Despite being at record highs, gold continues to find solid buying interest from central banks around the world and global investors.

-

The key is a growing fear of inflation, combined with uncertainty as to what is going to happen with US interest rates over the coming months and years.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily. The other concern is the loss of the Western World leader, not only due to the latest government shutdown but the ongoing consolidation of power in the Executive Branch.

It is pre-dawn Wednesday morning, October 1, as I write this and the US government has officially been shut down. But we knew this was coming, didn’t we? After all, the gold market, in all its iterations, rocketed to record highs early this week as central banks around the world and global investors rushed to the safe-haven market. This fits under Newsom’s Rule #5: It’s the what, not the why. We have been able to see the ‘what’ as gold futures (GCZ25) climb ever closer to the $4,000 and the cash Gold Index (GCY00) approaches $3,900. If more interested in ETFs, any number of them have also reached new highs. This morning, though, I’m going to break my own rule and talk about three of the ‘whys’ behind gold’s historic move. Some of you won’t agree. Like the Indian parable of The Blind Men and the Elephant, everyone has a different “view”.

Reason #1: Inflation. In his book “Intermarket Technical Analysis”, author John J. Murphy opened Chapter 3 by saying, “Of all the intermarket relationships explained in this book, the link between commodity markets and the Treasury bond market is the most important.” The next section of the chapter has the sub-title, “The Key is Inflation”. As you have likely learned by now, I couldn’t care less about “official” government numbers regarding inflation (e.g. Consumer Price Index, Producer Price Index, etc.), preferring instead the eyeball and/or ear test. All one has to do is walk into any store anywhere or talk to someone who has had to make a major purchase (e.g. a major repair for equipment, fertilizer, etc.) and we can understand real inflation. As I’ve said over the past decade, when the world’s largest economy (whatever that word means) is equated to the performance of the stock market while trade policy is reduced to one word (“Tariffs”, in case you were wondering), inflation is going to take off. The US has seen it, lived it, and will have to continue to deal with it for the foreseeable future, and the soaring price of gold continues to reflect this reality.

Reason #2: Interest rates. We know the US Federal Open Market Committee is between a rock and a hard place, again, knowing that the US president’s one word trade policy fuels inflation, acting as a tax on US consumers by increasing the price of nearly every import (Including movies made in other countries. No, I’m not kidding.). To offset the higher cost of purchasing almost everything, employment costs have gone up, increasing concern at the Fed over the future of the US job market. At the conclusion of the Fed’s September meeting, Chairman Jerome Powell announced the FOMC was cutting the Fed fund rate by 25-basis points, an act aimed at hopefully pacifying the US president, while concerns over both inflation and jobs remained front and center. If the US president gets his demand for drastically lower interest rates, the US dollar index would be expected to crumble, sending commodity prices skyrocketing. Except for those directly influenced by his one-word trade policy, most notably US soybeans. As of this writing, the Fed fund futures forward curve is showing the rate will be held steady at the FOMC’s October meeting. But we’ll see how this changes over the coming weeks.

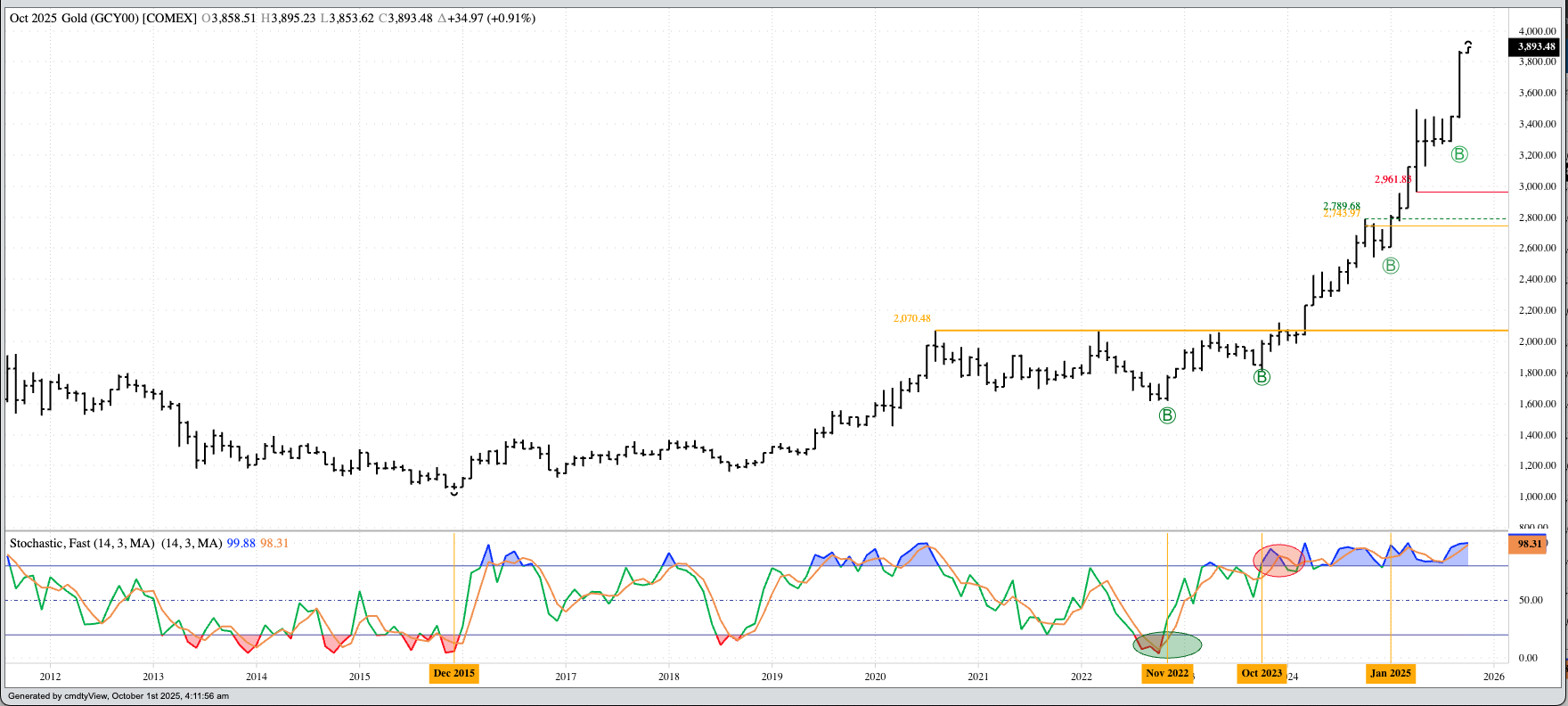

Reason #3: Consolidation of Power. Central banks and global investors long ago realized the Western World lost its leader over the past decade, the great experiment in representative democracy lasting fewer than 250 years. The political scientist in me – yes, that is what it says on the piece of paper I received upon graduation from good ol’ Fort Hays State University 4 decades ago – would argue the experiment never worked, but its failure was hidden by an intricately detailed façade. But this ‘artificial or deceptive front’ is gone, and we can see the US system for what it is. The current US president has openly stated he has no use for a 3-branch government, with any and all decisions coming from the executive office only. If you see the similarity between the real US system with those in place in Russia, China, and others cut from the same cloth, you aren’t alone. A look at the monthly chart for the Gold Index shows a gain of 42% since its October 2024 settlement of $2,743.97. And we know what happened in early November. It’s interesting to note the previous record run occurred between December 2015 and July 2020, including the US Presidential election of 2016.

I don’t see gold losing its runaway train momentum any time soon. Who is going to be the first to sell? As I told Kitco News last Friday, I have made it a habit to not step in front of runaway trains. It is better for one’s health.