Stocks certainly have had a tough time lately. Rising rates and increasing worldwide tensions led to the worst week for equity markets this year. Fear has finally entered both the stock and option markets.

Stock prices are now at recent lows. Option prices are trading at yearly highs. So, a covered call strategy of buying stocks and selling call options to hedge the position and reduce the cost further may be worth consideration.

Let’s take a look at a QQQ Covered Call ETF as a way buy stocks and sell calls in a simple and straight-forward manner.

Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq. You get exposure to Microsoft, Apple, Nvidia and all the other big NASDAQ names in one fell swoop.

The Global X Nasdaq 100 Covered Call ETF (QYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index.

QYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. QYLD has made monthly distributions for 10 years running. QYLD writes call options on the Nasdaq-100 Index, saving investors the time and potential expense of doing so individually.

Below are three big reasons why to consider a covered call QQQ strategy in the current market environment.

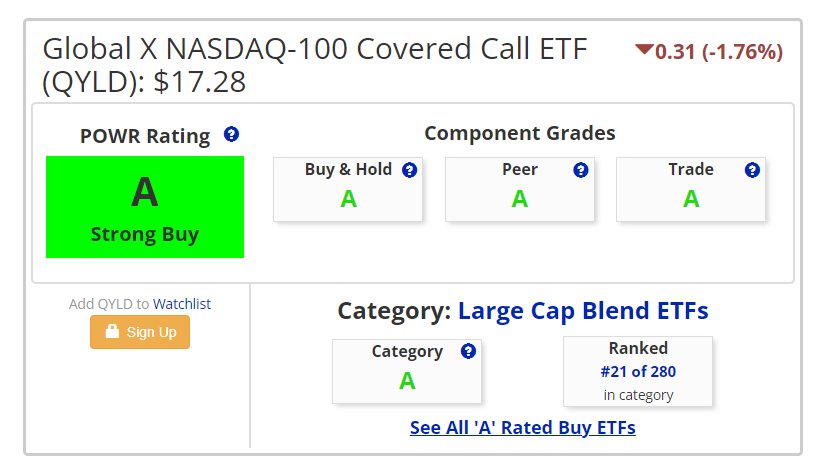

POWR Rating

The NASDAQ 100 Covered Call ETF (QYLD) is a Strong Buy (A-Rated) ETF. All Component grades are A-Rated as well. Ranks in the top 10% of the A-Rated Large Cap Blend ETFs. Straight As across the board.

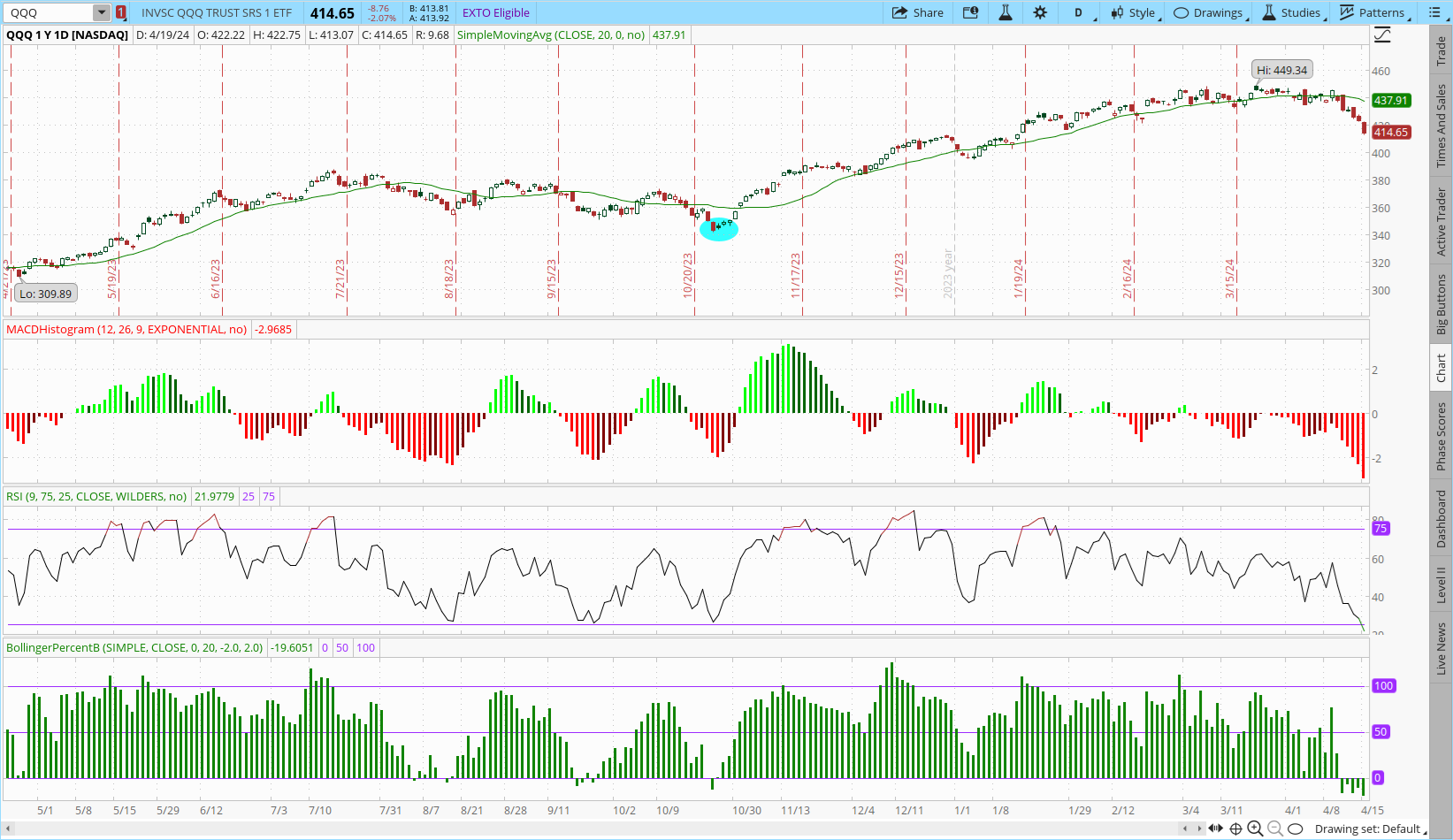

Technicals

QQQ is now the most oversold it has been in the past year. 9-day RSI is under 25. Bollinger Percent B turned negative. MACD is at an extreme as well. Shares are trading at a deep discount to the 20-day moving average.

The previous time QQQ was even close to this oversold was last October. It marked a significant short-term bottom in the ETF.

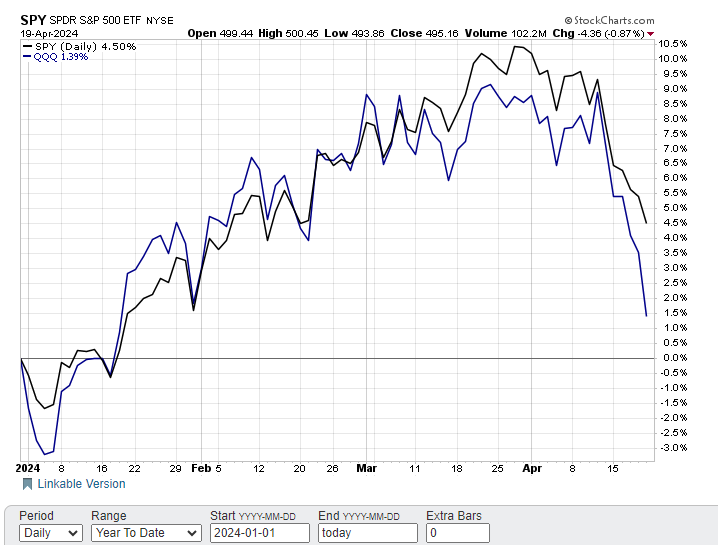

The NASDAQ 100 is now underperforming the S&P 500 by nearly 3% so far in 2024. Normally the two are more highly correlated.

Look for QQQ to outperform the SPY over the coming months and close the relative performance gap.

Implied Volatility

Many of you are familiar with the VIX-commonly called the fear gauge. It measures the implied volatility (IV) of 30-day options in the S&P 500 (SPY). It is referred to as the fear gauge since spikes in VIX are associated with dramatically increased investor anxiety.

The VXN, or “Vixen”, is a measure of the 30-day implied volatility in the NASDAQ 100 options. It is the VIX of the NASDAQ.

VXN now stands at well over 20 and is at the highest reading since last October.

This heightened fear is usually a reliable indicator that the NASDAQ 100 may be nearing a bottom. That certainly was the case last October when VXN spiked in a similar manner.

It may be wise to face the fear and follow the advice of Warren Buffett and “Buy when others are fearful.”

A high level of VXN also means that NASDAQ 100 options are comparatively expensive.

Investors looking to get back into the market at current levels may want to consider the benefits of selling expensive options to reduce the cost of buying an oversold QQQ. Going long stocks at lower prices and selling options at higher prices makes sense. It is certainly is better than doing the opposite.

This is the type of fundamental, technical, implied volatility and option analysis we employ every day at POWR Options. The market changes and it is important to change with it.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

QQQ shares closed at $414.65 on Friday, down $-8.76 (-2.07%). Year-to-date, QQQ has gained 1.39%, versus a 4.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

3 Reasons Why Now Is A Great Time To Consider A Covered Call Strategy In QQQ StockNews.com