China currently controls approximately 70% of the world’s rare earths mining and 90% of global rare earths processing, which leaves the supply chain exposed and has pushed critical minerals higher on the national security agenda, especially as demand for critical minerals is projected to double or even triple by 2030. On Feb. 2, President Donald Trump's administration confirmed the launch of “Project Vault,” putting almost $12 billion behind a strategic reserve of rare earth elements designed to reduce China’s grip on the sector.

The initiative will be funded by a $10 billion loan from the U.S. Export-Import Bank and nearly $1.67 billion in private capital, creating a stockpile similar to the national petroleum reserve and aimed at protecting auto, electronics, and defense manufacturers from supply disruptions. Three companies that could benefit from this policy shift are The Metals Company (TMC), Critical Metals (CRML), and NioCorp Developments (NB).

With Washington committing unprecedented capital to secure domestic critical mineral supplies, which of these three stocks offers the most compelling risk-reward profile for investors seeking exposure to the country's rare earths renaissance? Let’s take a closer look.

Rare Earths Stock #1: The Metals Company (TMC)

The Metals Company (TMC) is an exploration-stage critical minerals company working to develop polymetallic nodules from the deep seafloor. It is a non-traditional supply source that, if it reaches commercial scale, could help meet battery and industrial metal demand at a time when the U.S. government is prioritizing “Project Vault” stockpiling to reduce reliance on China.

That policy support has already been reflected in the stock’s performance. TMC stock is up 277% over the past 52 weeks and up 6% year-to-date (YTD).

On the fundamentals, TMC is still a pre-revenue developer that is funding operations while it works through permitting and a path to commercialization. In its third-quarter 2025 update, the firm reported cash of $115.6 million as of Sept. 30, 2025, alongside a net loss of $184.5 million, or $0.46 per share. Exploration and evaluation expenses were $9.6 million and while general and administrative expenses came to $45.7 million, lifted by mostly non-cash, non-recurring items like share-based compensation and fair value changes.

On the financing side, TMC has secured a $37 million registered direct investment led by Michael Hess, issuing 12.3 million shares at $3 per share as well as Class C warrants at $4.50, with a compulsory exercise feature if the stock trades above $7 for 20-straight sessions. The company said the funding should support operations through a potential commercial recovery permit, the kind of bridge capital investors watch closely in early-stage critical-minerals plays. TMC has also landed an $85.2 million strategic investment from Korea Zinc, which bought 19.6 million shares at $4.34 plus warrants at $7, received bulk nodule samples to validate processing pathways, and signaled interest in building U.S.-based refining and potentially pCAM capacity, which fits the supply-chain security logic behind Project Vault.

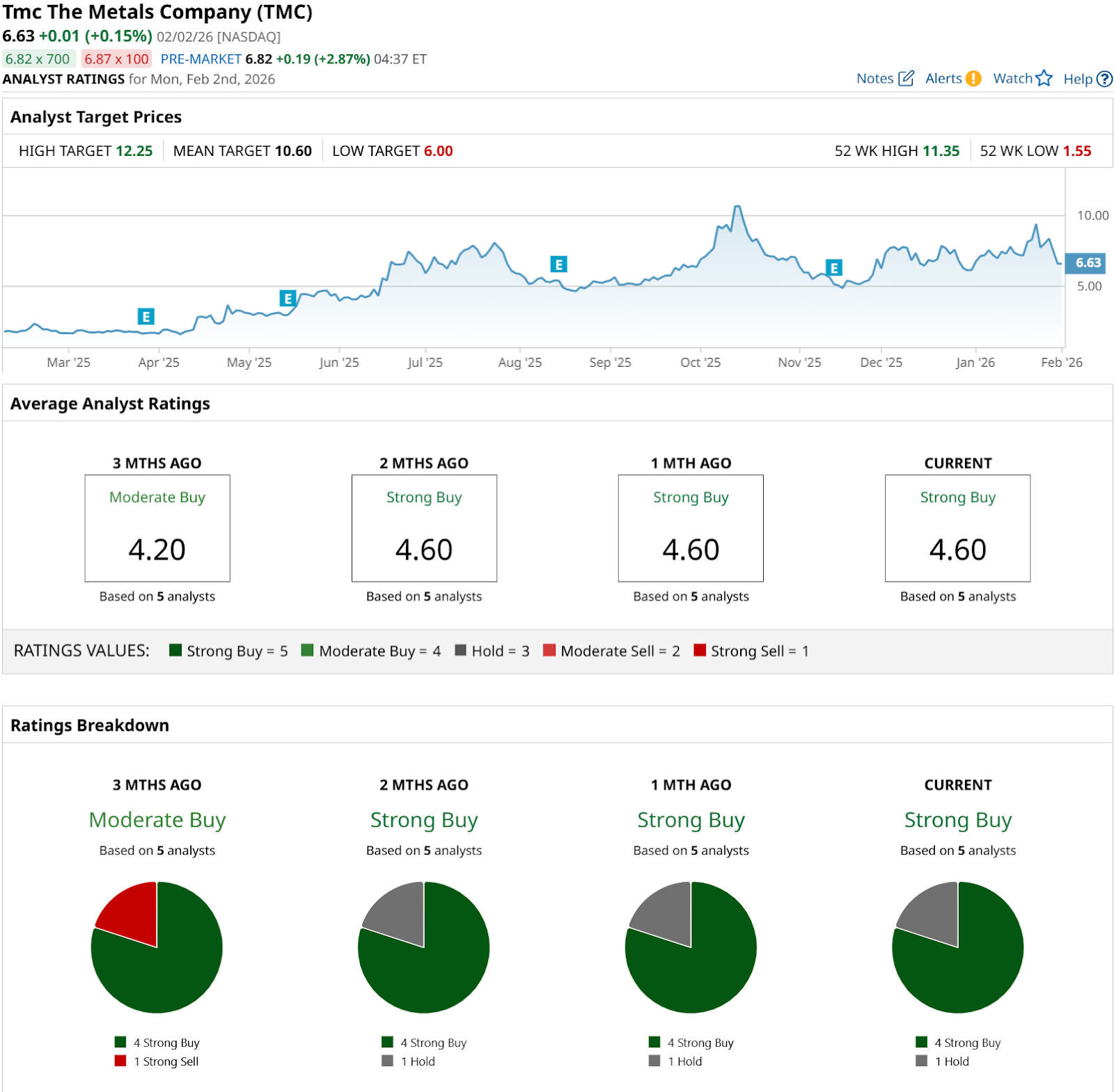

Analysts remain constructive. TMC stock has a consensus “Strong Buy” from five analysts and an average price target of $10.60. That implies about 62% potential upside from current price levels.

Rare Earths Stock #2: Critical Metals (CRML)

Critical Metals (CRML) is a development-stage rare earths company moving the Tanbreez project in Southern Greenland toward production. The goal is to progress from defining the resource into metallurgical work, pilot testing, and eventually full-scale operations.

The market has been quick to reflect the geopolitical angle when it comes to Critical Metals. CRML stock is up 54% over the past 52 weeks and 88% YTD, and shares have shown they can move quickly on policy and funding headlines.

On fundamentals, Critical Metals is still being valued more on project progress and financing than on operating earnings. In December 2025, the company said independent metallurgical work successfully replicated earlier pilot results, and it acquired a proof-of-concept pilot plant for about $2 million with commissioning targeted for Q2 2026, a practical step toward pilot-stage output and pre-production concentrate that could support offtake talks from mid-2026.

On the balance-sheet side, Critical Metals closed a $50 million PIPE tied to issuing 1.47 million ordinary shares plus a pre-funded warrant for 1.56 million shares, with resale registration rights. That extends the runway to keep advancing technical work and permitting toward the next key milestones.

The bigger catalyst has been Washington. U.S. government officials have discussed converting a $50 million Defense Production Act grant into an equity stake, pointing to unusually direct government interest in Critical Metals' strategic role.

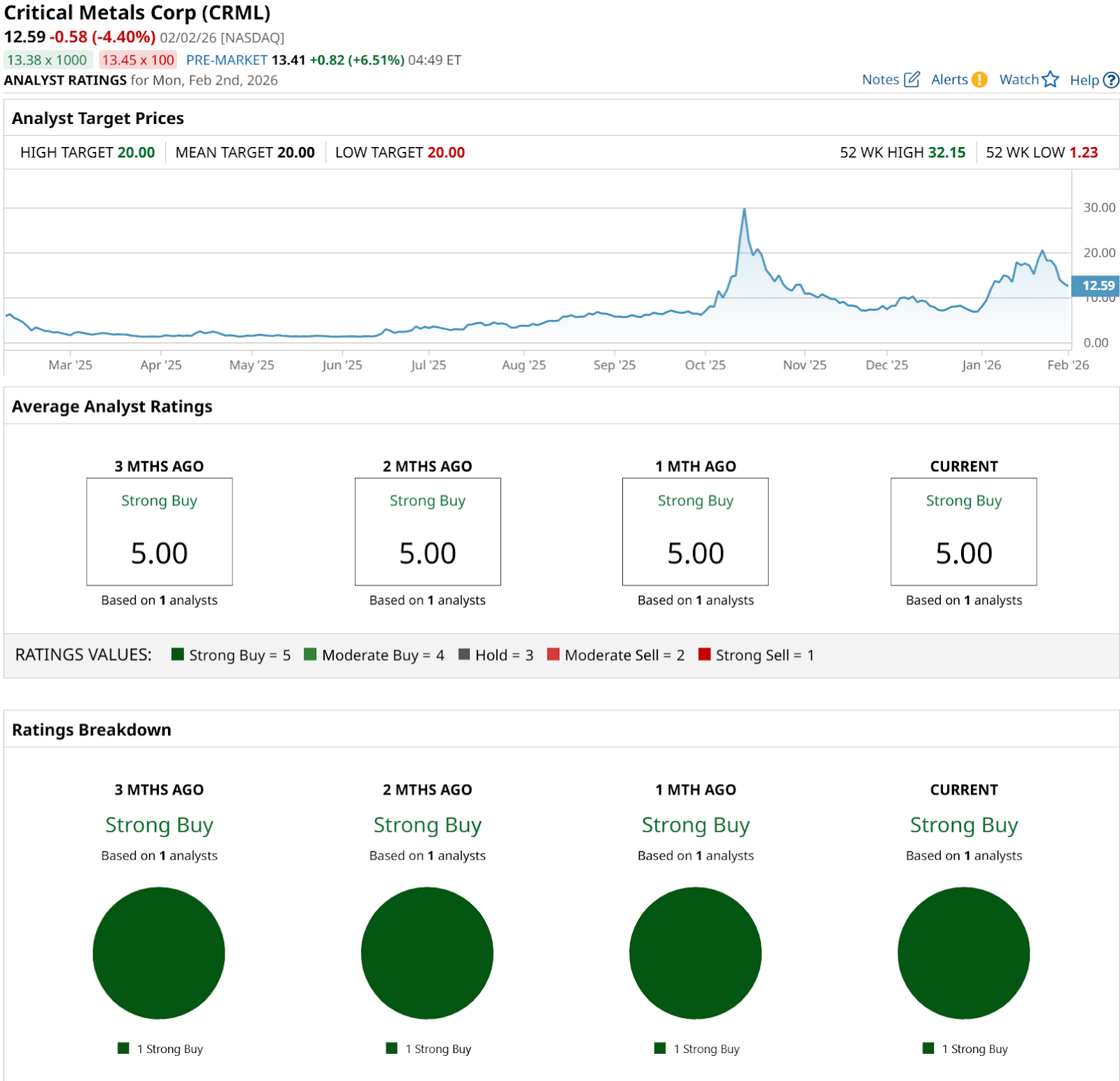

One analyst rates CRML stock as a “Strong Buy” with a $20 price target. That suggests roughly 54% potential upside from current levels.

Rare Earths Stock #3: NioCorp Developments (NB)

NioCorp Developments (NB) is a U.S.-focused critical-minerals developer working to finance and build the Elk Creek Project in Nebraska, with a focus on scandium, along with niobium and titanium materials.

The market has been positive on the company’s U.S. supply-chain angle. NB stock is up 161% over the past 52 weeks and up 26% YTD.

Financially, NioCorp is still pre-cash-flow and spending to move the project forward, but its cash position has helped support ongoing engineering and financing work. For the three months ended Sept. 30, the company reported a record cash balance of $162.8 million and a net loss of $42.7 million, or $0.53 per share. On an adjusted basis, net loss was $8.3 million, or $0.07 per share, with the larger reported loss mainly shaped by non-cash items tied to earnout shares and warrants.

Two updates connect the story more directly to Project Vault and U.S. procurement priorities. First, the U.S. Department of Defense awarded up to $10 million under Title III of the Defense Production Act to NioCorp’s subsidiary Elk Creek Resources to support a domestic scandium supply chain through engineering work, drilling, and feasibility study updates, which signals scandium is viewed as strategically important. Second, NioCorp completed an $8.4 million all-cash acquisition of FEA Materials' manufacturing assets and IP, with plans to produce aluminum-scandium master alloy in the U.S., supporting a more integrated approach once Elk Creek is financed and built.

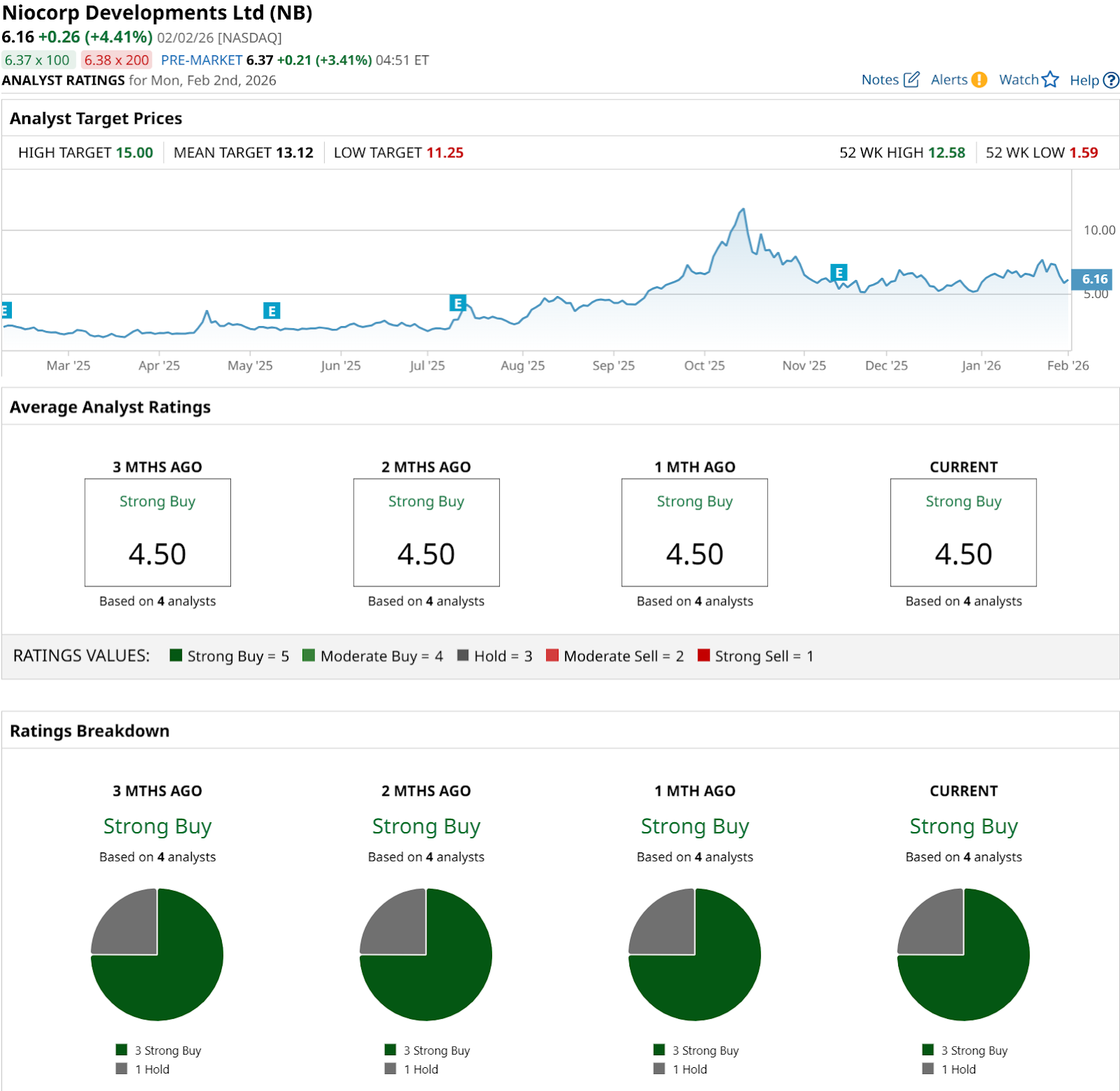

Analysts remain optimistic about NioCorp. NB stock has a consensus “Strong Buy” rating and an average price target of $13.12, implying about 97% potential upside currently.

Conclusion

Project Vault is basically Washington putting its money where its mouth is on rare earths, and that backdrop alone should keep TMC, CRML, and NB firmly on the radars of anyone betting on a U.S. critical-minerals supercycle. Each of these names still carry real execution risk, but they are now levered not just to commodity prices but to policy, defense budgets, and strategic procurement. That skews the medium term more to the upside than the downside, with volatile trading along the way as headlines and funding milestones come and go.