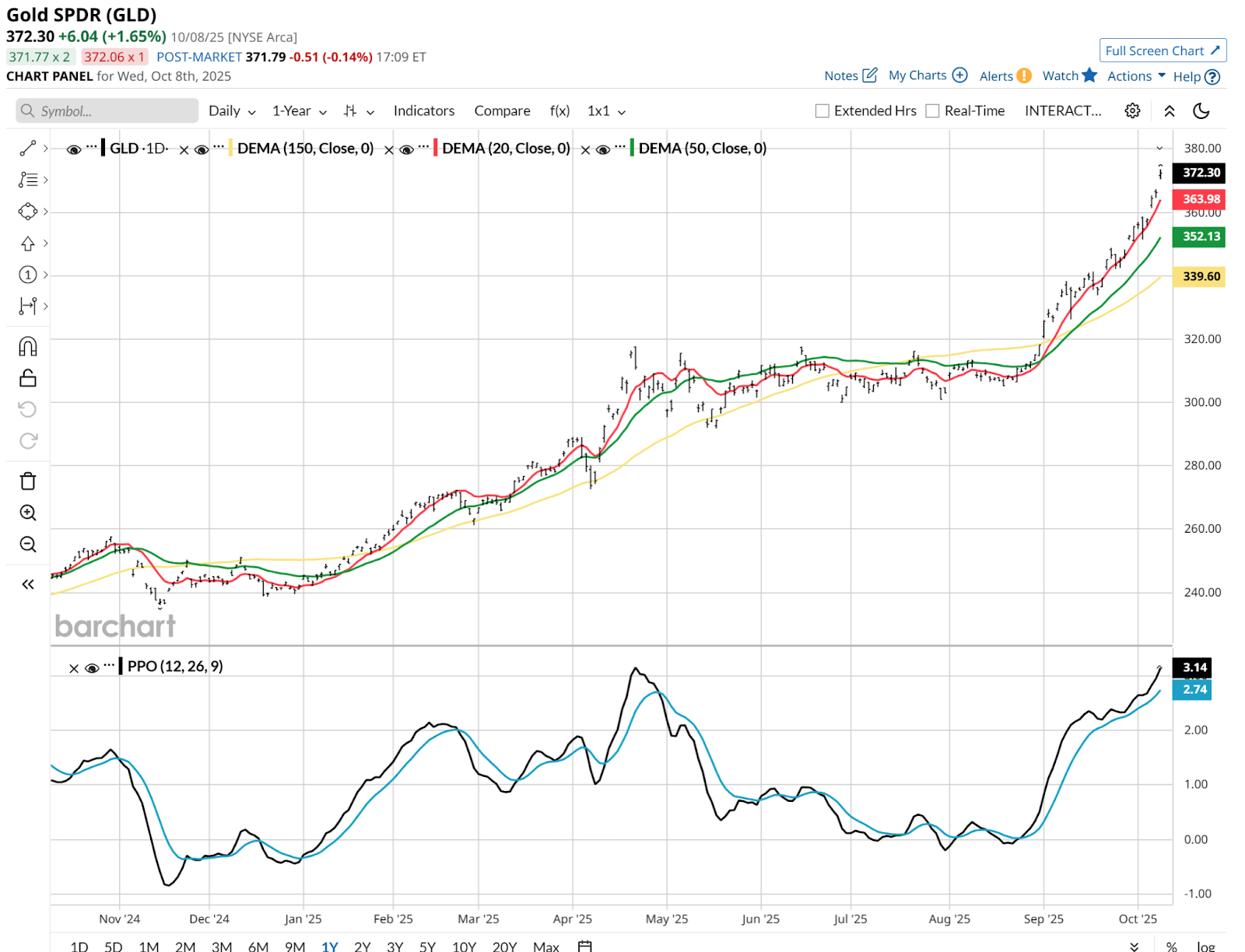

For investors in GLD, other ETFs that track the spot price of gold, and even funds that aim to benefit from appreciation in gold mining stocks, this is a critical time to think about where the gold rush can go. The chart above (daily view) shows the nearly parabolic move the yellow metal has delivered recently. It is up 20% since late August.

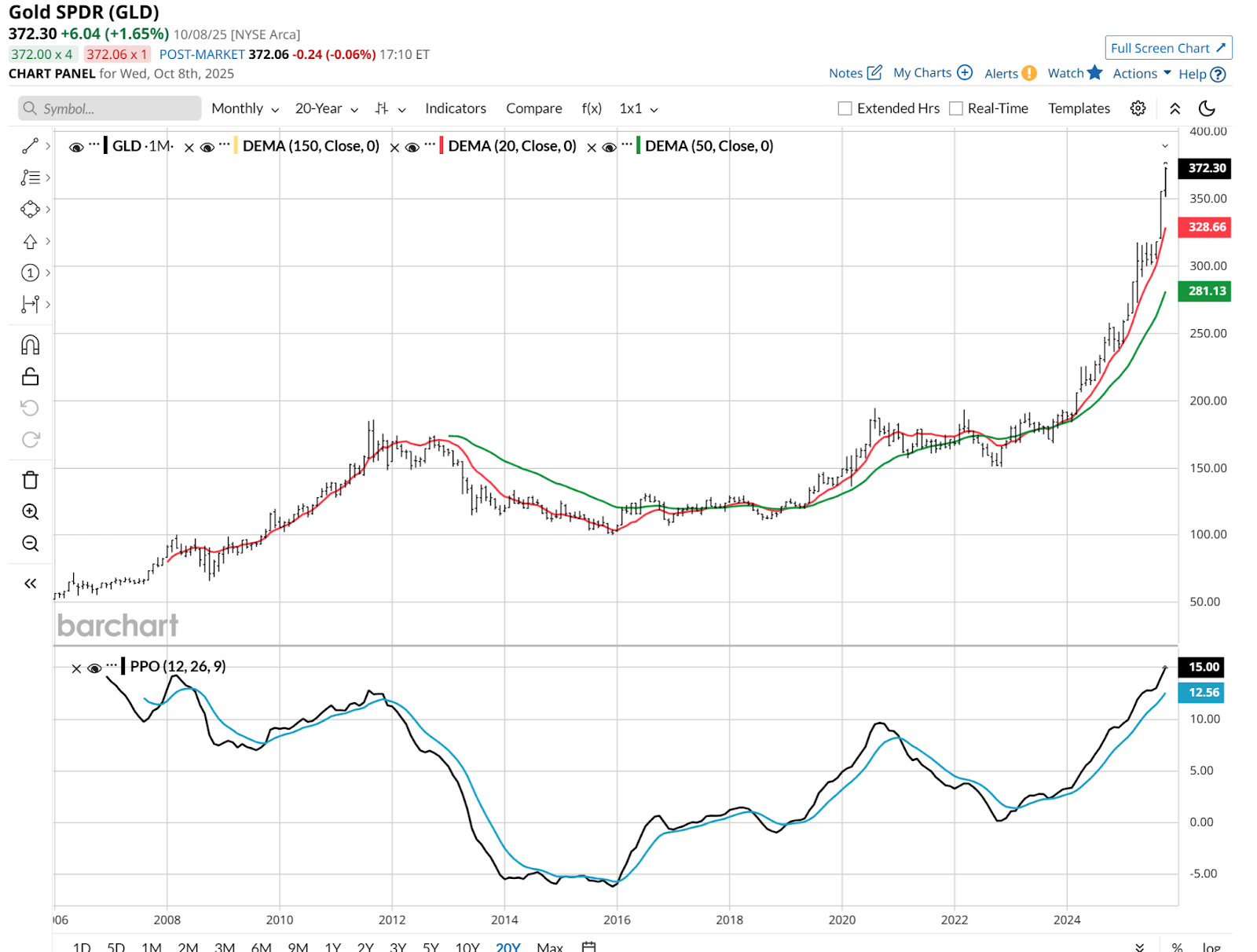

And here is GLD back to 2006. That Percentage Price Oscillator (PPO) indicator at the bottom recently reached all-time high territory. In other words, on that measure, it is more richly valued now than at any time in the past 20 years. The last time it ran up that high was in 2012. What happened next? A nearly 50% decline.

That’s all past tense, even if it reminds us what this asset is capable of doing, just at the point when FOMO gets a gold paint job. Who isn’t singing its praises right now?

Traders have so many ways to protect themselves, without giving up much upside, or even any at all. Let’s explore some of those routes.

The ‘You’re Not Midas’ Strategy

If an investor has held GLD for even just the past few weeks, they have a solid gain. The simplest way to cut risk but retain upside is to reduce your position. If you owned 100 shares of GLD, and sold half of it, you have half the risk. Simple enough. But in doing so, you just rung the register, so part of your initial profit objective is in the bag.

In other words, “Hey Midas, do you really need to hoard all of that gold?”

The Gold ‘ETF It’ Strategy

GLD moves up and down with the price of gold.The Direxion Daily Gold Bull 3X Shares ETF (BAR) does as well, but with triple the volatility. One application of leveraged ETFs is to essentially “downshift” after a profitable trade, by selling something like GLD and buying a very small position in something like BAR.

To put some basic dollars to this example, if $100 in GLD just rose to $120, selling that produces a $20 profit. But that $20 in a 3X ETF delivers about $60 in GLD equivalent “exposure,” albeit with the risks of leverage and the math of inverse securities.

Still, for those inclined to do some research on this, it might make sense to trade in a 1X fund for a 2X or 3X variety. A different way to “ETF it, ” if you will.

The ‘Golden Collar’ Strategy

I’ve provided many examples of collars in this space recently. So I’ll simply say that buying put protection and selling a covered call around GLD sets some important boundaries, following this “golden” up move.

The ‘Golden Ticket’ Strategy

Finally, traders are reminded that Willie Wonka doesn’t have a monopoly on the golden ticket. Neither does Lori Greiner of TV’s Shark Tank.

The other transition strategy I use frequently is to trade in GLD at a profit, and reinvest some portion of that profit in a call option on that same ETF. It could be at the money or out of the money, but either way, you are essentially playing with “house money” at that point.

Just Avoid the ‘Golden Sombrero’

There’s a term in baseball known as the “golden sombrero.” That’s when a player strikes out four times in a game. Does the label make sense there? No, but baseball is like that. Just don’t let the equivalent happen in your trading.