If the stock market were a bathroom faucet, you’d have a hard time falling asleep. Because that slow, methodical sound would keep you awake. Drip, drip, drip, drip…

That’s the sound markets make when, one stock or sector at a time, they start to roll over. And die, at least for a while. That’s what I see happening. And it should be a sign to self-directed investors to do the following:

- Enjoy what’s left of this bull run in many stocks. It might have months to go or just days or weeks. But the number of stocks still “bullish” according to my metrics is declining by the week.

- Let the market tell you its story. Currently, that’s AI stocks being bid up, in part due to massive liquidity and enthusiasm, since earnings are not nearly at the point where they could justify today’s valuations. But who says fundamentals have to matter? They haven’t for a while, other than in after-the-fact media narratives.

- Learn to hedge, proactively. This is not the same as “I’ll just go to cash and wait until the market looks better.” There’s a lot more we can do to, as I say, play defense with our offense, not one or the other.

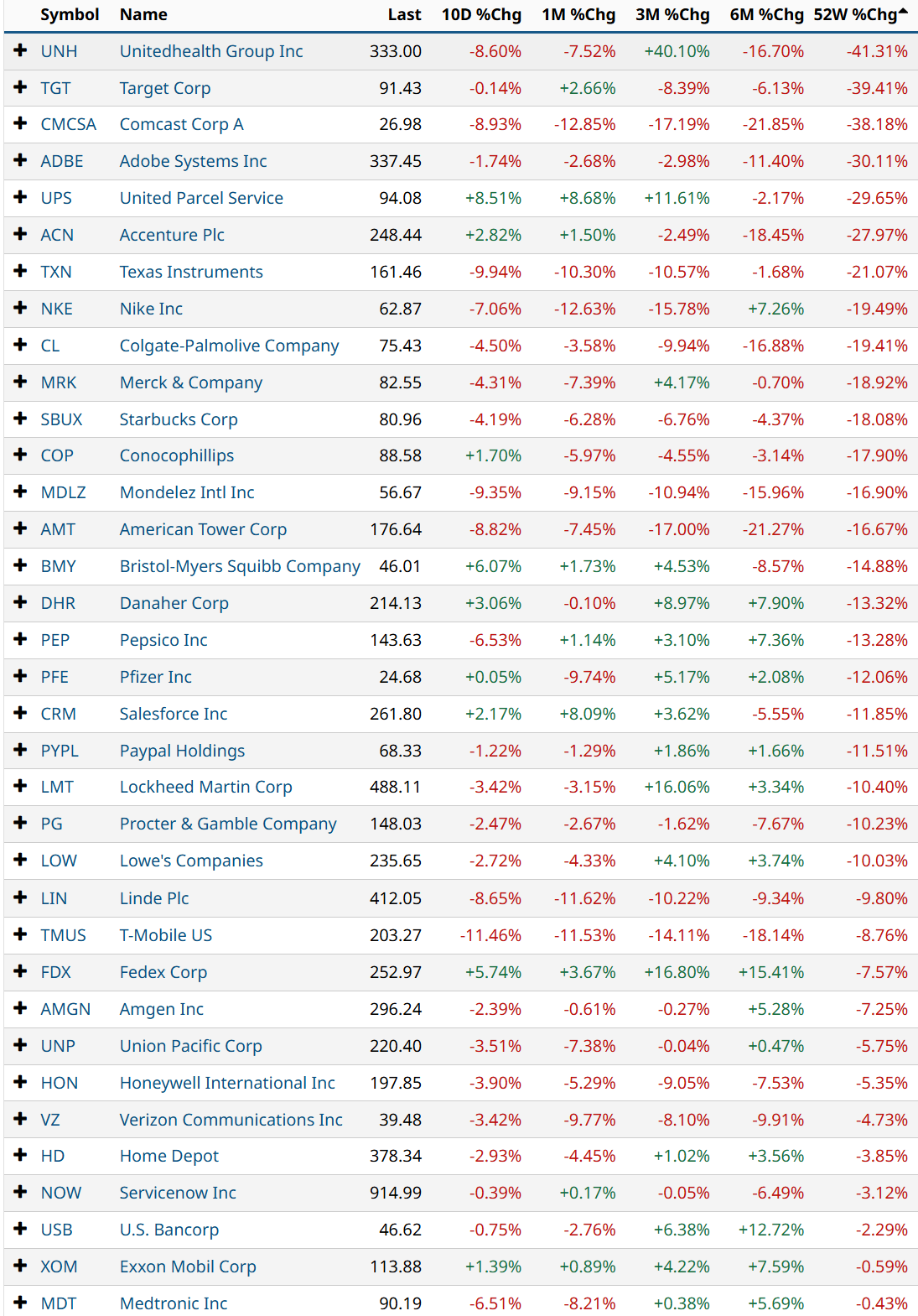

I looked around for three stocks that could be indicators for many more I see sliding down, gradually, but surely. As you can see from this table I created using Barchart’s watchlist tool, then plugging in the constituents in the iShares S&P 100 ETF (OEF), even among the 100 biggest U.S. stocks, the past 12 months have been, well, pretty miserable.

Facts vs. Headline Hype: These Stocks Are Down, Not Up

The far right column in that table shows the stocks within the current top 100 which are down since this time in 2024. There are 35 of them!

Yes, more than one-third of the biggest 100 S&P 500 Index ($SPX) stocks, the leader group for so long, are down. And by a median amount of around 13%-14%. Bull market, eh? Not when we look under the headlines. Here are three stocks that indicate what I see in too many places to consider this market anything other than on its last AI-supported leg.

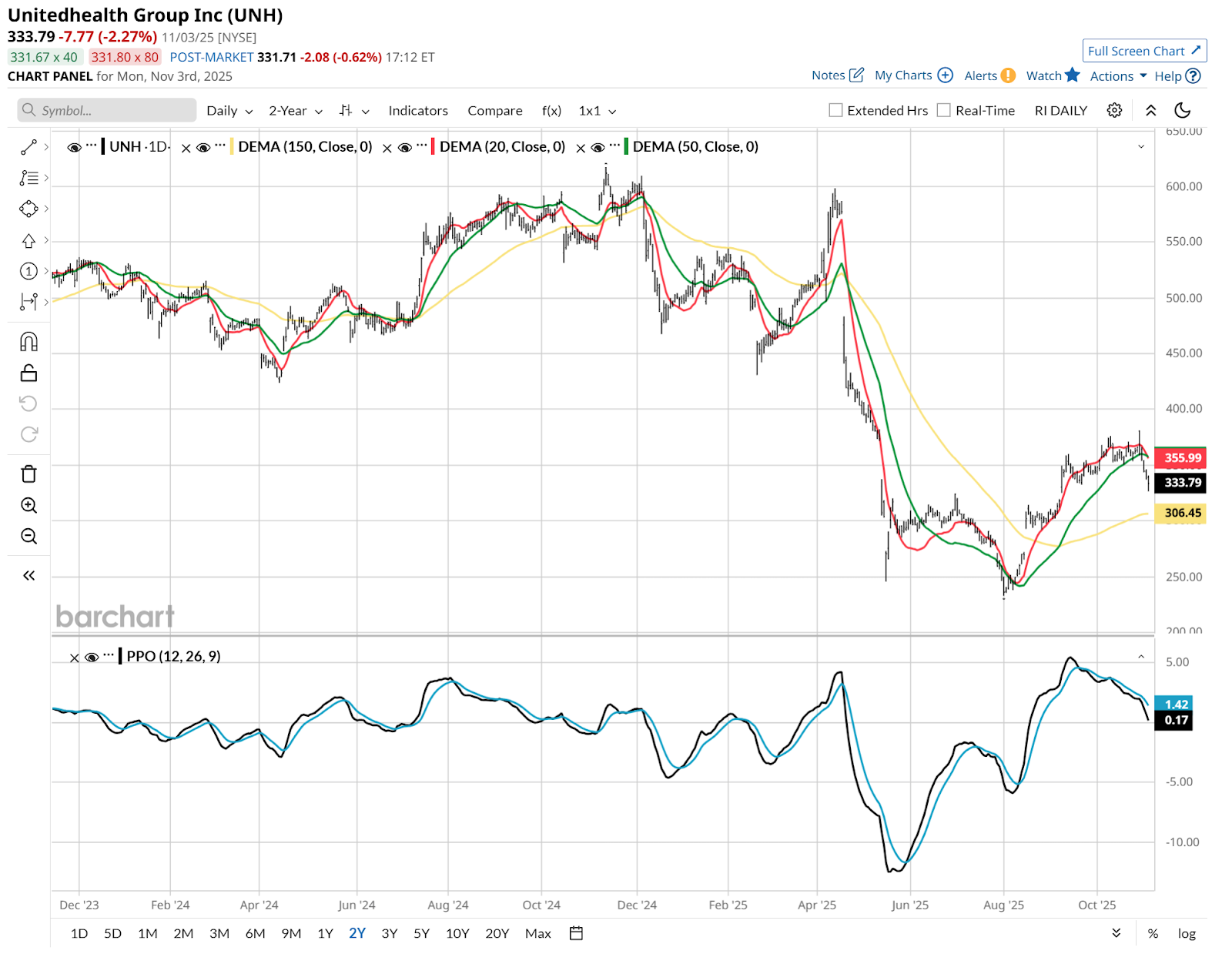

Stock #1: UnitedHealth

UnitedHealth (UNH) has been through a lot. The employees have, management has, and shareholders certainly have. And from the looks of it, things are ready to tip over once again.

Stock #2: United Parcel Service

United Parcel Service (UPS) is an excellent example of why buying the dip is still good for swing trading, but is on its way to being far less effective for investing.

UPS rallied recently, but its Percentage Price Oscillator (PPO) indicator in the bottom section of this chart indicates to me that risk has elevated again. So quickly, too. PPO at the top of its daily chart range is not a done deal, but as you can see from the other recent peaks, it makes it tougher for the stock to rise much from here. Keep that in mind next time a stock pops on earnings, but is still in a downtrend, like UPS is.

Stock #3: Colgate-Palmolive

Colgate-Palmolive (CL) finishes this gruesome trio and challenges the assumption that consumer staples stocks will hold up in a bad economy, since people still need to brush their teeth. If only investing and trading were that simple! This one could bounce as any stock can. But the path of least resistance is still lower.

So what should you do about this? Here are two quick ideas.

Position sizing is very important, especially now. That is, even if you own stocks that are in sustained downtrends, owning fewer shares is going to put fewer dollars at risk. In other words, you don’t need to take an all-or-nothing attitude on stocks you like. My technical work is just one factor here. But hedging does not have to be shorting or buying put options. Lower stock exposure is another route.

The tech sector continues to ignore what’s going on underneath. If you need any convincing that asset flows into S&P 500 index funds are driving that trade as much as anything, consider that nearly all of the 10 biggest stocks within that top 100 are up 20% or more over that same 52-week time frame. Translation: Index fund inflows make the rich richer.

By tracking what’s going on across more of the S&P 500, rather than just the very biggest names, we get a wider market perspective. And perspective is a very valuable thing to have right about now.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, as well as on Substack.