/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Innovation is moving faster than ever, and a new wave of technology companies is challenging industry heavyweights. From data intelligence to next-generation software platforms, here are three promising rivals who have the potential to challenge the global leaders in the artificial intelligence (AI) race in the long run.

Tech Stock #1: Palantir Technologies

Valued at $416.2 billion, Palantir Technologies (PLTR) has quietly evolved from a small defense contractor to one of the most powerful firms in the AI and data analytics industry. Its Gotham, Foundry, and AIP platforms help enterprises transform massive, complex datasets into meaningful insights, which few competitors can match at scale.

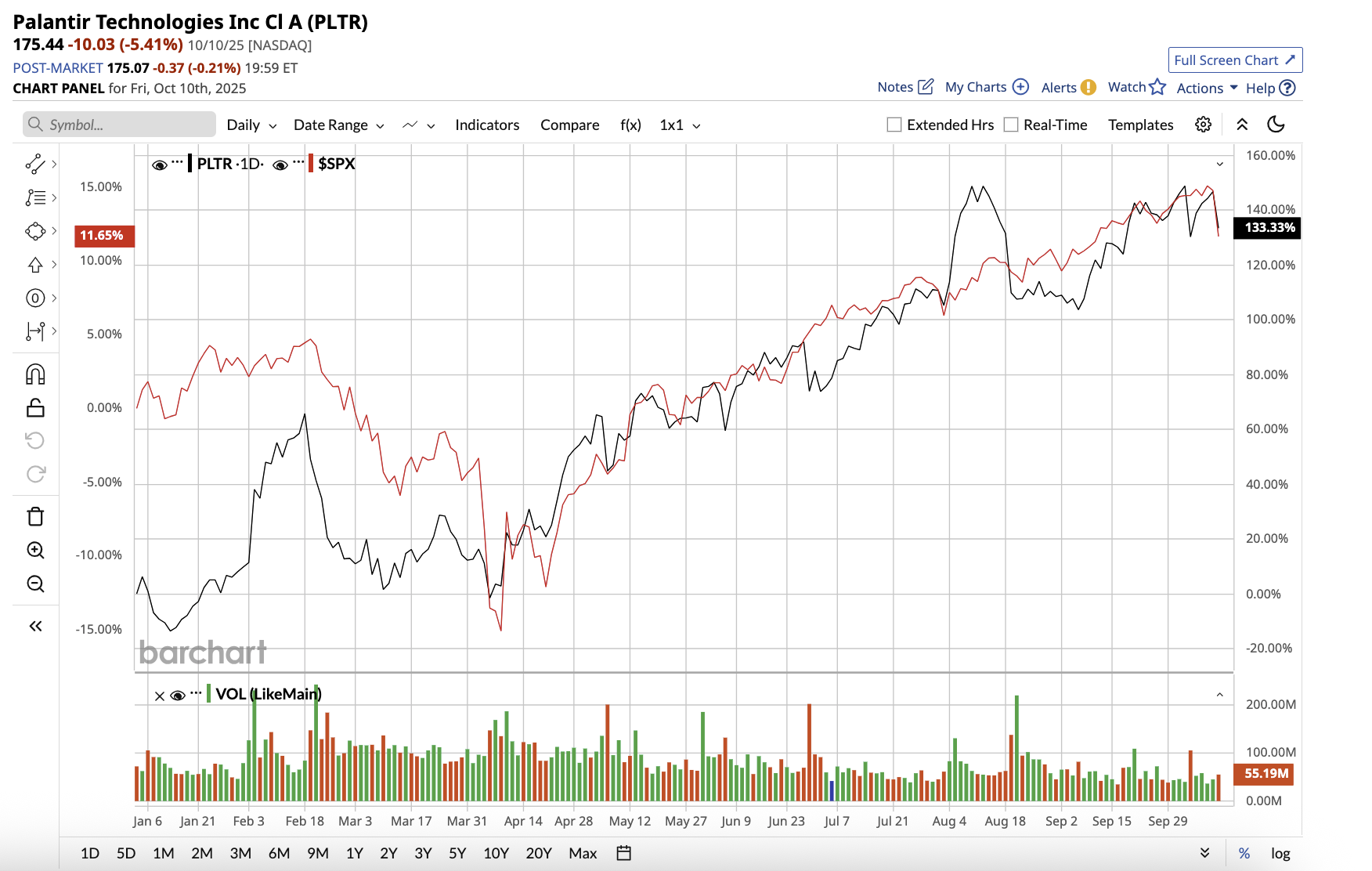

Palantir stock has skyrocketed 132% year-to-date, outperforming the broader market.

Its second quarter marked its first-ever billion-dollar quarter with a 48% year-over-year revenue surge. Its government partnerships remain key with a 53% increase in U.S. government business. However, domestic commercial revenue soared 93%, showing that Palantir is gaining traction beyond its traditional defense roots. Contract momentum was equally impressive. The company obtained 157 deals for more than $1 million, with 42 valued at more than $10 million, bringing the overall contract value to a record $2.3 billion. Backed by $6 billion in cash and short-term securities, Palantir has ample firepower to reinvest in innovation and expansion.

Analysts expect Palantir’s earnings to rise by more than 56.7% this year and 31.7% in 2026. While its valuation — 207 times forward earnings — remains steep, the company’s mix of growth, profitability, and government-backed resilience distinguishes it among AI startups.

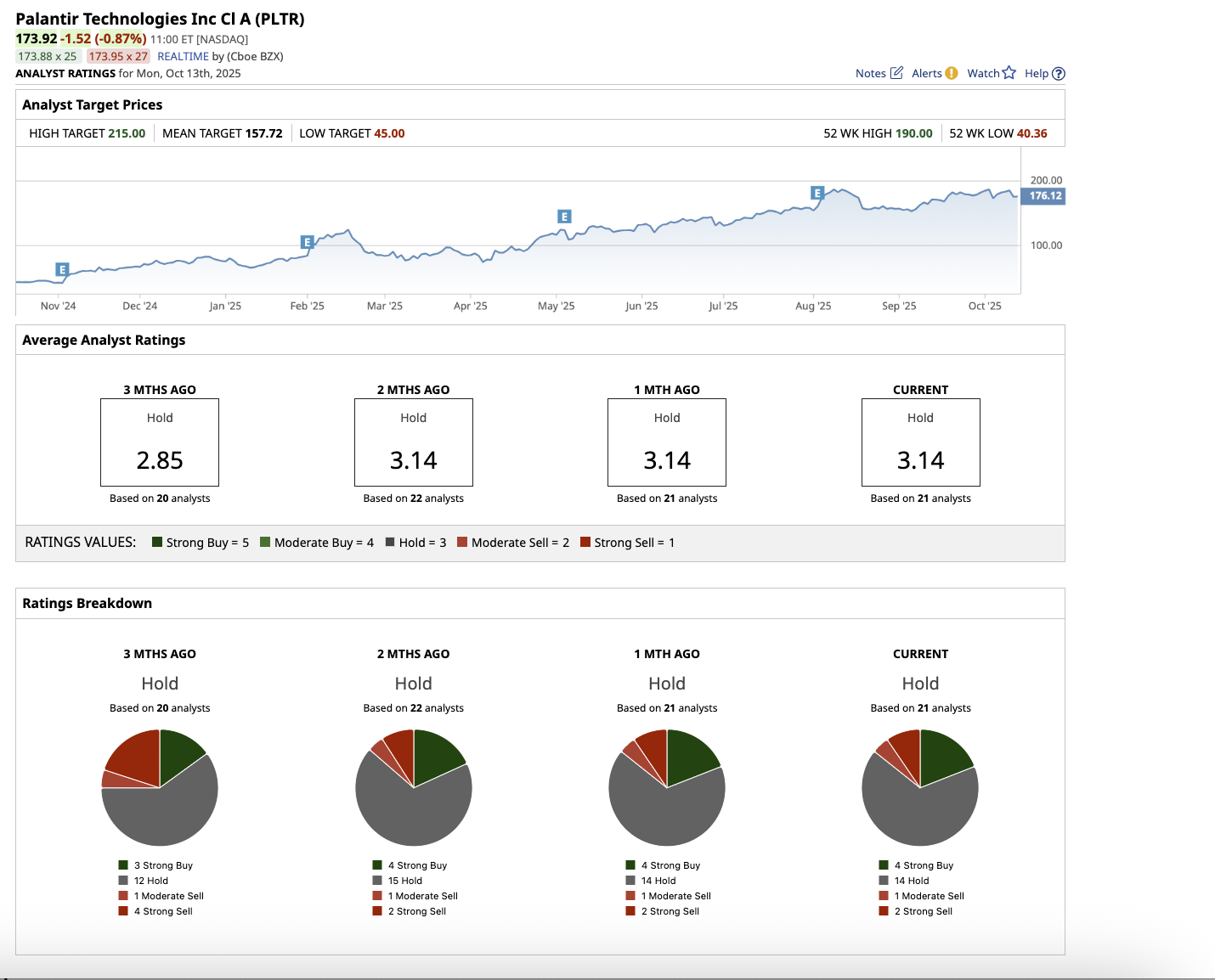

Overall, on Wall Street, Palantir stock is a “Hold.” Among the 21 analysts that cover the stock, four rate it a “Strong Buy,” 14 say it is a “Hold,” one rates it a “Moderate Sell,” and two say it is a “Strong Sell.” Palantir stock has soared this year, surpassing its average target price of $157.72. However, its Street-high estimate of $215 implies the stock has upside potential of 22.5% from current levels.

Tech Stock #2: Snowflake

Valued at $82.05 billion, Snowflake’s (SNOW) cloud-based platform enables businesses to store, manage, and analyze massive volumes of data seamlessly. The company has also introduced Snowflake Intelligence, a service that provides powerful insights to non-technical customers.

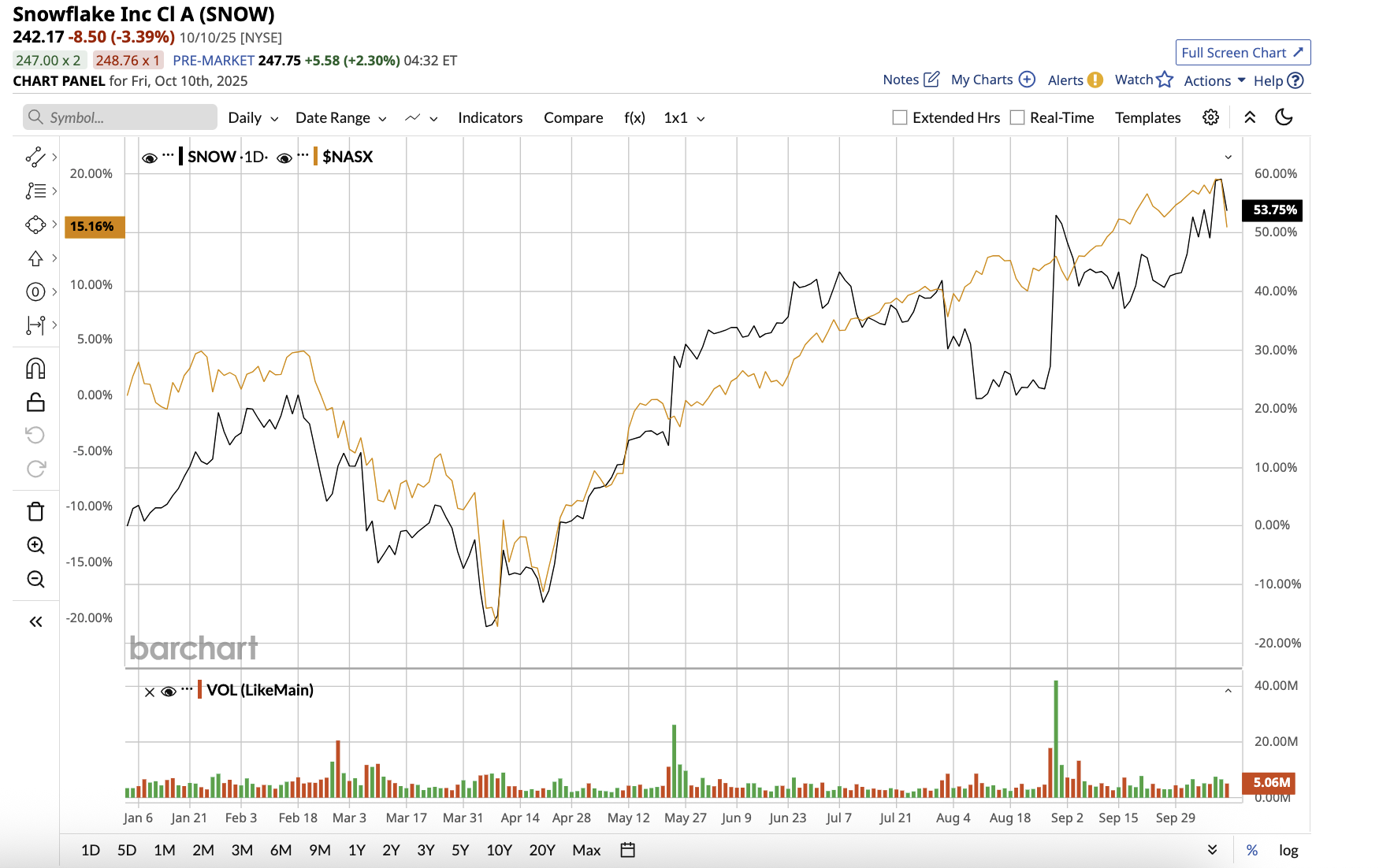

Snowflake stock has gained 58.8% YTD, compared to the overall market gain.

Nearly half of all new customer wins in the second quarter were influenced by AI-related features, and about 25% of Snowflake’s workloads now involve AI use cases. In Q2, product revenue increased 32% year-on-year to $1.09 billion, while remaining performance obligations (RPO), an important indicator of future sales, increased 33% to $6.9 billion. Net revenue retention rate of 125% demonstrates not just its capacity to recruit new clients but also to deepen connections with existing ones.

The company’s balance sheet is still robust, with $4.6 billion in cash and investments. That provides Snowflake plenty of room to grow its AI capabilities while addressing bigger industry challenges. After a loss in fiscal 2025, analysts anticipate Snowflake to earn a profit of $1.19 per share in fiscal 2026. Earnings are predicted to rise by an additional 38.6% in fiscal 2027. Currently, Snowflake trades at 14 times forward 2026 estimated sales, significantly below its five-year average.

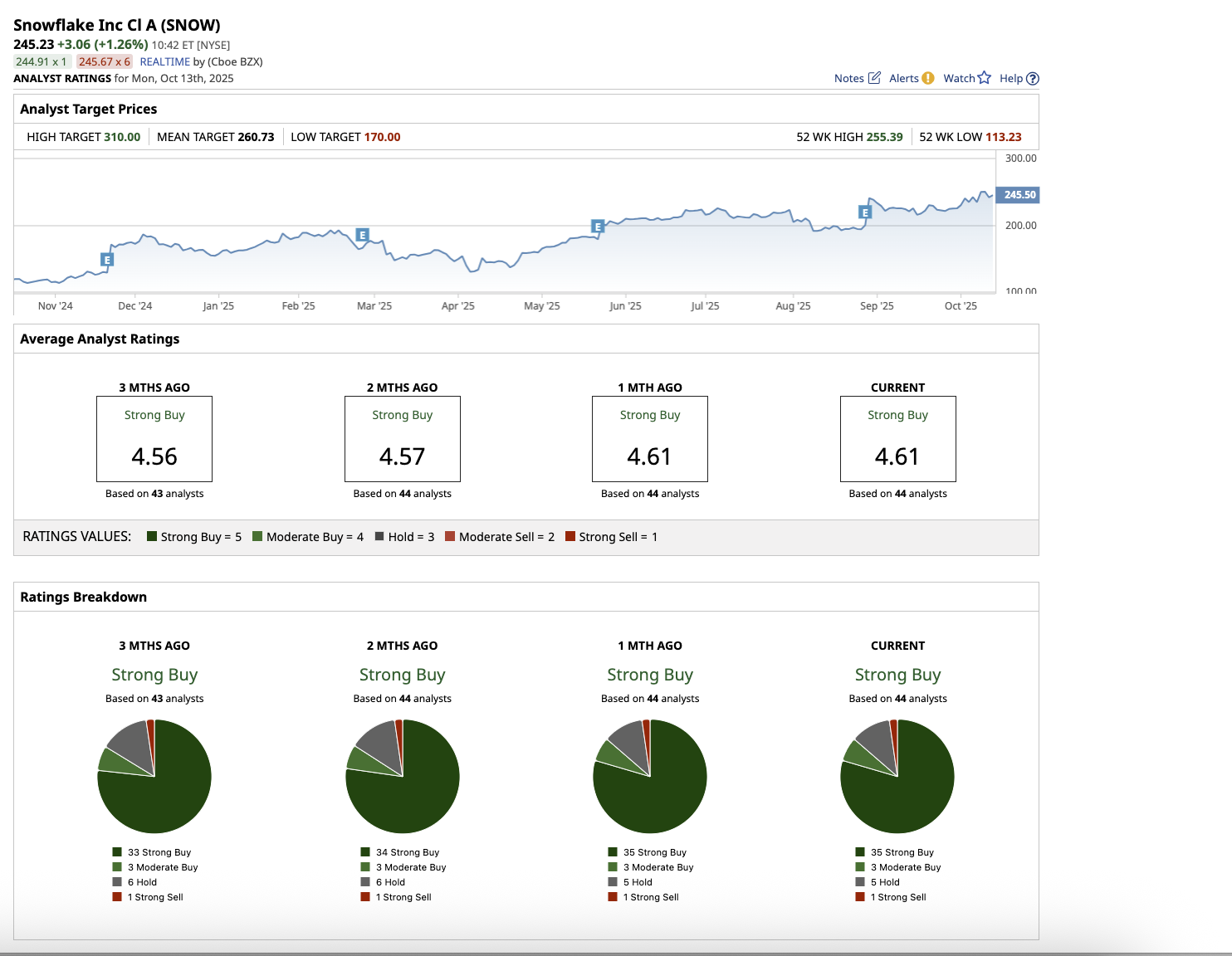

Overall, Wall Street has rated SNOW stock a “Strong Buy.” Out of the 44 analysts covering SNOW stock, 35 have rated it a “Strong Buy,” three suggest a “Moderate Buy,” five rate it a “Hold,” and one recommends a “Strong Sell.” The stock’s average target price of $260.73 implies 6.3% upside potential from current levels. Further, it has a high target price of $310, which suggests the stock could gain as much as 26.4% over the next 12 months.

Tech Stock #3: UiPath

Valued at $9.05 billion, UiPath (PATH) is a software company that uses robotic process automation (RPA) and AI to assist businesses in automating repetitive, rule-based digital processes. It has established a dominant position in the RPA market, which is projected to reach $30.85 billion by 2030, growing at an impressive 44% compound annual rate.

UiPath stock has surged 32.45% YTD, compared to the overall market gain.

In the second quarter of fiscal 2026, revenue increased 14% year-on-year to $362 million, while annualized recurring revenue (ARR) rose by 11% to $1.72 billion. The company reached an amazing 84% gross margin and broke even for the quarter, a significant improvement from a loss of $0.15 per share last year. UiPath’s net retention rate of 108% reflects healthy customer engagement and upselling momentum.

The company’s customer base continues to expand, now exceeding 10,800 organizations. Its latest suite of “Agentic AI” capabilities, which are designed to reason, plan, and act autonomously, represents a significant advancement in enterprise automation.

The company ended the quarter with $1.5 billion in cash and no debt, and it generated $45 million in free cash flow, providing flexibility to sustain its innovation drive.

Analysts anticipate 10.1% revenue growth and 25% earnings growth in fiscal 2026. Earnings are predicted to climb by double digits the following fiscal year. From a valuation standpoint, PATH stock is trading at roughly 23 times forward earnings, which is reasonable for a business leading a rapidly growing market.

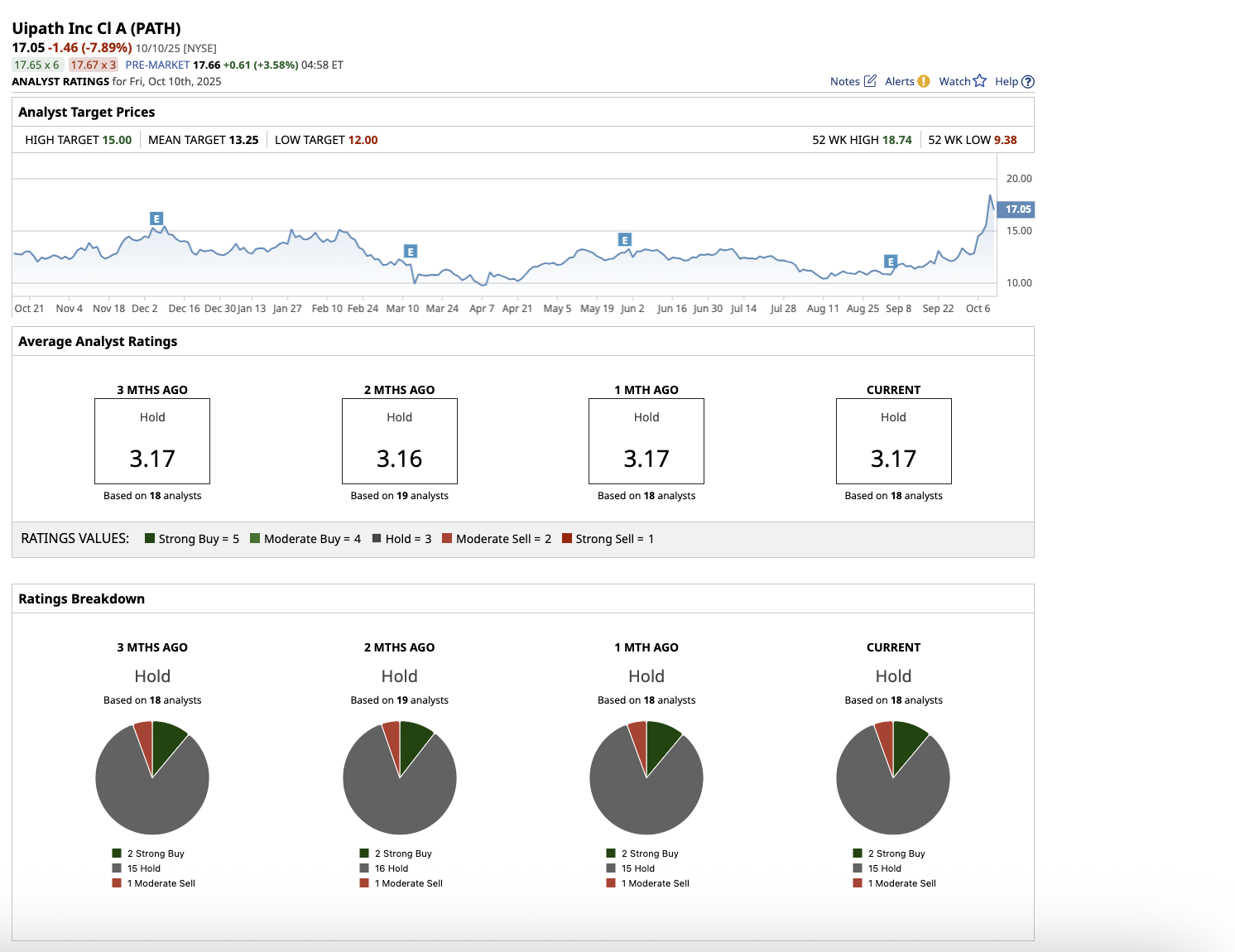

Overall, Wall Street rates the stock a “Hold.” Of the 18 analysts that cover the stock, two rate it a “Strong Buy,” 15 suggest a “Hold,” and one rates it a “Moderate Sell.” UiPath has surpassed its average target price of $13.25 and the Street-high estimate of $15.

.jpg?w=600)